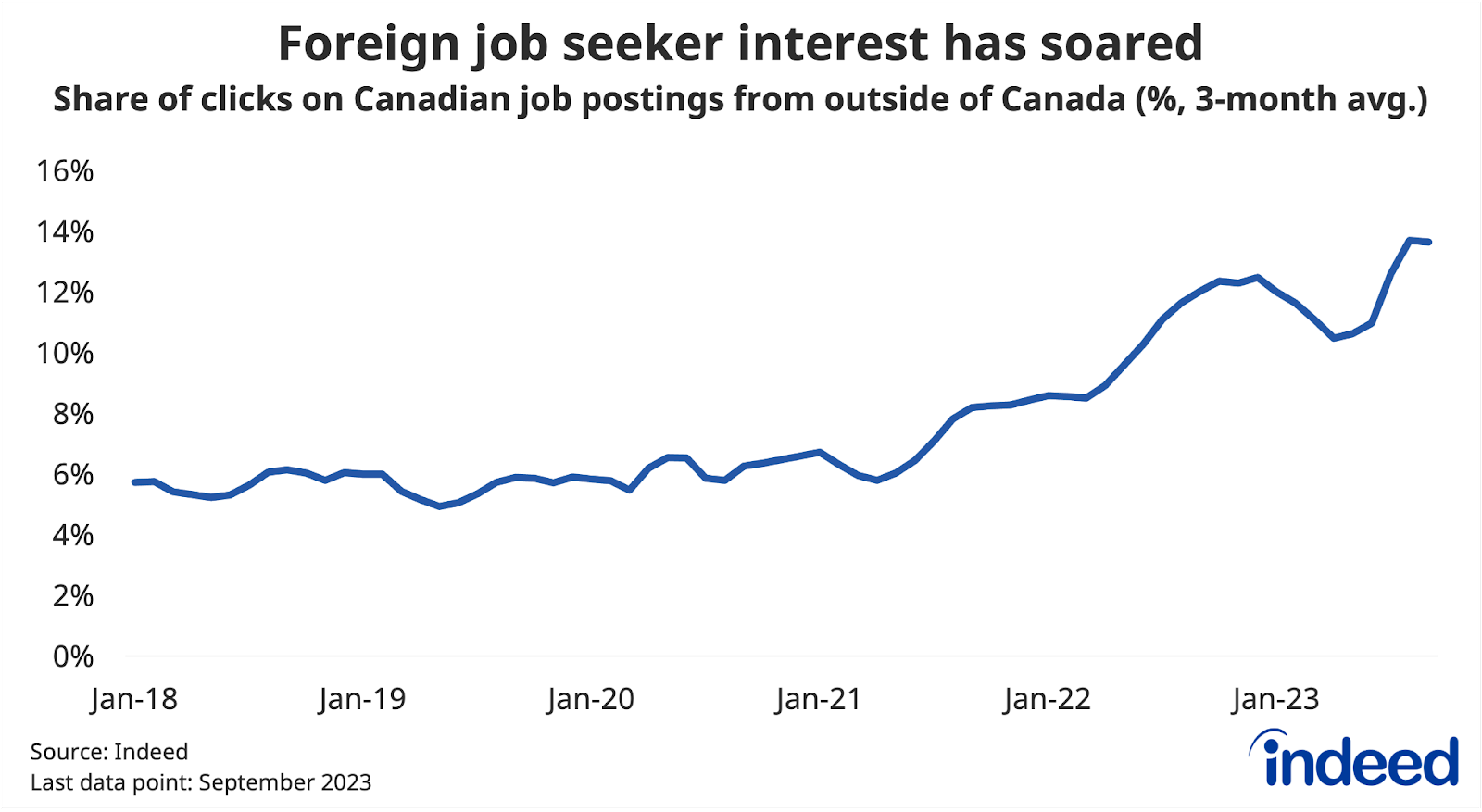

- Foreign job seekers are searching for jobs in Canada more often than they used to: in 2023Q3, 14% of clicks on Canadian job postings were made by job seekers from abroad, more than double their 6% share in mid-2019.

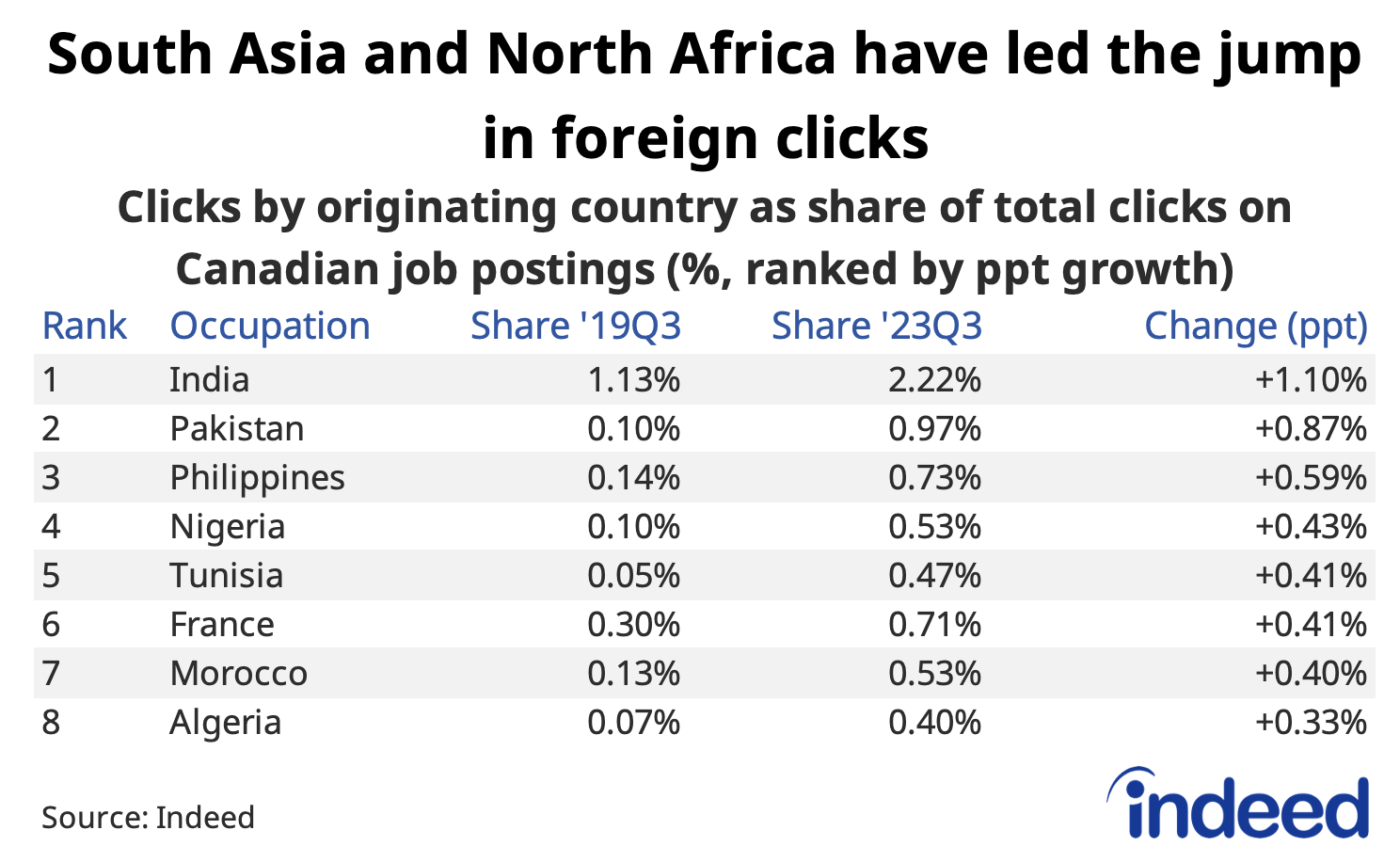

- The rise in foreign interest has come from a wide range of countries outside North America, led by India, but with substantial contributions from Pakistan, the Philippines, Nigeria, North Africa, and France.

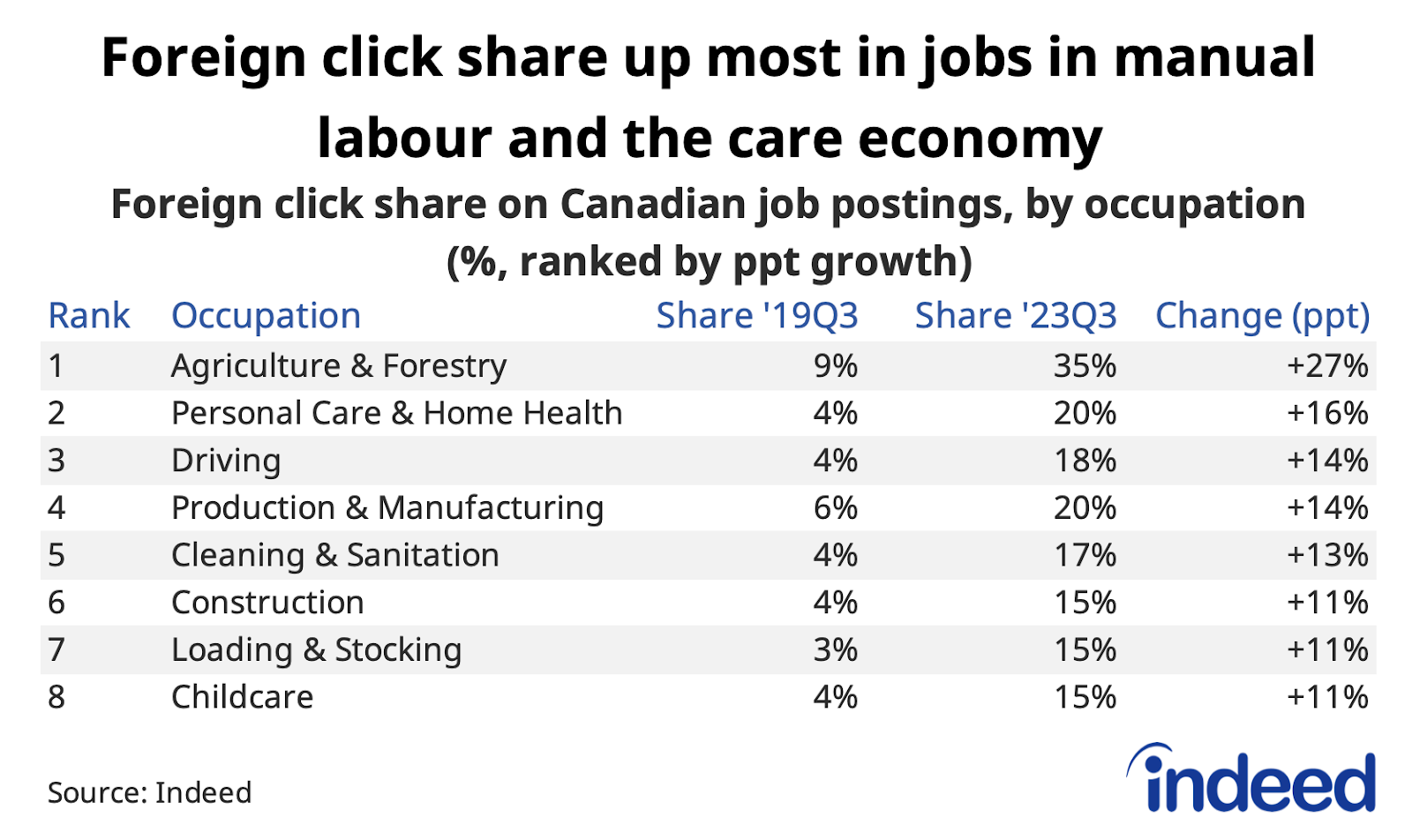

- Foreign click shares are up across occupations, but the largest increases have been among lower- and mid-paying in-person job types, with agriculture, personal care and home health, and driving experiencing the largest increases.

- The jump in foreign interest has come at a time when the Canadian population is growing quickly, suggesting policy changes expanding work permits to those abroad has helped attract job seeker attention, which could keep the inflow of newcomers elevated in the months ahead.

Canada’s population has been surging lately, led by a jump in newcomers with non-permanent work permits. This shift has coincided with recent policy changes, moves which could be translating into faster population growth by raising the likelihood someone looking to work in Canada successfully receives a permit, and also by potentially boosting interest in Canadian job opportunities more broadly. Rising foreign job seeker clicks on Indeed suggest this second factor has been an important trend.

Heading into the pandemic, approximately 6% of clicks on Canadian job postings on Indeed were made by job seekers abroad. The share was volatile in 2020 but started rising in earnest in mid-2021 as travel restrictions relaxed, before soaring further in 2022. As of 2023Q3, 14% of all clicks on Canadian postings were made by job seekers in other countries, more than double their share four years earlier.

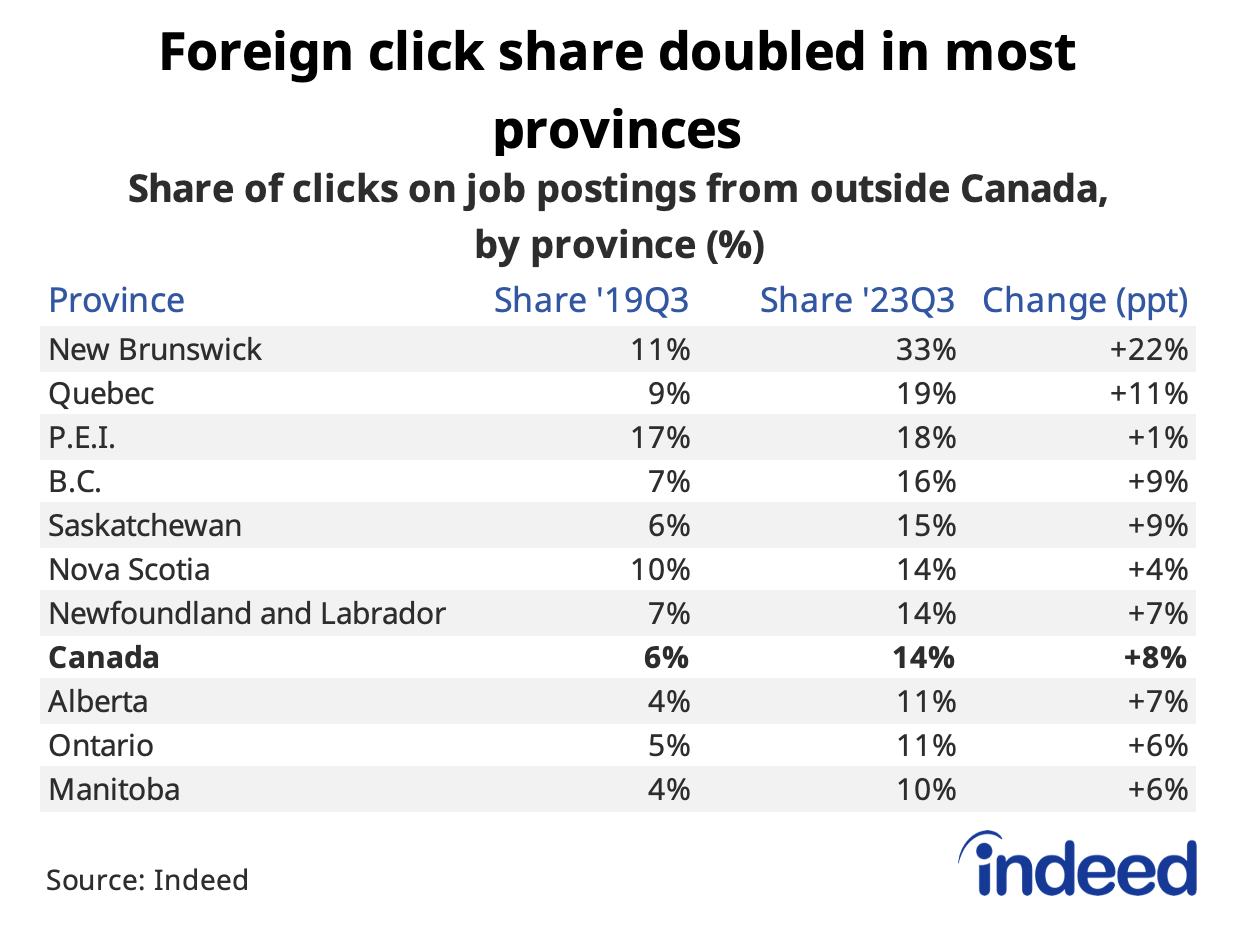

Foreign job seeker clicks as a share of activity has increased in all provinces. Their presence in 2023Q3 was particularly high in New Brunswick and Quebec, standing at 33% and 19% of clicks respectively, reflecting both their elevated shares in 2019 and their larger-than-average increases since. Meanwhile, the foreign click share is slightly below average in Ontario, but still more than doubled from four years earlier.

Broad-based increase in interest, though not from the US

The eight percentage point increase in foreign click share between mid-2019 and mid-2023 has been driven by a wide range of countries. Clicks from India, now the largest source of international interest, contributed the most (1.1 percentage points) to the growth. However, the job seeker footprint from Pakistan, the Philippines, and Nigeria grew at an even faster pace.

Meanwhile, the share of clicks from France, Tunisia, Morocco, and Algeria all shot up, likely contributing to the larger-than-average increases in foreign click share in Quebec and New Brunswick since 2019. On the flip side, the presence of US job seekers has slipped, though clicks from America still remain the second largest source of foreign interest in Canadian postings.

Foreign click shares up most among manual labour and care-economy jobs

Foreign click shares are up across all major occupations over the past four years, but the increases have been uneven. The largest increases have mainly been in lower and mid-paying jobs in manual labour, including agriculture, driving, manufacturing, as well as cleaning and sanitation. Agriculture in particular stands out, likely related to the long-standing substantial presence of temporary foreign workers in the industry. Clicks from abroad as a share of activity also rose substantially for care-economy sectors like personal care and home health, and childcare. These outsized increases in foreign click share generally reflected a combination of growing interest from outside of Canada, and in some cases, shifts in domestic job seeker interest away from blue-collar job postings.

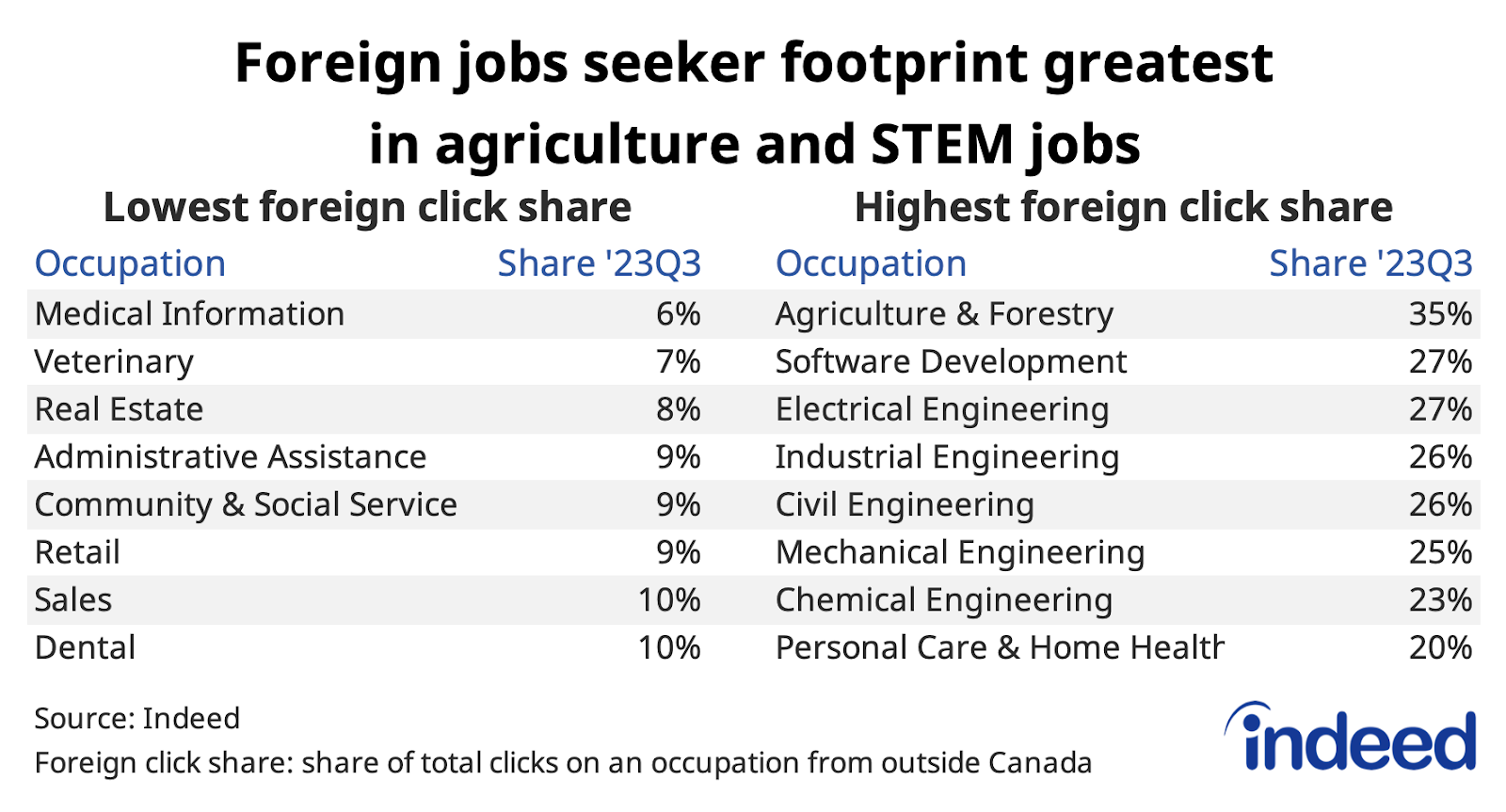

While the relative presence of foreign job seekers has expanded most in primarily manual labour-related jobs, outside of agriculture the occupations with the highest foreign click shares — in the range of 25% of total clicks on Canadian postings — are generally in STEM fields. Software development, where even in 2019, 20% of clicks came from abroad, stands out in particular as a segment where foreign job seekers have likely played an important role in the sector’s rapid growth over the past decade.

At the other end, foreign click shares in 2023Q3 were lowest across a range of service sector occupations, including administrative assistance, sales, and retail. Nonetheless, even in these sectors, the share of clicks from abroad this past quarter still exceeded the economy-wide average prevailing in mid-2019.

Conclusion

The surge in foreign interest in Canadian job postings in recent years suggest policy changes have caught the attention of job seekers abroad. Moreover, if the experience in 2022 is any indication, this elevated interest could keep the Canadian population growing quickly, at least in the near-term. Less clear though, are the impacts this shift has already had on the labour market.

Canadian job postings have fallen off since early 2022, as the foreign click share has risen further. However, across occupations, there isn’t a significant correlation between the change in job postings on Indeed as of September 2023 over the prior year, or since the start of the pandemic, and how much the foreign click share changed between the third quarters of 2019 and 2023. These limited correlations don’t necessarily mean the jump in foreign clicks hasn’t impacted the labour market, but rather the effects might be relatively subtle.

For instance, posted wage growth on Indeed has been somewhat faster than average in several of the manual labour-related occupations where foreign clicks have grown most. However, the gap in pay growth compared to other sectors might have been larger without growing interest from elsewhere. Conversely, the impacts of the rising foreign click share could be broad, rather than concentrated in specific segments of the labour market, consistent with the jump in interest across occupations. With no indication that population growth will slow in the near-term, assessing the labour market impacts of these trends will remain one of the key questions facing the Canadian labour market, but with answers elusive, given the limited information available to researchers in the Labour Force Survey.

Methodology

We track foreign interest in Canadian job postings by tallying clicks on job postings located in Canada by job seekers with IP addresses located outside of Canada. Job seekers for whom the location can not be determined are excluded. For analysis by occupational sector, only occupations with at least 1,000 clicks in 2019Q3 were included.