Key points:

- In late July 2023, 13% of Canadian postings on Indeed mentioned some form of location flexibility (either remote or hybrid work), a similar share to a year earlier, and still well above its 4% pre-pandemic rate.

- However, the nature of remote opportunities has changed, as 42% of overall location-flexible postings in July mentioned hybrid work, up from just 16% at the start of 2022.

- Hybrid opportunities have soared across remote-friendly sectors, but account for a particularly large share of work-from-home arrangements in white collar fields like finance and legal services. Tech and other knowledge economy sectors don’t mention time at the workplace as often, compared to other types of remote work.

- One reason mentions of location flexibility remain common is that it potentially attracts job seekers: in particular, recent Canadian job postings mentioning hybrid work were on average active on Indeed 5% fewer days than comparable job ads that didn’t mention any form of remote work.

Canadians working in jobs that can be done remotely are spending more time in the office, but much of the shift back to the workplace has been on a part-time basis. Indeed job postings suggest location flexibility, at least in some form, will remain prominent, in part because of its benefits for candidate recruitment.

The rise of remote work has been one of the enduring pandemic-era labour market shifts. Almost a quarter (24%) of Canadian workers in May 2023 typically weren’t working exclusively at a workplace, down one percentage point from a year earlier, according to the Labour Force Survey, but still far above its pre-pandemic rate. However, the nature of remote work has changed: in May, 41% of these “remote” workers (10% of all workers) had hybrid schedules, splitting time between on-site and at-home, up from a quarter of remote workers (6.3% of all workers) a year earlier.

Indeed job postings suggest both patterns—the persistence of location flexibility, but also a shift to hybrid work—are likely to persist. We track opportunities for location-flexible work by tallying Canadian job postings that feature a range of hybrid and other remote-related terms in their job description. These include postings that only mention remote work (i.e. phrases like “work from home” and “teletravail”), those featuring only hybrid-specific terms (like “hybrid schedule” or “in office 3 days a week”), and others that include both categories. While the data doesn’t allow for precise categorization, we classify these “overlap” posts as hybrid positions, as their job descriptions explicitly mention the potential for some on-site work.

Employers continue to offer location flexibility at elevated rates

At the start of 2020, less than 4% of Canadian job postings mentioned remote or hybrid work. But that share jumped at the onset of the pandemic, rising steadily through early 2022 and remaining elevated ever since. As of late July, 13% of postings included either remote or hybrid-related terms, similar to their level a year earlier. The flat trend since last summer partly reflects the overall weakness of job posting trends in remote-friendly sectors, like tech. After adjusting for this change in jobs-mix, the remote/hybrid share was actually up 1.5 percentage points from a year earlier.

Despite sharp declines in job postings in tech and other white collar sectors over the past year, many new job openings in these fields continue to offer the ability to work from home, at least some of the time. The overall remote/hybrid share rose further in the tech sector (where it was already highest), including covering almost half (45%) of postings in software development. The share of postings noting location flexibility in the legal services and banking and finance sectors both jumped above 37%. Marketing—as well as media and communications occupations—were two exceptions, with the share of postings in these fields offering remote/hybrid work falling somewhat from a year earlier.

Hybrid job postings have taken off, other remote postings have fallen back

Some form of remote work is still frequently offered in Canadian job postings, but it’s increasingly involving hybrid work. Job postings including hybrid-related terms started to appear in the second half of 2021, and by early 2022 accounted for 2.4% of all postings, and 16% of posts mentioning location flexibility. Their share has grown sharply since, with hybrid posts now making up 5.5% of overall Canadian job postings, and 42% of the subset of postings that mention location flexibility.

Without the rise of hybrid work, overall location-flexible options for work would’ve likely declined as the pandemic receded. At the end of July, 7.5% of Canadian job postings mentioned remote but not hybrid work, up 3.6 percentage points from their pre-pandemic share but down nearly 5 percentage points from early 2022. These non-hybrid (at least explicitly) remote opportunities remain plentiful and still account for the majority of location-flexible job postings, but are on the wane.

Hybrid work especially common in white collar fields

Hybrid job postings have jumped across the board, but they loom especially large in certain white collar sectors. Over 60% of the job postings mentioning location flexibility in accounting, insurance, and legal services specifically refer to hybrid work, while finance is also elevated. Meanwhile, hybrid postings account for less than 43% of overall remote postings in STEM fields like scientific research and development, software development, and IT operations.

The shift toward hybrid job opportunities suggests more time will be spent in the office going forward than in recent years. But the wide variation in the share of postings noting a hybrid arrangement across different fields highlights how remote work is likely to evolve differently depending on the sector. Knowledge economy jobs more amenable to independent work are likely to retain a greater share of fully remote workers, while collaborative white collar occupations are leaning heavily toward more hybrid arrangements. In both cases though, there’s no sign that workers are about to shift en masse back to the office full-time.

Job seeker interest is one factor keeping location flexibility common

The ultimate trajectory of remote work will depend on the preferences of both employers and workers. As the pandemic waned and offices reopened, some employers began taking note of some of the downsides to fully remote work. However, location flexibility has definitively emerged as a perk that can help to both retain existing workers and recruit job seekers. The rise of hybrid schedules serves as a kind of compromise option.

A subset of Canadian job seekers continue to expressly seek out remote work of some kind. As of late July 2023, 4.1% of all Canadian job seeker searches on Indeed included remote/hybrid-related terms, down slightly from a year earlier but still more than six times higher than the pre-pandemic rate. Meanwhile, there are signs this job seeker interest is helping employers fill job openings faster than otherwise.

Among a sample of more than 4 million Canadian job ads posted on Indeed between February 2022 and March 2023, those that included hybrid-related terms were active for 5% fewer days than similar positions that didn’t mention location flexibility (see methodology). The correlation wasn’t as tight for other remote postings, which were active 2% fewer days than baseline, though this result was only significant at the 10%, but not 5%, level. The shorter duration of these postings was likely related to greater candidate interest, as both hybrid and other remote positions generally received more daily job seeker applications than otherwise comparable postings.

These results don’t establish the causal impact of how mentions of remote work influence time-to-fill, the way an experiment like an “A/B test” by an employer would. Still, the correlations are consistent with the idea that offering location flexibility to potential candidates may help accelerate the recruiting process.

Will remote work be cyclical work?

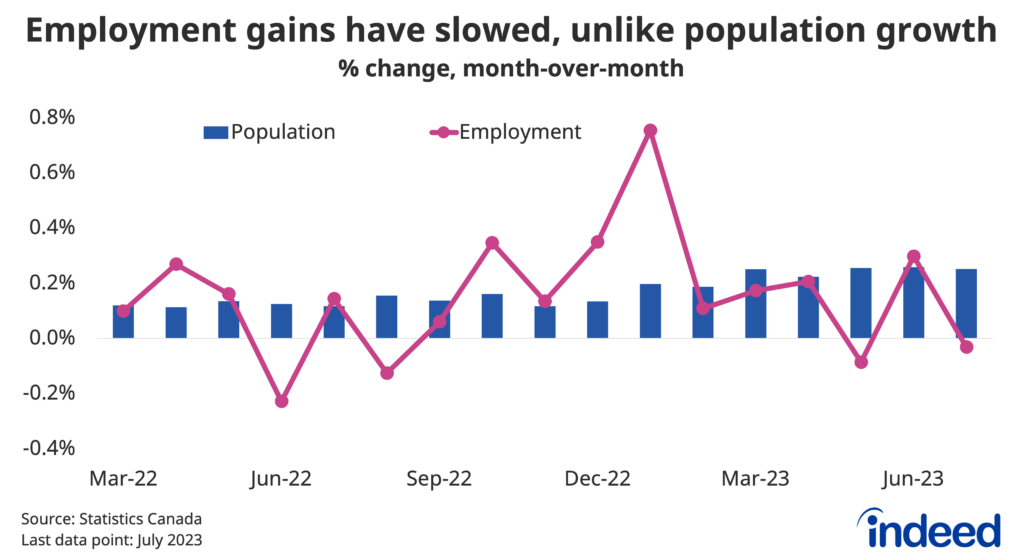

Going forward, both remote and hybrid work face potential headwinds, including employer concerns over remote work’s impacts on productivity and workplace cohesion. The health of the economy itself may also play a role: if the labour market softens and job seekers have fewer options, some employers might be less inclined to offer location flexibility.

In some fields, such as software development, job postings have already fallen sharply to below pre-pandemic levels. This shift in hiring conditions has potentially contributed to fewer fully remote opportunities. However, when taken together with the rise in hybrid work, there’s little sign that candidates are increasingly being expected to be at the office five days per week. As more data comes in, it could be the case that fully remote work ends up being cyclically sensitive, but hybrid work doesn’t.

The ultimate trajectory of both remote and hybrid work will be a balancing act between its costs and benefits. If location flexibility helps attract and retain workers, that alone may help its long-term staying power.

Methodology

A deep review of the methodology behind Indeed’s Hybrid/Remote Tracker can be found here.

To assess the correlation between duration of job posting activity and remote status, we tracked job postings that originated between February 2022 and March 2023, and compared how long postings with the same job title remained active on Indeed, across those that included hybrid-related terms, other remote work terms, and postings that didn’t mention location flexibility in their job descriptions (we also controlled for other factors like when the position was first posted, its province, the language used in the job ad, and whether the job ad included a posted salary, among others).

The results reported above come from regressions in terms of log-points, that also included interaction terms between job title, month of origination, and province, while standard errors were clustered at the firm level.