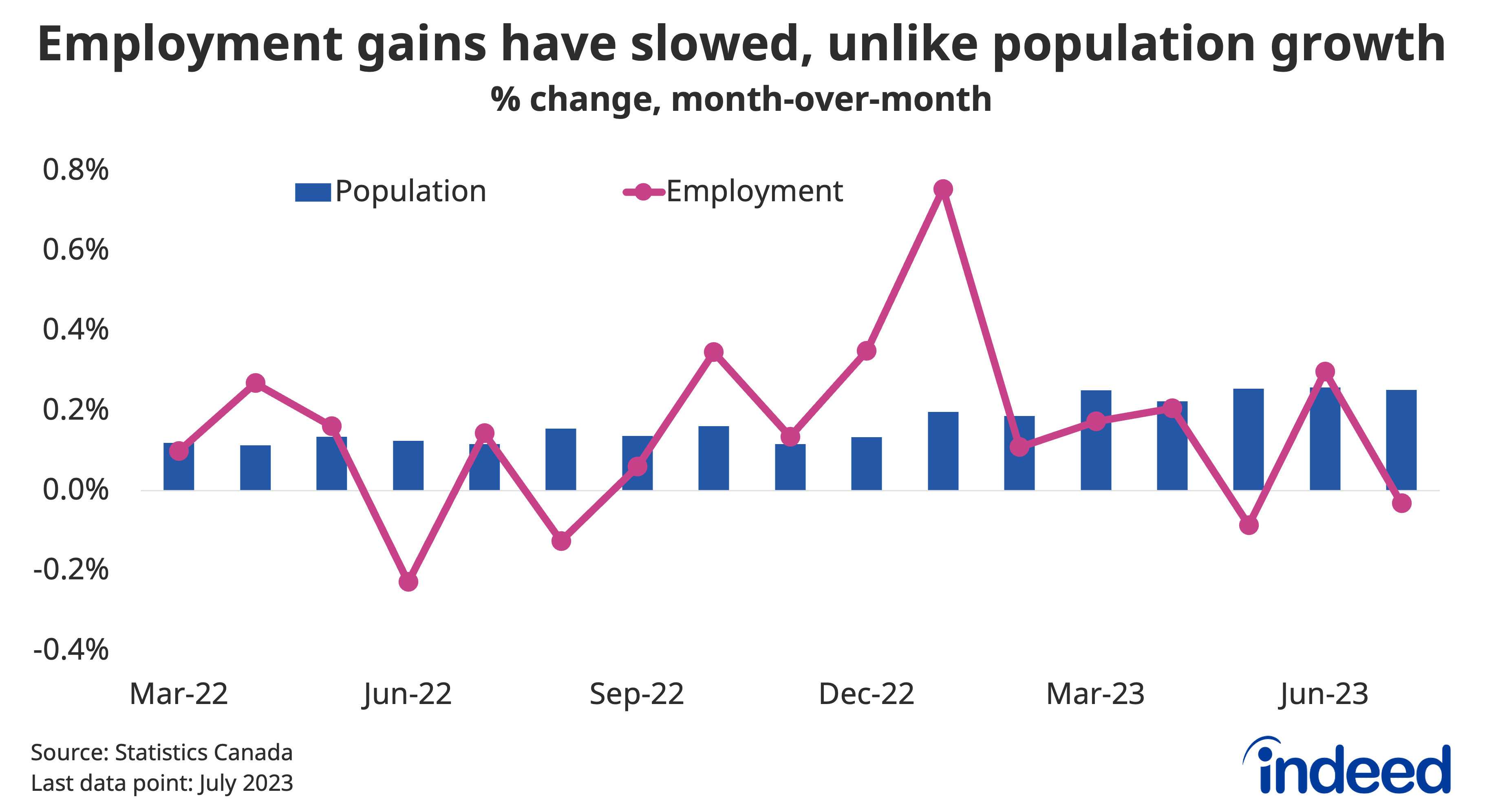

Canadian employment was flat in July, following a downshift in momentum that began in the second quarter. Slight monthly declines aren’t rare in the LFS, but they do stand out when the population is growing so quickly. Hours worked edged out a small gain, but have also been relatively flat in recent months. Overall, the employment rate – the share of the population with a job – has slipped, but remains in solid shape. But StatCan noted that the share of recent newcomers to Canada who were working had slipped over the past year, partially reversing substantial increases earlier in the recovery.

Cooler employment trends come at a time when employer hiring appetite has been steadily receding from its early highs. The drop-off in job opportunities is now starting to show up in the unemployment rate, likely impacting new entrants to the labour force, including recent immigrants, more than others. So far though, the weakness hasn’t been accompanied by a substantial rise in layoffs, showing up instead in relatively weak rates of new job creation. As a result, the downshift in overall momentum has been relatively gradual. Without a major change in the broader macroeconomy, it looks like this trend will continue.

In contrast to the soft job numbers, average hourly earnings growth came in stronger than expected, bouncing back to 5.0% year-over-year, reversing its dip to 4.1% the month prior. However the reacceleration was both potentially influenced by weak base-year effects, while wage growth after holding jobs-mix constant showed a less rapid 4.4% increase instead. As a result, the underlying trend in wage growth might not have been as hot as suggested by the headline number, fitting with other signs of cooler demand in the labour market.