- Canadian job postings continued their gradual decline through August 25th, falling to 29% below their early 2022 peak, though still up 23% from their pre-pandemic level.

- Job postings in 8 of 56 occupational sectors tracked were below pre-pandemic levels in late August, mainly in tech, as well as sales, and marketing, compared to none a year earlier.

- Posted wage growth slipped in July, falling to an average 3-month pace of 3.9% year-over-year, after holding steady at 4.1% throughout the second quarter.

- Falling job postings and cooler posted wage growth both suggest slower momentum for the labour market ahead, while also taking pressure off the Bank of Canada for further interest rate hikes.

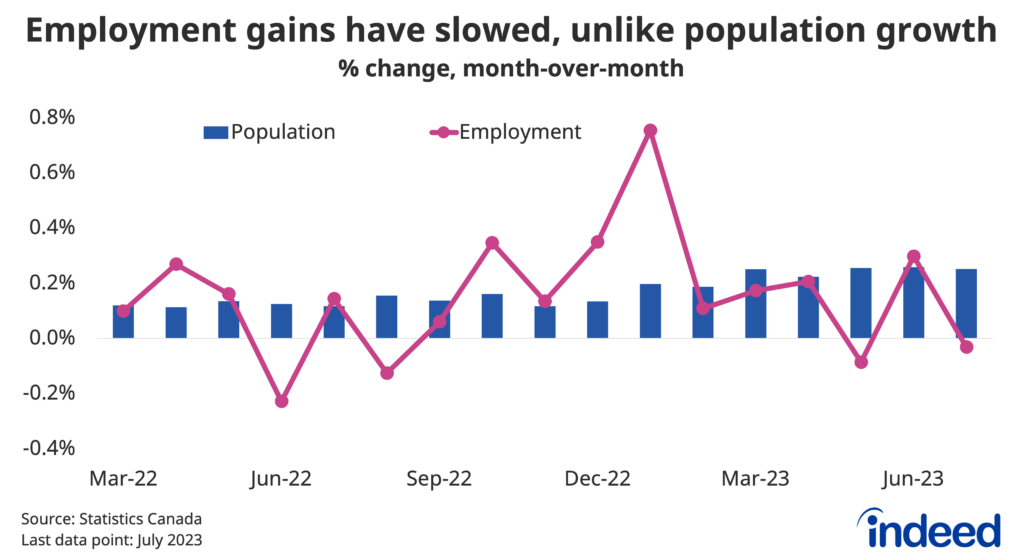

While employment has bounced up and down in 2023, the ongoing decline in job postings has been a constant trend. On August 25, 2023, Canadian job postings on Indeed were down 23% year-over-year, and 29% below their peak reached in May 2022. At the same time, postings remained 23% above their pre-pandemic level, reflecting both how elevated they were in early 2022, and their gradual pace of decline. Nonetheless, there’s no sign of the downtrend abating.

For most of 2022 through the start of 2023, job postings exceeded their pre-pandemic levels in all 56 of the broad occupational sectors we track, while three-quarters of categories had grown over 50%. But as hiring appetite has receded, those shares have converged. In late August, job postings in 14% of sectors were down compared to early 2020, while the share exceeding 50% growth had dropped to 16%.

Tech-related fields comprised most occupations that had declined relative to February 2020, though sales and marketing were also weak. Conversely, most of the occupations where postings were still up over 50% were in healthcare.

Posted wage growth slips below 4%

Amid the drop in job openings, growth of advertised wages and salaries ticked down in July. The Indeed Wage Tracker showed year-over-year growth in posted wages had already cooled from its 5.3% peak in mid-2022, but had flattened to about 4.1% throughout the second quarter of 2023. However, the trend eased further in July, with annual posted wage growth running at a 3-month average of 3.9%.

Posted wage growth has eased since the start of the year across the occupational pay scale. Advertised salaries continue to grow faster among lower-paying job types, led by retail and customer service, both of which stood above 5% year-over-year. Meanwhile, posted wage growth has slowed more sharply in mid-paying occupations over the past six months, including in sectors like driving, and construction.

Lastly, posted wage growth continues to lag in higher-paying job types, though the pace hasn’t slowed as much as others in recent months. Part of this reflects trends in the healthcare sector, where advertised salaries are growing relatively slowly, but the rate of growth has held steadier than in other areas of the economy.

Wage growth remained at an elevated 5.0% year-over-year pace in the July Labour Force Survey, though the details were softer than suggested by the headline figure. Both trends in job postings, and their advertised wages, suggest wage growth is set to cool. This likely isn’t great news for job seekers conditions, following an already subdued second quarter. However, it is also consistent with a cooler inflation environment, which could push the Bank of Canada to pause in September, after resuming its policy rate hikes in July.

Methodology

All job postings figures in this blog post are the index of seasonally-adjusted Canadian job postings on Indeed re-based to February 1, 2020, using a seven-day trailing average. February 1, 2020, is our pre-pandemic baseline. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. Each series, including the national trend, occupational sectors, and sub-national geographies, is seasonally adjusted separately. This week, we applied our quarterly revision, which updates seasonal factors and fixes data anomalies. Historical numbers have been revised and may differ from originally reported values. New job postings are posts that are seven days old or less.

The number of job postings on Indeed, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.

All posted wage growth data in this post refers to the three-month trailing average of the year-over-year growth rate in average posted wages.

To calculate the average rate of posted wage growth, we follow an approach similar to the Atlanta Fed US Wage Growth Tracker, but we track jobs, not individuals. We begin by calculating the median posted wage for a given country, month, job title, region, and salary type (hourly, monthly, or annual). Within each country, we then calculate year-on-year wage growth for each job title-region-salary type combination, generating a monthly distribution. Our monthly measure of wage growth for the country is the median of that distribution. Alternative methodologies, such as the regression-based approaches in Marinescu & Wolthoff (2020) and Haefke et al. (2013), produce similar trends.More information about the data and methodology is available in a research paper by Pawel Adrjan and Reamonn Lydon, Wage growth in Europe: evidence from job ads, published in the Central Bank of Ireland’s Economic Letter series.