Key Points:

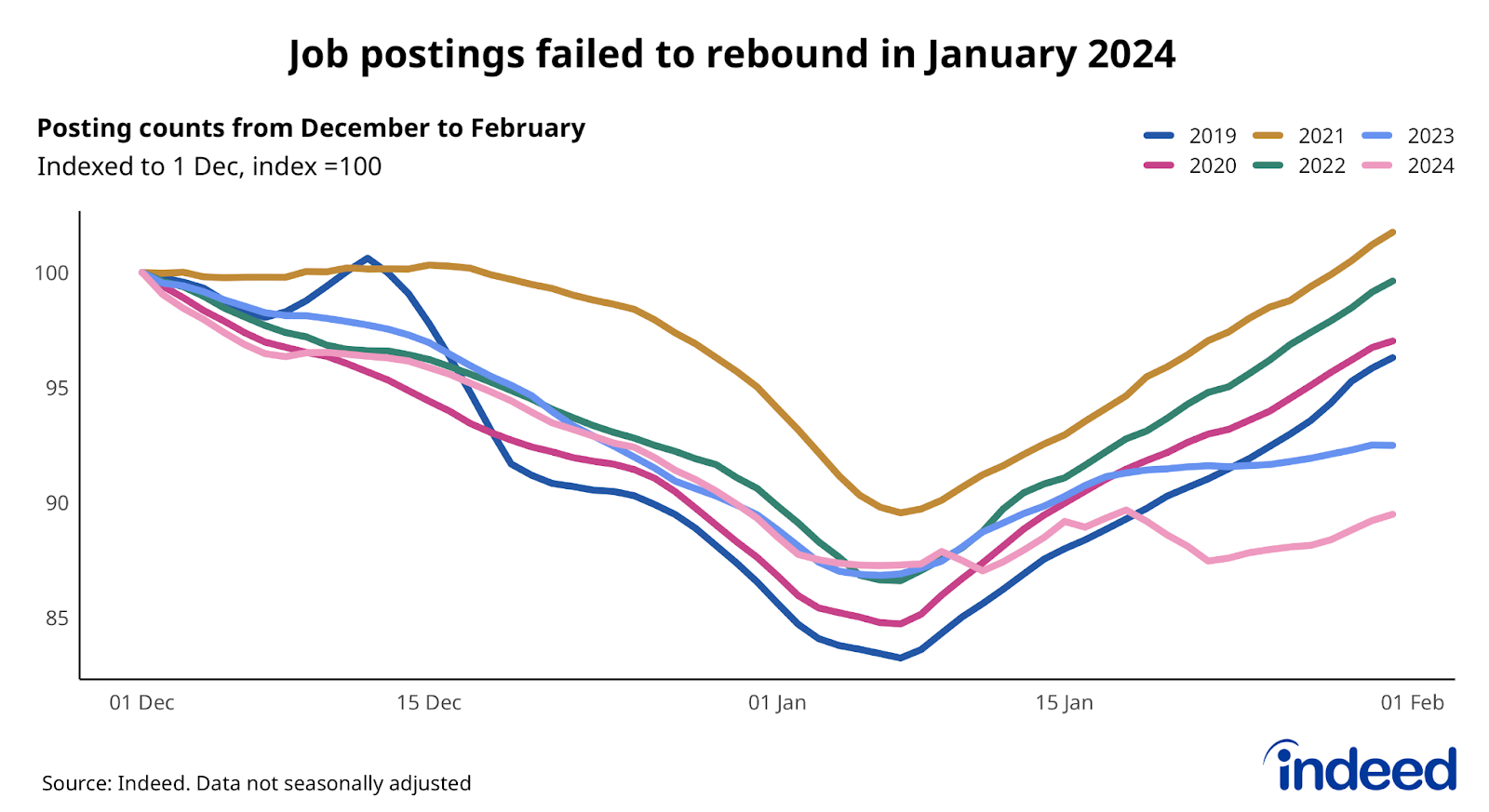

- UK job postings only increased by 0.2% in January 2024, much less than the pre-pandemic jump of 11.3% in January 2020, and below the 3.4% rise in January 2023.

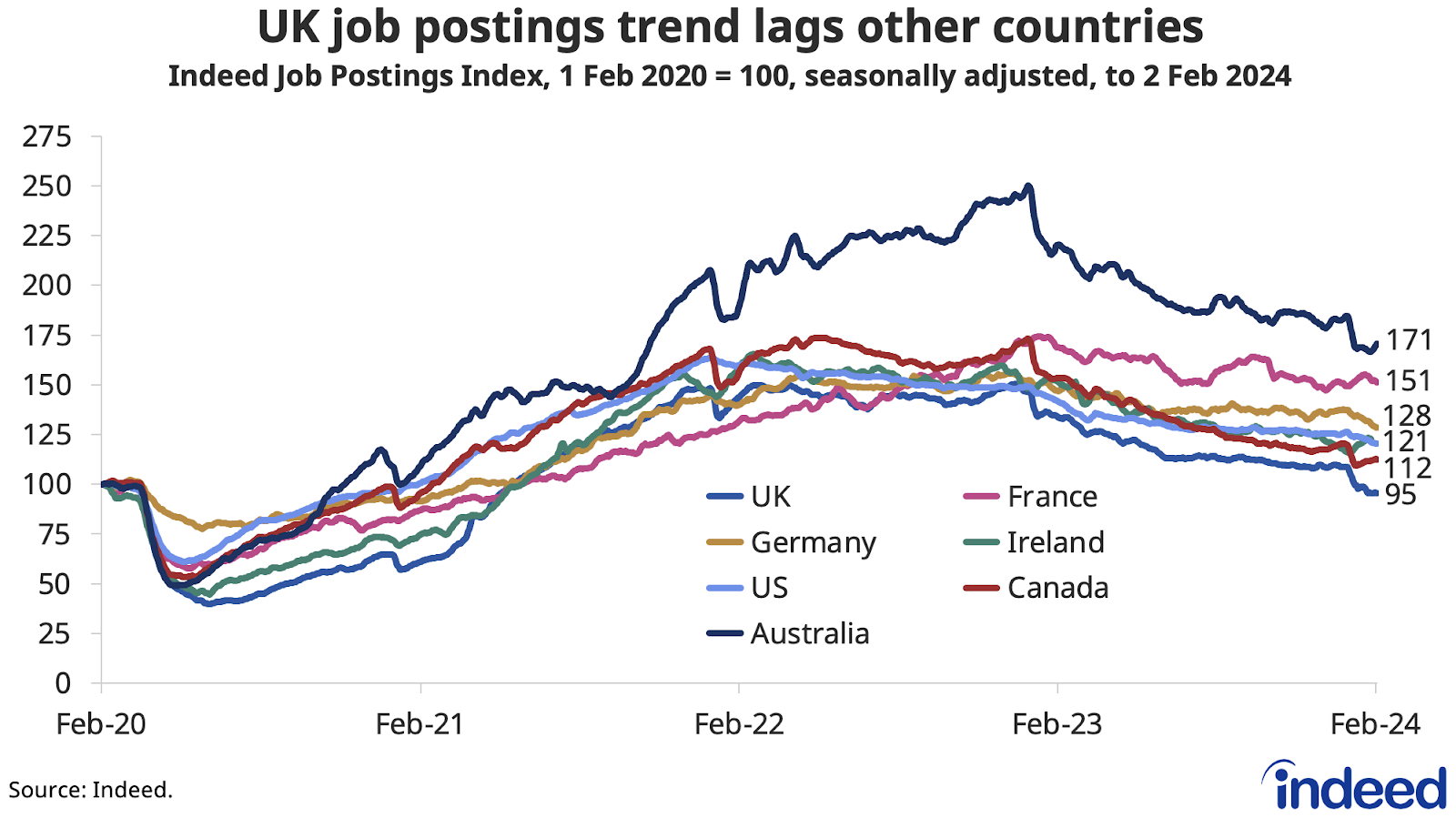

- That leaves UK postings down 5% on their 1 February 2020, pre-pandemic baseline, in contrast to other countries where they remain comfortably above the threshold.

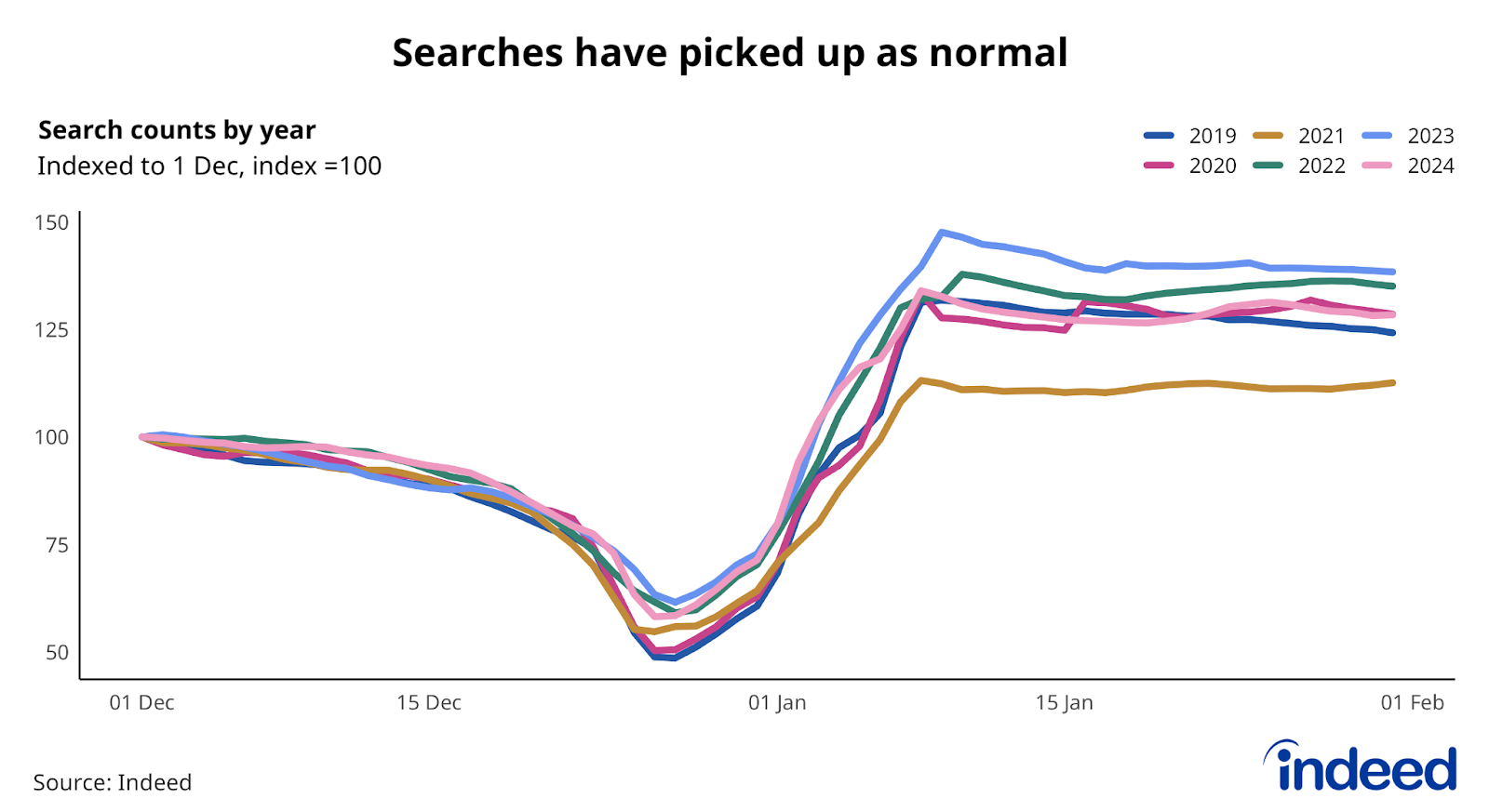

- While postings have failed to follow typical seasonal patterns to start 2024, jobseekers are conducting searches at rates in line with prior years.

Job postings usually follow a familiar pattern around the turn of the year, slowing sharply as the holidays approach and then rebounding strongly into January as employers ramp up their hiring plans for the year. But that pattern hasn’t materialised at the start of 2024.

While jobseekers are following familiar trends and picking up on searches to start the year, job postings are not following. UK job postings barely rose in January, up by a meagre 0.2% during the month. That’s much weaker than the typical double-digit January bounce, and even the lacklustre 3.4% increase seen in 2023.

It leaves UK job postings at around their lowest ebb since May 2021, when the economy was recovering from Covid lockdowns. As of 2 February 2024, postings are 5% below their pre-pandemic baseline as of 1 February 2020, on a seasonally adjusted basis. The majority of occupational sectors have experienced a slowdown in hiring demand from peaks, as the post-pandemic hiring boom fades into the rearview mirror.

The weakness in UK postings contrasts with other countries in Europe, North America and Australia, where postings are still comfortably above pre-pandemic levels. The slow start to the year suggests a cautious approach from employers, with forecasters expecting the UK economy to see relatively sluggish growth this year along with stubborn inflation pressures. While layoffs have so far remained fairly low, businesses may be putting more of a focus on retention rather than hiring of new staff in the current climate.

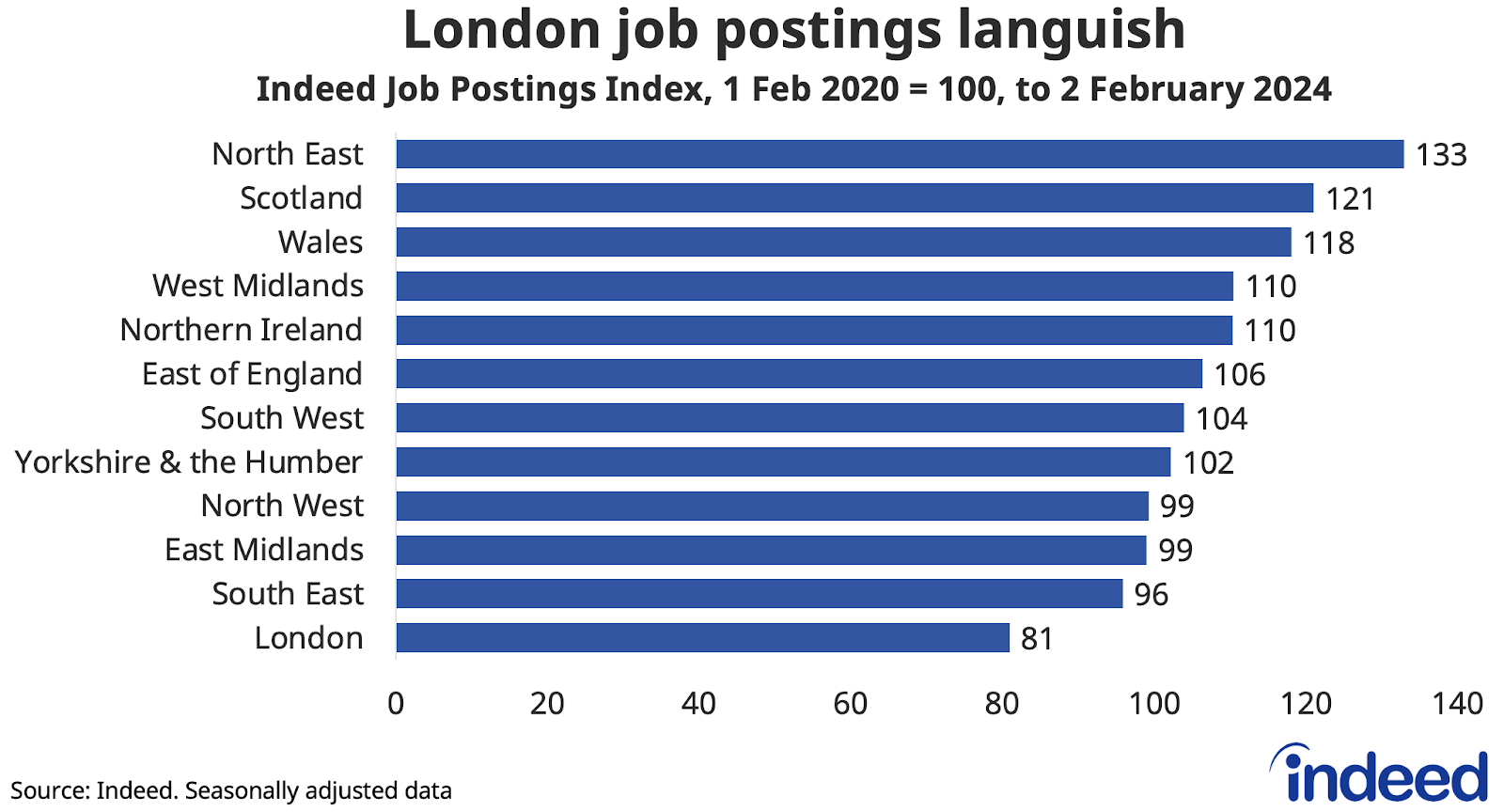

London has suffered a lasting hit

The UK average is pulled down by weakness in London and the South East, which together account for around one-third of total job postings. Job postings in London, in particular, are languishing well below pre-pandemic levels, down 19% from 1 February 2020. The persistence of hybrid working and a hiring slowdown across many professional occupations continue to be factors weighing on job postings in the capital. Conversely, job postings in regions with greater reliance on public sector jobs, such as the North East, Scotland and Wales, have held up the most.

Jobseeker searches have picked up but hiring is still challenging in some sectors

Searches also typically see a January bounce, with jobseekers eager to explore fresh opportunities at the start of the new year. This January, searches picked up as normal after the holidays and were pacing in line with previous years (apart from the lockdown-afflicted winter of 2021, when the rise was muted).

Though the labour market has softened, hiring isn’t necessarily easy. For some sectors in particular, jobseeker interest remains substantially lower than before the pandemic. Average clicks on social science roles are down 33% versus pre-pandemic, relative to the average job on Indeed. Interest in community & social service jobs is down 31%, while cleaning & sanitation roles have seen a 30% fall. Childcare has seen a 27% drop, underlining the skills shortage that has triggered the government’s new childcare recruitment campaign as it seeks to expand provision for working parents.

Conversely, some occupations have seen a substantial improvement in jobseeker interest. Though, in several cases including tech, this reflects a sharp decline in job postings, leaving more jobseekers chasing each available position. Clicks on software development roles are up 252% on average since February 2020, relative to the average job. Clicks on information design & documentation jobs have increased 168% in this period, while mathematics (153%), legal (77%) and marketing (62%) roles are also receiving higher interest.

Conclusion

The UK labour market hasn’t received its usual January injection of job postings, marking a distinct softening in hiring demand. The question in 2024 is whether the job market stabilises or retreats further. The Bank of England is hoping the continued fall in vacancies will mean wage growth easing from its current elevated levels, paving the way for interest rate cuts later this year. But with unemployment still low and continuing challenges around workforce participation, it remains a somewhat tight labour market. Policymakers have indicated their intention to wait for further evidence this won’t lead to a resurgence of inflation pressures before pivoting to rate cuts.

From an employers’ perspective, hiring challenges have eased but haven’t completely disappeared, with many industries needing to fill roles but not always receiving sufficient jobseeker interest. Remaining competitive on pay, benefits and flexibility continues to be important to attracting and retaining talent.

Hiring Lab Data

Job postings data is available on our Data Portal. We also host the underlying job-postings chart data on Github as downloadable CSV files.

Methodology

Data on seasonally adjusted Indeed job postings are an index of the number of seasonally adjusted job postings on a given day, using a seven-day trailing average. February 1, 2020, is our pre-pandemic baseline, so the index is set to 100 on that day. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. We adopted this methodology in January 2021. Data for several dates in 2021 and 2022 are missing and were interpolated. Non-seasonally adjusted data are calculated in a similar manner except that the data are not adjusted to historical patterns.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.