Key Points:

- Hiring demand has largely normalised, with job postings having fallen slightly below pre-pandemic levels.

- Wage growth has peaked, but is still high. Its persistence remains key to the timing of any potential future interest rate cuts by the Bank of England.

- Despite return-to-office calls, location flexibility remains a focus for both employers and jobseekers.

The UK labour market continued to soften in recent months and begins 2024 with hiring demand broadly back to immediate pre-pandemic levels. But the labour market remains somewhat tight, and though most sectors have seen substantial cooling, that doesn’t necessarily mean hiring is easy.

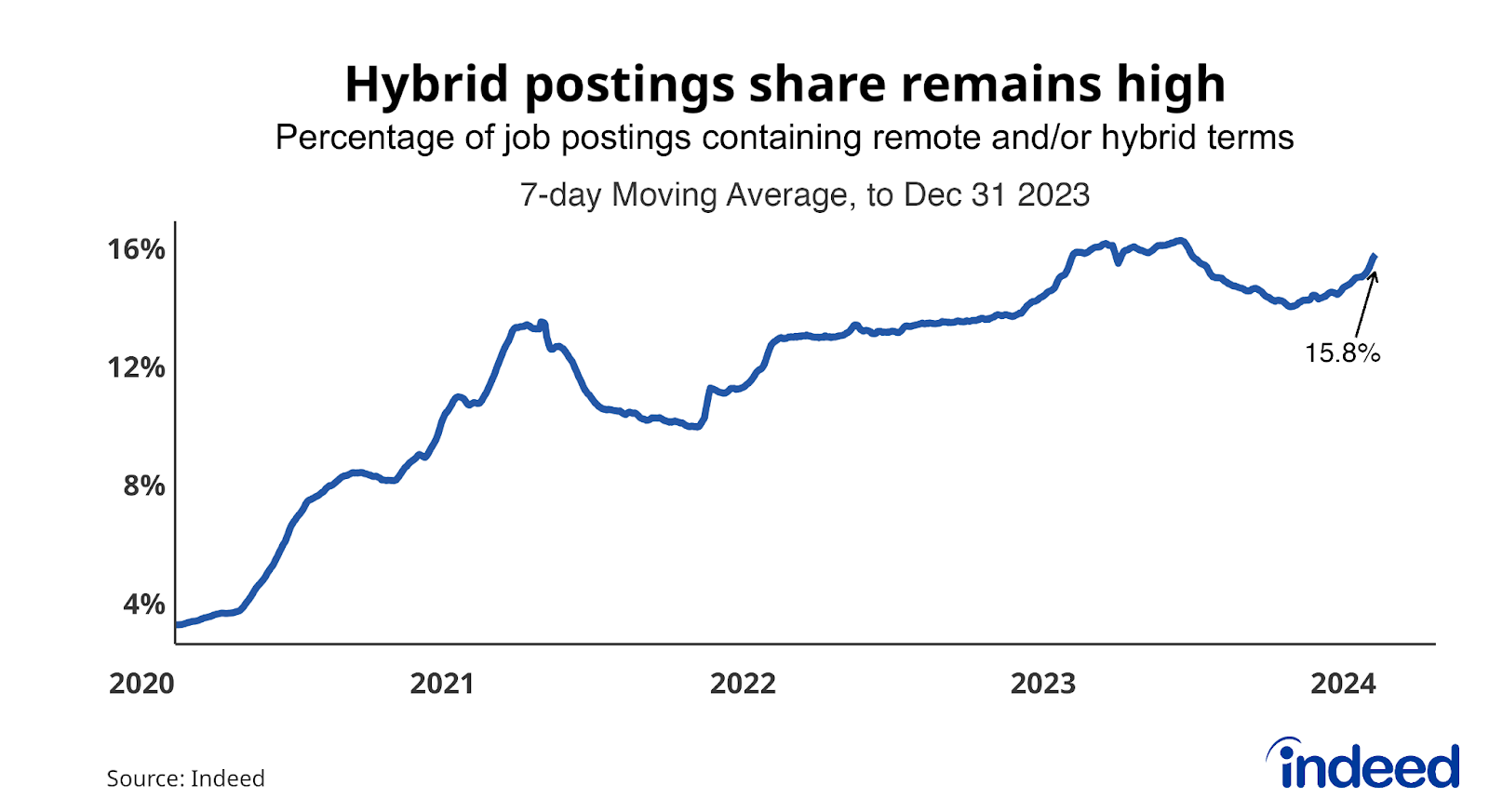

Spotlight: Hybrid job postings share has rebounded

There was much focus on return-to-office in 2023, but the share of UK job postings on Indeed mentioning remote or hybrid flexibility held up. As of the end of December, 15.8% of UK job postings on Indeed mentioned the potential for remote or hybrid work, largely in line with the May 2023 peak of 16.3%. Though the labour market has softened (and categories that typically feature a large share of remote-eligible jobs, including tech, have slowed sharply), employers remain conscious of jobseekers’ preferences for location flexibility in a still-somewhat-tight market for talent. The share of searches containing remote or hybrid terms was 2.7% at year-end, near its all-time high of 3.0% and up tenfold from pre-pandemic levels.

Labour Market Overview

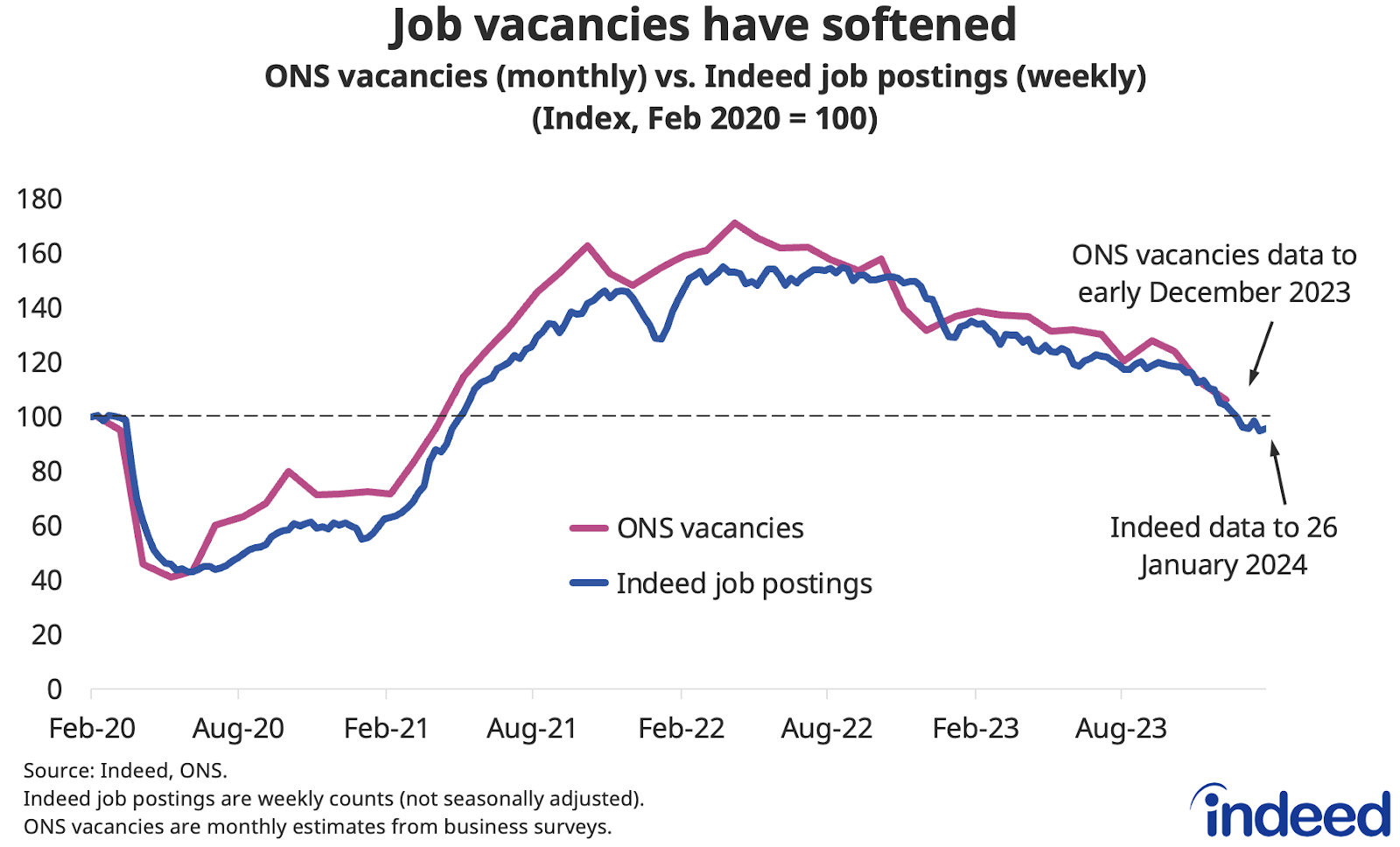

The gradual cooldown of the UK labour market continued into January. As of early December, vacancies as measured by the ONS were down 38% from their April 2022 peak but were still 6% above their level on the eve of the pandemic. The Indeed Job Postings Index, which includes more recent data through late January, is now slightly below pre-pandemic levels — as of 26 January, total UK job postings on Indeed were 4% below their 1 February, 2020 level.

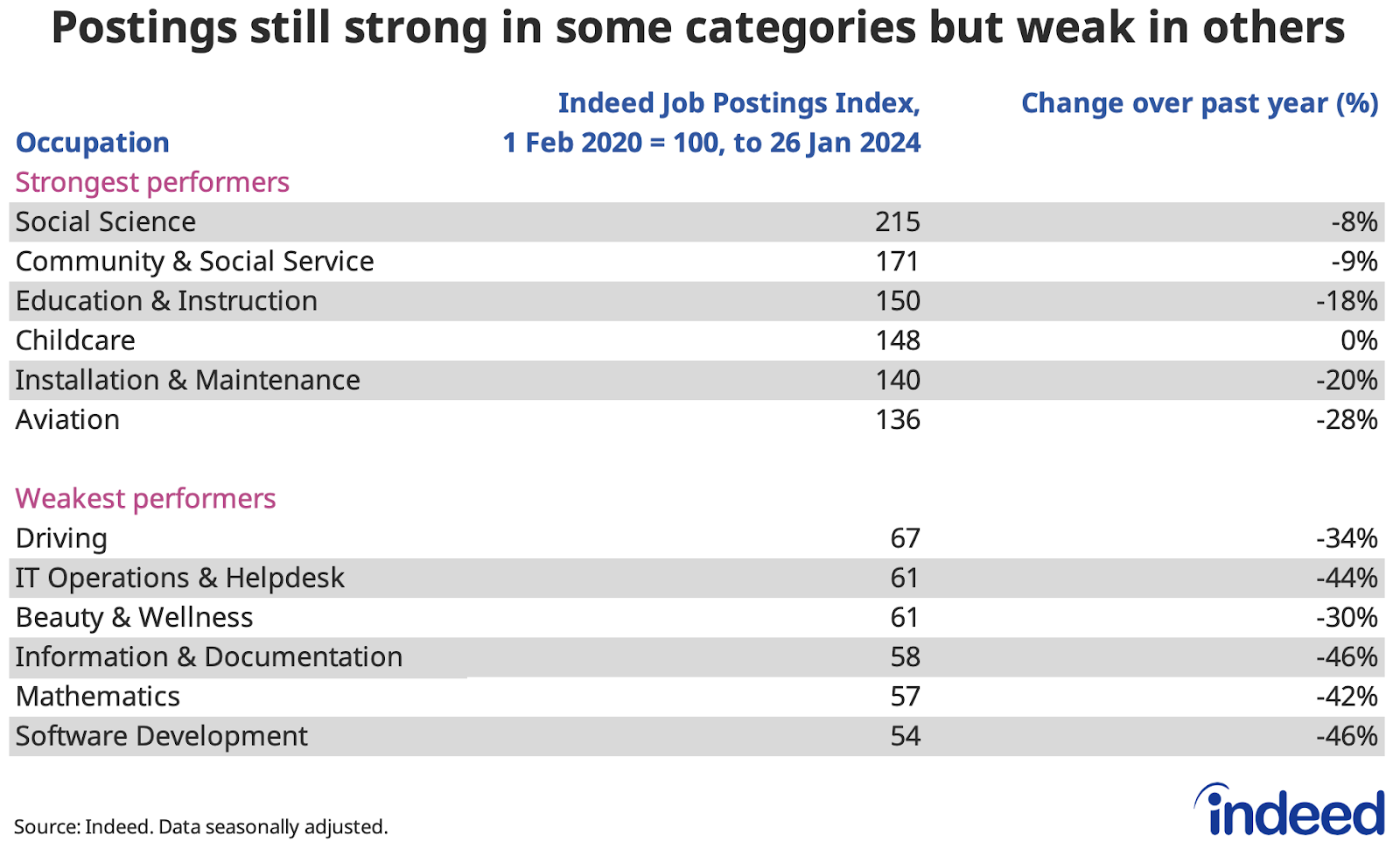

Job postings have fallen in most occupations over the past year, but some categories are holding up better than others. Postings for social science jobs are more than double their pre-pandemic baseline. By contrast, tech categories are among the weakest performers, with job postings for software developers down 46% from the baseline.

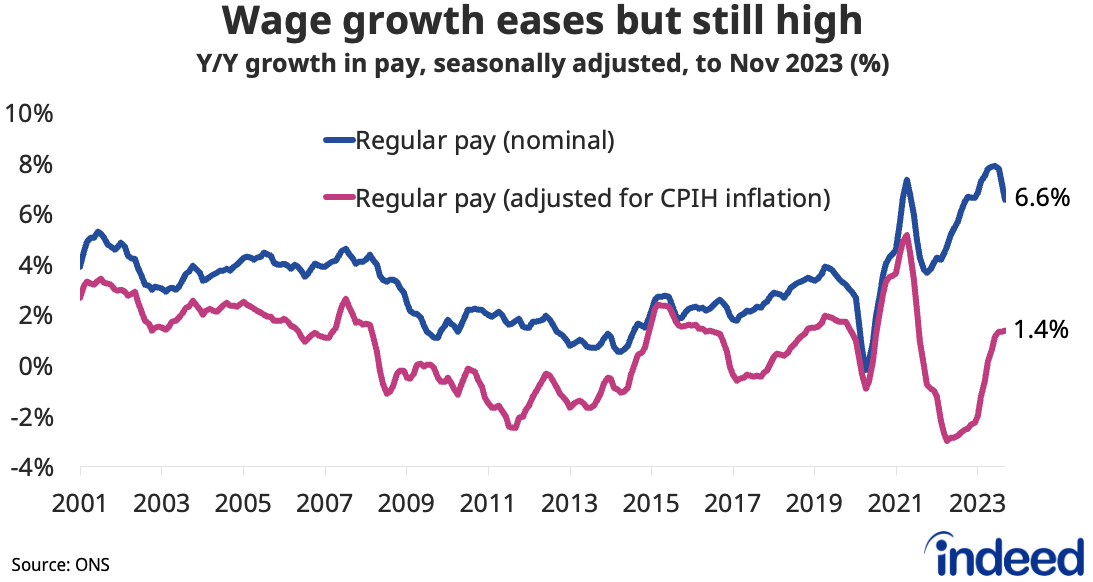

Wage growth has peaked, with the latest ONS figures showing regular pay growth easing from 7.2% year-on-year to 6.6% in the three months to November (and down from a peak of 7.9% in the period to August). In real terms, pay continues to rise as the annual pace of inflation remains below the pace of wage growth. Adjusted for inflation, regular pay was up 1.4% year-on-year in the latest period, the strongest growth in more than two years.

Data from the Indeed Wage Tracker paints a similar picture: UK wage growth has peaked, but remains high at 6.6% year-on-year (stronger than in the euro area and US). Sectors with the highest rates of posted annual wage growth in December, according to the Indeed Wage Tracker, were childcare (10.1%), cleaning & sanitation (8.6%), and retail (8.1%). The lowest year-on-year wage growth as measured by the Indeed Wage Tracker was in software development (1.6%), where postings declined substantially last year. Wage growth is running below the current 4% rate of inflation in around one-in-ten job categories.

The ONS was once again unable to publish the full suite of labour market data in its January release, pending methodological work to address issues with the Labour Force Survey. ‘Experimental’ estimates suggested the headline unemployment rate was unchanged at a still-low 4.2% (up from a low of 3.5% in mid-2022), while the employment rate ticked up slightly and inactivity dipped.

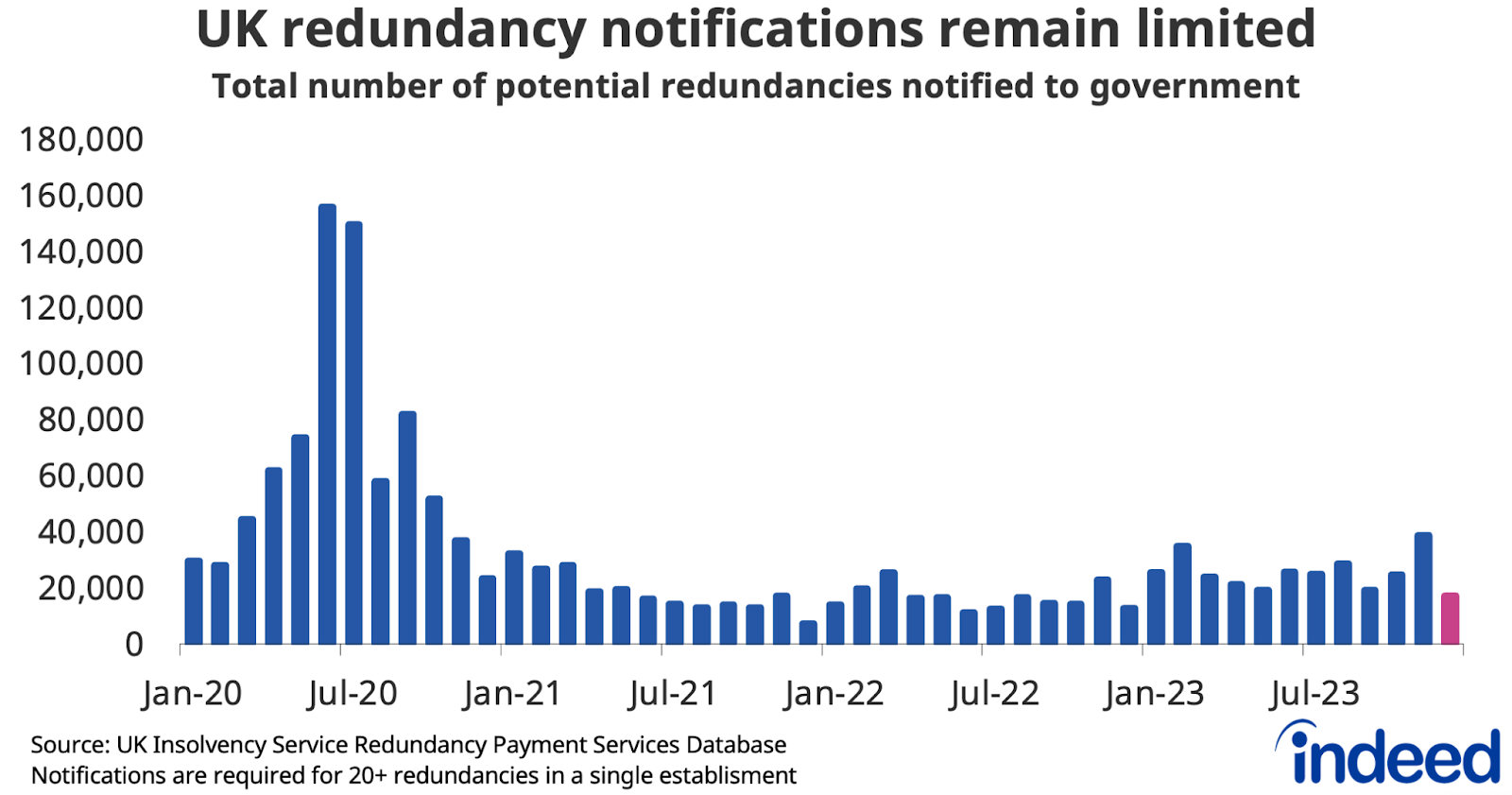

Meanwhile, notifications of potential redundancies have remained modest in recent months despite some layoff announcements in sectors including tech, professional services and construction.

Conclusion

With the post-pandemic hiring boom firmly in the rearview mirror and vacancies having largely normalised, the question in 2024 is whether the job market stabilises or retreats further. Though labour demand has softened substantially, wage growth is still running strong. The ongoing pace of wage growth — high enough to give workers a meaningful boost in purchasing power, but not so strong as to potentially re-ignite cooling inflation — is a key determinant in the timing and scale of any potential easing of monetary policy later in the year. From an employer’s perspective, hiring challenges have eased but haven’t completely disappeared. With unemployment still fairly low and nominal wage growth still fairly high, it remains a somewhat tight labour market. Remaining competitive on pay, benefits and flexibility continues to be important to attracting and retaining talent.

Hiring Lab Data

Job postings data is available on our Data Portal. We also host the underlying job-postings chart data on Github as downloadable CSV files. Typically, it will be updated with the latest data one day after this blog post was published.

Methodology

The Indeed Job Postings Index is a daily measure of labour market activity that is updated and will continue to be released weekly, superseding the Job Postings Tracker. The primary difference between the Indeed Job Postings Index and the legacy Job Postings Tracker is the level. The Indeed Job Postings Index is set to 100 on February 1, 2020, and this effectively provides a uniform level shift of 100 to the existing Job Postings Tracker across all time points.

To calculate the average rate of wage growth, we follow an approach similar to the Atlanta Fed US Wage Growth Tracker, but we track jobs, not individuals. We begin by calculating the median posted wage for each country, month, job title, region and salary type (hourly, monthly or annual). Within each country, we then calculate year-on-year wage growth for each job title-region-salary type combination, generating a monthly distribution. Our monthly measure of wage growth for the country is the median of that distribution.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.