Key Points:

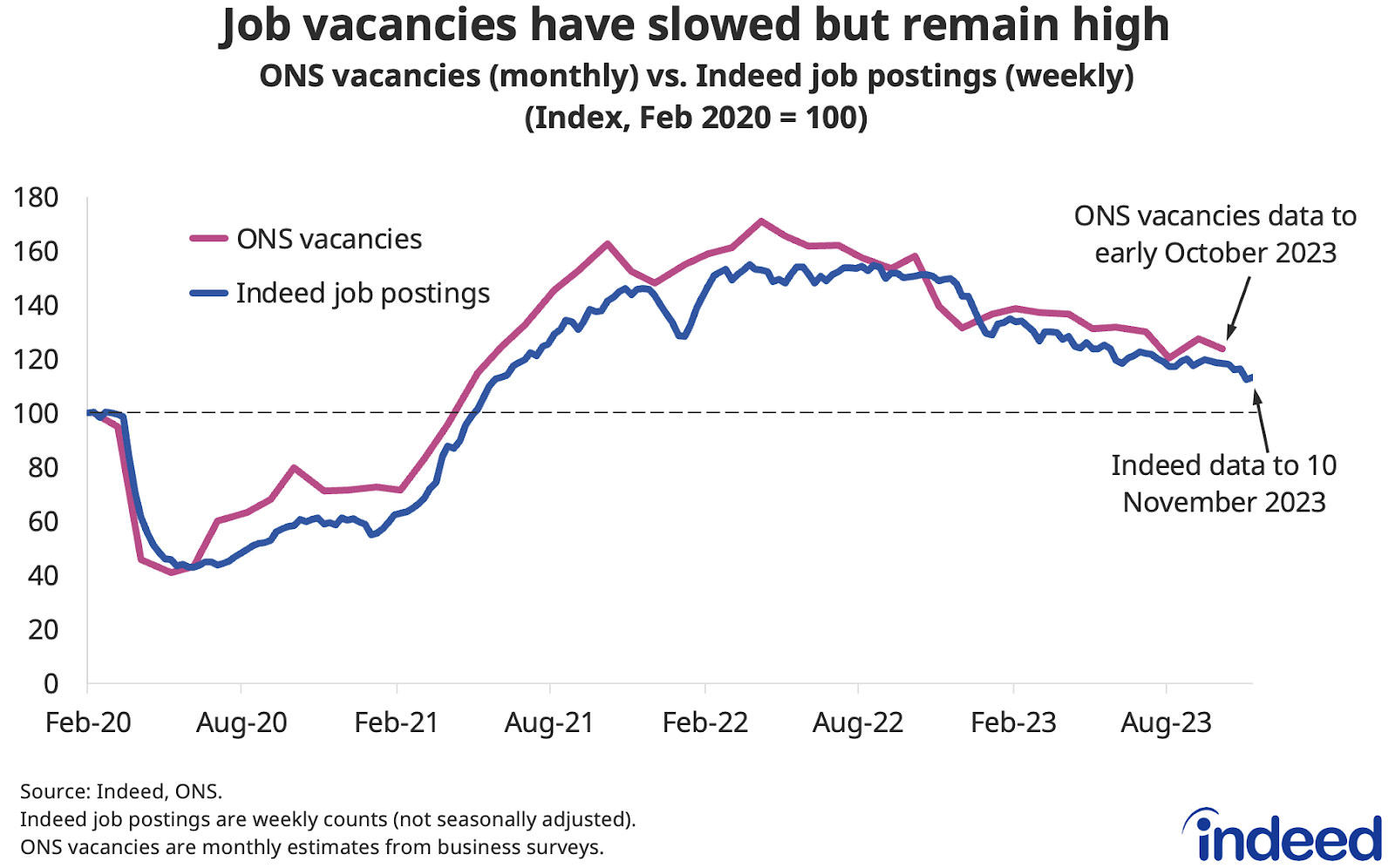

- Vacancies continue to fall from peaks.

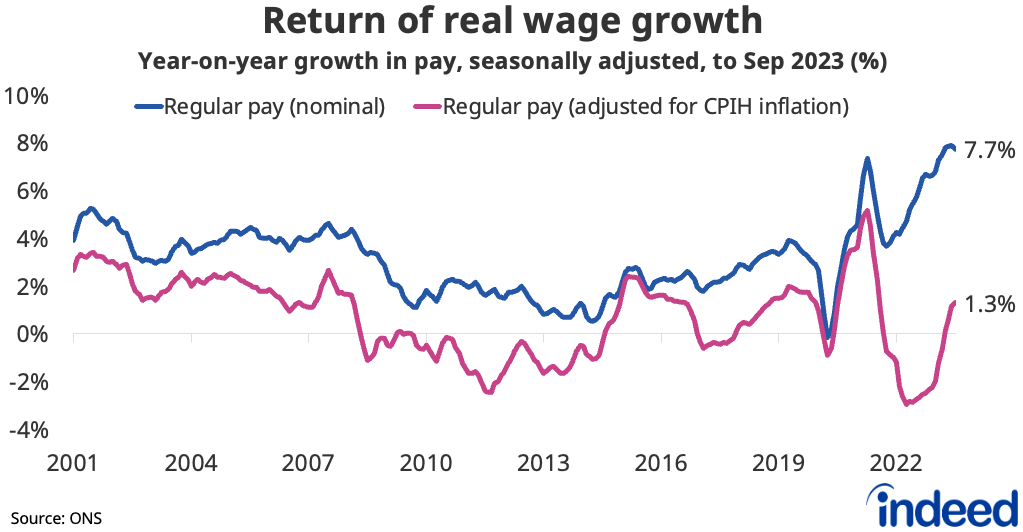

- Real terms pay growth strengthens.

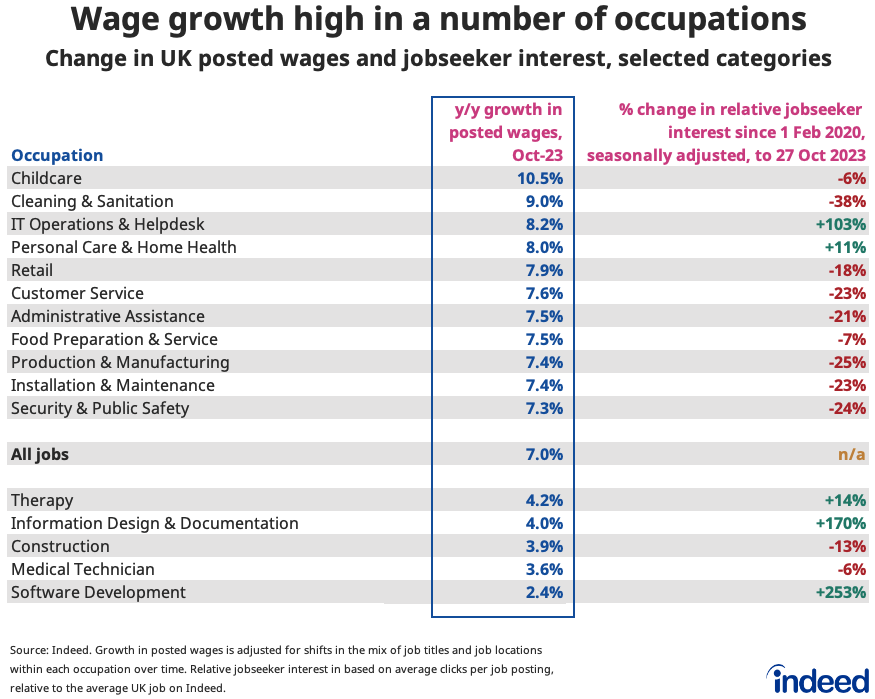

- Posted wage growth remains high in several occupations.

The UK labour market continues to cool, with vacancies dropping further from their previous highs, albeit remaining above pre-pandemic levels. Wage growth appears to have peaked in nominal terms but remains elevated, and with inflation falling back, is now rising the most in real terms for two years.

Spotlight: Posted wages still rising strongly in several occupations

The Indeed Wage Tracker, based on posted wages for new hires, edged down to a six-month low of 7.0% year-on-year in October, from 7.1% in September. However, wage growth remains high in a range of predominantly lower-paid occupations including childcare, cleaning, care, retail, customer service and food service. In many cases, this reflects lower jobseeker interest in those categories versus pre-pandemic, reflected in a reduction in average clicks on job postings relative to the average job on Indeed.

Labour Market Overview

The UK labour market continues to soften. Vacancies fell by 58,000 to 957,000 in the three months to October, down for a sixteenth consecutive period. Vacancies are now down 26% from their peak of 1.3 million seen in May 2022. Indeed job postings data (on both a seasonally adjusted and non-seasonally adjusted basis) signals further easing in hiring demand through early November.

Regular pay growth dipped to 7.7% year-on-year in the three months to September (down from a peak of 7.9%), though remains elevated. With inflation now well down from its high mark, workers are belatedly seeing their wages rise in real terms, at 1.3% year-on-year. A further substantial fall in consumer price inflation in October will deliver a further boost.

Headline measures of employment, unemployment and inactivity were again published only with ‘experimental’ status due to concerns over low response rates to the underlying Labour Force Survey. The figures suggest the unemployment rate was unchanged at 4.2%, while the employment rate dipped slightly to 75.7%. The inactivity rate was stable at 20.9%, and remains above pre-pandemic levels.

But the questionable veracity of the ONS figures derived from the Labour Force Survey means it’s hard to gauge exactly how fast the labour market is rebalancing. The ONS was again unable to provide updated estimates of the reasons behind certain inactivity, such as that due to long-term sickness.

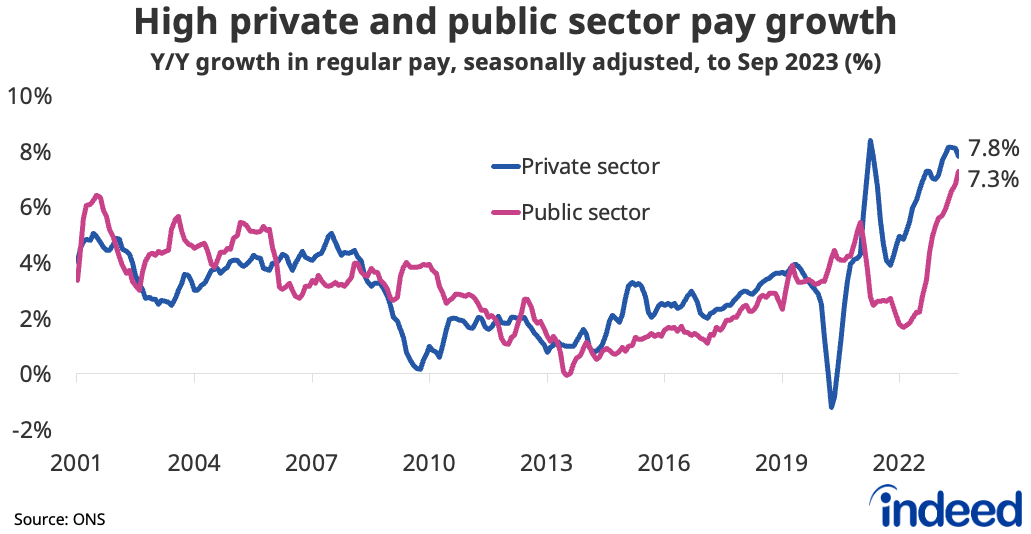

Following a period of widespread industrial action and recently agreed public sector pay deals, public sector regular wage growth hit a record high at 7.3% y/y, and is now only slightly below the private sector at 7.8%.

Conclusion

The UK labour market continues to rebalance. It would appear a matter of time before that translates into weaker pay growth, but for now, wages continue to rise strongly. With inflation falling back, workers are seeing belated real terms wage growth after a period of squeezed living standards.

Hiring Lab Data

We host the underlying job-postings chart data on Github as downloadable CSV files. Typically, it will be updated with the latest data one day after this blog post is published.

Methodology

The Indeed Job Postings Index is a daily measure of labour market activity that is updated and will continue to be released weekly, superseding the Job Postings Tracker. The primary difference between the Indeed Job Postings Index and the legacy Job Postings Tracker is the level. The Indeed Job Postings Index is set to 100 on February 1, 2020, and this effectively provides a uniform level shift of 100 to the existing Job Postings Tracker across all time points.

To calculate the average rate of wage growth, we follow an approach similar to the Atlanta Fed US Wage Growth Tracker, but we track jobs, not individuals. We begin by calculating the median posted wage for each country, month, job title, region and salary type (hourly, monthly or annual). Within each country, we then calculate year-on-year wage growth for each job title-region-salary type combination, generating a monthly distribution. Our monthly measure of wage growth for the country is the median of that distribution.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.