Key points:

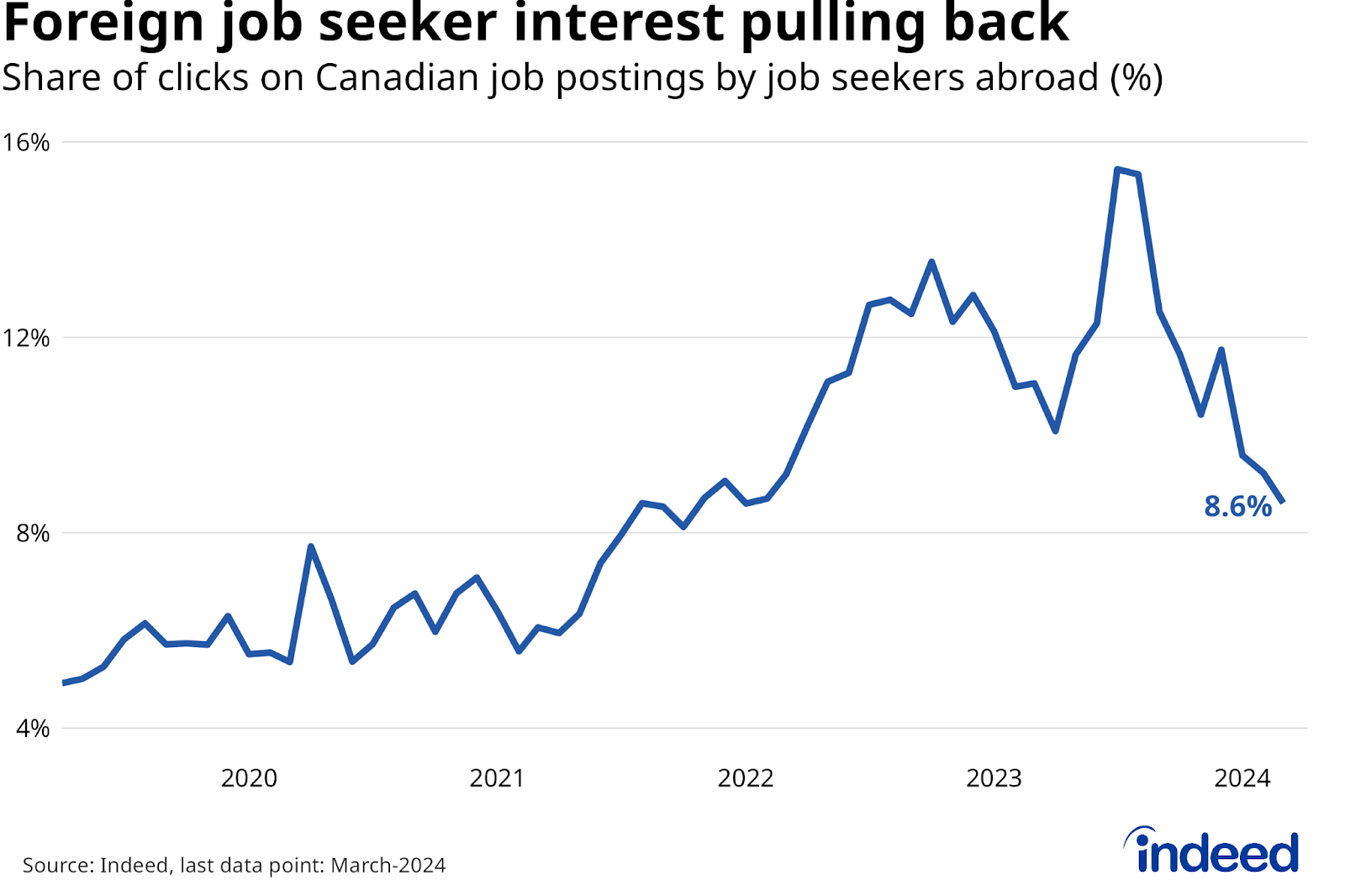

- After surging through mid-2023, global job seeker interest in Canadian job postings has fallen back. In March 2024, 8.6% of clicks on Canadian job postings came from outside of Canada, down from an average of 14.4% in Q3 2023.

- The recent decline in interest from abroad was broad-based, but especially sharp among job seekers located in South Asia, Africa, and the Middle East.

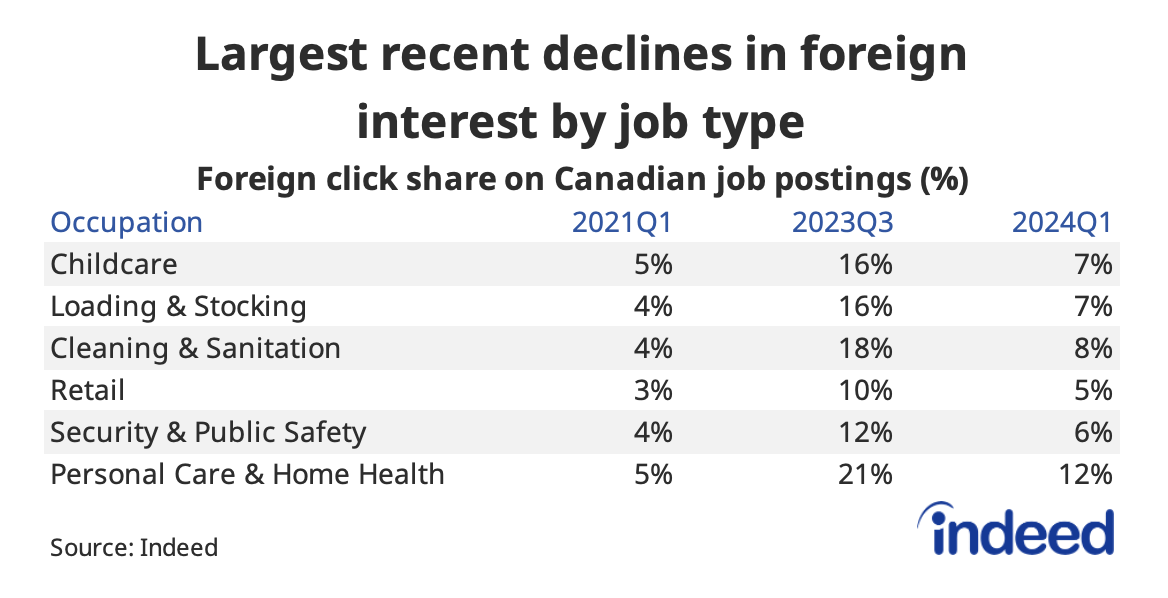

- Foreign click shares were down most among jobs with the sharpest earlier jumps, particularly in lower-paying sectors including cleaning and sanitation, loading and stocking, and child care.

- The drop-off in foreign interest highlights how the recent wave of international migration to Canada is set to slow as job seekers respond to both a weaker job market and upcoming policy changes reducing the numbers of non-permanent residents in Canada.

The economic and policy environment that drove Canada’s soaring population growth in 2023 has come to a halt, and foreign job seekers have noticed. The share of clicks on Canadian job postings on Indeed made by job seekers outside of Canada fell from an average of 14.4% in Q3 2023 to 8.6% of overall job seeker activity in March 2024, a decline of 40%. The foreign click share remains above the 6.5% rate that prevailed from 2019 to 2021, but it has pulled back substantially.

The drop in foreign job seeker interest since mid-2023 has been quite broad-based. Among the 29 countries where job seekers comprised at least 0.1% of clicks on Canadian postings in mid-2023, the click-share fell over the next two quarters in all but Australia, which was flat.

At the same time, the shifts were particularly dramatic in some regions. The foreign click-share more than halved among job seekers searching from Pakistan, Bangladesh, Tunisia, and Algeria, as well as several other countries in Africa and the Middle East. Declines from India and the Philippines weren’t as sharp in relative terms, but contributed substantially to the overall decline given their large initial click-shares. Job seekers from the US also pulled back somewhat, while declines among job seekers from South Korea, Latin America, and Western Europe were more modest.

Foreign interest down most for lower-paying jobs

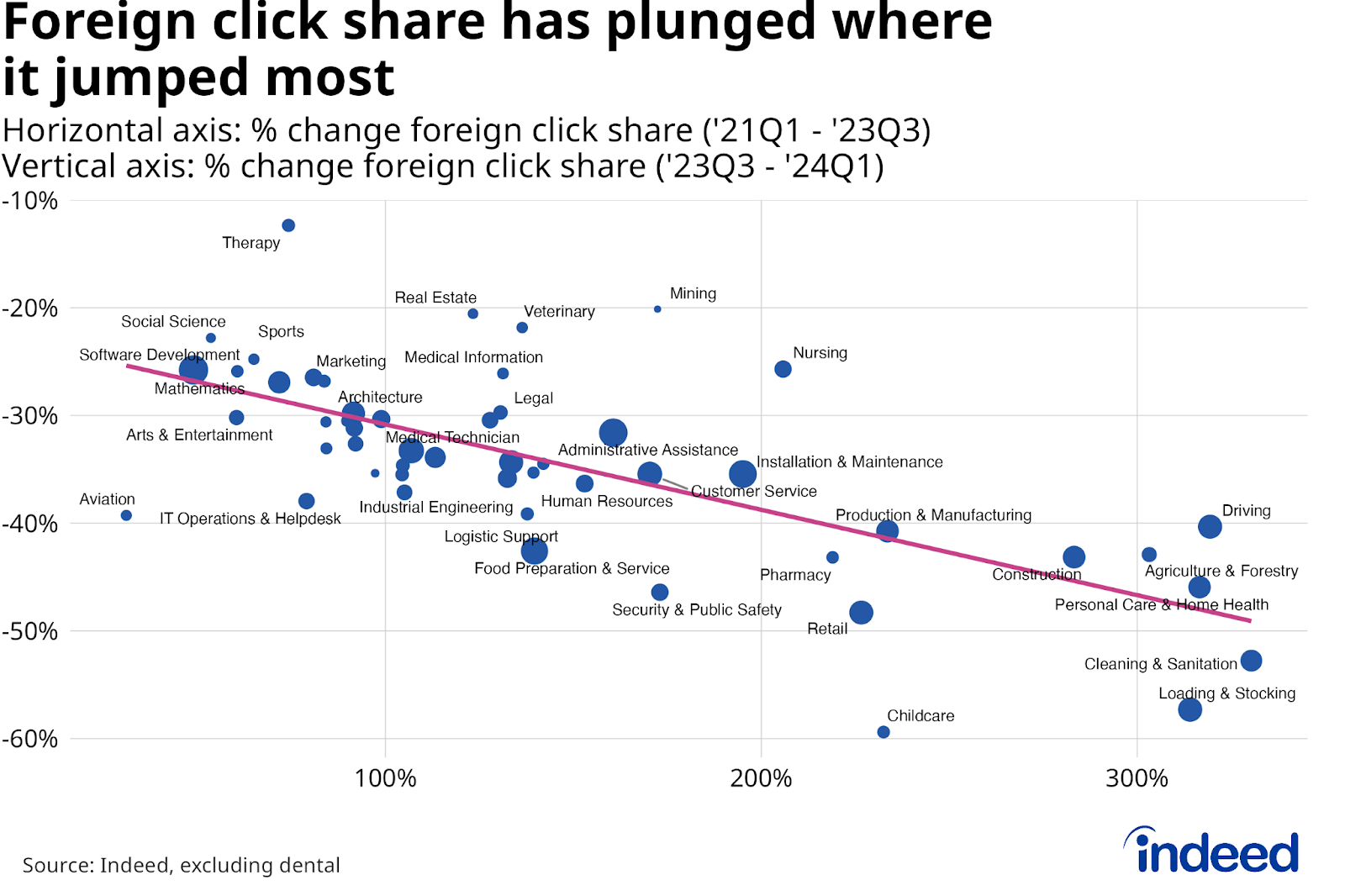

Job seekers located outside of Canada have typically accounted for especially high shares of job seeker clicks on job postings in STEM fields and agriculture. However, the run-up in clicks from abroad through mid-2023 was sharpest in lower-paying positions. These same jobs , especially in the service sector, have also led the subsequent decline.

Between Q3 2023 and Q1 2024, the share of clicks from abroad going to job postings in child care, loading and stocking, cleaning and sanitation, retail, security and public safety, and personal care & home health, all fell by more than 45%, reversing most (though not all) of the gains made over the prior two years. On the flip-side, while still substantial, the decline was not as sharp in areas like tech, where increases in earlier years weren’t as dramatic.

Falling foreign interest foreshadowing drop in non-permanent residents

The fall in foreign job seekers exploring Canadian job opportunities comes off a year of exceptional population growth, driven by soaring ranks of non-permanent residents from abroad. However, the situation has changed quickly.

On one hand, a weaker labour market and strained housing affordability have made Canada a less attractive destination for foreign job seekers. But policy changes – both announced and upcoming – have likely also played an important role. Lowering the weekly work-hour limit for international students probably had an immediate effect, while the federal government’s stated intention to reduce the number of non-permanent residents in Canada suggests obtaining a temporary work permit could also be more difficult in the years ahead.

The broader labour market impacts of lower population growth will probably be gradual. It will likely shake up the recruitment landscape in the lower-wage sectors that frequently employ non-permanent residents. But whether it substantially impacts employer’s ability to hire will depend on how the overall economy evolves amid a slowdown in international migration.

Methodology

We track foreign interest in Canadian job postings by tallying clicks on job postings located in Canada by job seekers with IP addresses located outside of Canada. Job seekers for whom the location can not be determined are excluded. For analysis by occupational sector, only occupations with at least 1,000 foreign clicks in 2023Q3 were included.