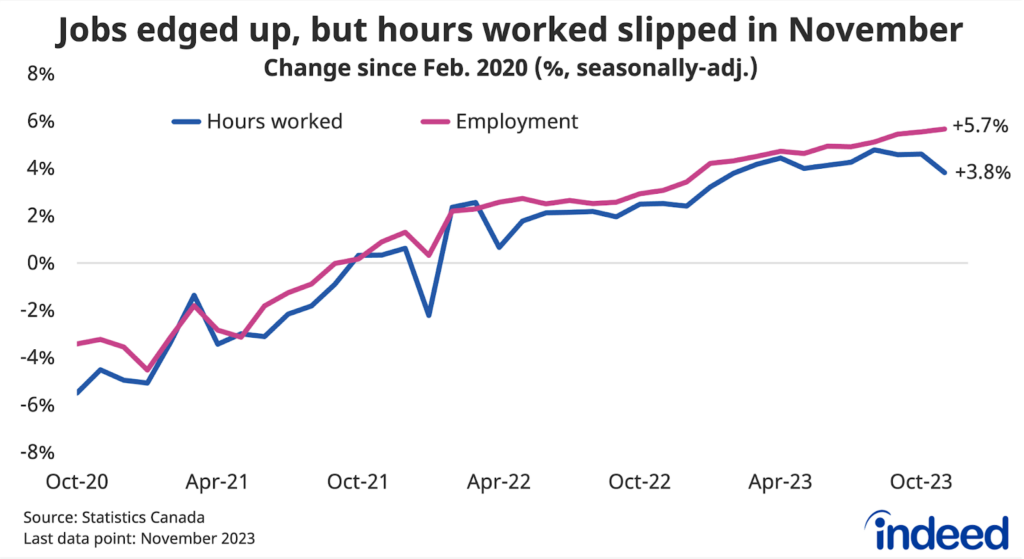

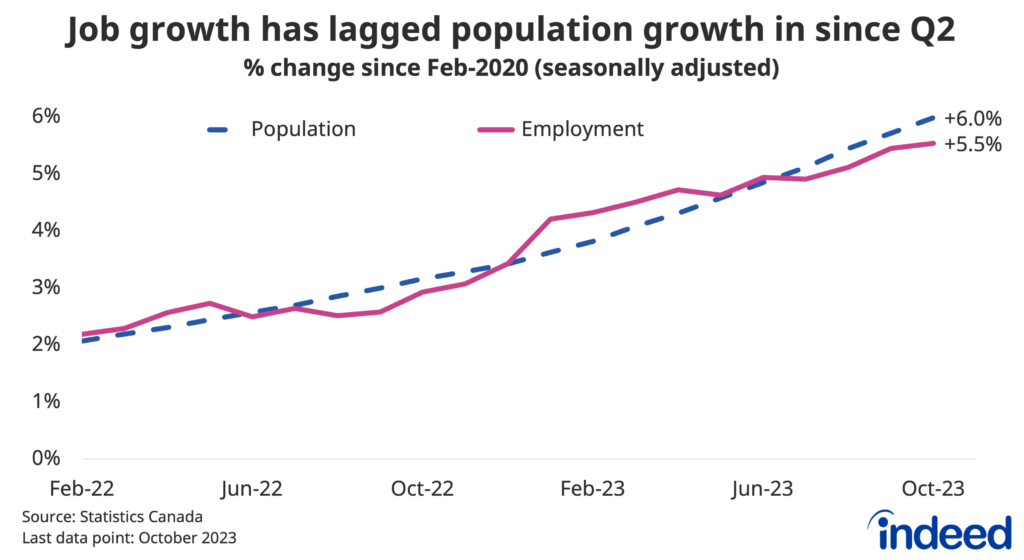

Not a great way to end the year, though things could be worse. Canadian employment was flat in December, even as population growth remained brisk, similar to trends already in place throughout the second half of 2023. This led the employment rate to slip 0.2 percentage points, returning to where it stood in late 2021. Hours worked actually ticked up, but only partially offset a decline in November.

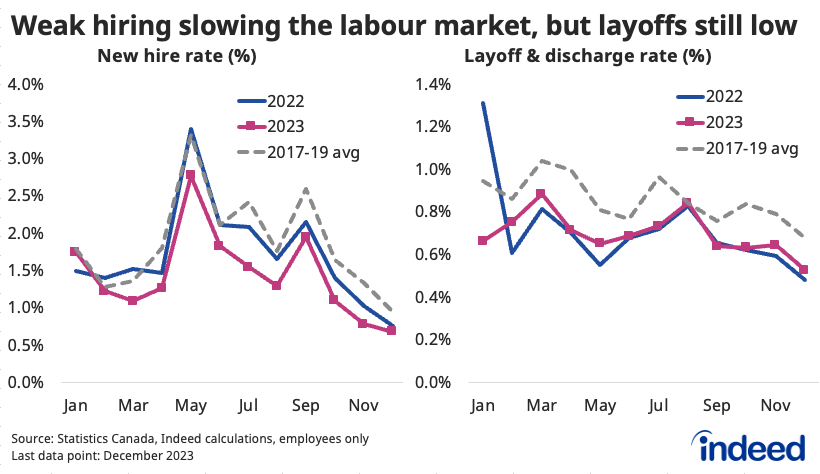

Even with the weak December job numbers, the unemployment rate held steady at a still-low 5.8%, as labour force participation fell. However, the flat unemployment rate also reflected continued low layoff rates, which stayed below pre-pandemic norms throughout 2023. Instead, the stalling labour market is evident in a weak pace of new hiring. The slow pace of new jobs being started appears to be hitting youth employment in particular, with the share of 15-24-year-olds working down sharply over the past year, while holding steadier among older demographics.

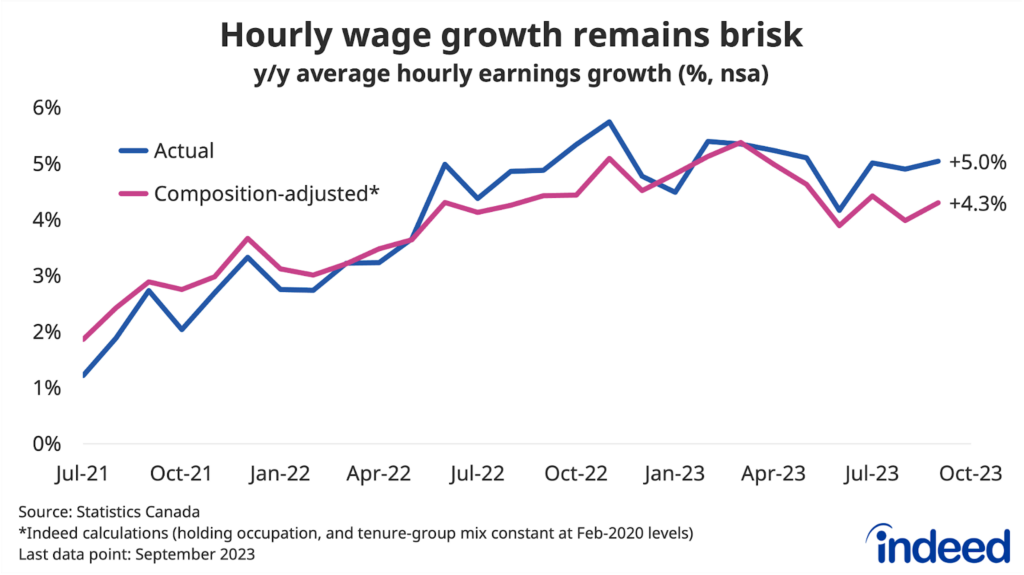

The job seeker’s market of 2022 receded last year, but cooler conditions haven’t had a major imprint on wage growth. In fact, hourly earnings growth accelerated to 5.4% year-over-year in December, matching their highest annual rate for 2023. Part of the strong numbers reflect the types of jobs that have been growing, but nonetheless highlight how wage dynamics have reacted relatively slowly to the changing economic situation. This has been good news for the ability of paychecks to claw back the earlier hit from inflation, but it’s unclear how long this will last.

Overall, the December LFS showed a continuation of several themes that defined the 2023 Canadian labour market. The question for 2024 is: can we hold on from here?