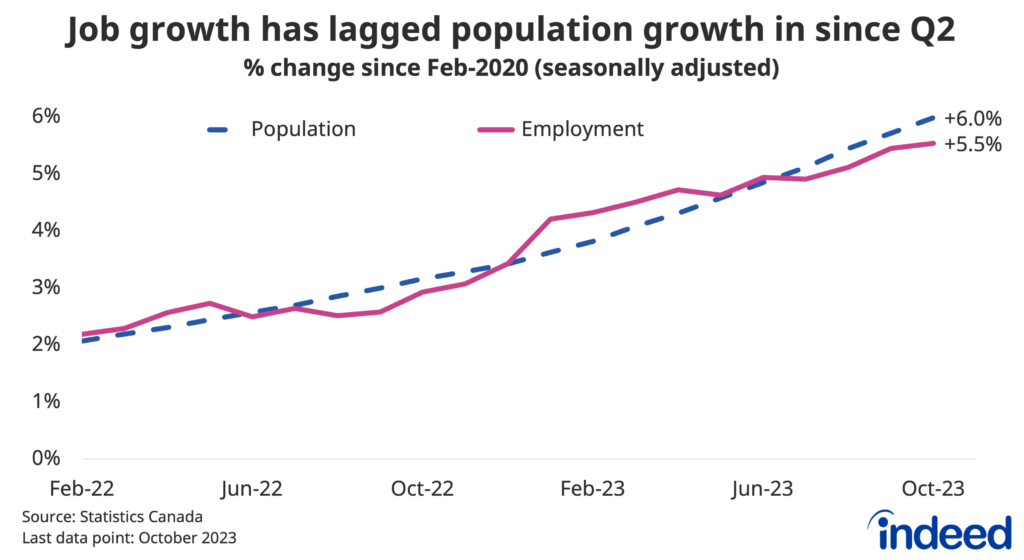

November was another ho-hum month for the Canadian labour market. In a trend that we’re starting to get used to, employment rose, but slower than population growth. The result was another uptick in the unemployment rate, this time to 5.8%. Joblessness is still low by historical standards, but conditions have clearly shifted from the start of 2023.

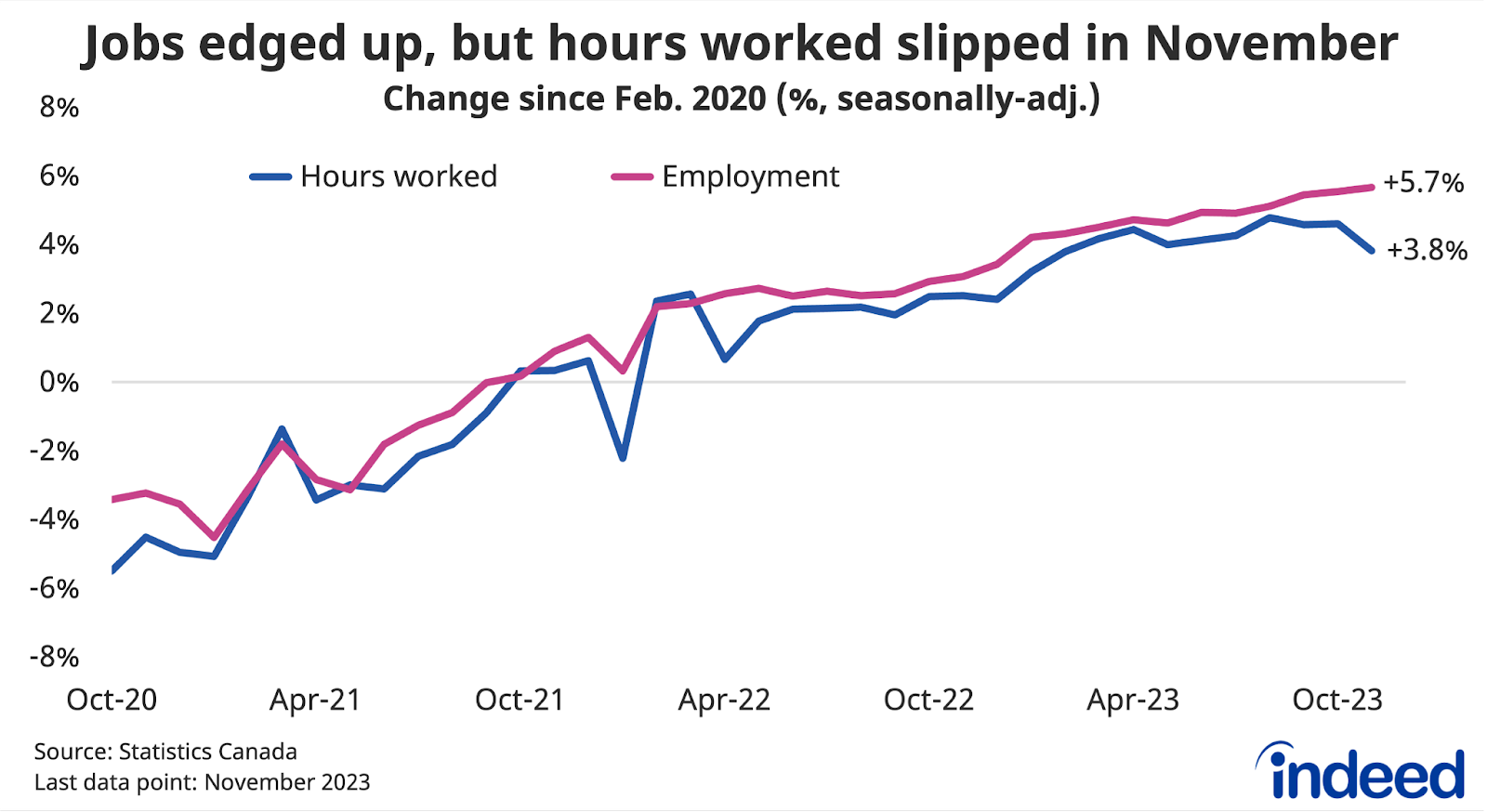

The details beneath the headline numbers tilted to the downside. Despite full-time jobs leading overall growth, total hours worked fell — not a great sign for GDP growth after Q3 showed a slight decline. New hiring remained weak, and while the layoff rate was still low, it ticked up compared to last year (after closely tracking 2022’s pattern throughout the year). Job growth by industry was mixed, with both construction and manufacturing showing solid gains. However, finance and real estate, as well as wholesale and retail trade both dropped, continuing their recent weakness.

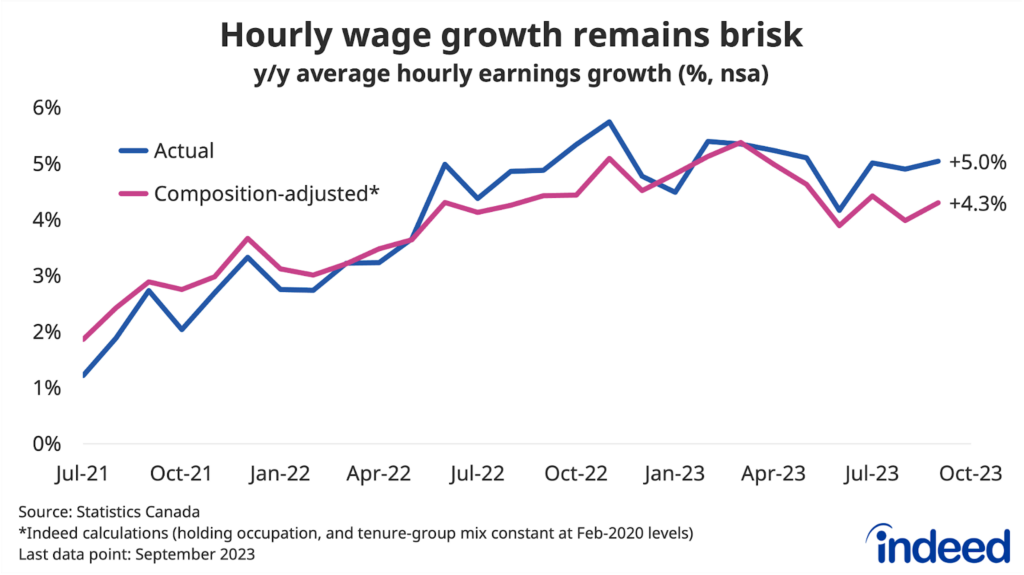

Also sticking to a familiar story were wages, except here the story has been more positive. Average hourly earnings grew at a brisk 4.8% year-over-year pace, defying other downbeat metrics. At this rate, wages are solidly outpacing inflation, which is good news for household incomes. But with the rest of the economy at stall speed, and employer hiring appetite receding, we’re left wondering whether the trend can continue as we enter 2024.