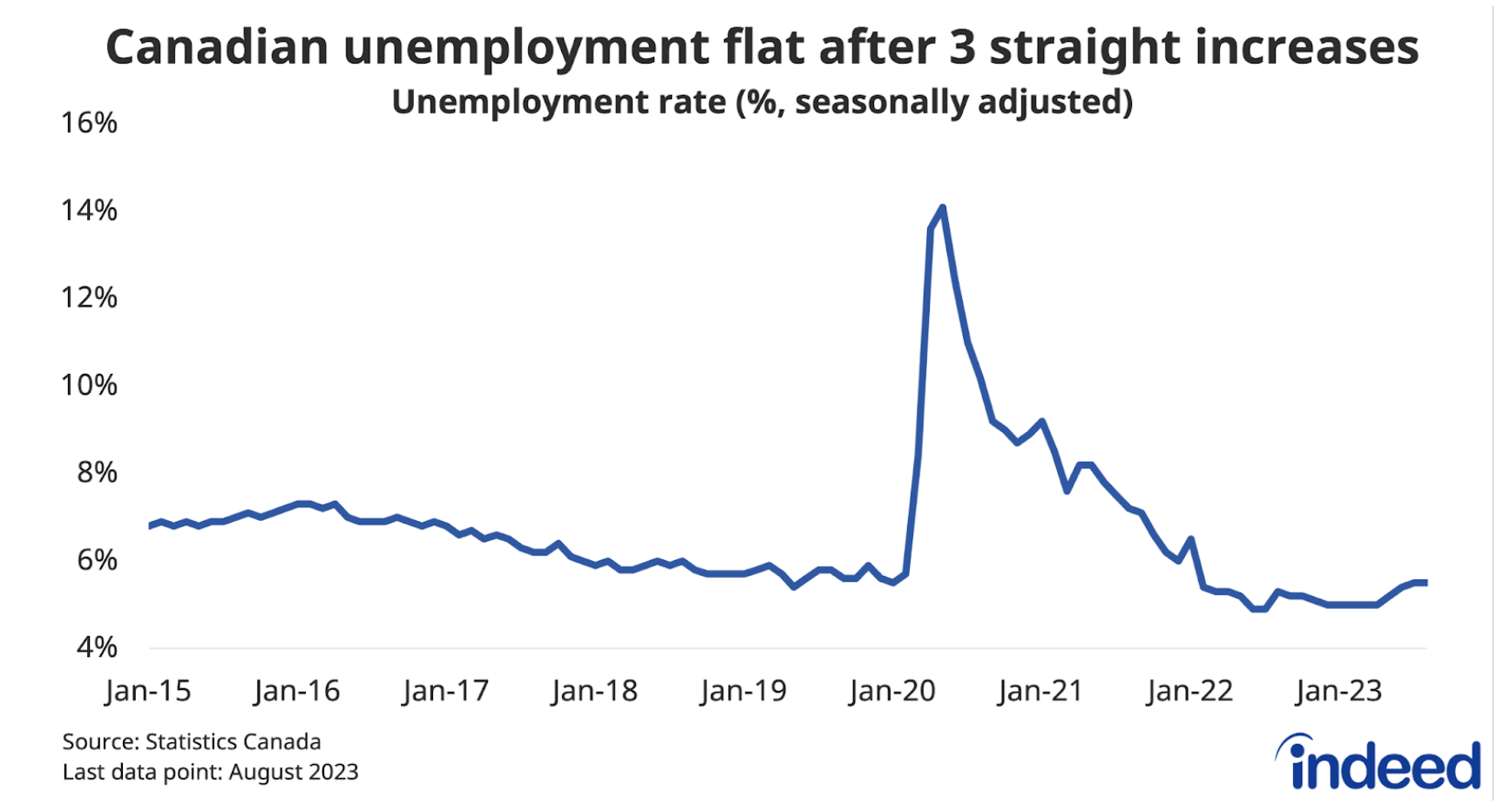

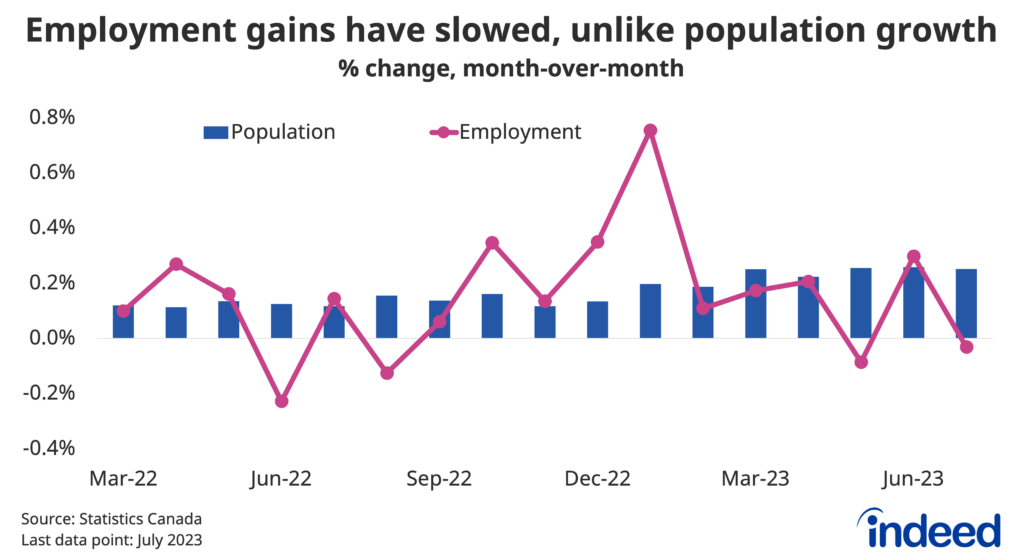

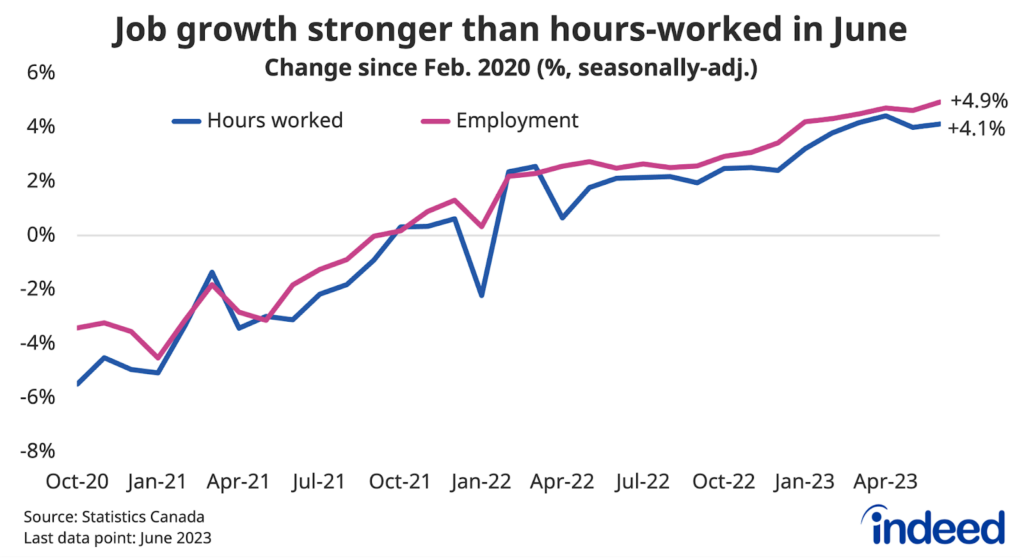

The Canadian labour market continued to tread water in August. The unemployment rate held steady at a relatively low 5.5%, while employment growth bounced back after a weak July. Job gains weren’t quite strong enough to keep up with surging population growth, highlighting how Canada’s rapid population growth requires us to readjust our baseline for what constitutes a strong monthly LFS. Nonetheless, hours worked grew somewhat faster than employment, a welcome sign after lagging job growth in recent months.

Industry-level job growth highlighted how emerging trends in earlier periods can shift suddenly with each month of data. Both construction and professional services posted strong gains following earlier declines. The latter was a particular surprise, given already elevated employment levels in professional services, and sharp drop-offs in employer hiring appetite in tech and other white-collar sectors. On the flip side, manufacturing jobs dipped, partially reversing their strong second quarter.

On the surface, wage growth remained brisk, with hourly earnings growth edging down just slightly from 5.0% to 4.9% year-over-year. However, after adjusting for changes in job composition, pay growth came in at a softer 4.0%, down from 4.4% in July, as mid- and higher-paying job types grew faster over the past year. Overall, this suggests that underlying momentum for wage growth is softer than suggested by the headline numbers, consistent with other signs of slowing demand as the economy adjusts to a higher interest rate environment.