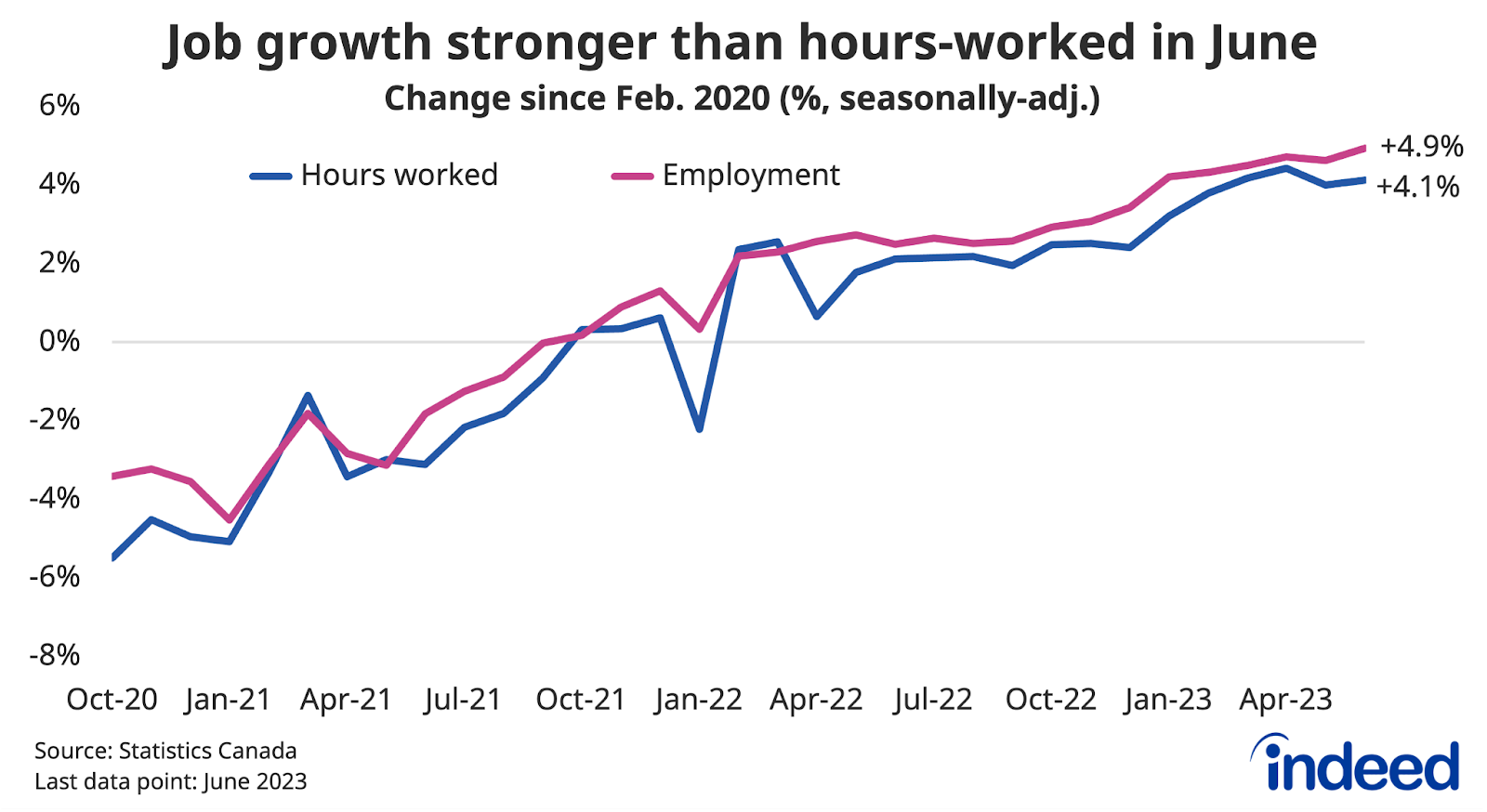

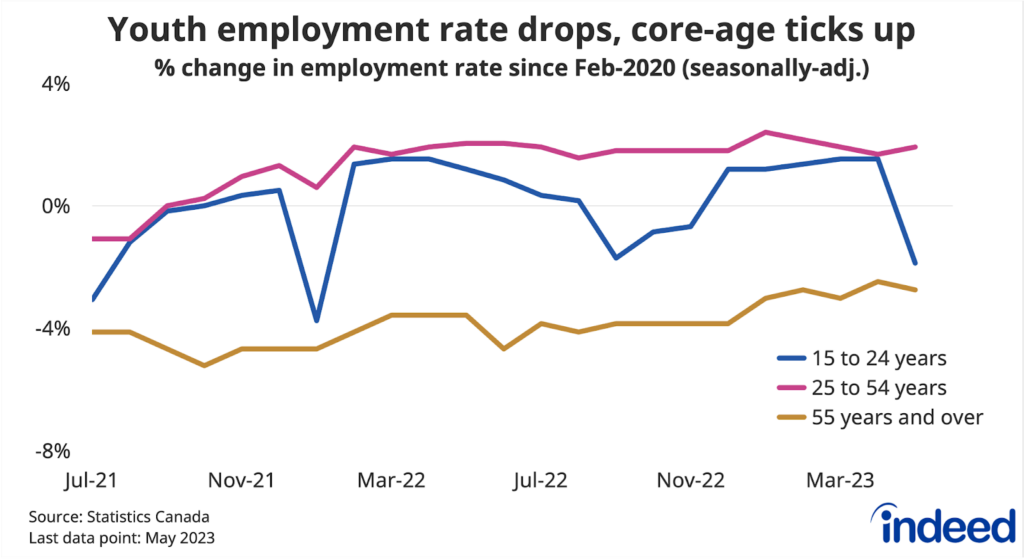

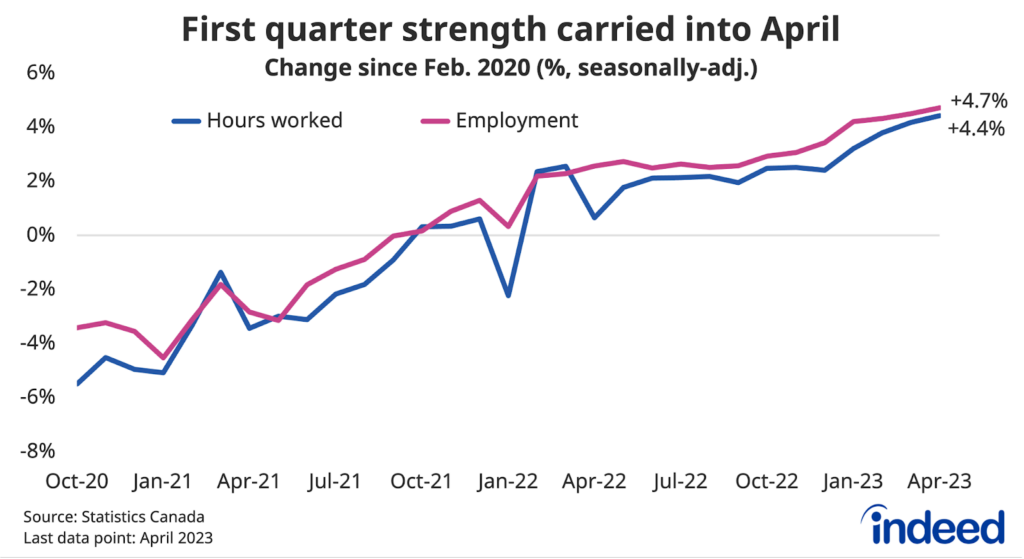

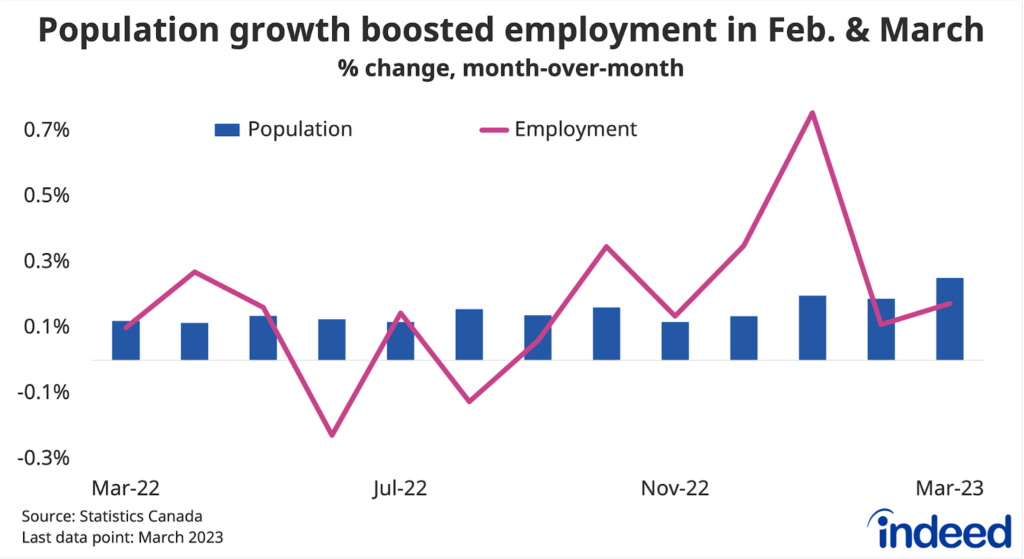

Not exactly stellar, but at this point, good enough. A solid showing for Canadian job growth in June confirmed the May dip was more of a hiccup rather than a major turning point. However, not all the details were as strong as the headline 60,000 employment increase. First, the population is growing rapidly, raising the bar on what constitutes a strong monthly gain. Second, hours worked were relatively flat in June—while youth summer employment remained on the soft side—suggesting the drop off in employer job vacancies is causing challenges for some job seekers. Nonetheless, Canada’s ongoing low layoff rate continues to support overall employment levels.

Turning to industries, the often volatile wholesale and retail trade sector posted a solid June after a weak May, while accommodation and food services were flat, continuing a recent trend. Perhaps the most notable development of late is the soft job numbers in the professional and technical services industry, where, after leading Canadian job growth over most of the recovery, employment has slipped in the past three months. Job postings on Indeed in tech, and some other white collar occupations have dropped off faster than others over the past year, which might be now showing up in the employment data.

As overall hiring appetite has waned, the conditions supporting the solid Canadian wage growth have started to turn. Growth of advertised wages and salaries on Canadian job postings on Indeed began cooling in the second half of 2022, and the trend is starting to show up in the average hourly earnings data. Pay growth is still elevated on a year-over-year basis, but starting to cool, dropping to a 4.2% pace in June, from 5.1% the month prior. This could be good news on the inflation front, but less so if it means a slower rebound in households’ purchasing power from the earlier shock to the cost of living.