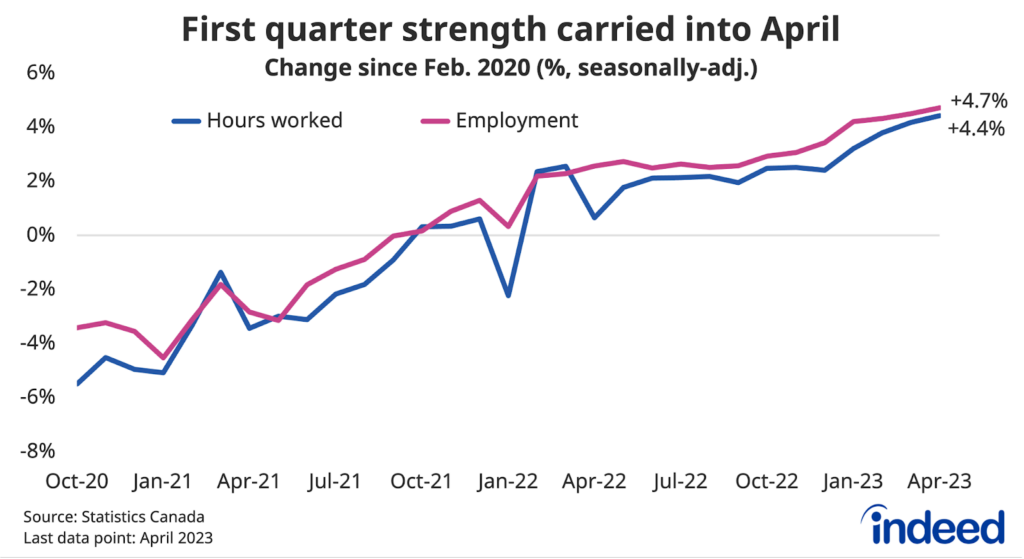

Canadian job market momentum has cooled after a strong first quarter. The question following the May LFS is whether we’ve hit a true turning point. After a solid start to the year, Canadian employment took a modest step back in May, with the unemployment rate rising to 5.2% after holding steady at 5.0% since December. Total hours worked rounded out the weak headline numbers, falling somewhat more than jobs.

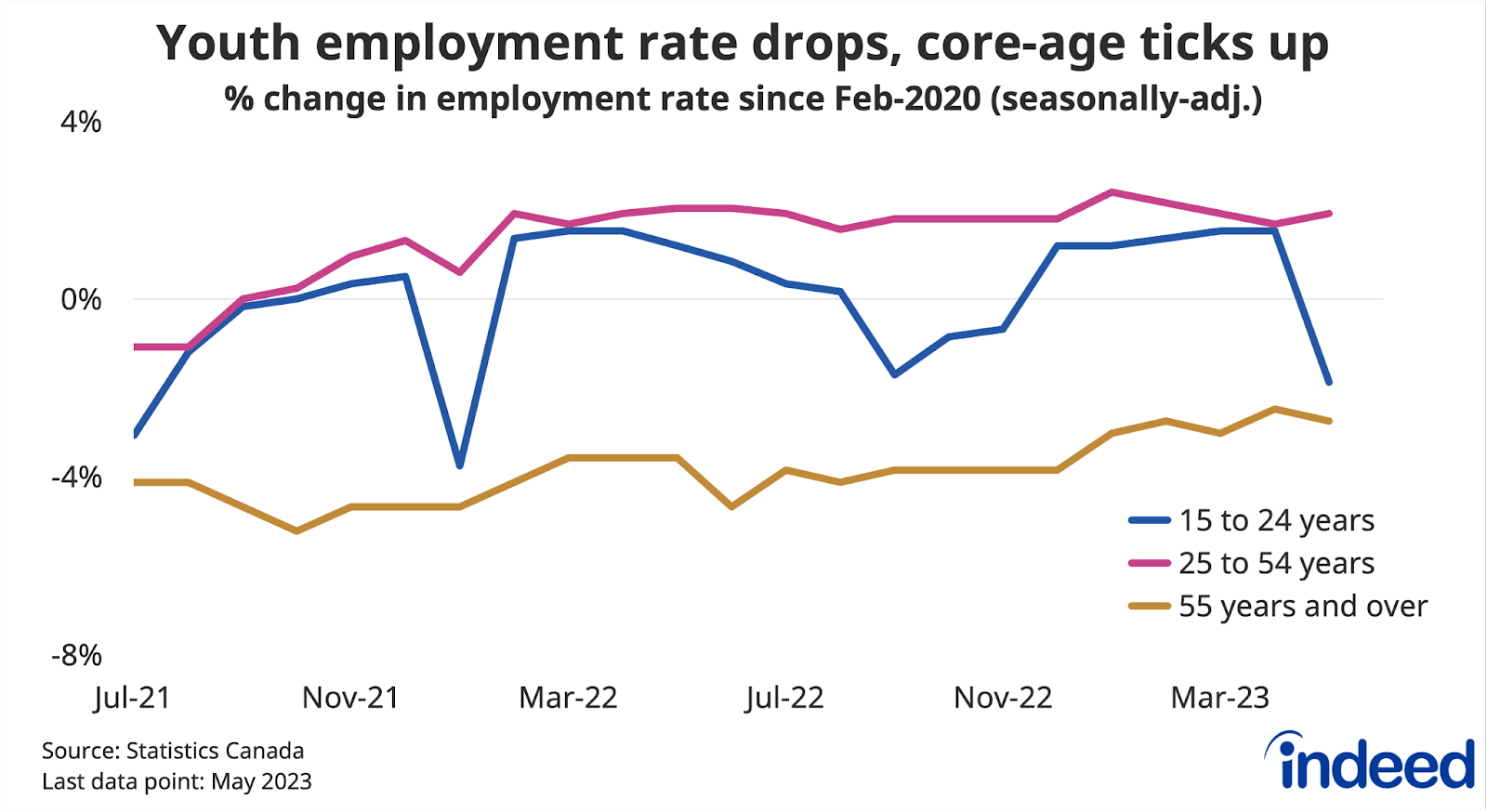

Trends were mixed beneath the top-line figures, making it tough to separate signal from noise. Youth employment was particularly weak, as the summer hiring season got off to a slow start. However, the number of core-age (25- to 54-year-old) workers actually posted a solid increase; enough to offset most of the decline among the younger cohort. Meanwhile, self-employment came in quite weak, while the ranks of private and public sector employees held steady.

The soft start for summer employment among youth comes at a time of cooling employer demand for workers. Both total and seasonal job postings on Indeed have declined over the past year, but from particularly elevated levels. The weak youth job numbers in May suggest that the highly favourable conditions for job seekers that have prevailed for over a year are starting to normalize. Nonetheless, it’s too soon after one weak report to assess how quickly conditions are moving in the other direction.