Key Points:

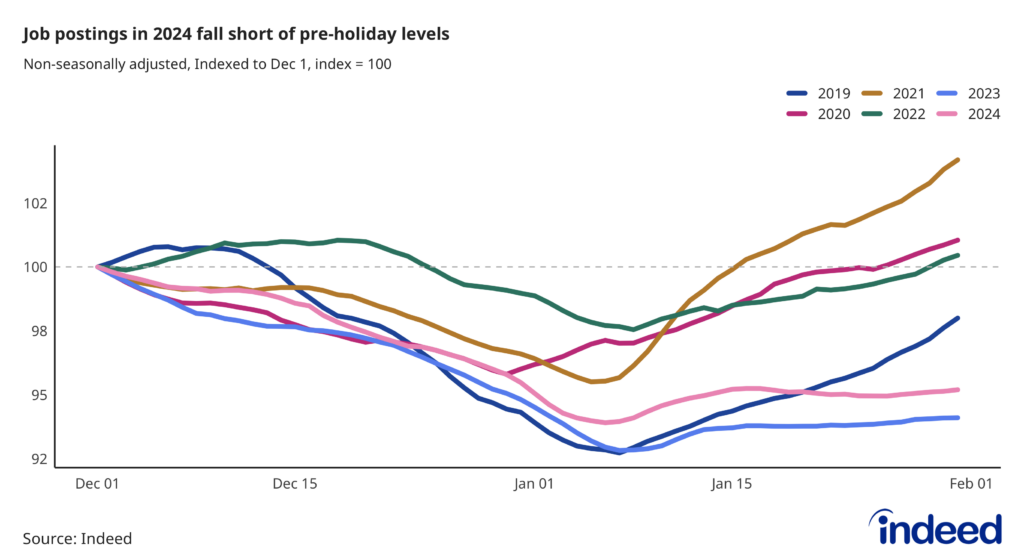

- Overall job postings did not experience their typical January bounce in 2024, ending January down 5% from pre-holiday, Dec. 1 levels.

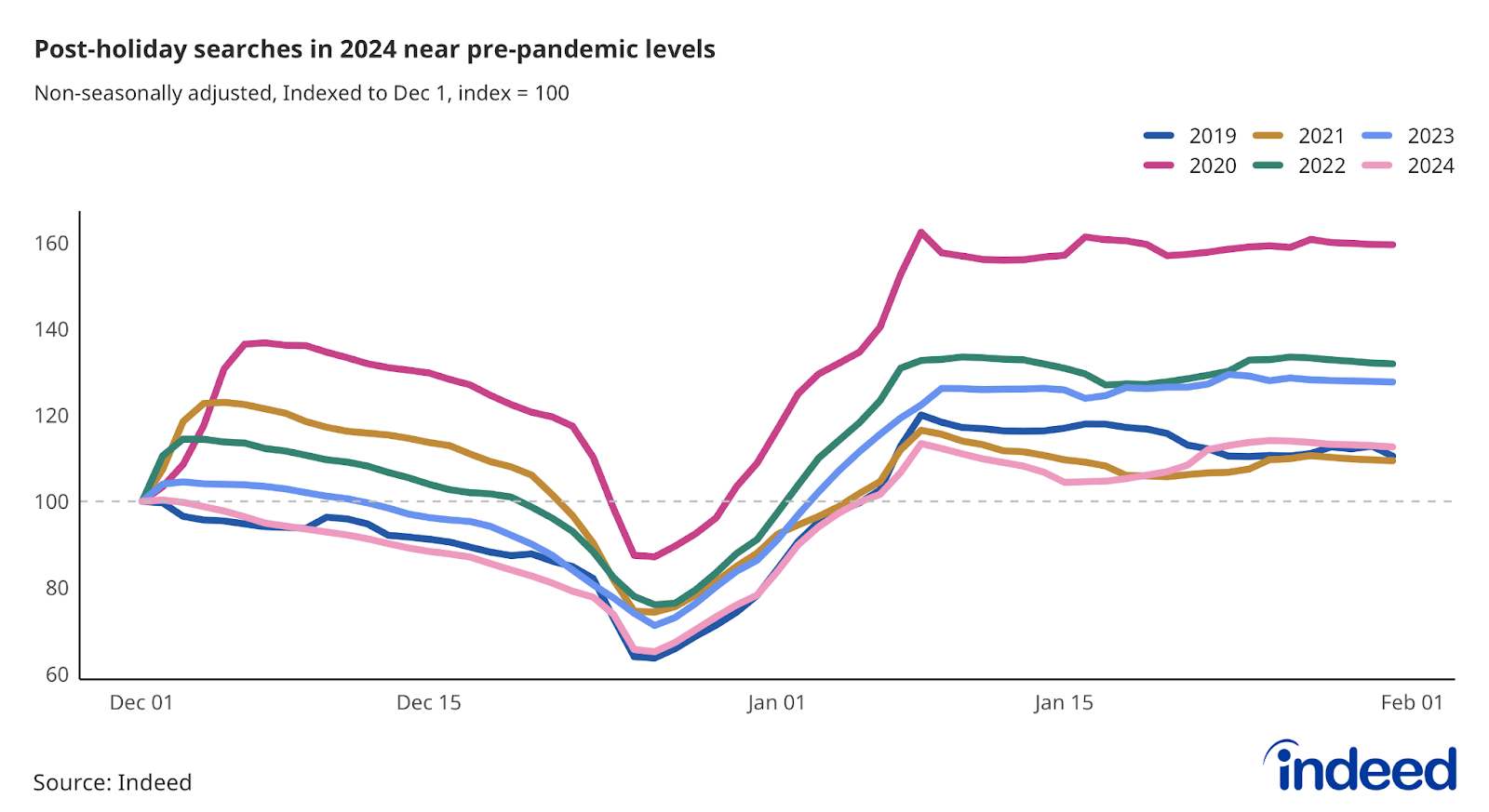

- The number of people searching for a job in January 2024 was higher than in the pre-holiday period, but lower than the same month in the early pandemic years, and in line with 2019 levels.

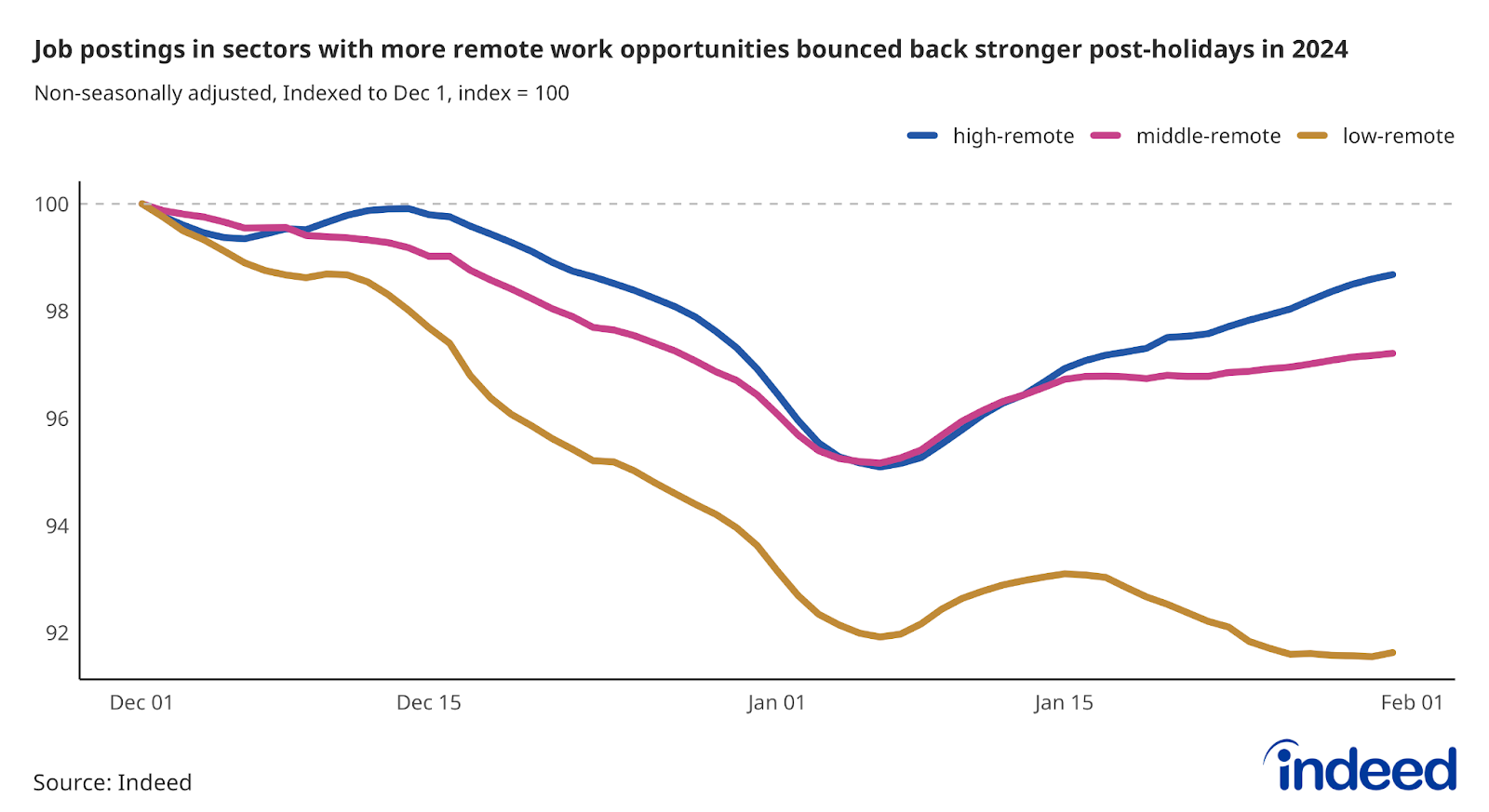

- With some exceptions, job postings in sectors where relatively high shares of jobs can likely be done remotely generally recovered better than postings in sectors more likely to require in-person work. But postings for both high- and low-remote sectors ended January 2024 below the levels seen in early December 2023.

The new year brought some hopeful job seekers to the search bar, but a lot less than the same periods in the early years of the pandemic. Additionally, those who were looking had fewer jobs to choose from compared to years past.

Many professional sectors typically ramp up hiring in the new year after the holiday lull, but the annual rebound in postings was sluggish in 2024, a signal of cooling employer demand. Furthermore, job searchers came back to the market after the holidays at roughly the same rate as before the pandemic, a potential signal of diminishing confidence in the market compared to recent years. But the news may not be all bad: A comparatively larger post-holiday bump in searches compared to postings in January could mean the start of the year was a relatively good time for employers to fill open roles, with more job seekers competing for fewer opportunities.

Postings fell below pre-holiday trends, but searches rebounded

Job seekers took the most recent holiday season seriously. Job searches fell 34% between Dec. 1 and Christmas Day, comparable to seasonal trends last observed in 2018-2019. And the typical post-holiday bump in searches was more muted this January than in recent years. But by the end of January, search volume had rebounded to levels 13% higher than those observed on Dec.1, in line with the bumps observed in 2018-2019 (searches were 11% higher at the end of January than the start of December) and 2020-2021, but much smaller than the larger rebounds witnessed in 2019-2020 (+60%), 2021-2022 (+32%), and 2022-2023 (+28%).

So while the rebound in searches was lackluster, at least there was a rebound. The level of job postings sank 3% between Dec. 1 and Dec. 25, and then essentially stayed at that level through January, ending last month down 5% from Dec. 1. This year’s trend in holiday posting levels was reminiscent of the flatline observed in 2022-2023, and was more underwhelming than either the early pandemic years and the immediate pre-pandemic period.

Not all sectors had a post-holiday surge

The sectors with the largest post-holiday increase in job postings relative to Dec. 1 were mixed, and several sectors that experienced strong post-holiday gains in recent years experienced much smaller gains this year. Postings for roles in the sports sector rose the most between Dec. 1, 2023, and Jan. 31, 2024, up 4.1% over the period, likely reflecting increased seasonal demand for personal trainers and other related roles as Americans worked on New Year’s fitness resolutions. Postings for human resources roles also made the list of biggest gainers, up 2.9% from Dec. 1 through Jan. 31. But that bump pales in comparison to the 17% jump in HR postings observed between Dec. 1, 2020, and Jan. 31, 2021. The relatively weak rebound in HR roles is worth monitoring as a proxy for overall hiring, as HR positions typically recruit and help onboard new hires.

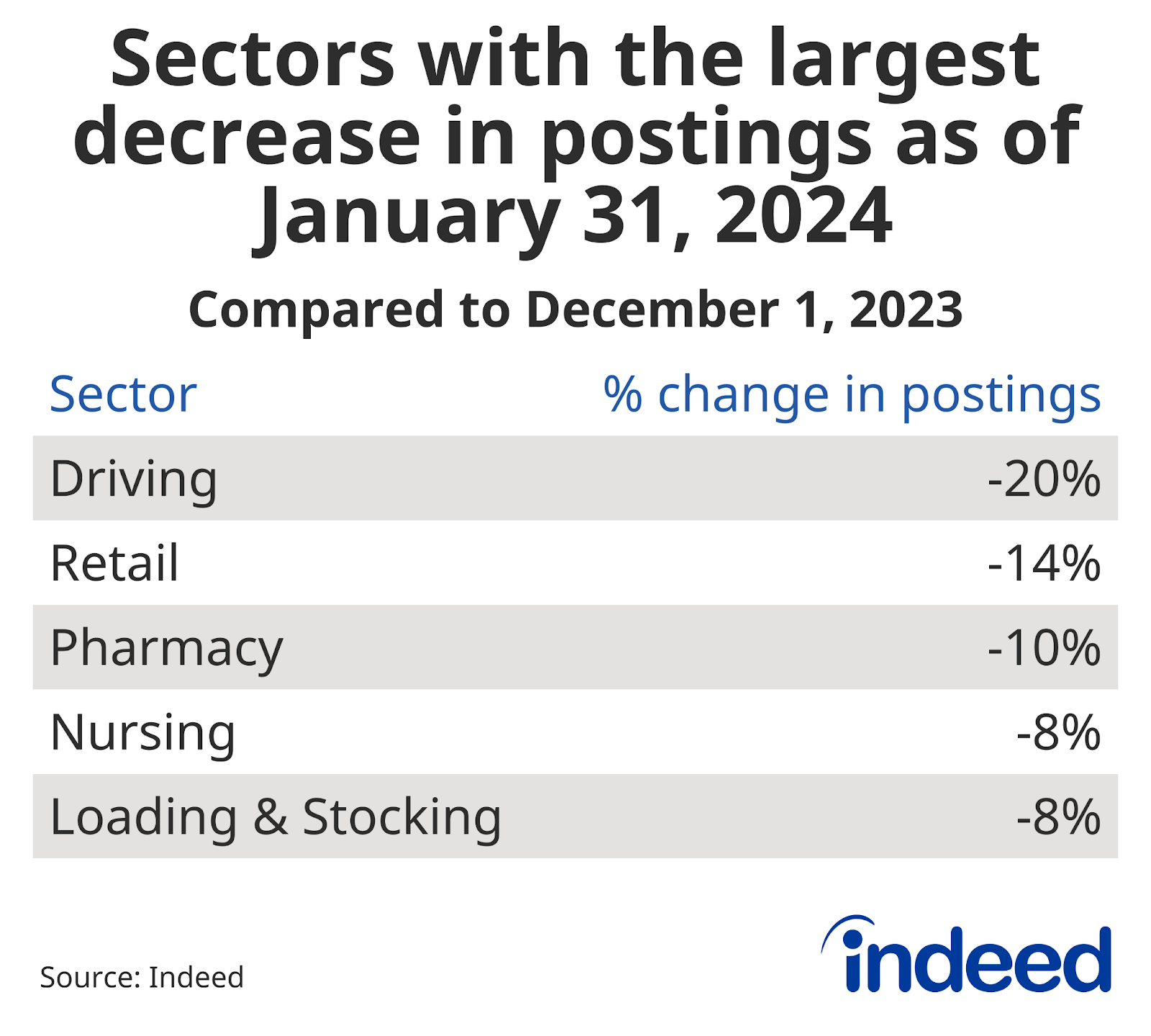

Sectors with the largest declines in postings at the end of January relative to the start of December include driving (-20% on Jan. 31 compared to Dec. 1), retail (-14%), and pharmacy (-10%).

With some exceptions, job postings in sectors where relatively high shares of jobs can likely be done remotely generally recovered better than postings in sectors more likely to require in-person work. Postings for sectors that are typically both in-person and holiday-related — including retail, driving, and loading & stocking — remained low throughout January. But in-person sectors that offer services that could be easier to postpone during the holidays — including veterinary, dental, and childcare — fared comparatively better, though still fell short of a full return to pre-holiday levels.

The professional sectors that typically have an uptick in post-holiday hiring are often the same sectors that are more likely to offer remote or hybrid work opportunities. But while overall postings in these sectors — including software development and marketing — have held steady in recent months, they have fallen sharply from recent peaks after skyrocketing throughout 2022, and further reductions could spell trouble.

In earlier years, including the pre-pandemic year of 2019, postings in high work-from-home sectors have eventually exceeded their Dec. 1 baseline by the end of the following month. But after each of the past two holiday seasons, job postings in high work-from-home sectors have fallen short of rebounding to pre-holiday levels, suggesting that employers are either comfortable with their current workforce, or aren’t planning on a big increase in labor needs as they head into the new year.

Conclusion

2024’s lackluster job posting rebound and lower search activity compared to previous years points to a cooling job market, particularly for professional sectors that usually see an uptick in January hiring. This year’s relatively weak post-holiday surge may have favored those employers seeking to fill already-open positions, taking advantage of decent job seeker demand coupled with weaker competition from other employers.

Methodology

The remote/hybrid tiers of occupational sectors were determined by sorting each sector by their average remote/hybrid share of job postings in 2019. The sectors are then split into three tiers, each covering one-third of job postings in 2019.

US searches on Indeed included queries on both the desktop and mobile versions of Indeed.

Data on non-seasonally adjusted Indeed job postings are an index of the number of job postings on a given day, using a seven-day trailing average. February 1, 2020, is our pre-pandemic baseline, so the index is set to 100 on that day. Data for several dates in 2021 and 2022 are missing and were interpolated.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.