Key Points:

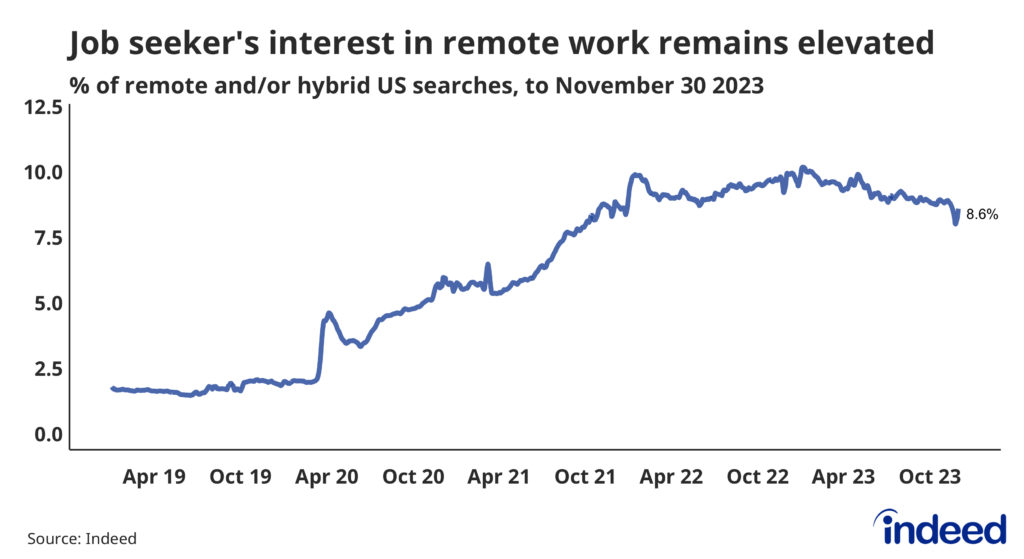

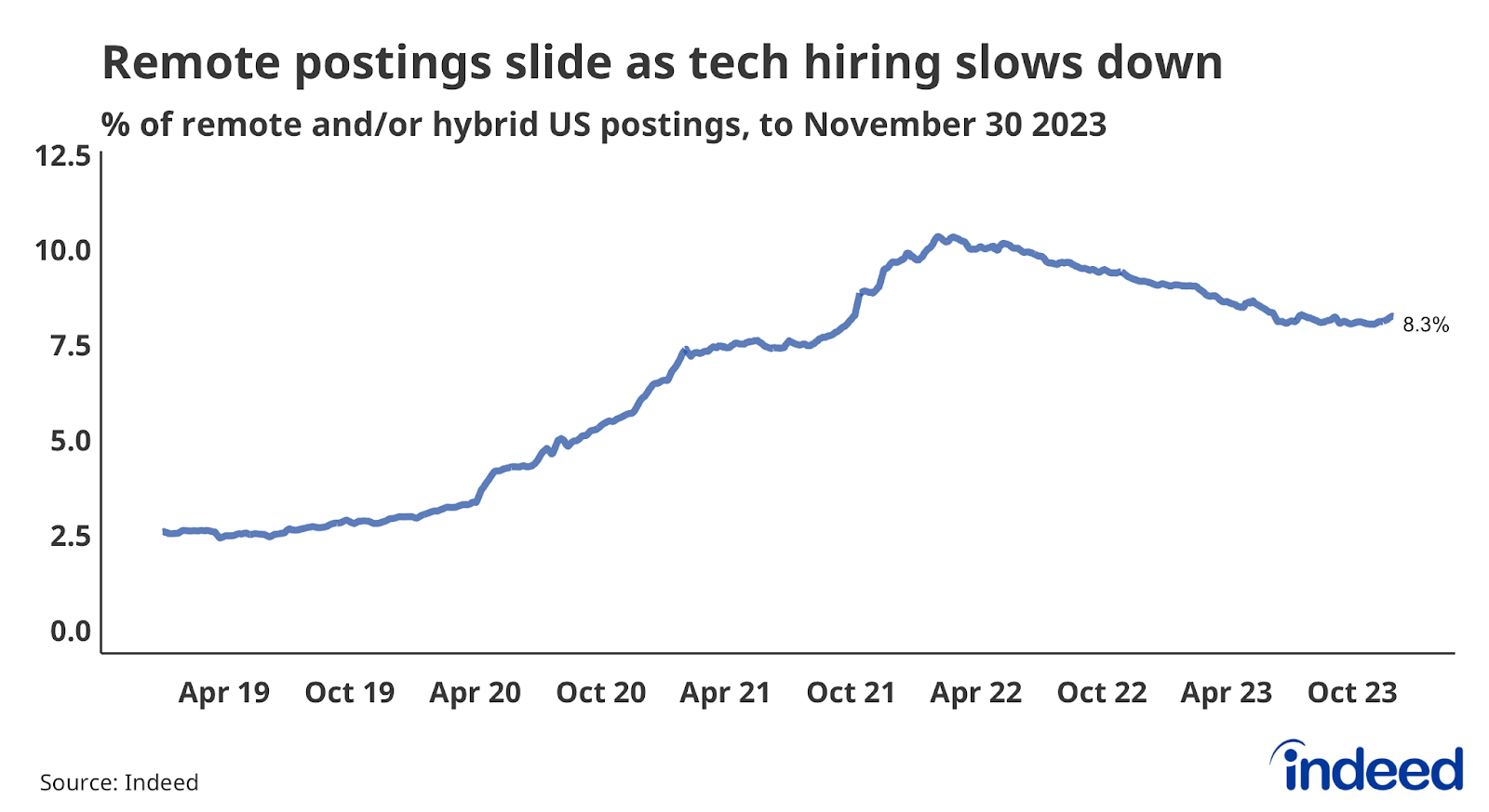

- Job seekers’ interest in remote work hasn’t faded much: Keywords related to remote work appear in 8.6% of all job searches, and 8.3% of job postings advertise some form of remote work — both only down slightly from recent highs.

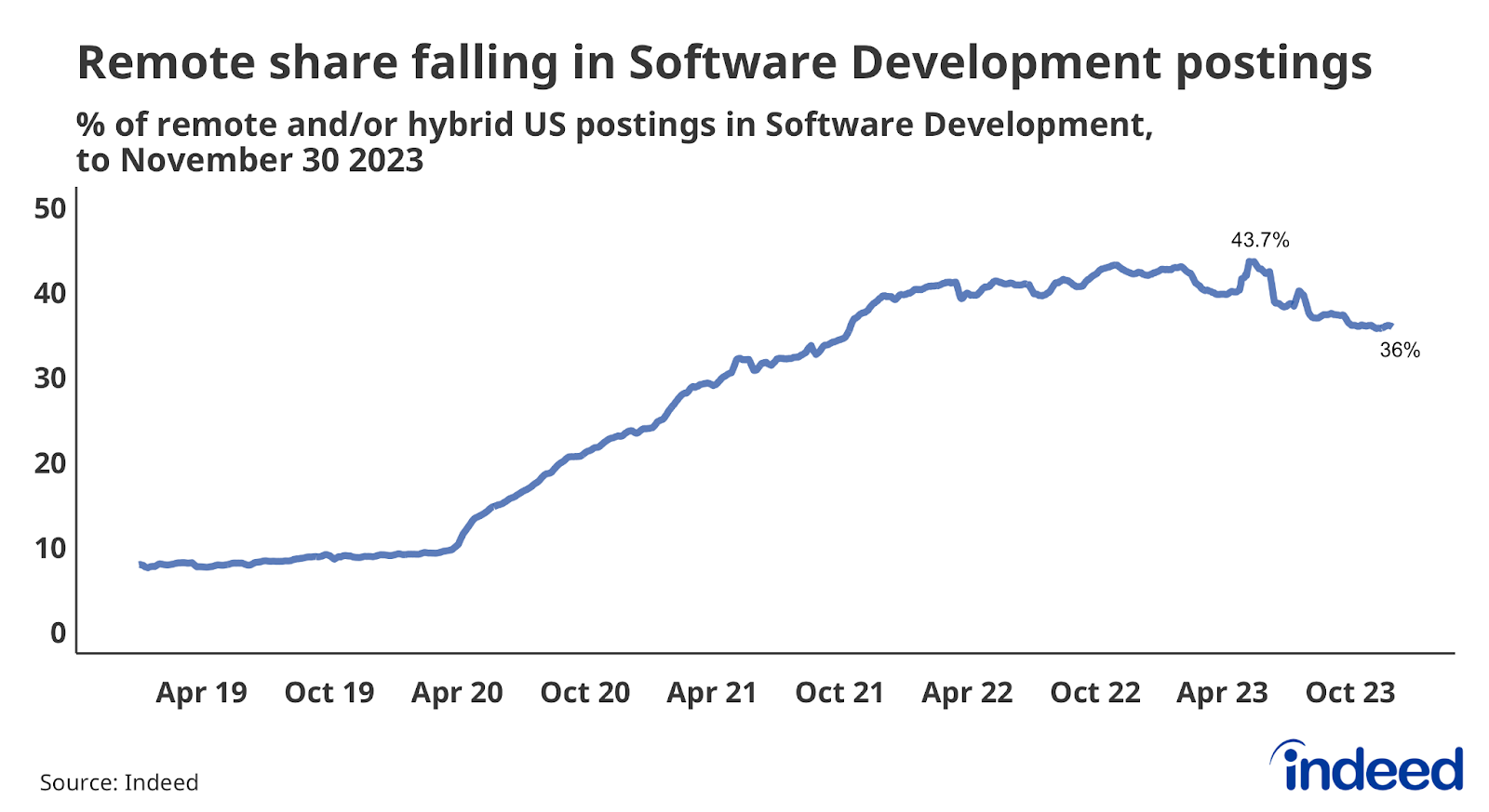

- Opportunities for remote work have declined notably in some sectors. The share of Software Development postings advertising remote work, typically one of the most remote-friendly jobs, is down to 36%, from a peak of 43.7% earlier this year.

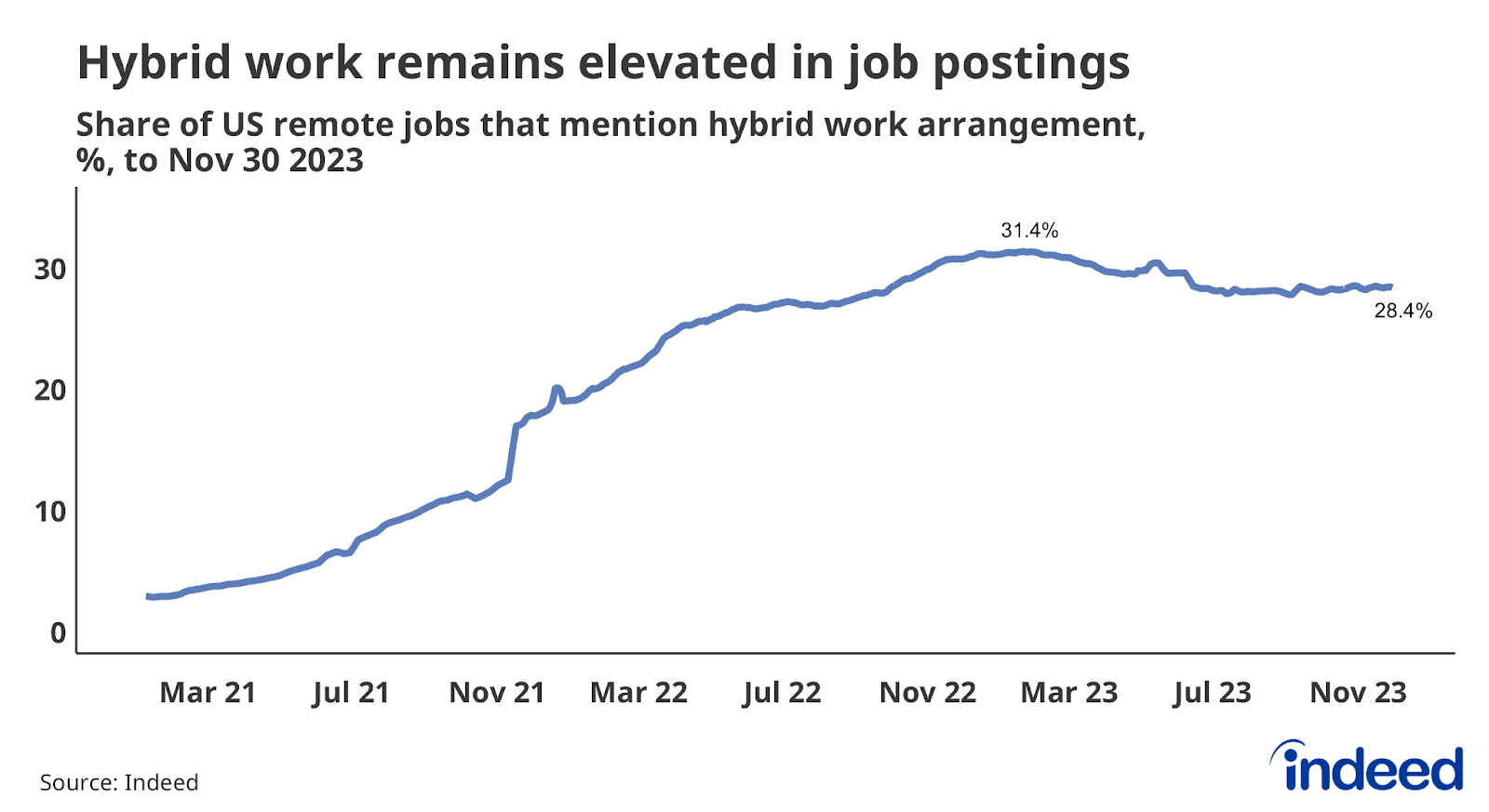

- Hybrid work arrangements remain a key option for flexibility, appearing in 28.4% of remote job postings.

Remote and hybrid work has proven itself to be one of the longer-lasting workplace trends to come out of the COVID-19 pandemic. The share of job searches on Indeed featuring remote work keywords, and the share of job postings advertising that remote-hybrid-arrangement, have fallen throughout 2023 but remain near recent peaks. An overall slowdown in corporate or tech-related job postings — postings for jobs already more likely to be remote-friendly — is driving most of this trend. But even some of the most remote-friendly roles, including software development, are mentioning remote work less frequently as the year comes to a close.

Job seeker interest in remote work is down only marginally

Job seeker interest in remote work has cooled only slightly this year. The share of searches on Indeed containing keywords related to remote work fell to 8.6% through November 30, 2023, from its peak of 10.2% in early January 2023.

Remote postings are down, but context matters

The share of job postings advertising remote/hybrid work options fell slightly over the past year from a peak of 10.3% on February 26, 2022, to 8.3% as of November 30, 2023. This may be less of a signal that employers are changing their minds on remote work, and more a reflection of the kinds of jobs most impacted by the labor market slowdown. The jobs that are typically the most remote-friendly are also the jobs that are posting with far less frequency this year compared to years prior.

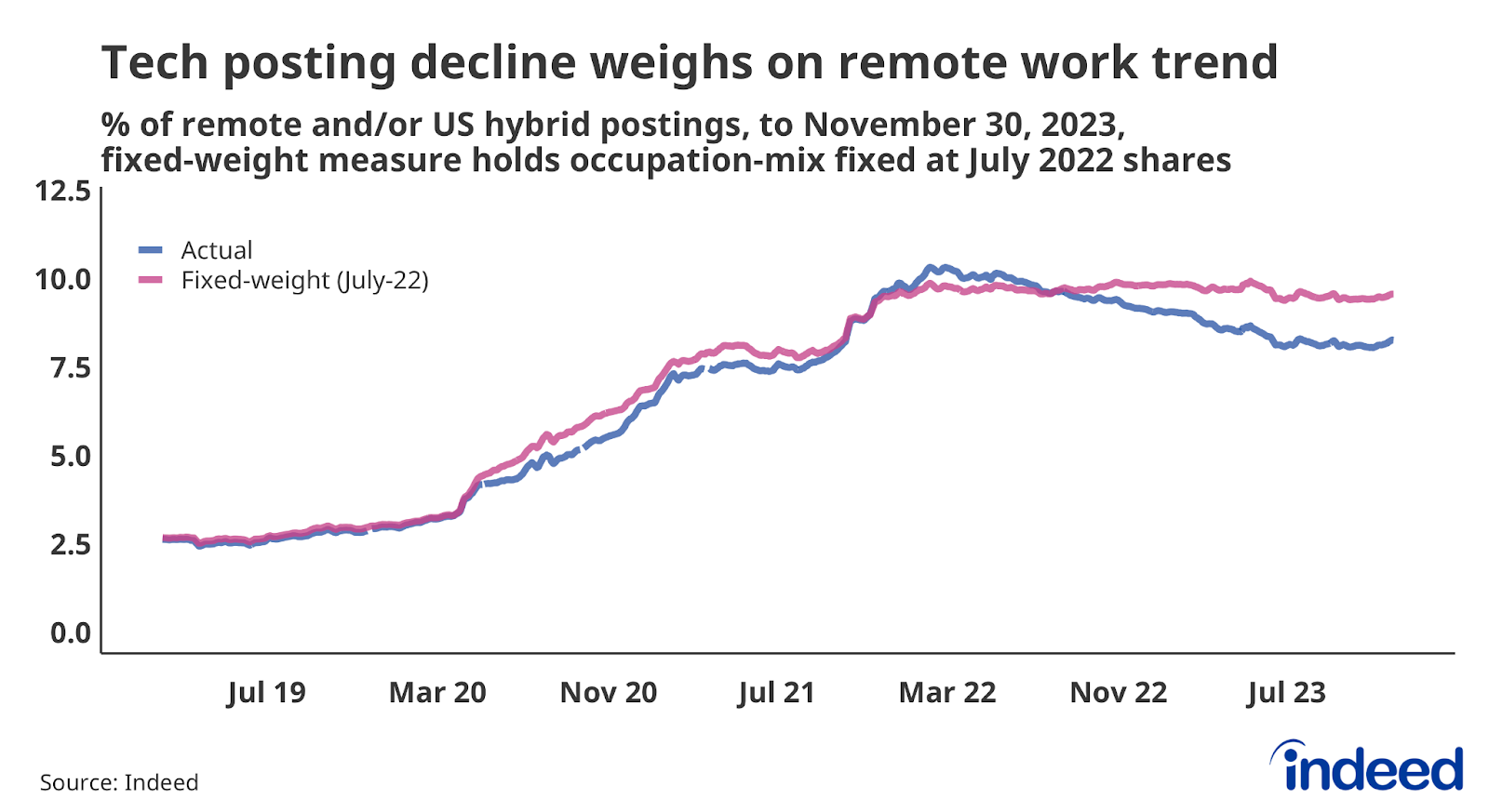

As the labor market has slowed over the past year, tech and corporate postings — including Software Development, IT Operations & Helpdesk, and Banking & Finance — have exhibited significant declines as employers in these fields pull back on hiring. A high share of these postings tend to mention remote work, weighing on the overall trend. If the occupation mix of job postings on Indeed were held constant from July 2022, essentially factoring out the decline in tech and corporate postings, the share of job postings would have only dipped slightly from the May 2023 peak of 9.9% to 9.6% on November 30, 2023.

Remote options for developers on the decline

One notable decline in the prevalence of remote work is within Software Development job postings. The share of remote-eligible software developer jobs fell from a high of 43.7% in early May of 2023, to 36% as of November 30, 2023. This could be a sign that in addition to pulling back on hiring in this space (as of December 1, 2023, Software Development postings were down 48.8% from the same time last year), employers are also looking to bring more workers back into the office, at least on a part-time basis.

The best of both worlds? Hybrid postings remain elevated

With some employers requiring their remote workers to return to the office full-time or at least a few days a week, the share of remote job postings mentioning “hybrid” work climbed through much of 2022, and peaked in mid-January 2023 at 31.4%. Hybrid work mentions in remote postings have since declined a bit, but remained near their peak (at 28.4%) through November 30, 2023.

It is likely still too early to say if these remote work trends have settled into their long-run trajectory. What is more likely is that some employers may yet grapple with a return to office, while other employers and workers settle into the flexible work arrangement that best suits their needs. Together, these are trends that warrant a close eye as we move into 2024.

Methodology

A deep review of the methodology behind Indeed’s Hybrid/Remote Tracker can be found here.

We identify job postings as open to remote work if the job title or description includes terms like “remote work,” “telecommute,” “work from home,” “hybrid,” or similar language, or if the location is explicitly listed as remote. These postings include both permanent and temporarily remote jobs, though employers often don’t specify.

We calculate the remote share of postings on a daily basis. When reporting data on specific months we present the monthly mean of the daily series.

The Indeed Job Postings Index is built from a 7-day moving average of job postings, with the index set to 100 on February 1, 2020. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. We adopted this methodology in January 2021. Data for several dates in 2021 and 2022 are missing and were interpolated. Non-seasonally adjusted data are calculated in a similar manner except that the data are not adjusted to historical patterns.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.