Takeaways

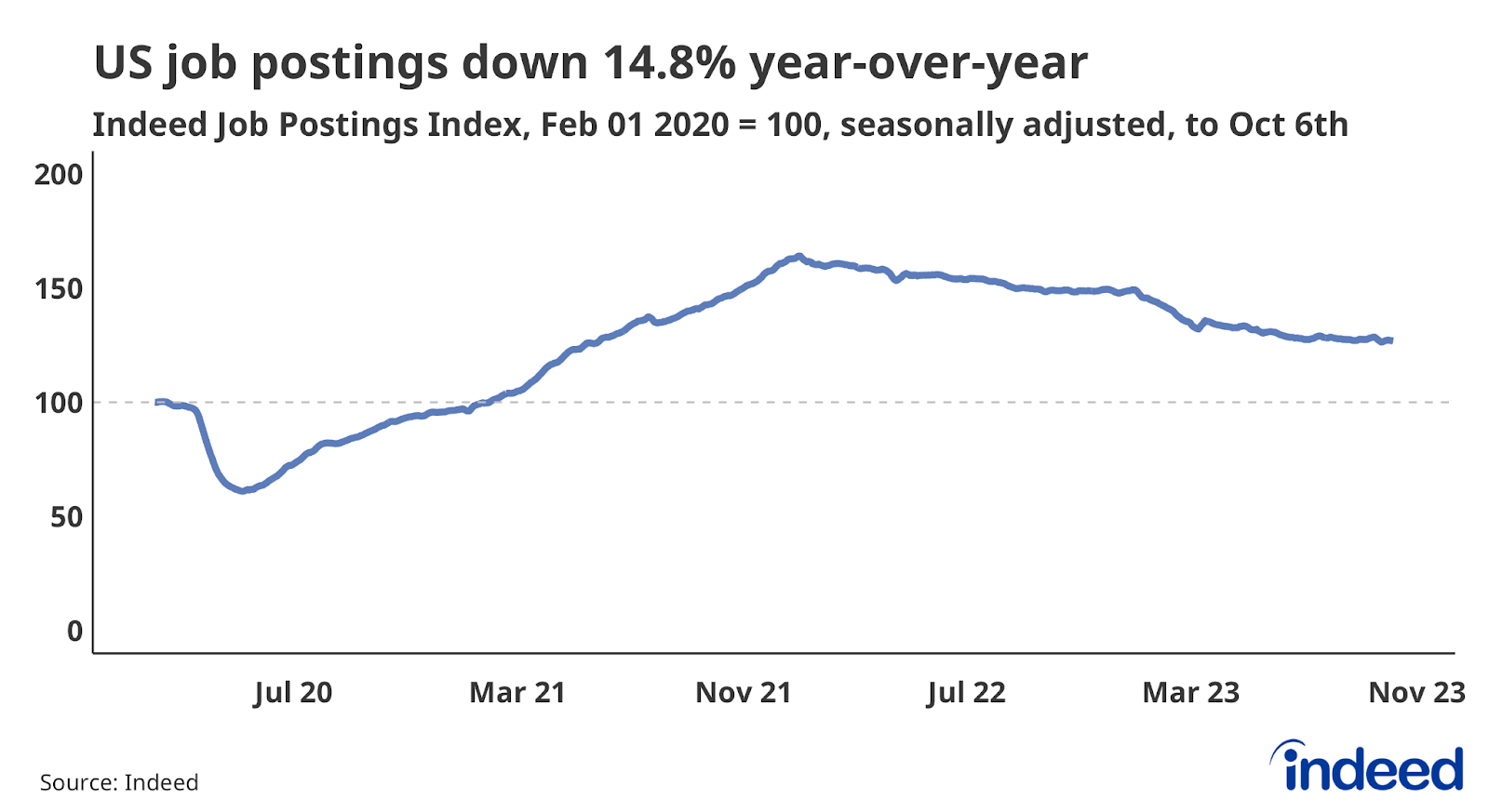

- Demand for workers across the labor market is down, as overall postings have fallen 14.8% from October 6, 2022.

- Postings in Retail-related categories have fallen slightly year-over-year, but are mostly flat in recent months.

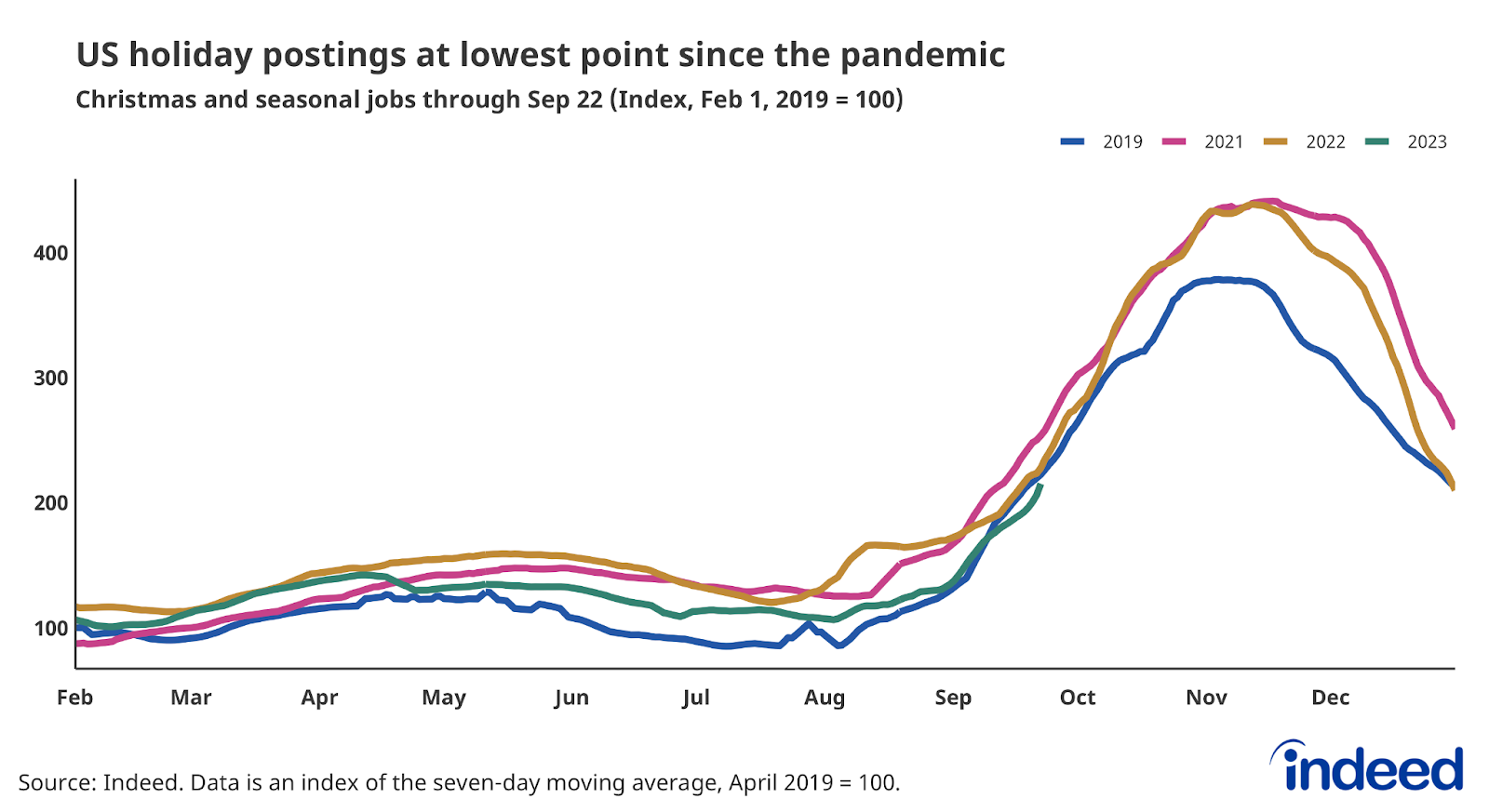

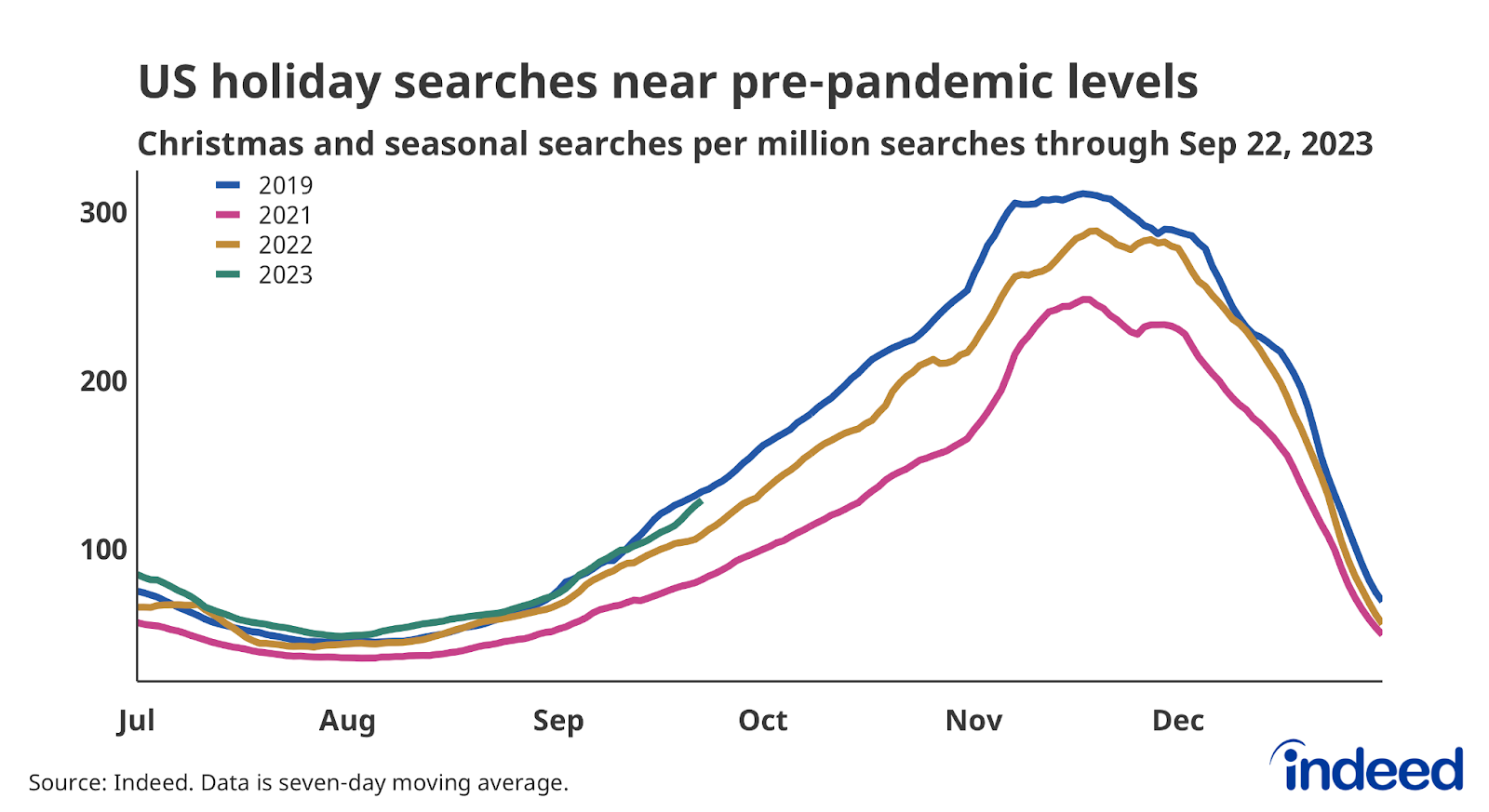

- Holiday postings are off to a slow start but job seeker interest in those roles is back to pre-pandemic levels.

Indeed job postings

The labor market slowdown continued through the third quarter of 2023, which is reflected in the Indeed Job Postings Index. As of October 6, job postings are down 14.8% from the same date last year. However, employer demand for workers is still elevated. As of October 6, the Indeed Job Postings Index remained at 127, meaning job postings are still 27% above their pre-pandemic baseline.

Retail job postings

Job postings for segments inside the Retail vertical remain in decline. Food Preparation & Service and Retail postings are down 9.7% and 10.5%, respectively, from October 2022, but have mostly leveled off in the third quarter of 2023. Hospitality & Tourism postings are down 14.1% over the past year but have stagnated at their pre-pandemic baseline in recent months.

Seasonal hiring

The number of seasonal/holiday job postings on Indeed has fallen below pre-pandemic levels. As of late September, seasonal job postings were down 3% from the same time in 2019, and 6% below levels from the same period a year ago. The decline in postings so far this year is a sign that employers in industries that typically hire large numbers of seasonal workers—including retail and sales—are feeling confident that their current workforce will be sufficient to weather the season.

Job seekers are showing greater interest in seasonal work this year compared to the past few years. As of late September, job seeker searches for holiday/seasonal jobs were at a three-year high, up 19% from the same time in 2022, and less than 4% below 2019 levels.

For more labor market insights from the Indeed Hiring Lab, follow along on our blog at hiringlab.org.