Takeaways

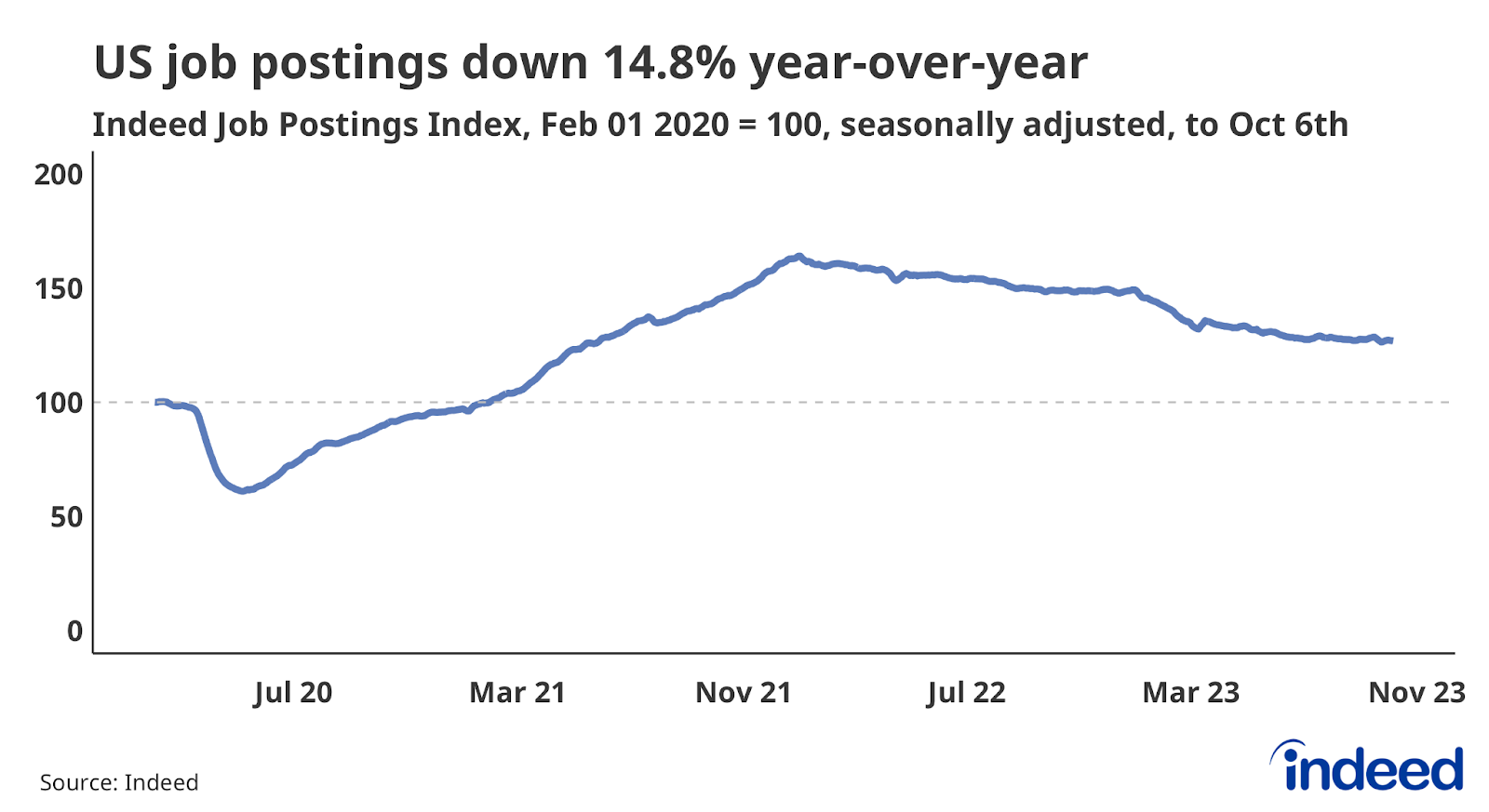

- Demand for workers across the labor market is down, as overall postings have fallen 14.8% from October 6, 2022.

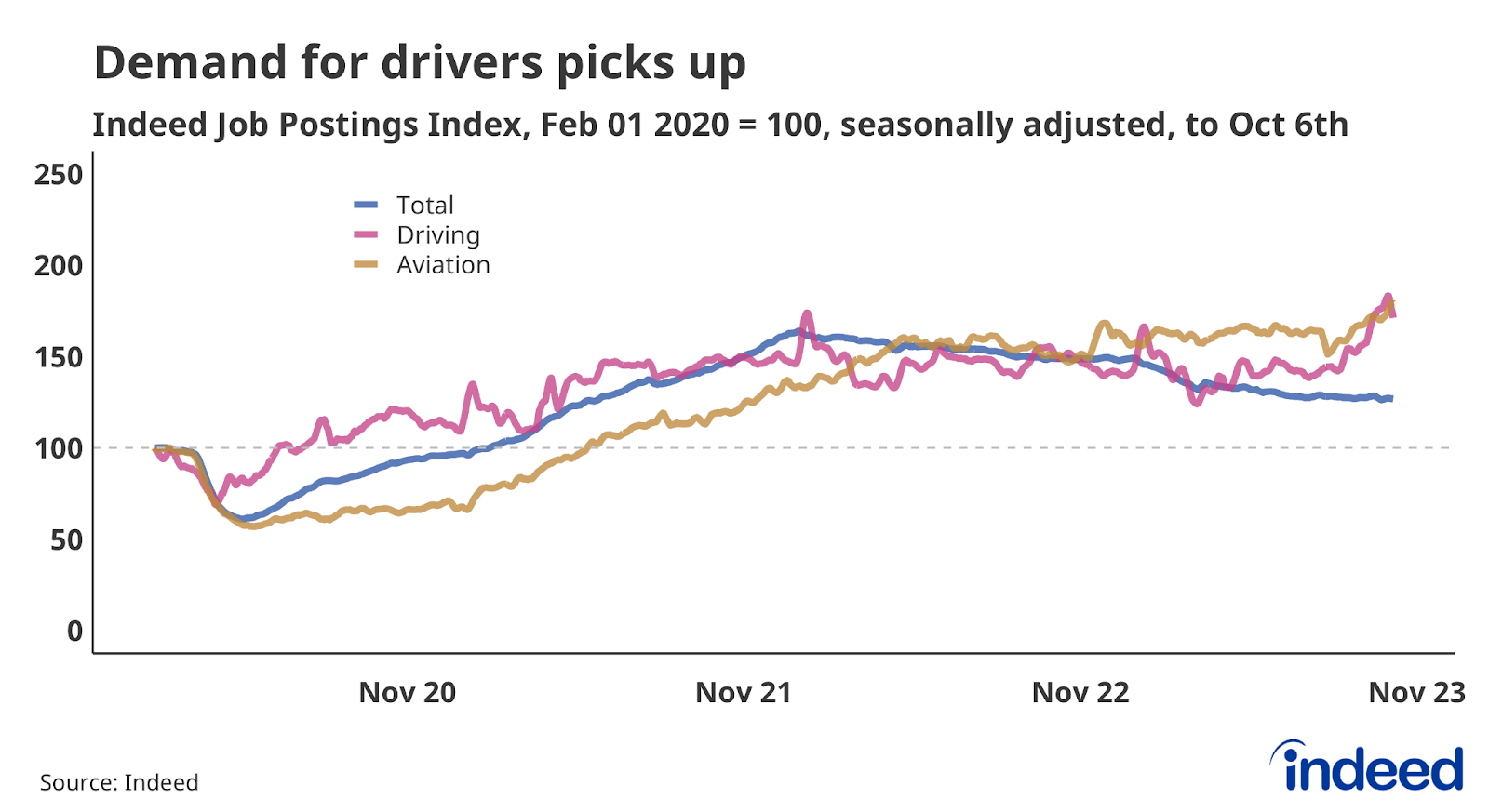

- Aviation and Driving postings have notched gains over the past year, while other transportation categories have fallen.

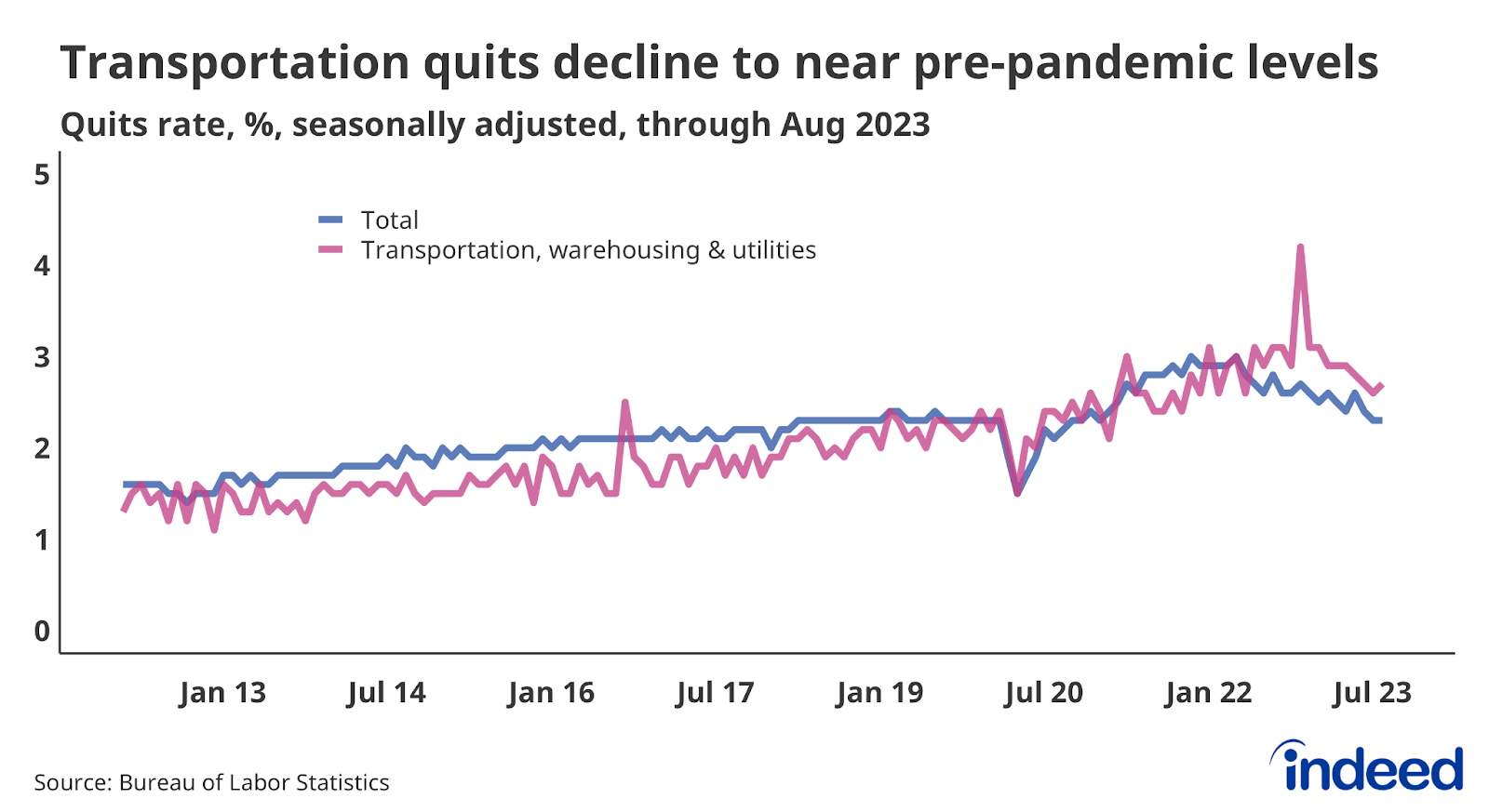

- Workers are staying put more as the quits rate has descended to near pre-pandemic levels.

Indeed job postings

The labor market slowdown continued through the third quarter of 2023, which is reflected in the Indeed Job Postings Index. As of October 6, job postings are down 14.8% from the same date last year. However, employer demand for workers is still elevated. As of October 6, the Indeed Job Postings Index remained at 127, meaning job postings are still 27% above their pre-pandemic baseline.

Transportation job postings

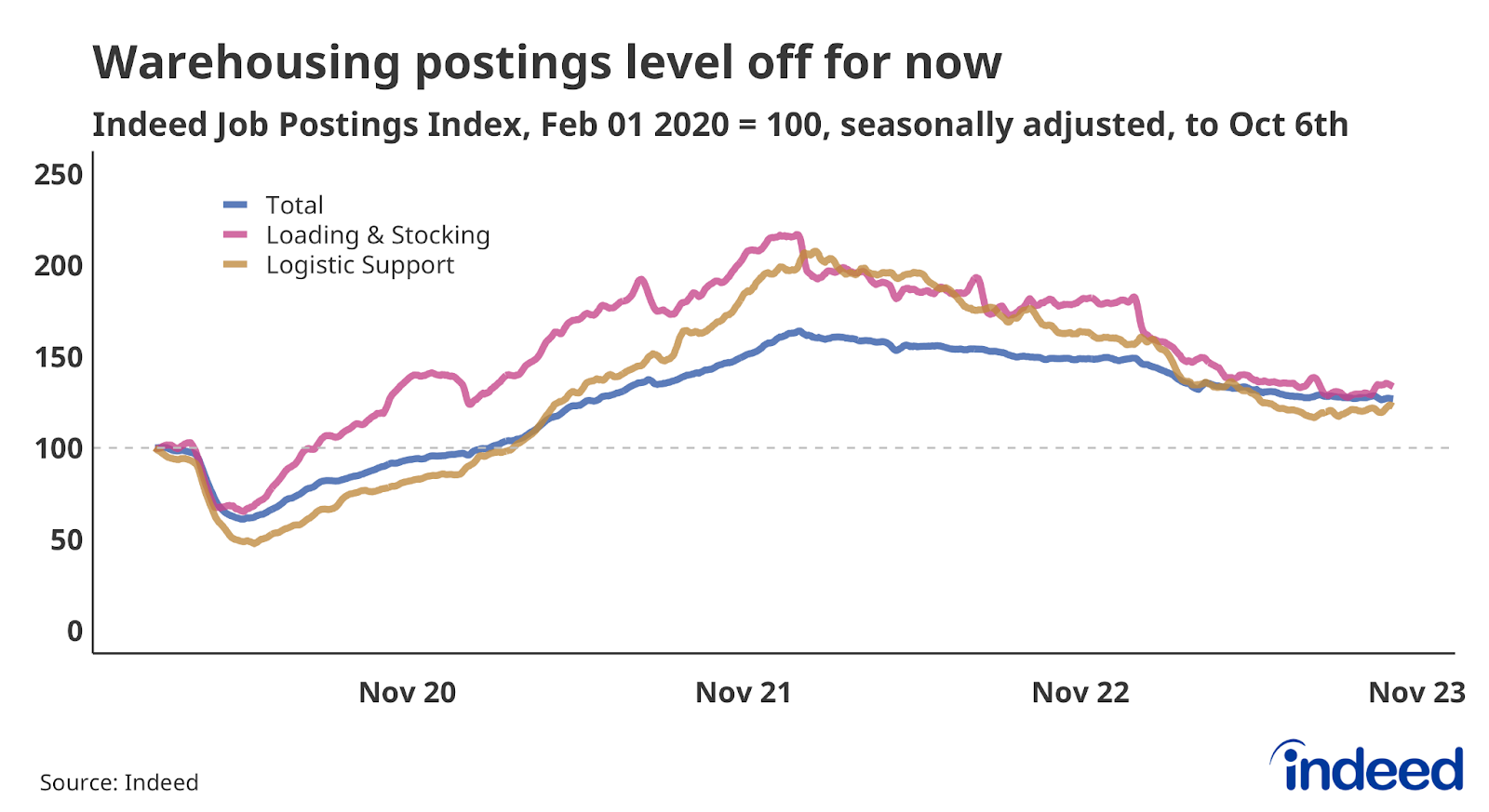

The slowdown in parts of the Transportation vertical has abated in recent months. Loading & Stocking and Logistic Support postings have leveled off through the third quarter, but both categories are still down 25.2% over the past year.

Employer demand for workers in other areas of transportation has notched up in recent months. Aviation postings have risen 19% from last year while Driving postings are not far behind, up 14.3% from the same time last year.

Transportation quits

As the labor market slowed this year workers have become a bit more cautious about switching roles, as evidenced by the recent decline in the quits rate. According to the Bureau of Labor Statistics, the share of workers voluntarily leaving their jobs each month in the Transportation, Warehousing & Utilities industry has fallen back to near pre-pandemic levels. While turnover is still high by historical standards, employers are facing less of a retention issue compared to this time last year.

For more labor market insights from the Indeed Hiring Lab, follow along on our blog at hiringlab.org.