Takeaways

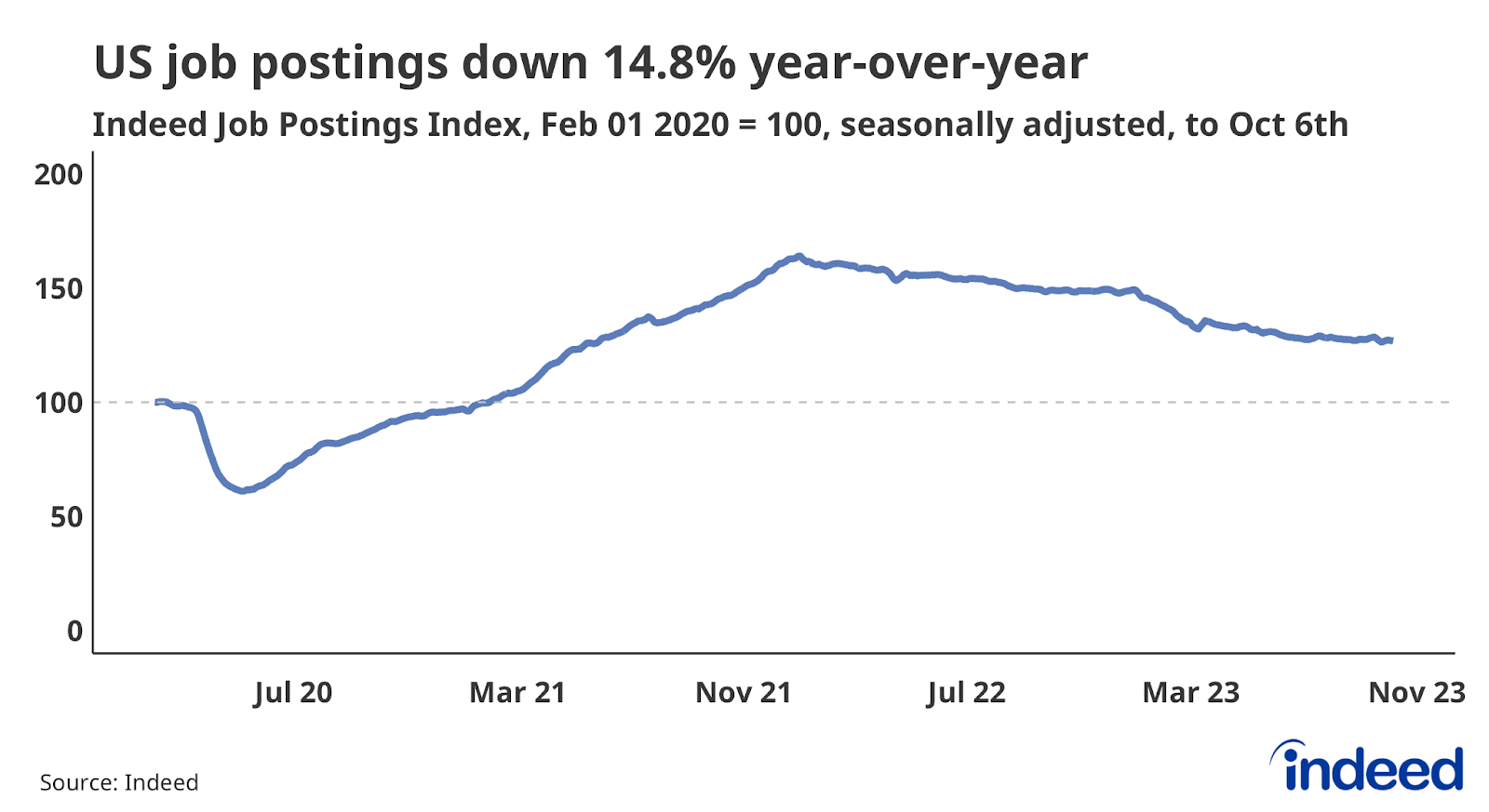

- Demand for workers across the labor market is down, as overall postings have fallen 14.8% from October 6, 2022.

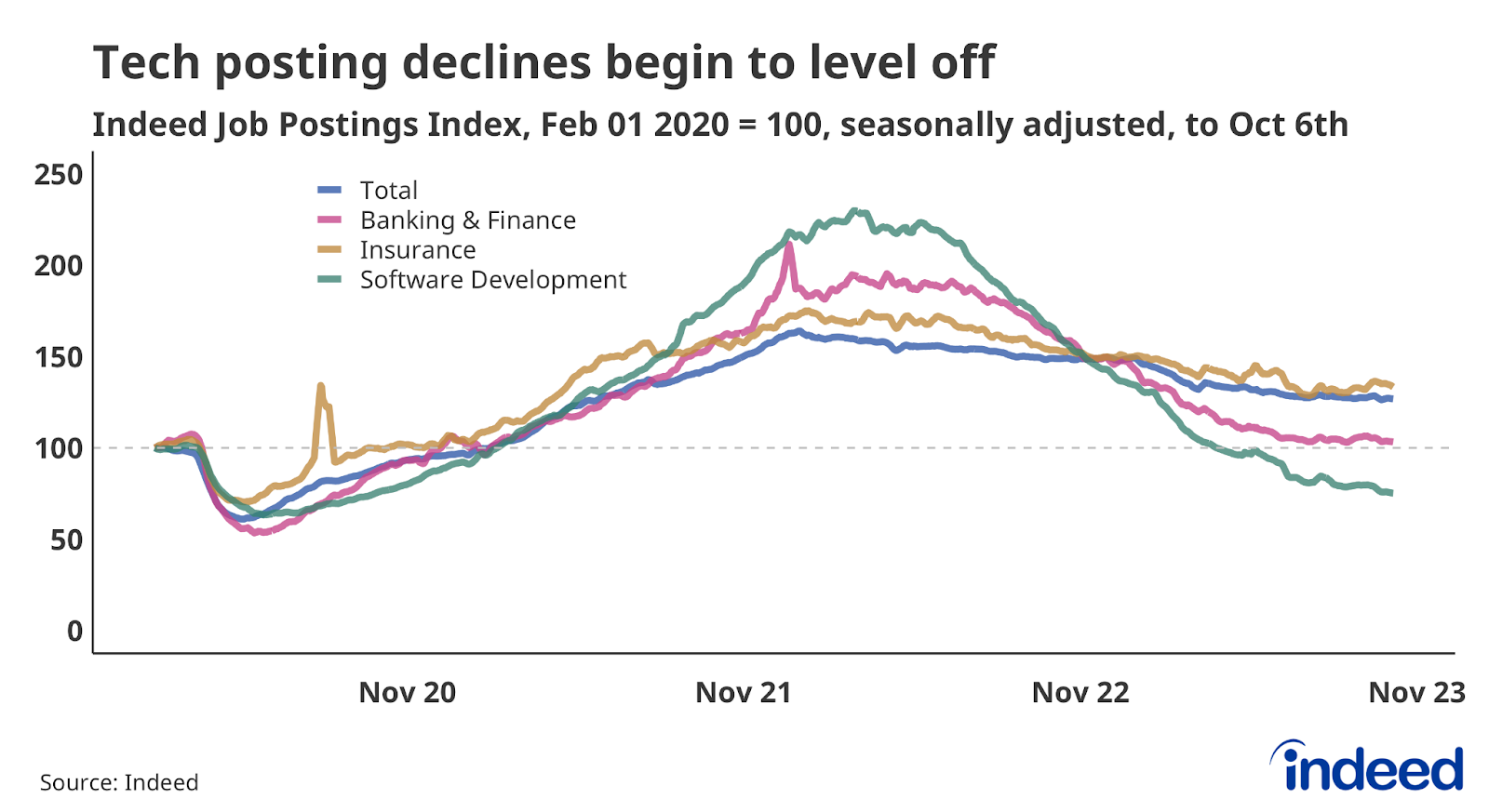

- B2B-related postings are declining across the board but Software Development’s sizable drop of 54% over the past year leads the entire labor market.

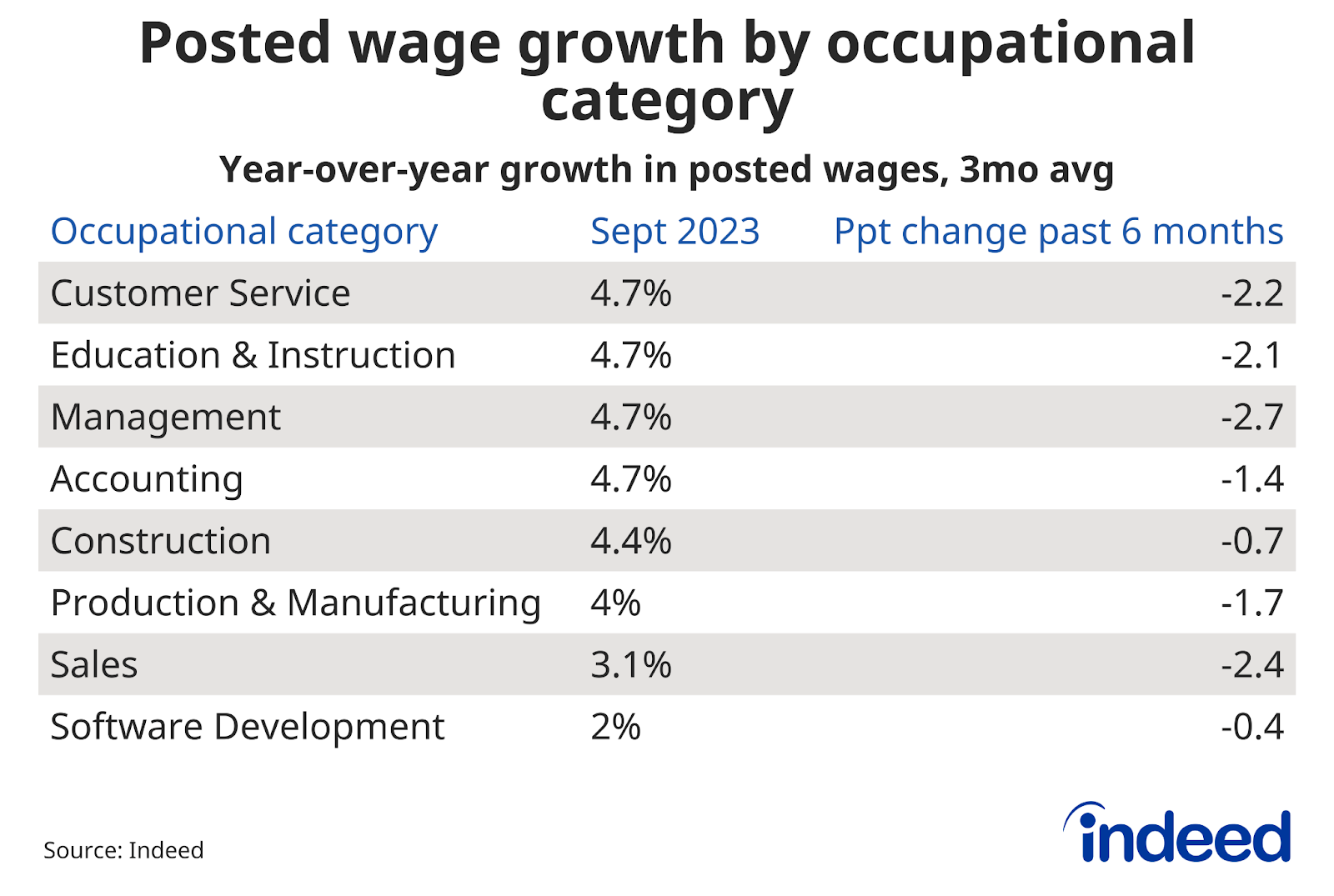

- Wage growth across all B2B categories has slowed over the past six months.

Indeed job postings

The labor market slowdown continued through the third quarter of 2023, which is reflected in the Indeed Job Postings Index. As of October 6, job postings are down 14.8% from the same date last year. However, employer demand for workers is still elevated. As of October 6, the Indeed Job Postings Index remained at 127, meaning job postings are still 27% above their pre-pandemic baseline.

Business-to-business postings

Software Development postings have shown the largest decline across the entire labor market, down 54% from the same time last year. While demand for Banking & Finance workers has been level in recent months, the category is down 35.6% since this time last year and now rests right near its pre-pandemic baseline. Insurance postings are holding up much better, only declining 13.2% over the past year.

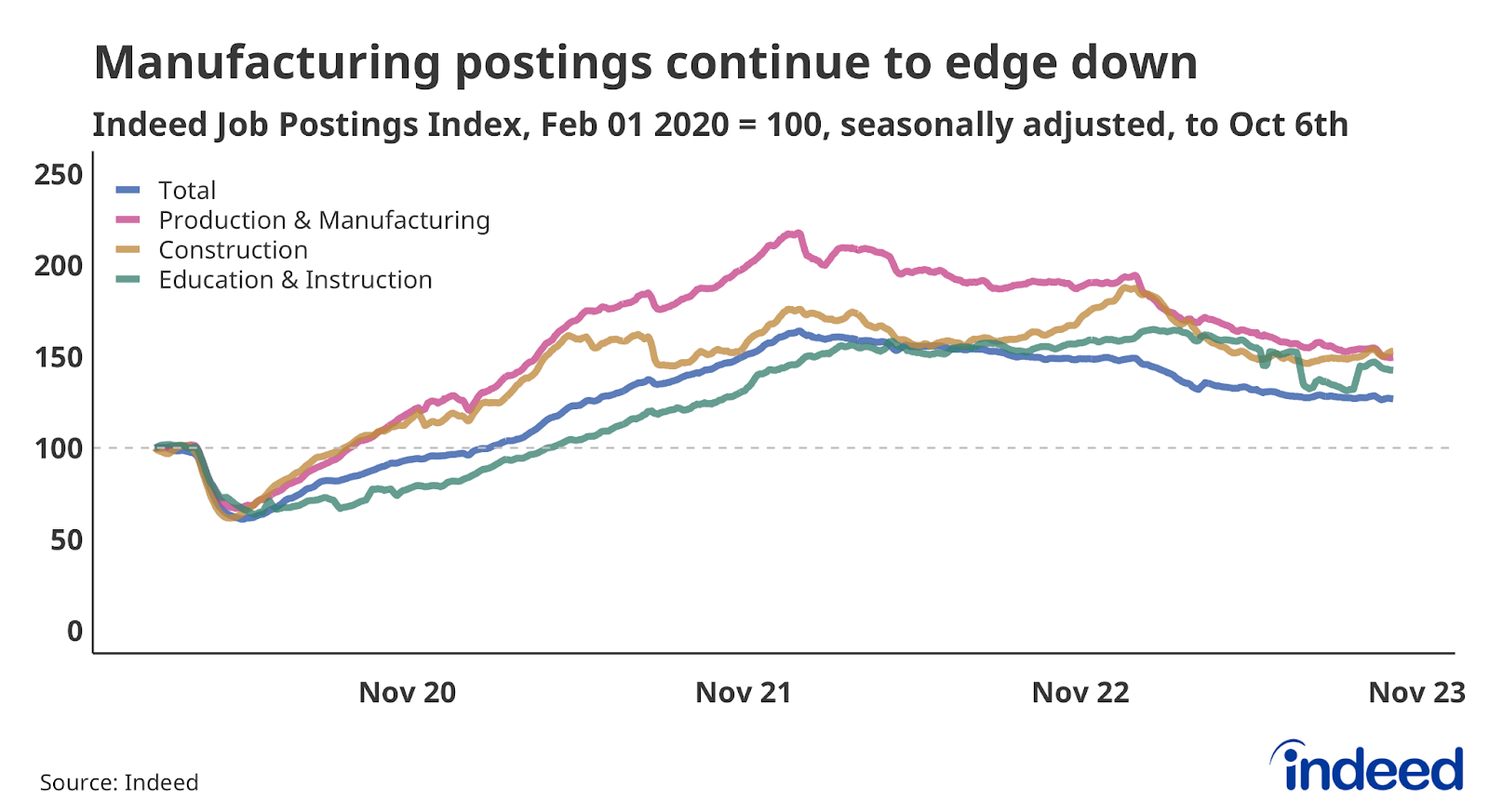

Postings in all other B2B categories have notched declines as well. Production & Manufacturing postings have extended their steady decline, down 21.7% over the last year. The fall in demand for Construction roles earlier this year has leveled off, but the category still shows a year-over-year drop of 7.1%. Education & Instruction postings are exhibiting a similar reduction, down 7.6 from October 6, 2022.

Wage growth

Indeed data shows that wage growth has slowed across all categories over the past six months. Meanwhile, weakening demand for Software Development roles appears to be impacting wage growth, which is below all other B2B categories at 2% year-over-year.

For more labor market insights from the Indeed Hiring Lab, follow along on our blog at hiringlab.org.