Key Points:

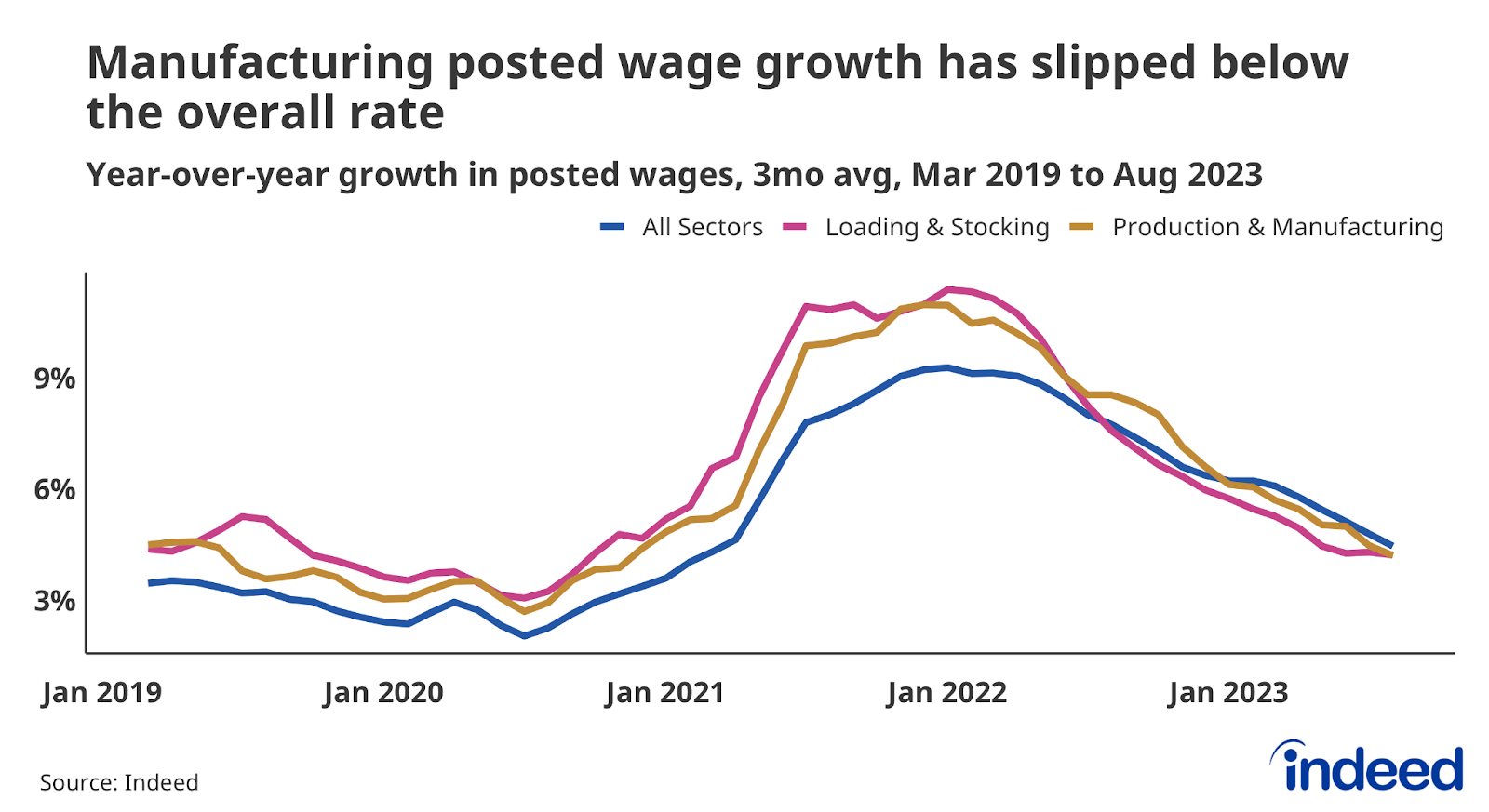

- Posted wage growth for production & manufacturing jobs cooled to 4.2% in August, below the 4.5% growth rate across all sectors.

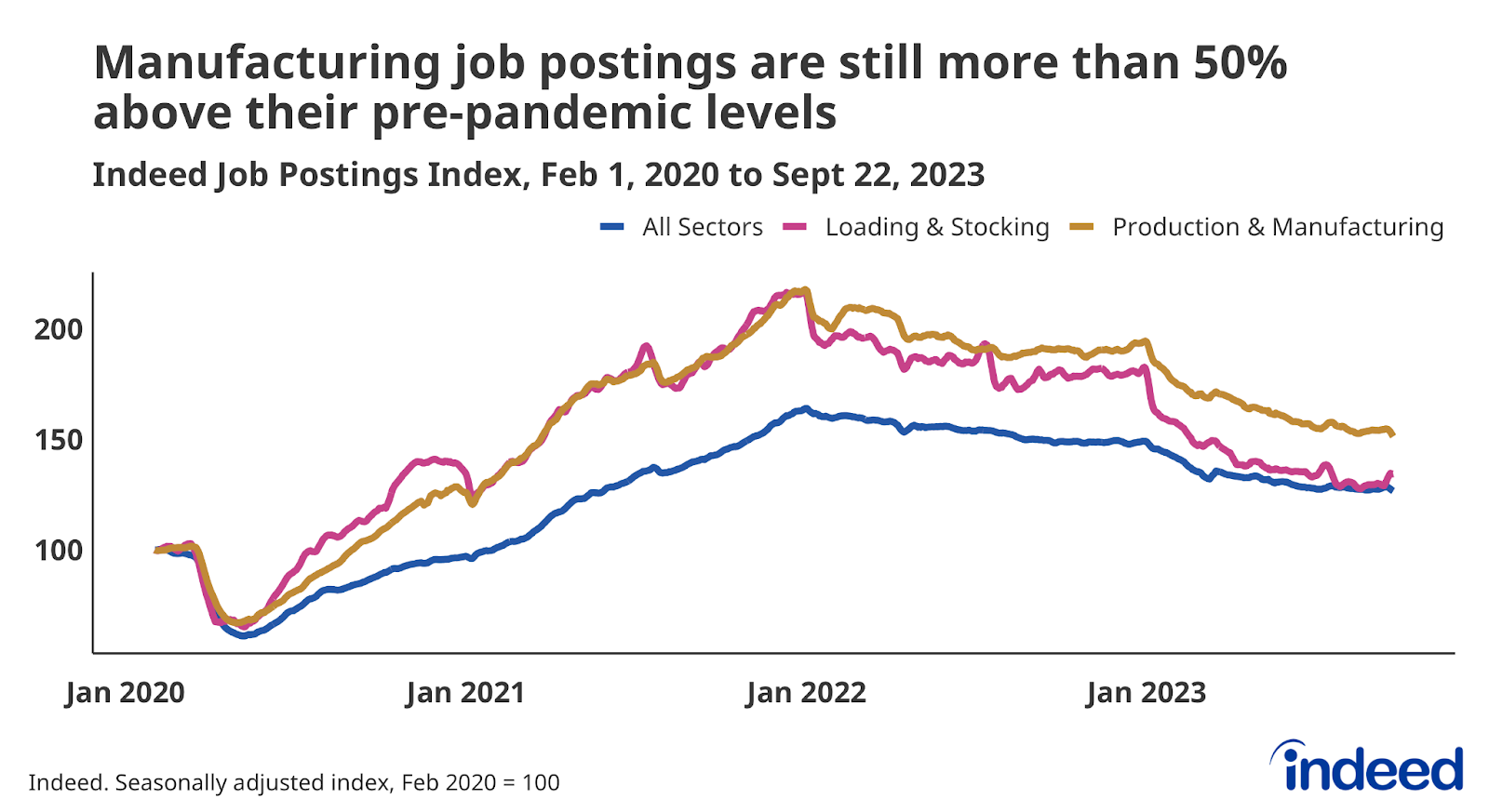

- Employer demand for production & manufacturing workers remains elevated. The Indeed Job Posting Index in that sector was 51.3% above pre-pandemic levels as of September 22, 2023.

- While production & manufacturing wage growth remains strong, it has fallen behind national averages.

Our monthly Labor Market Update looks at an important labor market trend through the lens of Indeed data. A more comprehensive view of the US labor market can be found in our US Labor Market Overview chartbook. Data from our Job Postings Index—which stands 26.6% above its pre-pandemic baseline as of September 22—and the Indeed Wage Tracker, are regularly updated and can be downloaded on our data portal, and GitHub.

The US labor market continues to show remarkable strength even as job postings decline and wage growth slows. One side effect of this continued labor market resilience has been a rise in demands from organized labor in several industries including manufacturing, headlined by the United Auto Workers (UAW) strikes that started this month.

Demands for higher wages for manufacturing workers are central to these organized labor efforts. Posted wages for production & manufacturing workers rose 4.2% year-over-year in August 2023 (on a three-month, average basis), according to the Indeed Wage Tracker. While above the sector’s pre-pandemic, 2019 annual average growth of 3.9%, it represents a dramatic pullback from a recent peak of 11% annual growth reached in December 2021.

Manufacturing workers also often express an interest in loading & stocking jobs, and wages in that sector have shown similar growth patterns over the past few years. Annual growth in advertised pay in loading & stocking jobs peaked in January 2022 at 11.4%, but has since fallen to 4.2% in the most recent reading. While 4.2% annual growth in both the manufacturing and loading/stocking sectors is historically strong, it’s still less than the 4.5% annual growth pace for posted wages overall.

The fact that wage growth in these sectors has slipped below the national average is somewhat surprising, considering that employer demand for workers in those occupations has held up better than demand overall. As of September 22, total job postings were 26.6% above their February 2020 level, while production & manufacturing and loading & stocking were 51.3% and 34.4%, respectively, above their levels from the same time.

It’s possible that manufacturing and other employers are reluctant to continue offering such large pay increases after increasing pay by so much in 2021 and 2022. But the slowdown in wage growth also likely reflects declining demand for new workers since last year. Despite remaining well above pre-pandemic levels, job postings in production & manufacturing, and loading & stocking, have both dropped by more than 20% compared to the same time last year, while overall postings have declined more slowly (-15%).

And while annual wage growth in the 4-5% range may seem strong, historical context is important. Before the 1990s, production manufacturing jobs often paid more than similar jobs outside of manufacturing. But that advantage disappeared as wages grew at a slower-than-average rate for these manufacturing workers in the decades that followed. The result is fewer dollars per hour for manufacturing workers compared to what it might have been if their wage growth had kept pace with national averages. Additionally, measures of average wage growth conceal the fact that some individual workers may have gotten smaller (or larger) pay increases, and their wages may still be falling short of what is needed to maintain or advance their standard of living.

Manufacturing wage growth over the past few years has been strong. But historically, pay growth in these jobs has not always kept pace with the average. Additionally, we should view the recent declines in job postings and overall wage growth in a similar light. While the labor market is not as hot as it was a year or two ago, it remains hotter than in 2019 by many measures. Job postings and wage growth are coming down, but they are doing so at a steady pace and are doing it—so far—without any significant increase in unemployment.

For more on the current state of the US labor market, including the latest from the Indeed Job Postings Index, check out our US Labor Market Overview chartbook.

Note to readers: Effective Sept. 17, a New York pay transparency law requires employers to disclose certain salary information in job postings for roles that will be performed in the state. On Indeed’s site, job postings in New York that do not include employer-provided pay information will not be visible until pay information is added or employers indicate the job is exempt. Indeed Job Postings Index data published Sept. 22, 2023, is the first to cover this period, and users may notice that the level of job postings in New York state has fallen sharply compared to prior versions. In the past, similar declines have been observed in states that have implemented comparable salary transparency regulations. In order for our real-time data to accurately reflect changes in job postings activity related to the newly enacted law, we are intentionally not adjusting the New York series. Hiring Lab will continue to monitor the impact of pay transparency laws on the labor market and publish the Job Postings Index as scheduled.

Methodology

To calculate the average rate of wage growth, we follow an approach similar to the Atlanta Fed US Wage Growth Tracker, but we track jobs, not individuals. We begin by calculating the median posted wage for a given country, month, job title, region, and salary type (hourly, monthly, or annual). Within each country, we then calculate year-on-year wage growth for each job title-region-salary type combination, generating a monthly distribution. Our monthly measure of wage growth for the country is the median of that distribution. Alternative methodologies, such as the regression-based approaches in Marinescu & Wolthoff (2020) and Haefke et al. (2013), produce similar trends. More information about the data and methodology is available in a research paper by Pawel Adrjan and Reamonn Lydon, Wage growth in Europe: evidence from job ads, published in the Central Bank of Ireland’s Economic Letter series.

Data on seasonally adjusted Indeed job postings are an index of the number of seasonally adjusted job postings on a given day, using a seven-day trailing average. February 1, 2020, is our pre-pandemic baseline, so the index is set to 100 on that day. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. We adopted this methodology in January 2021. Data for several dates in 2021 and 2022 are missing and were interpolated. Non-seasonally adjusted data are calculated in a similar manner except that the data are not adjusted to historical patterns.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.