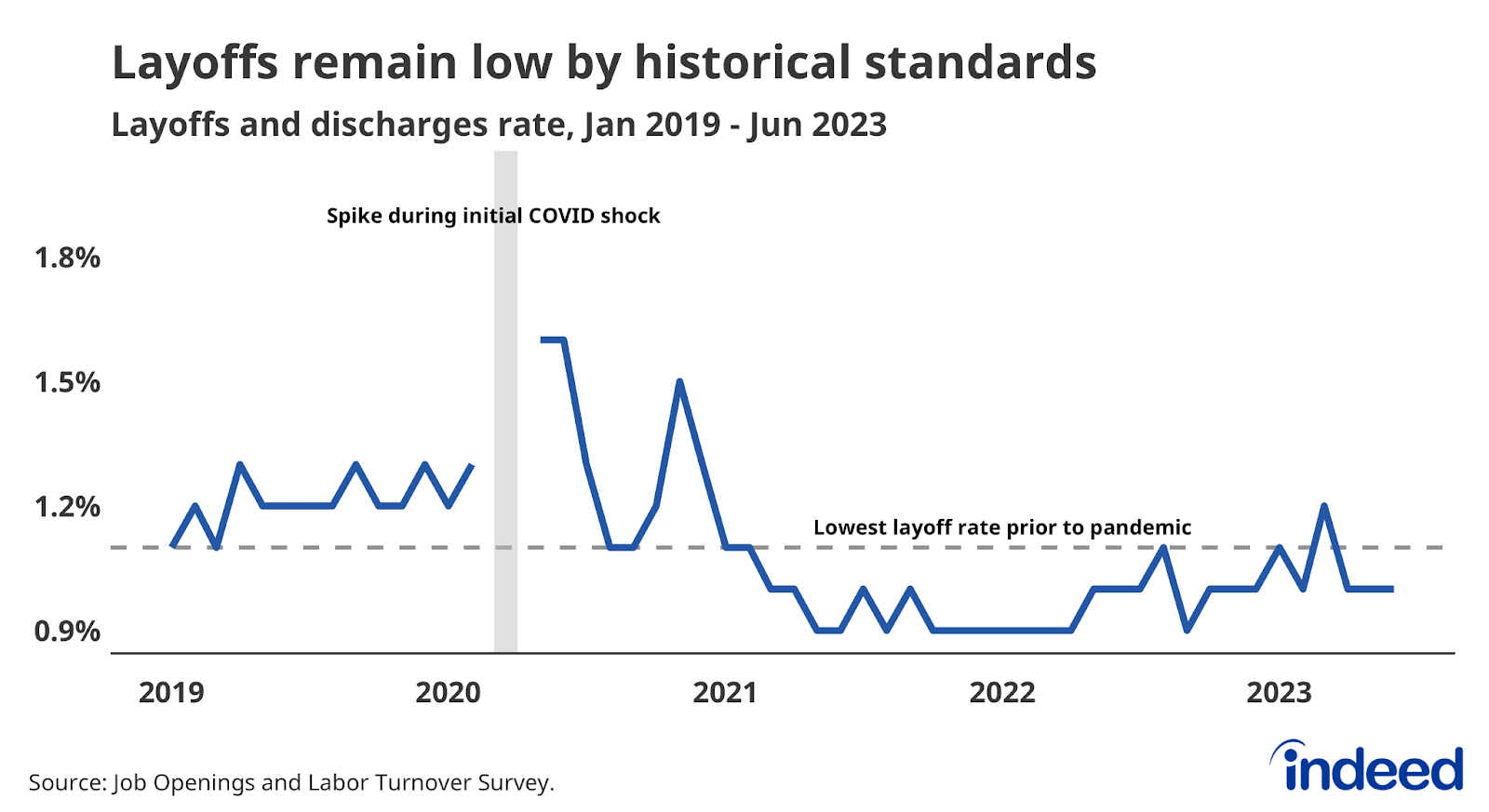

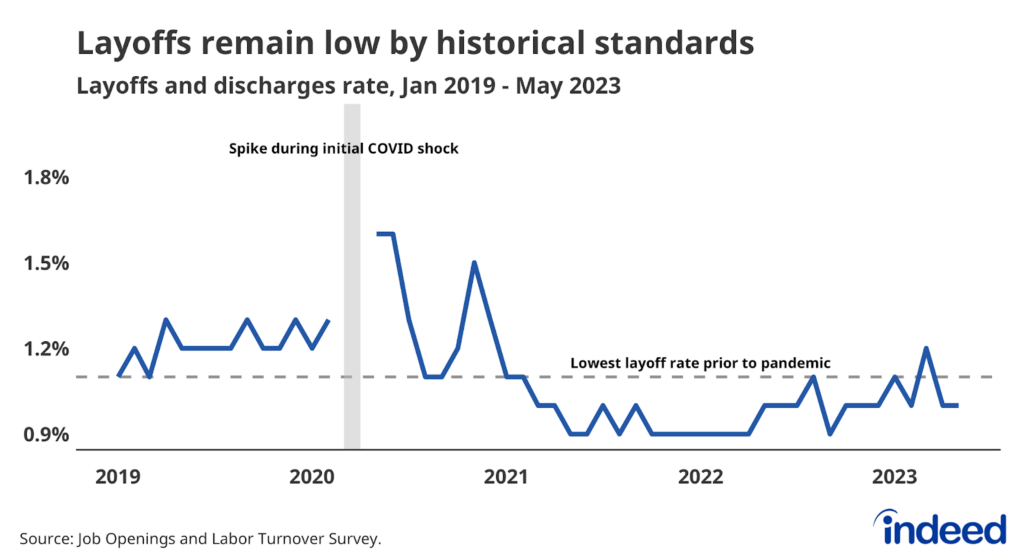

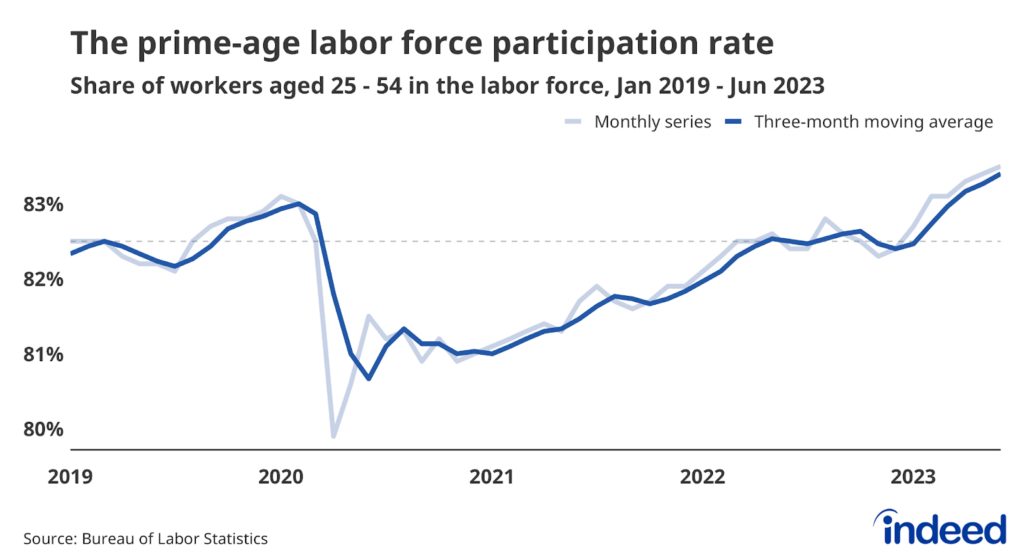

The US labor market has come off the boil, but it’s still simmering. Demand for workers — whether new or existing ones — remains high, and job seekers are still in the driver’s seat. Job openings still outnumber unemployed workers by a ratio of 1.6 to 1. The quits rate, a key signal of job seeker confidence, remains above its pre-pandemic average, and the layoff rate at 1% remains below the lowest rate we’d seen before 2020 of 1.1%. But there are some signs of a slowdown: Both the hiring rate and total openings are at their lowest points in more than two years (though both are still above pre-pandemic levels). For good or ill, depending on your perspective, the labor market remains stubbornly strong.

The data on layoffs show just how resilient employer demand for workers remains. Layoff data, a loud emergency siren during economic downturns, are instead signaling a muted “all’s well” for current employees. The layoff rate stayed steady at 1% throughout the second quarter, a rate that would have been an all-time low prior to 2021. Every major industry sector reported a layoff rate in June equal to or below its February 2020 level. Even the Information sector, which covers many tech and media industries, had a layoff rate in June below its immediate pre-pandemic rate.

A variety of economic data show the US economy was cruising in the second quarter, and the June JOLTS data is no exception. Demand for workers was elevated and workers left their old jobs to take new ones at a strong pace. The tempo of the current slowdown may be too gradual for many policymakers at the Federal Reserve, as job openings are only gradually declining, but workers have much to celebrate and still possess substantial leverage. If layoffs continue to remain low, this tenacious and tight labor market can endure.