Key points:

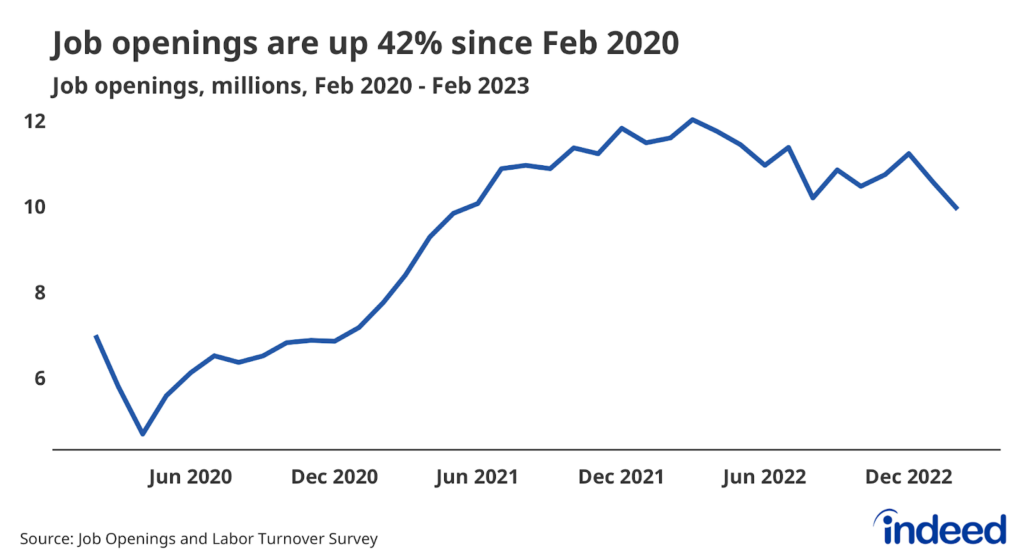

- Job openings declined in May, as employers were looking to fill 9.8 million job openings at the end of the month.

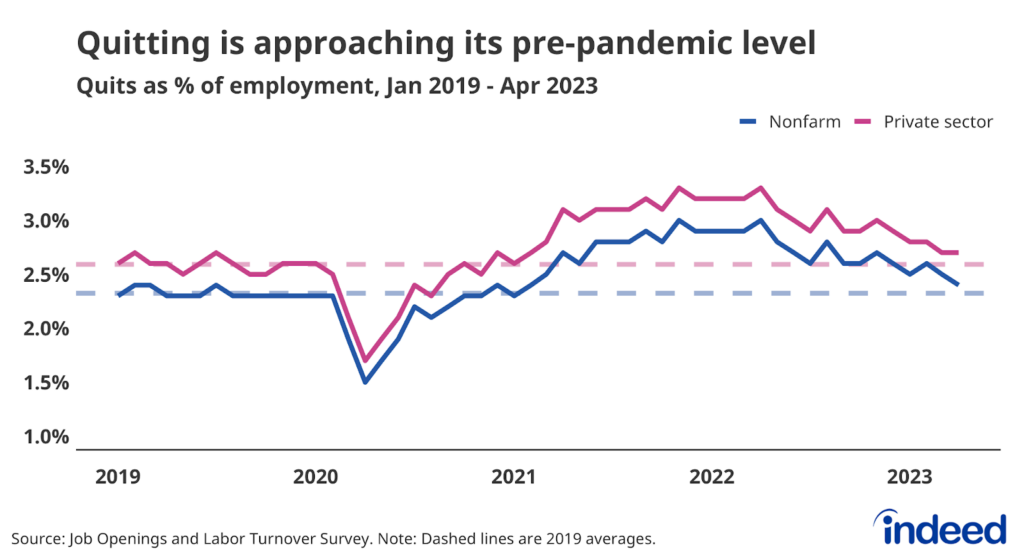

- The quits rate bucked its recent downward trend, signaling that any further moderation in quitting will continue to be gradual.

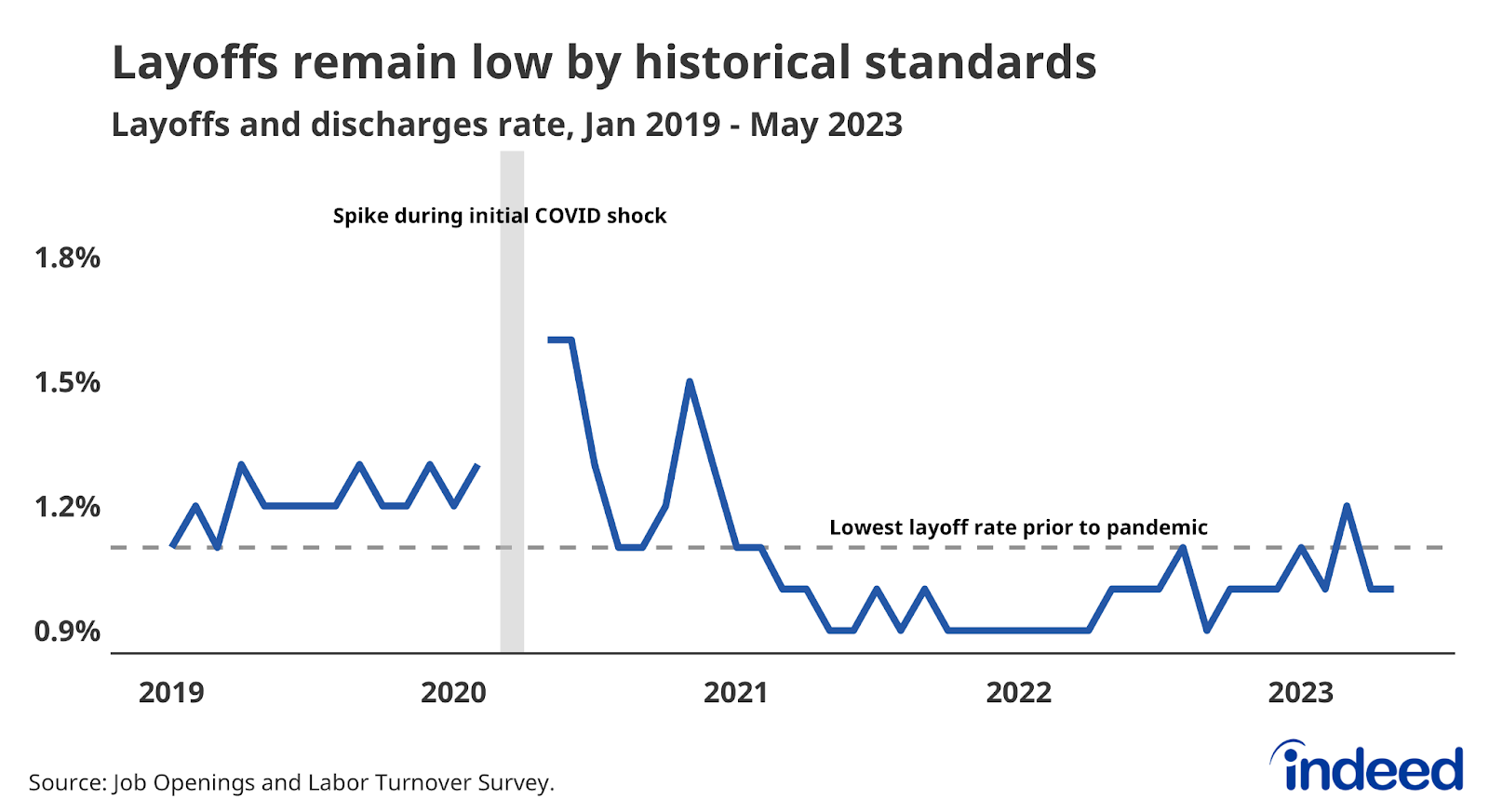

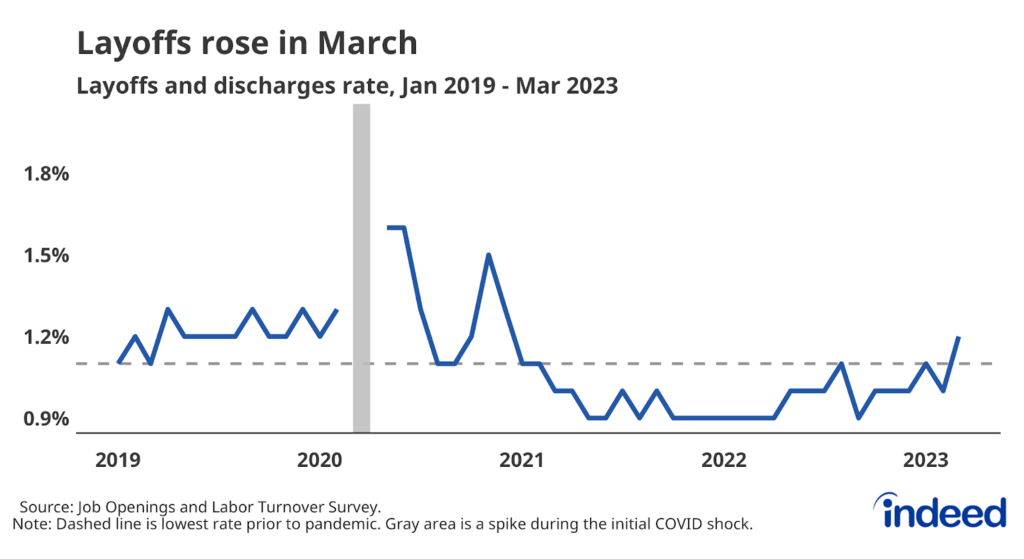

- Despite job openings declining by 14% over the past year, employers haven’t started shedding workers at an elevated rate, as the layoff rate registered at 1% in May.

- The labor market won’t always stay this strong, but job seekers, employers, and policymakers should take comfort from this recent run of data.

If you look past some of the volatile topline data you’ll see today’s JOLTS report continues to reflect a gradually slowing yet still-robust labor market; one that is cooler than a year ago but still hot. Over the past year, job openings are down 14% and the quits rate is down 13% from its pandemic-era peak. Yet demand for workers is still substantial, with job openings up 40% from their February 2020 levels, and workers continue to quit their jobs at rates higher than in 2019. This moderation continues to be quite gradual, a good sign for job seekers but a concern for the Federal Reserve.

Rumors of the Great Resignation’s demise were greatly exaggerated, at least for now. The quits rate rose in May, bucking the recent downward trend. Even if the jump in this report partially reflects noisy data, the moderation in quitting has been quite gradual. Workers are still able to find new jobs at an elevated rate. Another key metric declined in May, as the ratio of job openings to unemployed workers dropped to 1.6, hitting its lowest level since October 2021. And despite constant concerns and predictions of a recession, the layoff rate again came in below pre-pandemic levels.

The labor market isn’t always going to be this strong. Recessions happen. But for now, demand for new hires remains elevated, and employers are still holding onto the workers they have. Any number of potential stumbling blocks could derail this economic expansion, but today’s data—and data from the past several months—continue to make a soft landing scenario increasingly likely. This should be enough to give job seekers, employers, and policymakers some comfort as the summer wears on.