Key Points:

- Job growth slowed to 209,000 jobs in June and the three-month average of gains declined to 244,000, a strong pace by any objective standard.

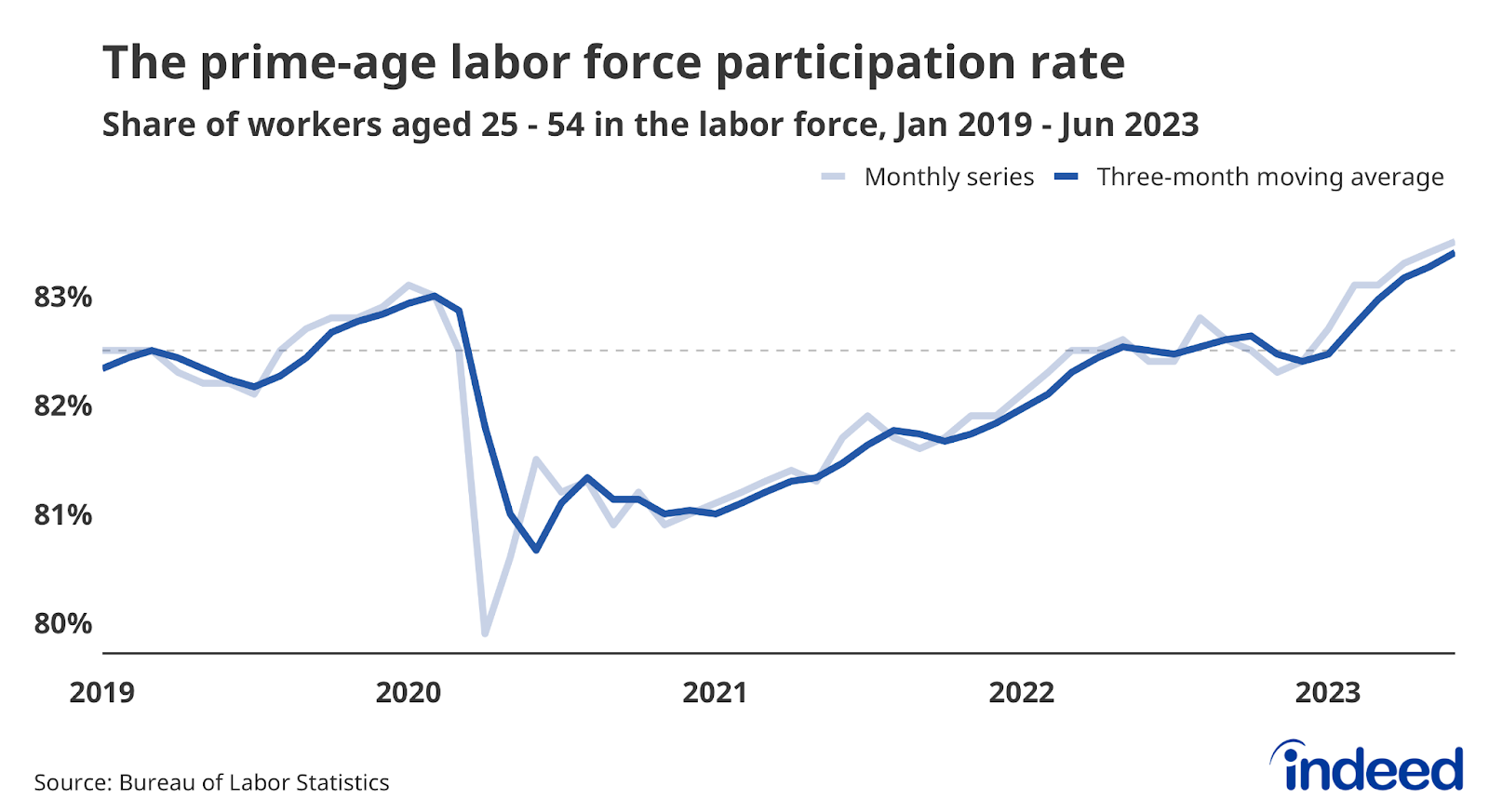

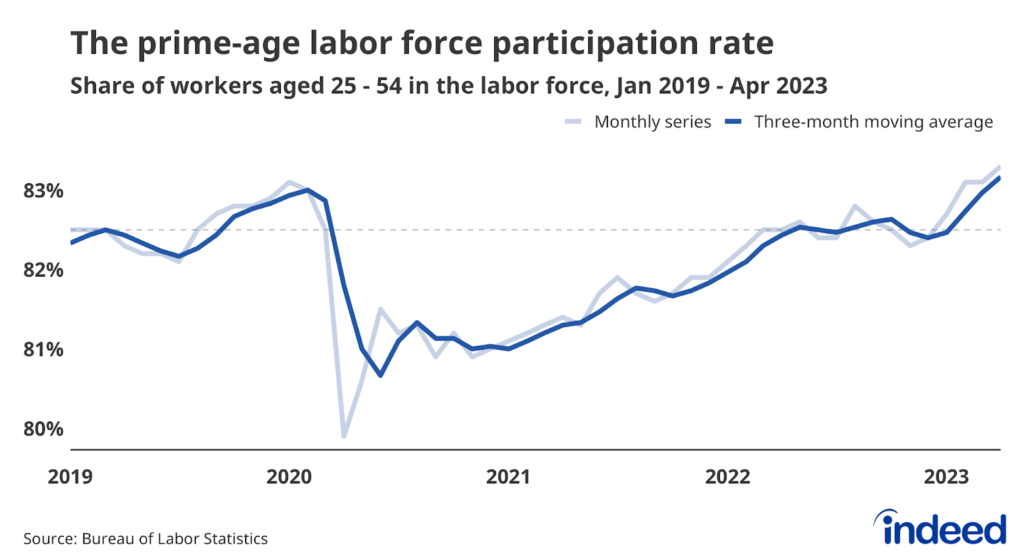

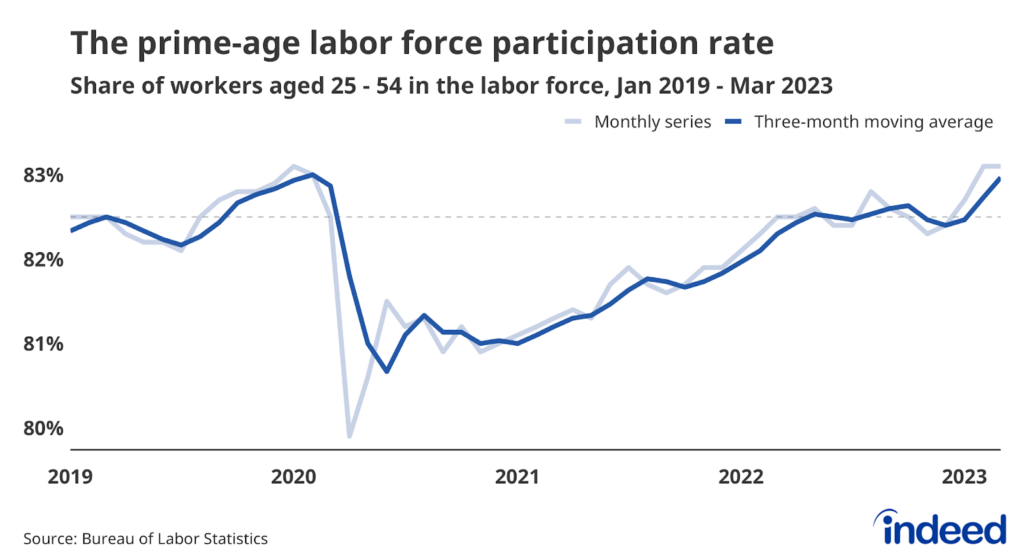

- Workers continue to enter the labor force with the labor force participation rate for workers ages 25 to 54 hitting rates not seen since April 2001.

- The source of jobs growth contained some surprises with construction adding 23,000 jobs—while hotels, bars, and restaurants added notably fewer jobs in June.

The US labor market has not been weighed down by the pessimism regarding economic growth. Payroll gains have moderated, but hiring continues to be strong by any objective standard. People in their prime working years are rejoining the labor force after concerns last year that workers would never return. The US labor market wrapped up the first half of 2023 in a position of strength, and it will take something dramatic happening to derail it anytime soon.

Don’t dismiss job growth of 209,000 per month. Yes, this pace is notably slower than what we’ve seen in recent years. However, given the slowing growth of the US population, we’d need job gains of somewhere between 60,000 and 80,000 per month to keep up with labor force growth. So gains in excess of 200,000 are more than double the pace needed to keep the labor market tight.

The results of this continued strong hiring can be seen in the growth of the prime-age labor force. The share of workers ages 25 to 54 in the labor force rose again to 83.5%, the highest rate since May 2002. Women saw another strong rise over the month, continuing their more rapid post-pandemic bounceback. The participation rate for prime-age women is not only above its 2019 level, but it also set an all-time high for the third straight month.

The sources of the job gains have some surprises in both positive and negative directions. Construction continues to be notably resilient, adding 23,000 jobs in June, with almost half of those gains coming from residential specialty trade contractors. On the flip side, accommodation and food services job gains, a constant source of jobs in the post-pandemic recovery, dropped dramatically to under 5,000 a month, a steep decline from the roughly 60,000 a month on average it added in the year prior.

The labor market is slowing down, but it’s doing so from a position of strength. This report is just another proof point that the labor market is going through a welcome moderation. Demand for workers is high but slowing, and the supply of workers is growing. Nothing is guaranteed, but the US labor market continues to point toward a slower, but more sustainable pace of economic growth.