Editor’s Note: Indeed Hiring Lab previously released a proprietary metric called the Remote Job Tracker, measuring the aggregate share of job postings in a specific location that included keywords associated specifically with remote work. Today, as hybrid in-office/at-home work arrangements emerge as a primary modality of flexible work — which itself is a topic of growing interest to job seekers, employers and policymakers alike — we are updating and renaming the Remote Tracker to the Remote & Hybrid Job Tracker. This re-released series expands upon the definition of remote work previously used to construct the Remote Job Tracker, and now includes terms more generally associated with hybrid work arrangements.

For details about the data and methodology, please see our methodology post here.

Key Points:

- Job seeker interest in remote work remains near its all-time high after leveling off in early 2022.

- The overall share of postings advertising remote/hybrid work has fallen over the past year, though remote roles are growing in a majority of sectors analyzed.

- Engineering, Social Science, and Chemical Engineering are where the share of remote postings have grown the most.

- The general overall trend for remote work is being affected by a more significant decline in job postings overall in categories where remote work is typically more common.

Three years since the start of the COVID-19 pandemic, and remote work remains prevalent in the US labor market. Job seekers continue to search for remote/hybrid roles at near-record levels, even as the share of postings overall that advertise flexible work arrangements has fallen lately. But that broad decline is masking notable continued growth in a number of fields as the market continues to cool and adjust to broader economic factors that are weighing on growth elsewhere.

Job seeker interest in remote work remains high

Job seeker interest in remote work is not exhibiting any consistent signs of slowing, stabilizing near an all-time high between 9-10% since early 2022.

The share of remote postings falling over the past year

But while job seeker interest in remote jobs has seemingly leveled off, the overall share of job postings advertising remote/hybrid work options has fallen over the past year, from a peak of 10.3% on February 26, 2022, to 8.4% as of May 31, 2023. However, this may not be a clear indication that employers have changed their minds on remote work, as the types of jobs where hiring has slowed the most are likely a factor.

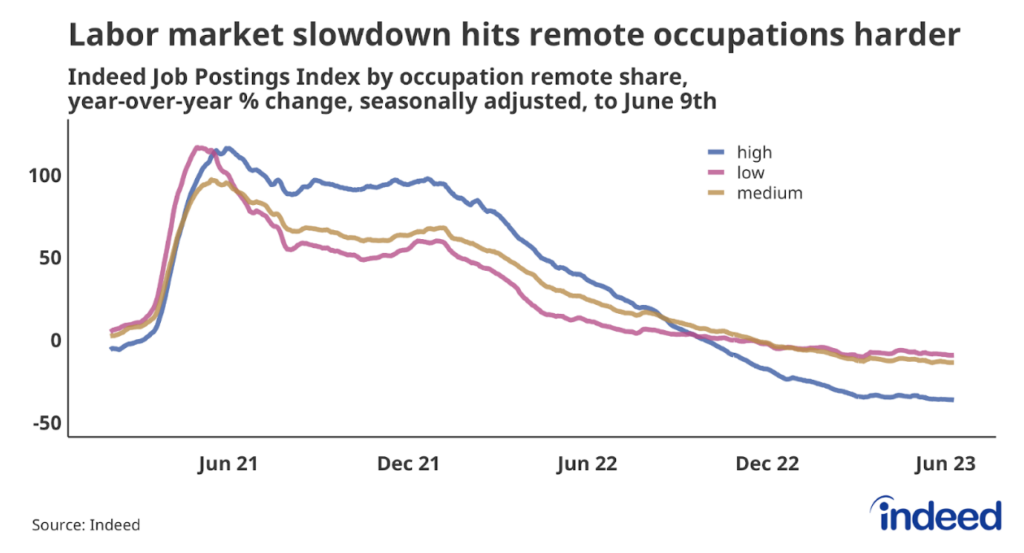

Over the past year, job postings have fallen the most among occupations that traditionally feature the most hybrid/remote opportunities, including Software Development, IT Operations & Helpdesk, and other corporate roles. In other words, the overall declining trend in remote/hybrid job postings is being affected by an outsized decline in job categories that typically promote remote opportunities.

Job categories with a low- or medium-sized share of remote postings were down 9.3% and 13.6% year-over-year, respectively, in early June. But job postings in categories with relatively high shares of remote/hybrid jobs have fallen far more drastically, down about 36% from a year ago.

Where is remote work on the rise? Where is it not?

And while the overall share of remote postings is falling, a deeper dive into the data by occupational category reveals more of a mixed bag. In general, remote work is rising in more job categories than it is falling. From May 2022 to May 2023, the share of remote postings rose in 33 of 55 job categories used in this analysis. These 33 categories represent a near-majority of the overall labor market, accounting for 49% of job postings on Indeed in May 2023.

Almost a quarter (22.1%) of jobs in Civil Engineering roles were remote/hybrid in May, up from 16.9% a year ago, the biggest annual jump in the share of remote jobs of any sector analyzed. Other job categories with fast-rising remote opportunities include Social Science, Chemical Engineering, and Banking & Finance.

Meanwhile, there are areas of the labor market where remote work opportunities are clearly dwindling. The occupational categories with the largest annual declines include many general corporate-related roles, such as Human Resources, Marketing, and Media & Communications. Employers may be feeling less pressure to offer remote work in some of these categories as related job postings have fallen substantially over the past year for many of these corporate-related roles.

Where is remote work most common?

The three occupations with the highest share of postings advertising remote work are all tech-related sectors, and nearly all of the most-remote occupations are only becoming more remote. Every category, with the exception of Marketing, has registered an increase in its remote share over the past year.

But among what may traditionally be considered corporate or white-collar job categories, remote work trends are decidedly mixed.

Some of the roles that may first come to mind when picturing a white-collar job, including Human Resources, Marketing, and Media & Communications, have notched the largest declines in remote work across the entire labor market. Meanwhile, some corporate roles that may require a bit less in-person collaboration, including Accounting and Insurance, have seen increases in their share of job postings that mention remote work.

While there continues to be no shortage of anecdotal stories both of employers thriving with remote workers and those that are attempting to draw them back into the office, for now, it seems remote opportunities remain abundant for those interested and are growing in some occupations.

Methodology

A deep review of the methodology behind Indeed’s Hybrid/Remote Tracker can be found here.

We identify job postings as open to remote work if the job title or description includes terms like “remote work,” “telecommute,” “work from home,” “hybrid,” or similar language, or if the location is explicitly listed as remote. These postings include both permanent and temporarily remote jobs, though employers often don’t specify.

We calculate the remote share of postings on a daily basis. When reporting data on specific months we present the monthly mean of the daily series.

The Indeed Job Postings Index is built from a 7-day moving average of job postings, with the index set to 100 on February 1, 2020. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. We adopted this methodology in January 2021. Data for several dates in 2021 and 2022 are missing and were interpolated. Non-seasonally adjusted data are calculated in a similar manner except that the data are not adjusted to historical patterns.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.