Key points:

- Some 2.3% of job postings on Indeed indicate hiring is urgent, up from 1.6% on January 1, 2021.

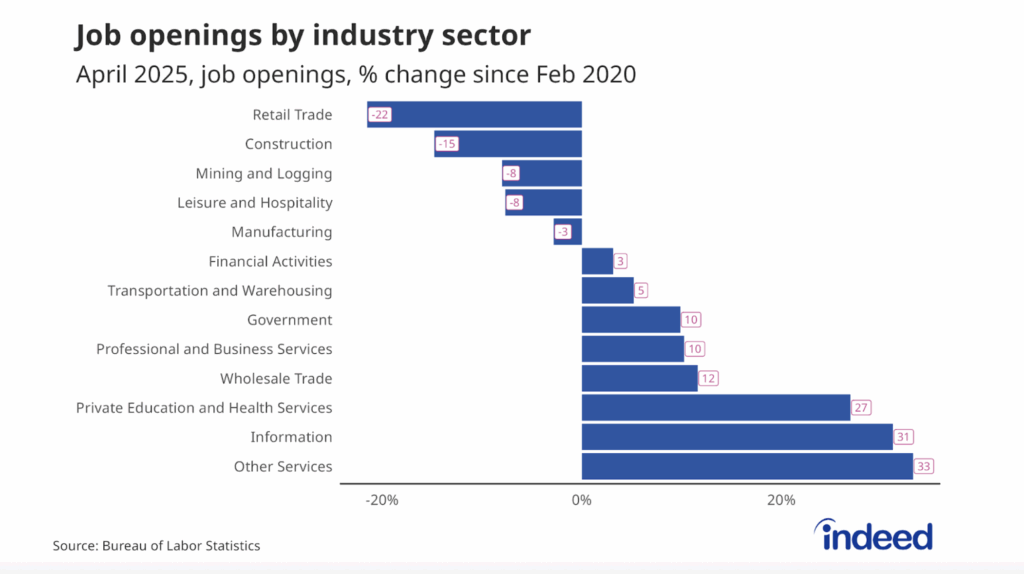

- Jobs that need to be filled quickly are likely to be in sectors where posting trends show demand for labor is above pre-pandemic baselines.

- Sectors that are hiring urgently are likely to have employees work on site.

As the pandemic recedes in the US, many businesses are said to be having trouble hiring. The anecdotes have been hard to quantify and data is scarce. However, on the heels of a disappointing jobs report, in which job growth fell far short of expectations, questions swirl about labor supply. Extended unemployment benefits, the difficulty of finding childcare, and questions about the safety of in-person work may be holding back labor force growth, some observers believe.

But what about labor demand? To understand the employer side of the equation, we looked at Indeed job postings that use terms like “hiring urgently,” “urgent hiring,” or “immediate start’’ in the job description. Such terms don’t always mean an employer is having trouble hiring, but they could be signs of tightening demand for workers. What’s more, the share of Indeed job postings noting that hiring is urgent has picked up in recent weeks. These urgent-hire jobs are more likely to be in sectors where postings are above their level before the pandemic and are less likely to involve remote work.

Urgent hiring is accelerating

In the seven days leading to May 14, 2.3% of Indeed job postings indicated that hiring was urgent, up 0.7 percentage point from January 1. That reversed a slight decline in the share of job ads noting hiring was urgent from July 1, 2020 to January 1, 2021.

This rise in postings for jobs employers want to fill quickly points to a growing demand for workers. But why now? The threat of COVID-19 has turned a corner thanks to widespread vaccination. And that may be unleashing pent-up demand for in-person activities like dinners out and weekends away. If there’s a burst of consumer demand for services, employers need to have enough workers.

Hiring urgency tracking overall recovery

Since the start of the pandemic, Hiring Lab has tracked what has been happening with job postings on Indeed. Some sectors, like loading & stocking, are far above their pre-pandemic levels, meaning they are seeing elevated hiring demand compared with the pre-COVID period.

The more a sector’s job postings are growing relative to where they were before COVID-19, the more likely that it has a higher share of postings noting that hiring is urgent. It isn’t the case in every sector, but the relationship is positive and statistically significant.

On May 14, 8.8% of all personal care and home health job postings used urgent hiring terms, a 2.2 percentage point increase from the 6.6% on February 1. The trend reflects an economy that has recovered slightly, but is still in a pandemic. More than 4% of job postings in the childcare, nursing, and cleaning & sanitation sectors indicated hiring was urgent. The shares of urgent hiring postings were also above 4% in driving and construction, thanks to widespread online shopping and a housing boom.

What about sectors, like food preparation & service, where labor shortage anecdotes abound? It turns out that less than 2% of postings in food preparation & service and hospitality & tourism used urgent hiring terms. That doesn’t mean the anecdotes about trouble hiring are wrong in these areas, but it suggests other sectors may be having even harder times finding workers.

Urgent hiring job postings are usually for on-site work

In terms of employer demand, the relationship between job postings that use remote work terms and those that use urgent hiring terms is negative and statistically significant. In other words, postings for jobs more likely to be remote are less likely to note hiring is urgent. This signals employers looking to fill in-person roles are feeling pressure to add workers. It also may indicate that coronavirus risk still matters to some job seekers. That seems to contradict the fact that consumer spending on services is improving, a sign health concerns are receding. It may simply be though that an evening with friends and family is a very different choice than working in close quarters for an extended period. The pandemic may be less threatening, but it is not over.

Conclusion

Stories about labor market shortages have kicked off a debate about the supply and demand for labor. Job postings on Indeed using urgent hiring terms have risen, indicating that labor demand is tightening. This is especially the case in sectors where job ads are up from before the pandemic. Moreover, sectors with higher shares of job postings specifying urgent demand for workers are more likely to involve on-site work.

Of course, posting trends speak only to the labor demand piece of the puzzle. The pandemic and policy responses to it have profoundly affected labor supply. Difficulty securing childcare and the availability of extended unemployment benefits appear to be affecting the readiness of some potential workers to take jobs and the ability of employers to fill vacancies.

It’s difficult to determine how much these factors are constraining labor supply. But the fact that urgent hiring jobs are less likely to be remote shows COVID-19 can’t be dismissed yet. Large swaths of the populations are still not fully vaccinated. Labor market frictions are complex in the best of times. As we emerge from the pandemic, these dynamics are all the more difficult to parse out.

Methodology

We define urgent hiring job postings as those in which terms like “hiring urgently,” “urgent hire,” “immediate start,” “urgent vacancy,” or “start today,” appear in the job description. These postings do not refer to the ‘hiring urgently’ tag visible to job seekers on Indeed. We identify job postings as open to remote work if the job title or description include terms like “remote work,” “telecommute,” “work from home,” or similar terms, or if the location is explicitly listed as remote. These postings include both permanently and temporarily remote jobs, though employers often don’t specify.

Panel regressions were run with fixed effects and robust estimators of variance. Statistical significance was determined at the 0.05 level. R-squared value for the joint regression was 0.18. Regression was run for daily data from January 1, 2021 to April 30, 2021.

The second figure in this blogpost refers to the percentage change in seasonally adjusted job postings since February 1, 2020 using a seven-day trailing average. February 1, 2020 is our pre-pandemic baseline. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. Each series, including the national trend, occupational sectors, and sub-national geographies, is seasonally adjusted separately. We adopted this new methodology in January 2021. Historical numbers have been revised and may differ from originally reported values.

This blogpost is based on publicly available information on the Indeed US website and any other countries named in the post. Unless specified otherwise, it is limited to the United States, is not a projection of future events, and includes both paid and unpaid job solicitations. US Armed Forces job postings are excluded.