Key points

- Since mid-2016, job seeker interest in healthcare positions has fallen relative to the average job, a trend that is sharper in metros with higher percentages of people 65 or older.

- At the same time, employers are eager for healthcare workers, with six of the top 10 job titles searched by employers in 2019 healthcare-related.

- What this means for employers: Employers probably have to step up their efforts — and raise wages — to attract the healthcare talent they need.

- What this means for job seekers: With falling job seeker interest and employers aggressively seeking to fill healthcare positions, now is a good time for healthcare workers to ask for raises.

As the US senior population rises and the last of the Baby Boomers start to transition into retirement, employment in the healthcare sector is flourishing. Projected to increase its share of total employment in coming years, healthcare shows no sign of slowing, especially given that Boomers are living longer than previous generations. Yet, as stories of nursing shortages swirl, there’s a growing concern about whether the nation has enough healthcare workers to care for its aging population.

Unemployment in the healthcare and social assistance sector sat at 2.0% in January 2020, the lowest ever recorded. This underscores that the pool of unemployed healthcare workers for employers to recruit from is slim. Such a low jobless rate indicates that whatever unemployment there is in the sector is probably frictional, meaning it simply reflects time between jobs for those making a switch. And without large numbers of jobless healthcare people to draw on, employers must hire from an already-employed pool of workers. This tightening of the healthcare labor market suggests there may be a dearth of healthcare workers to help Baby Boomers live out their golden years.

Healthcare labor market tightens further

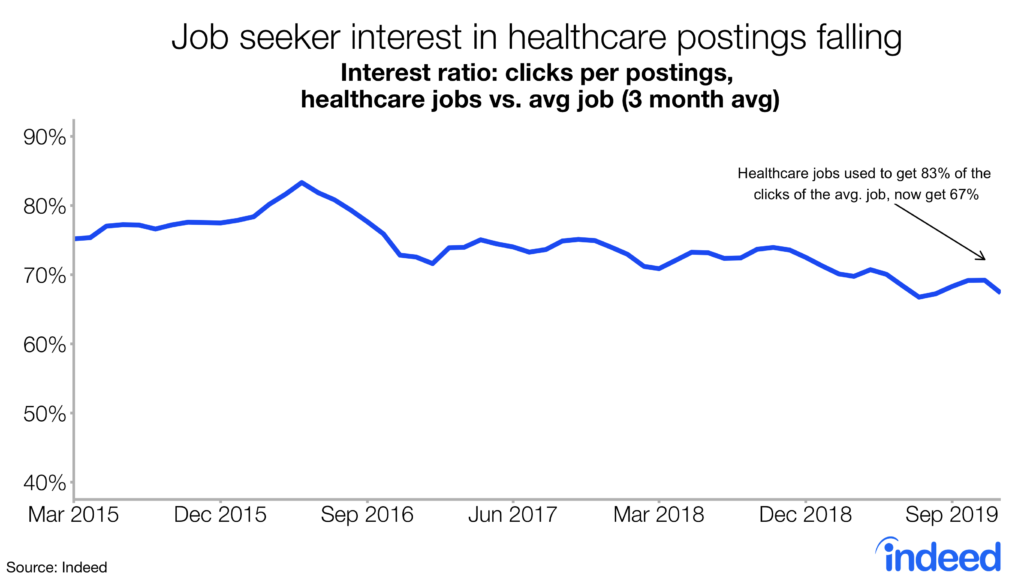

To examine how job seeker interest in healthcare has changed over time, we measured the tightness of the healthcare labor market by looking at the number of clicks Indeed job postings received. Fewer clicks on a posting indicate fewer workers are available to fill that position. We then compared those healthcare job posting clicks to the national average of clicks per posting, yielding a measure of healthcare labor market tightness.

Over time, healthcare jobs are getting fewer clicks per posting relative to the average job on Indeed. From mid-2016 to the end of 2019, job seeker interest in healthcare jobs relative to all jobs fell nearly 20%. And, with low unemployment rates in both the overall economy and the healthcare sector, it seems the healthcare job market will continue to tighten in coming months.

What is driving the decline in job seeker interest? One factor is that the mismatch between healthcare workers and healthcare jobs is greater than the mismatch in the overall economy. Some of this is due to healthcare’s high licensing requirements.

Healthcare tightness is affected by a metro’s aging population

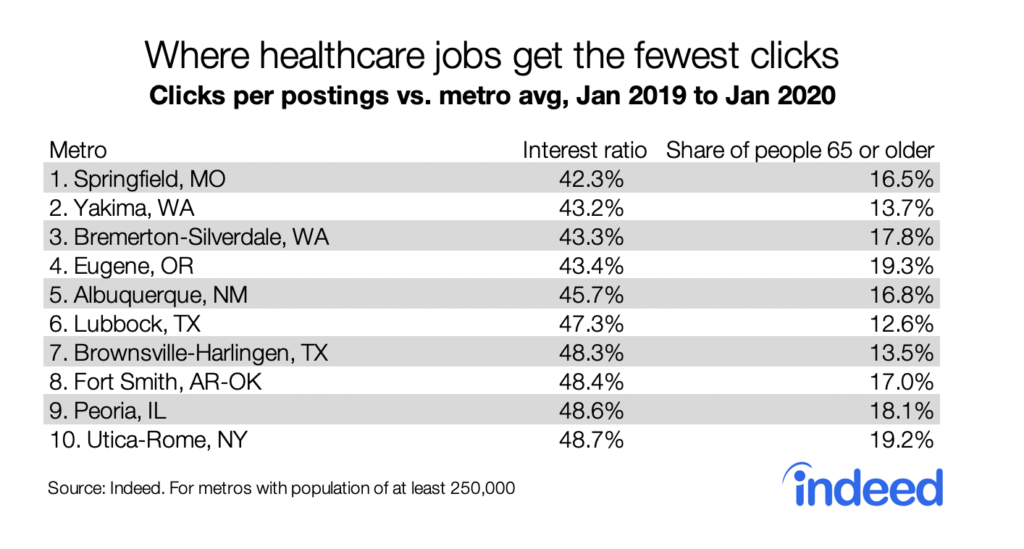

We looked at which metros are experiencing the biggest healthcare labor market squeezes and also examined how a metro’s share of those 65 and older is related to job seeker interest in healthcare positions.

Springfield, MO tops the list of metros with the tightest healthcare job markets. In 2019, Springfield’s healthcare job postings received only 42.3% of the clicks of the average posting in that metro.

When controlling for a metro area’s total population and average clicks per posting, as the share of people 65 or older increases, clicks per posting on healthcare jobs fall. Of the 10 tightest metros, seven have a higher share of people 65 or older than the national average.

This isn’t because fewer people are participating in the labor force in these metros, but is due instead to healthcare employers’ greater need for staff to care for aging populations.

At the same time, the number of workers interested in healthcare job postings doesn’t quickly rise to match employer demand, leading to fewer clicks per posting. What this means is that as a metro’s population ages, the supply of healthcare job seekers relative to demand is likely to tighten further. This could spell bad news for Baby Boomers and Gen Z-ers alike, who could experience longer wait times and overworked staff because of insufficient staffing.

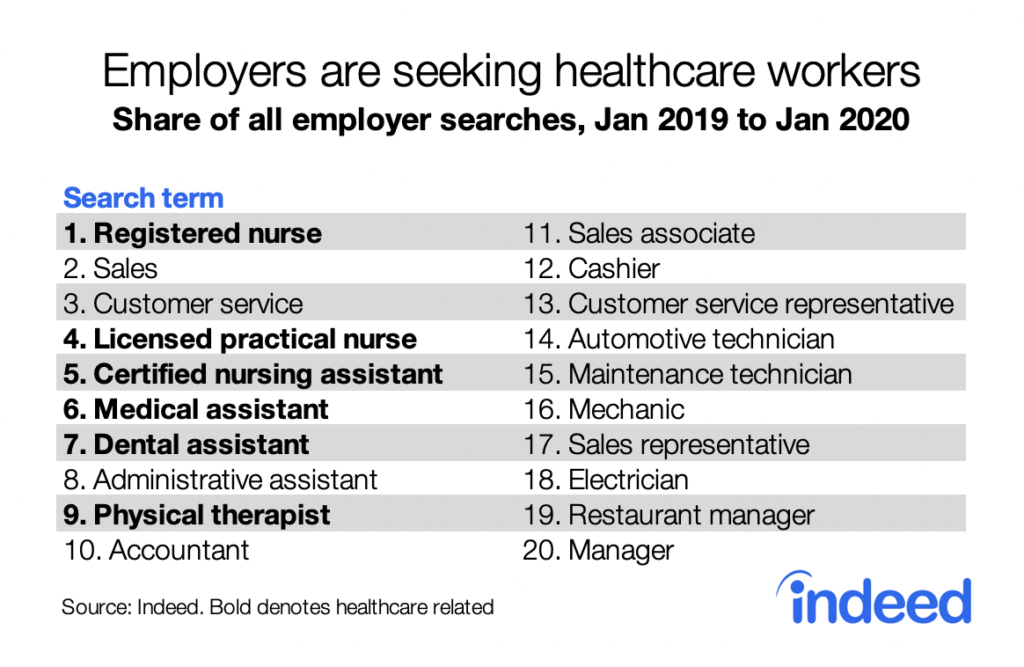

Top employer searchers are concentrated in healthcare

How are employers responding to the tightening healthcare labor market? The answer is they are becoming more aggressive in seeking out healthcare talent. Of the top job titles searched by employers in 2019 on resumes uploaded to Indeed, six were healthcare-related. Registered nurse led the pack, while licensed practical nurse and certified nursing assistant were also among the top five.

The most heavily searched job titles, including healthcare and non-health-related occupations, are tough to fill. For the top 20 search terms, the share of employer searches outpaced the share of job seekers with a similar job title on their resumes. For example, the share of employer searches for the term “physical therapist”’ was over four times the share of job seekers who had that occupation as their most recent job title.

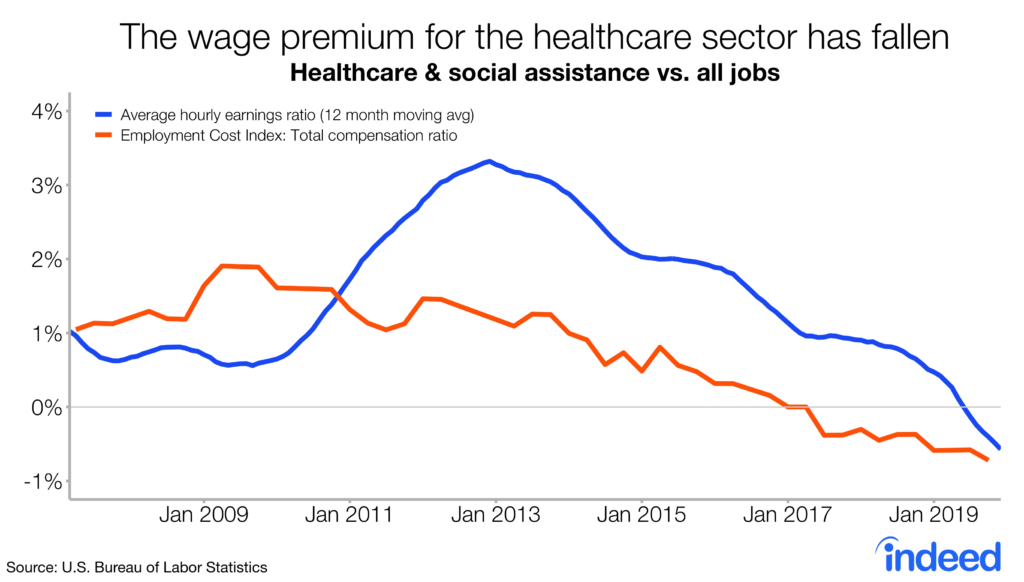

Raising wages could help

Since mid-2019, average hourly earnings for healthcare and social assistance workers has dipped below that of the typical American job. The Labor Department’s Employment Cost Index, which measures total compensation and controls for changes in a sector’s occupational mix, has shown a similar trend since early 2017. It’s not clear what is driving this relative pay decline, but in part it may reflect falling union membership.

While healthcare’s average weekly hours are still below those of the average job, they have been slowly ticking up. In other words, the decline in healthcare earnings relative to the average job isn’t driven by falling hours. With interest in healthcare jobs gradually dwindling at the same time employers are actively searching for healthcare workers, higher pay may be in order. Raising wages could help keep current healthcare workers and draw new talent to the sector.

Conclusion

As America prepares to care for the swelling ranks of seniors, a few challenges lie ahead. Over the past few years, the healthcare job market has tightened, with healthcare positions getting smaller fractions of clicks than the average job. Metros with aging populations particularly struggle since rising shares of people 65 and older are associated with declining relative interest in healthcare jobs. This means healthcare employers must step up their push to attract talent even though they are already searching more actively than their counterparts in other sectors. Raising healthcare wages may be one way to ease the strain and attract talent.

Methodology

Healthcare jobs were identified by a curated list of 590 healthcare-related job titles.

Shares of people 65 and older by metro area were calculated using 2018 population estimates. The relationship between the share of those 65 and older and clicks per posting on healthcare jobs was determined through a linear regression with robust standard errors and weighted by a metro’s total population while controlling for each metro’s clicks-per-posting ratio. The share of people 65 and older was statistically significant in the regression. To be included in the regression, the metro area had to have had at least 1,000 jobs postings in 2019 and at least 250 healthcare job postings.

Employers top search terms were from searches from Jan 1, 2019 to Jan 1, 2020 on resumes uploaded to Indeed. The top search terms were matched as closely as possible to the most recent job title on job seeker resumes.