The Indeed Hiring Lab tracks business-to-business (B2B) employment trends, analyzing the latest Indeed and Bureau of Labor Statistics data. We look at overall labor market trends and dive deeper into job posting trends in various B2B occupational categories. Finally, we focus on recent developments in layoffs and worker turnover.

Takeaways

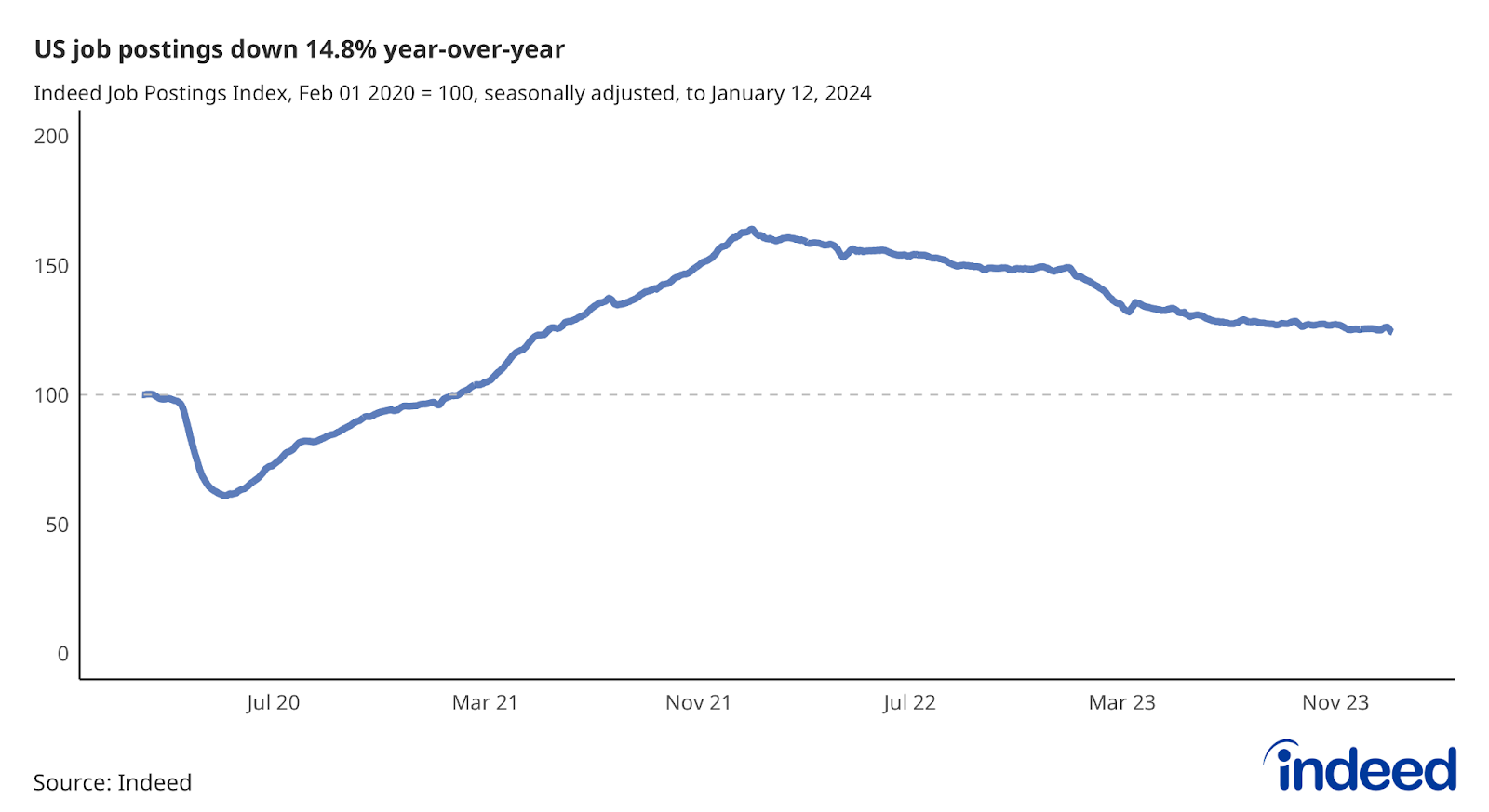

- Employer demand for workers overall continues to decline, with job postings down 14.8% from mid-January, 2023.

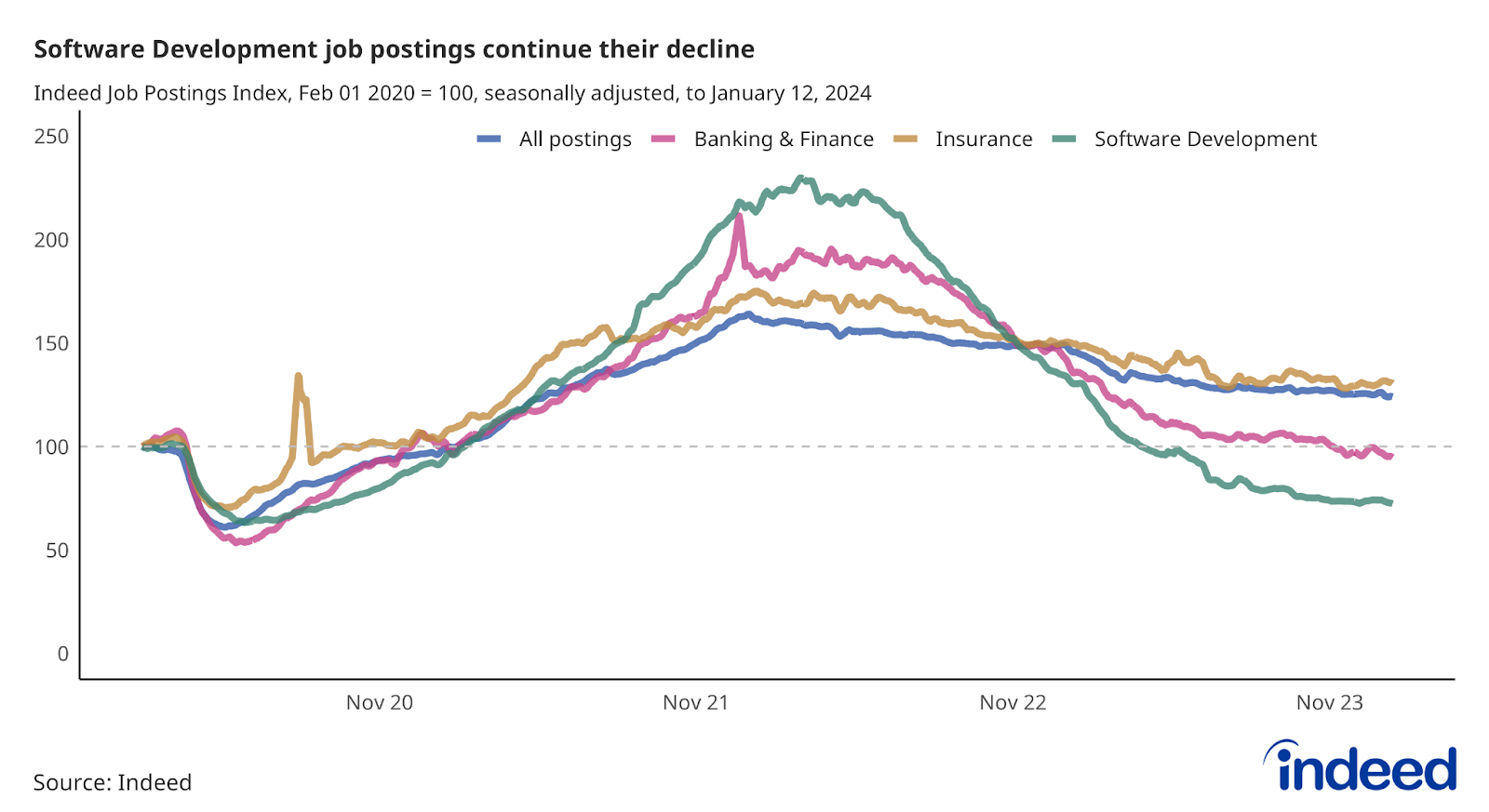

- Job postings in all B2B-related segments have declined, with Software Development postings down 44.5% year-over-year.

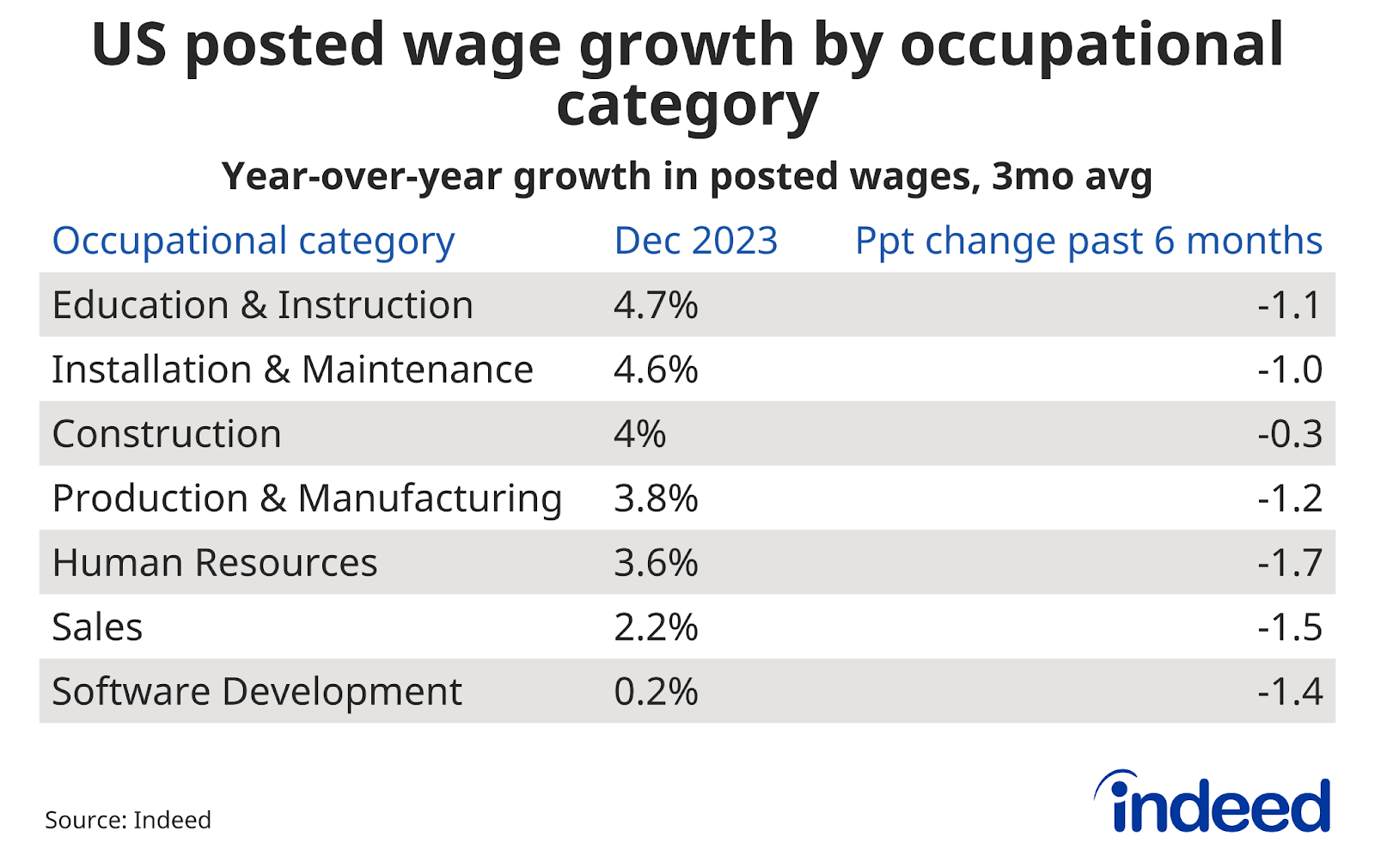

- Wage growth across all B2B categories has slowed over the past six months, with Software Development wage growth nearing 0%.

Indeed job postings

While employer demand for workers overall is still elevated compared to pre-pandemic norms, the market has cooled definitively over the past year. The Indeed Job Postings Index (JPI) stood at 124 on Jan. 12, meaning total postings were still 24% above their level from Feb. 1, 2020. Postings were down 14.8% year-over-year, though the pace of the annual decline slowed notably in the second half of 2023. The JPI fell by 20 index points in the first six months of the year (from 148 to 128), but by only 4 index points in the second half of the year.

Business-to-business postings

Software Development job postings were down 44.5% year-over-year as of January 12, as postings fell throughout the year (though at a somewhat slower pace than in much of 2022). Recent declines in Banking & Finance job postings have pushed them 30.4% lower than their level from a year ago, and below their pre-pandemic baselines by TK%. Insurance job postings were down 12.8% for the year ending Jan. 12, though stayed largely flat throughout the second half of 2023.

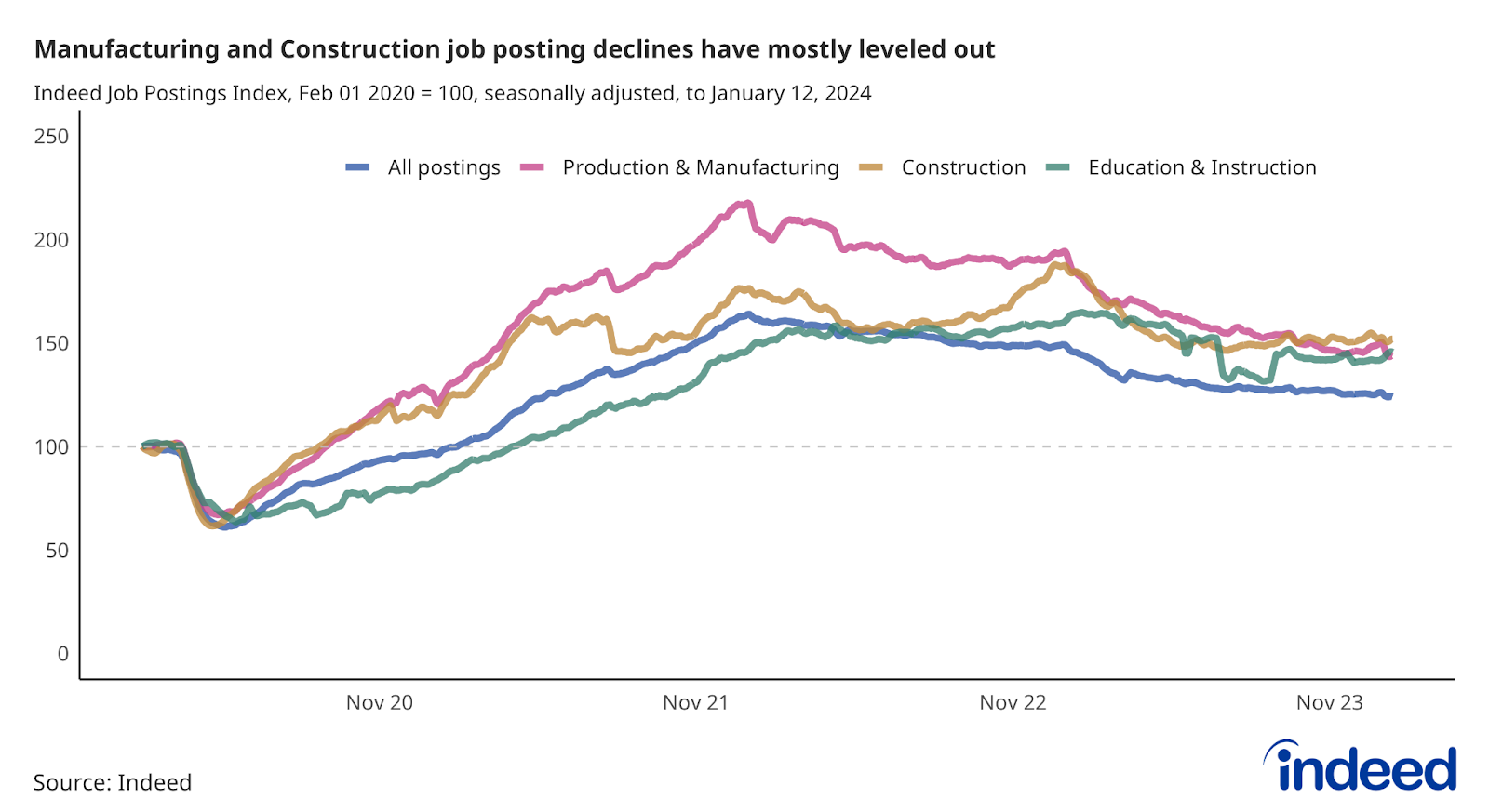

Production & Manufacturing job postings have been in a long, mostly steady decline from their post-pandemic high — down 21.9% over the past year. Demand for workers in Construction and Education & Instruction has also fallen, with postings down 17.7% and 11.4%, respectively, from Jan. 12, 2023.

Wage growth

The Indeed Wage Tracker points to easing wage growth across the B2B vertical. Annual advertised wage growth in Education & Instruction and Software Development jobs is at opposites, at 4.7% and 0.2%, respectively. Wage growth in all categories slowed in the second half of 2023.

For more labor market insights from the Indeed Hiring Lab, visit us at hiringlab.org.