The Indeed Hiring Lab tracks Transportation employment trends, analyzing the latest Indeed and Bureau of Labor Statistics data. We look at overall labor market trends and dive deeper into job-posting trends in various Transportation occupational categories. Finally, we dive into recent trends in worker churn.

Takeaways

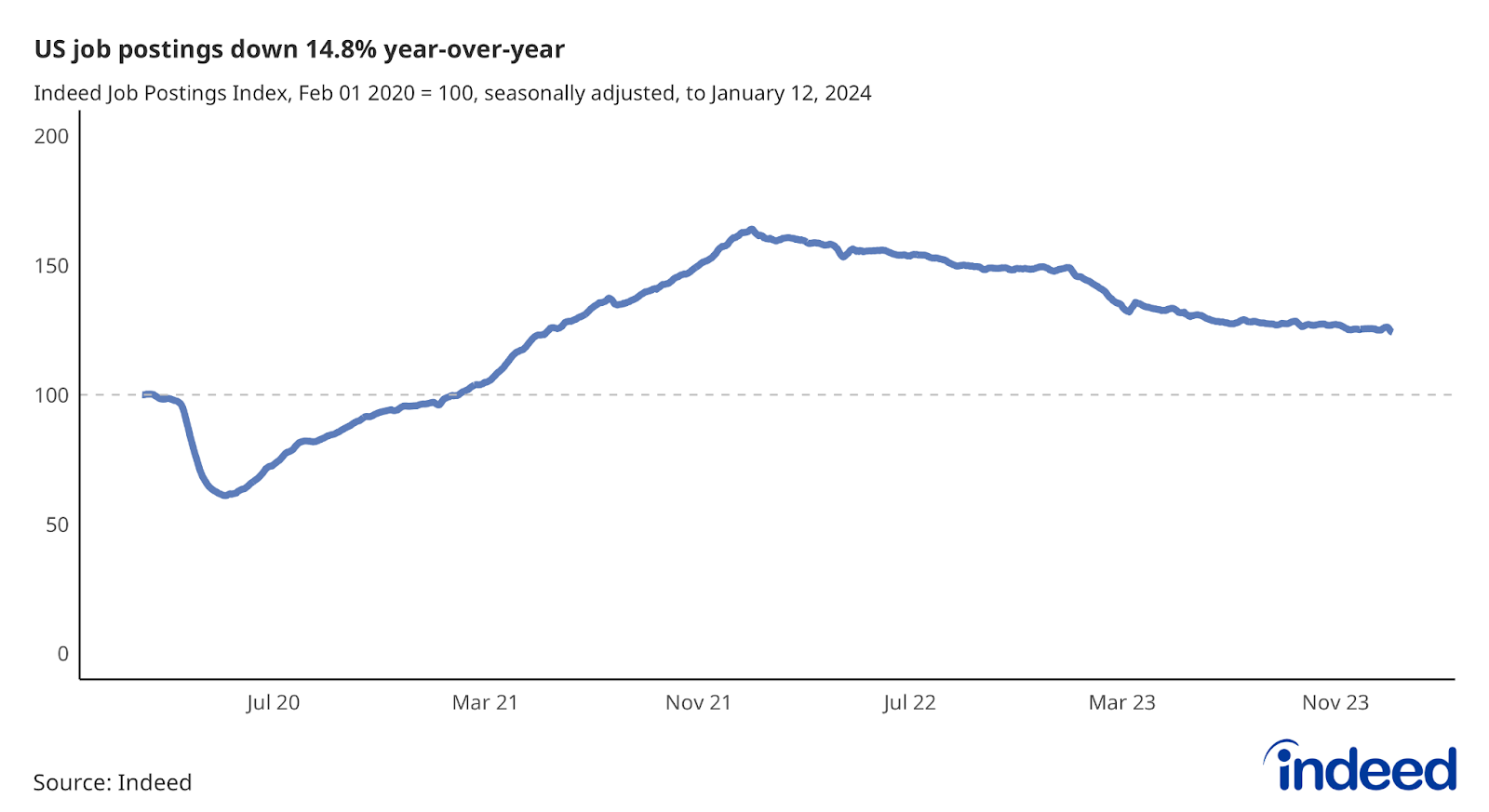

- Employer demand for workers continues to decline, with job postings down 14.8% from mid-January, 2023.

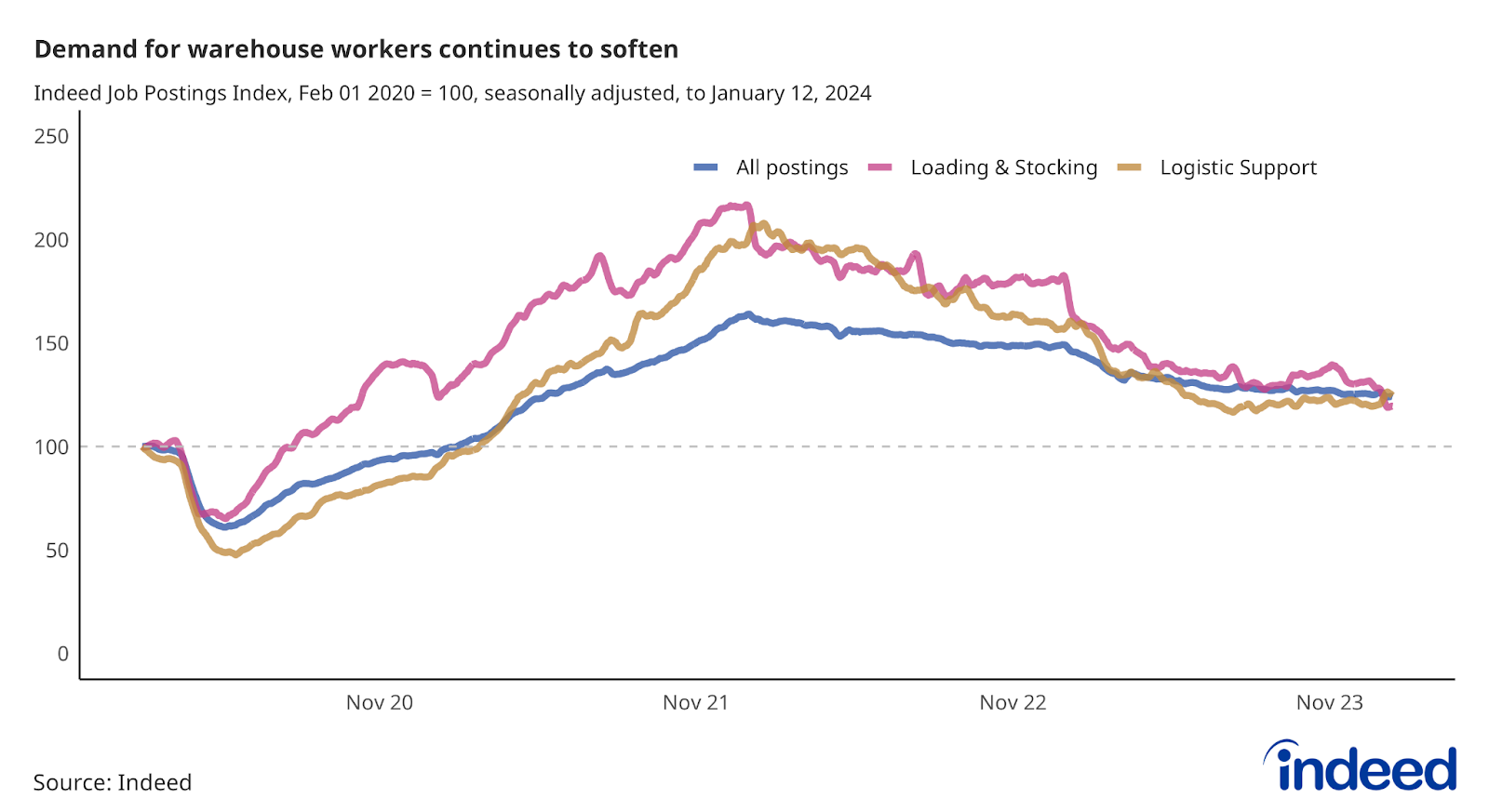

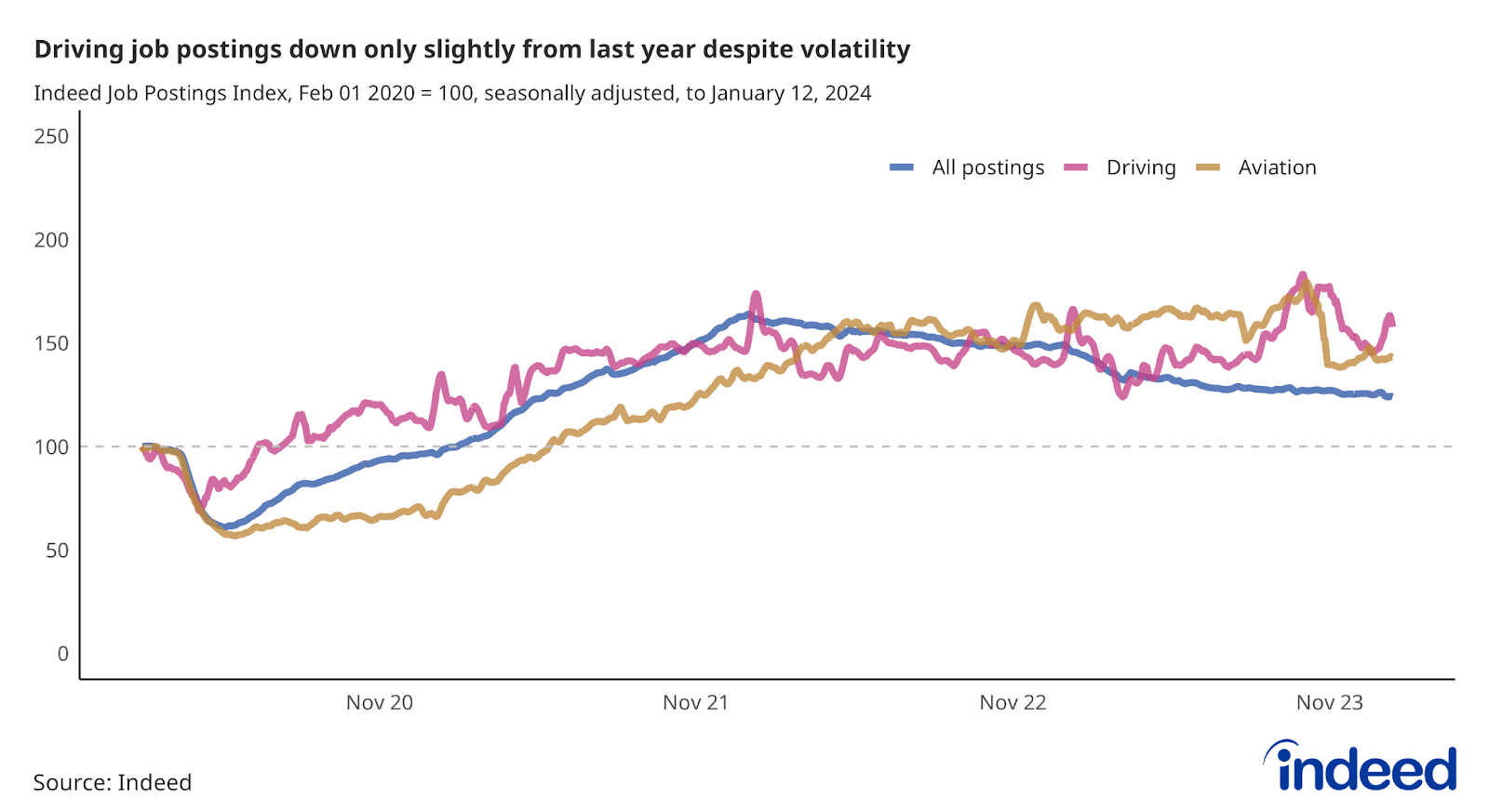

- Job postings in all segments of the Transportation vertical have declined over the past year.

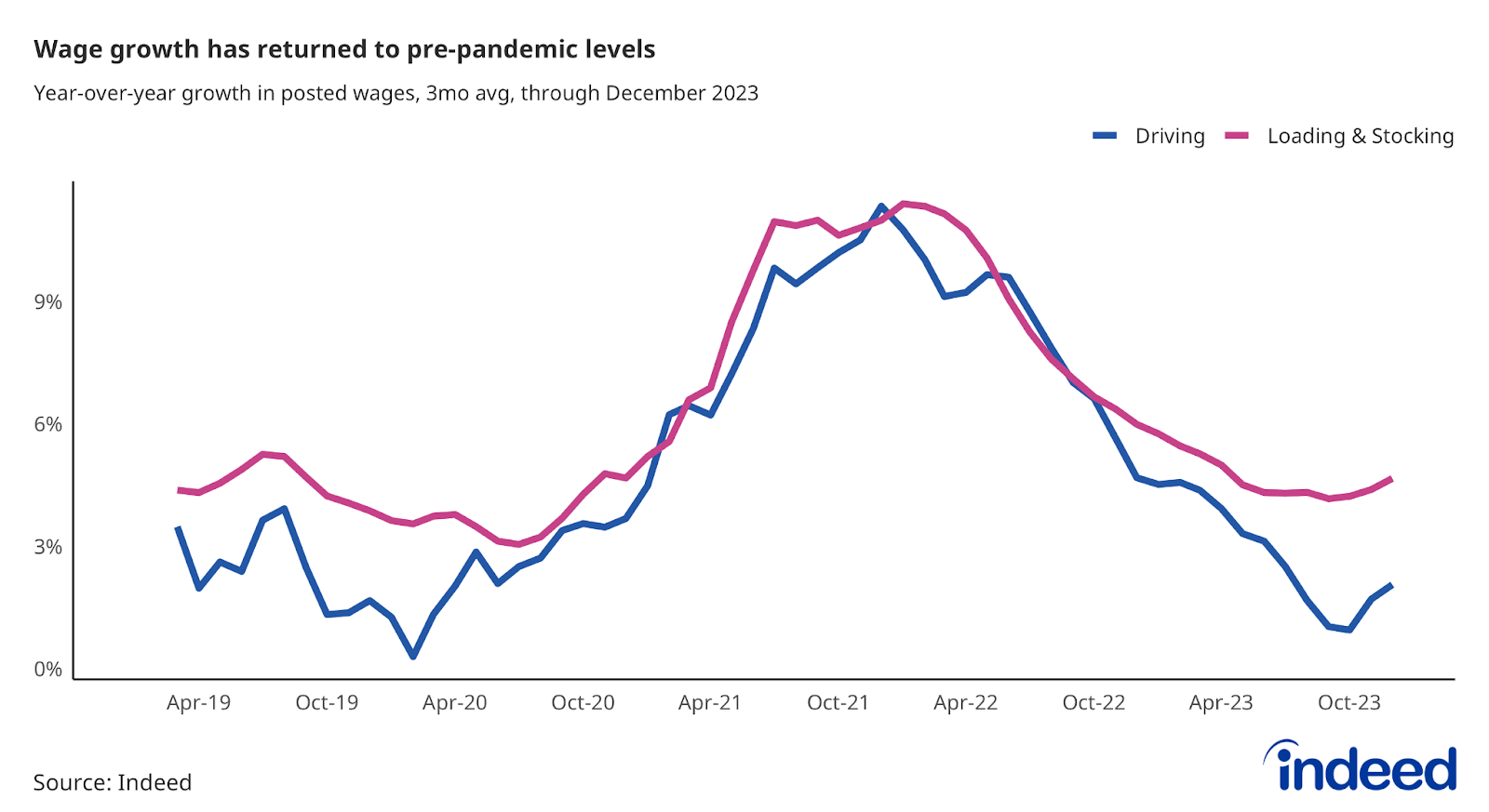

- Wage growth in Driving and Loading & Stocking postings is down to pre-pandemic levels.

Indeed job postings

While employer demand for workers overall is still elevated compared to pre-pandemic norms, the market has cooled definitively over the past year. The Indeed Job Postings Index (JPI) stood at 124 on Jan. 12, meaning total postings were still 24% above their level from Feb. 1, 2020. Postings were down 14.8% year-over-year, though the pace of the annual decline slowed notably in the second half of 2023. The JPI fell by 20 index points in the first six months of the year (from 148 to 128), but by only 4 points in the second half of the year.

Transportation job postings

While job postings in all segments of the Transportation vertical have fallen over the past year, some have held up better than others. Loading & Stocking postings, a category comprising mostly warehousing roles, declined in the fourth quarter of 2023 and were down 26.2% year-over-year as of Jan. 12. Meanwhile, Logistic Support postings remained level through the fourth quarter, and were down 21.2% over the past year.

The job posting trends for other areas of Transportation have been a bit more volatile. Driving job postings picked up markedly at the end of 2023 and were down just 2.5% year-year as of Jan. 12. Over the same period, aviation job postings were down 9.9%.

Wage growth

The rate at which employers raise pay to stay competitive has fallen across the labor market over the past two years, and this is also evident in the Transportation segment. Despite recent minor upticks, year-over-year wage growth for Driving (up 2.1% as of December 2023) and Loading & Stocking roles (up 4.7% as of December 2023) is in line with pre-pandemic levels.

For more labor market insights from the Indeed Hiring Lab, follow along on our blog at hiringlab.org.