Key Points:

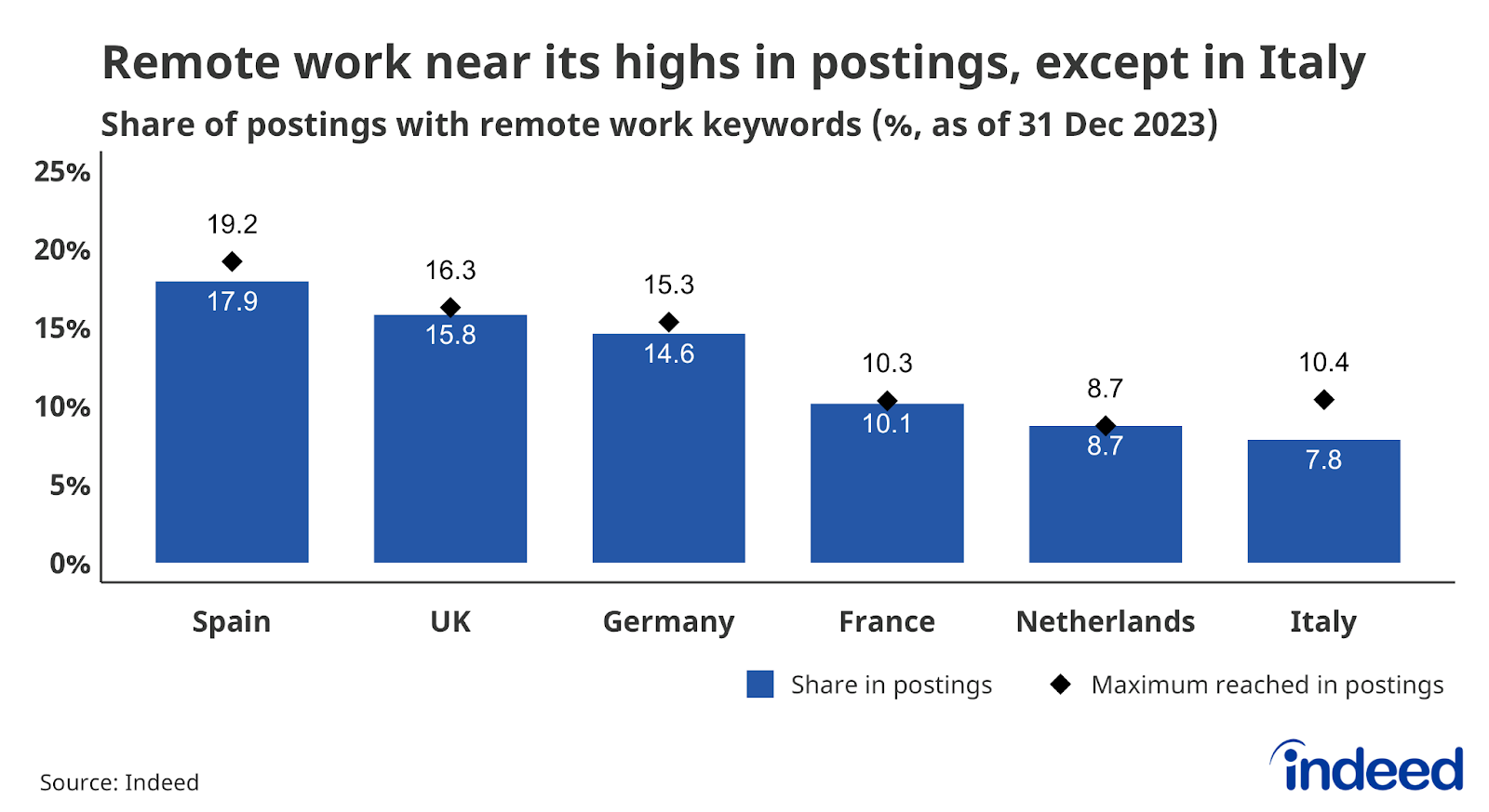

- Despite loud calls to return to the office, the share of jobs noting the potential for remote work remains at or near peak levels in Europe’s largest economies. Roughly 10% of job postings in France advertise remote/hybrid work opportunities, compared to 15-16% in both the UK and Germany.

- Among the six largest European economies, Spain has the highest share of remote/hybrid-eligible job postings, at 18%. The prevalence of remote work is lowest among job postings in Italy (8%), where the share of postings mentioning remote work continues to decline from its 2021 peak (10%).

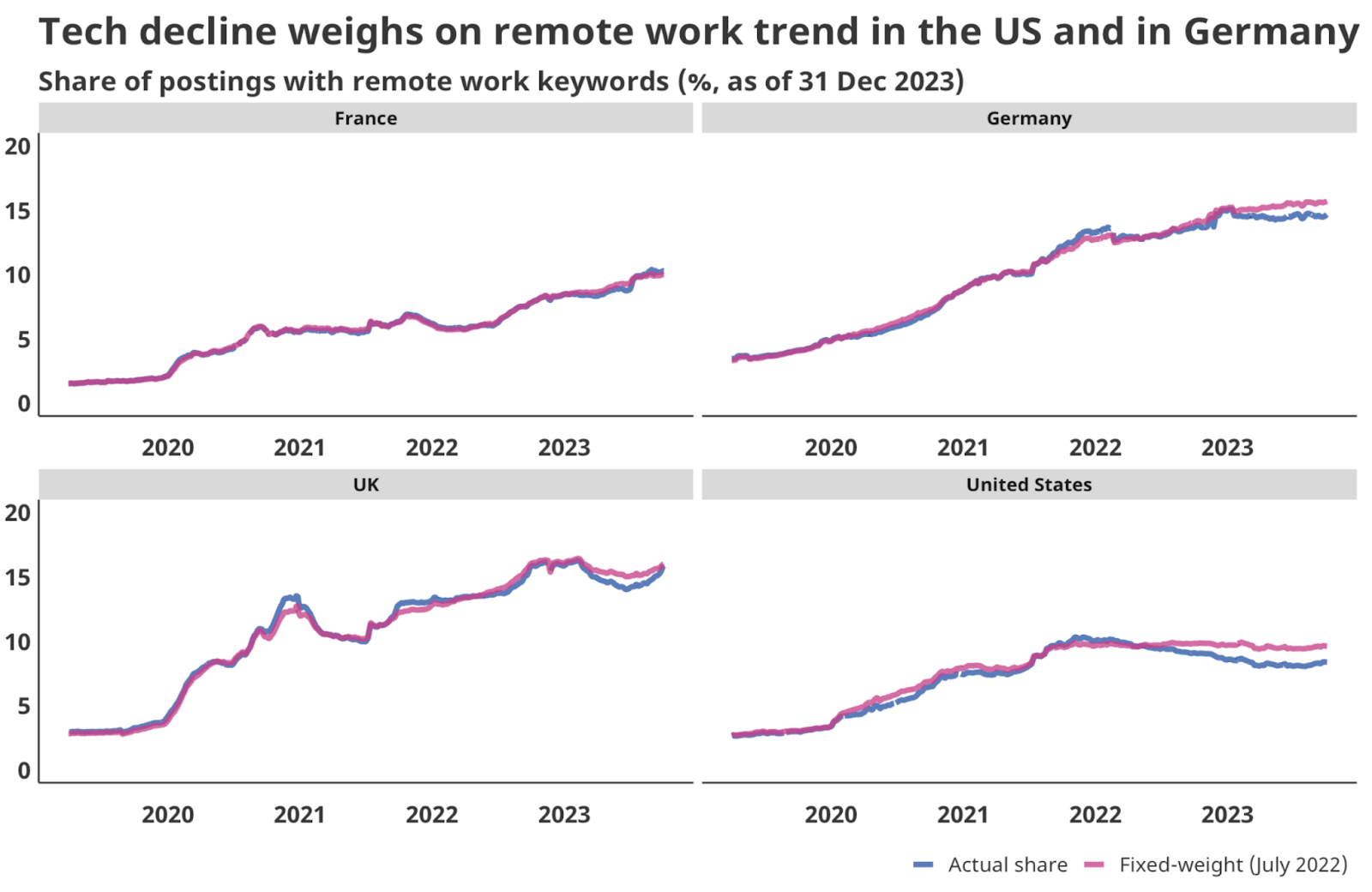

- A decline in technology postings — typically a sector in which large shares of jobs can be done remotely — explains almost all of the recent overall decline in remote-eligible job postings in the United States (currently at 8%, from 10% at the beginning of 2022). A similar effect is observed in Germany: the overall prevalence of remote work in postings would be at a record high if the share of job postings in the country’s digital sector had not fallen throughout 2023.

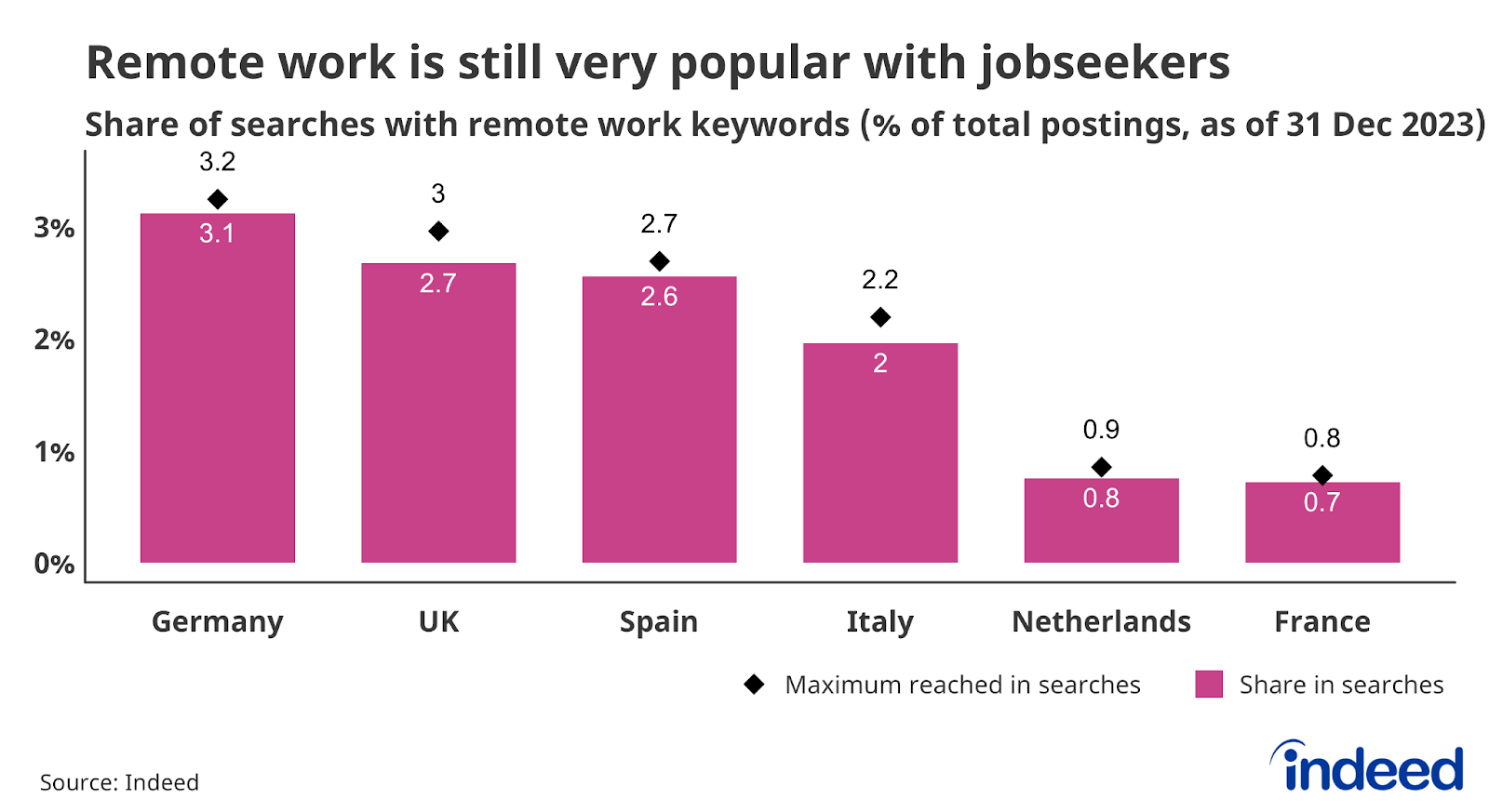

- The proportion of searches for remote/hybrid work is at or near historically high levels in most countries, a reliable signal of sustained jobseeker interest in remote work.

Remote work remains almost as popular as ever in most European countries, with both the share of postings mentioning remote/hybrid work potential and the share of searches directly seeking remote work opportunities staying at or near record highs — with some important exceptions.

In five of the six major European economies analysed, the share of job postings mentioning some form of remote/hybrid work is at or near all-time highs. Italy, where the share of remote-eligible job postings peaked in 2021 at 10.4% but has since fallen to just 7.8%, is the lone holdout. Nevertheless, in all six countries, many more postings mention remote/hybrid work than before the pandemic.

Differences do emerge across countries in the overall share of postings that offer remote/hybrid work — as of 31 December 2023, the share was more than twice as high in Spain (17.9%) as in Italy (7.8%). But those differences can largely be attributed to differences in the occupational mix of postings in each national labour market. When controlling for such structural differences (see Methodology), the disparities between countries diminish, though still persist.

But while the share of postings mentioning remote work reaches into the double digits in many countries, the share of searches from jobseekers actively searching for remote or hybrid work opportunities is uniformly much lower. Across all six European countries analysed, direct searches that include keywords related to remote work occurred in only about 3% or less of total searches (3.1% in Germany, 2.6% in Spain, 2.7% in the UK, 2.0% in Italy, and less than 1.0% in France and the Netherlands). But keyword searches alone, while often a valuable signal of job seeker interests and priorities, are not always a perfect indicator: the number of words used in many searches is very low, and some searches don’t even contain any words. The most important fact is that the proportion of searches, while low, is at or near historically high levels in most countries, a reliable signal of sustained jobseeker interest in remote work.

In Germany & the US, the tech sector significantly influences remote work trends

The potential for remote work varies greatly by profession — many jobs in the tech sector, for example, can be performed remotely. Any examination of the overall prevalence of remote work must consider if any potential increases in remote work in postings merely reflect a structural effect in the composition of the types of jobs being offered. In other words, if a higher share of the overall number of job postings is coming from sectors where remote work is more prevalent, then we’d expect the overall share of job postings mentioning remote work to rise as well.

In Germany, for example, the overall share of job postings advertising remote work would have been slightly higher at the end of 2023 (15.7% theoretically, compared to an actual reading of 14.6%), and above its historical peak of 15.3%, if the overall share of tech jobs had remained constant at July 2022 levels. A similar trend is observed in the United States: the overall share of US postings advertising remote work declined throughout 2022 and into 2023, but would have remained stable if tech postings had remained at earlier levels rather than declining. In France and the UK, however, the presence (or lack thereof) of job postings for the digital sector does not overly impact the share of remote work in postings.

Conclusion

Remote work continues to be a popular feature of the European labour market. Remote work does bring with it a number of organizational challenges and a necessary shift in management practices. But overall, in many European markets where mobility is restricted by the housing crisis and the effect of salary increases is diluted by recent years’ price rises, working from home remains a benefit valued by employers and jobseekers alike.

Methodology

A deep review of the methodology behind Indeed’s Hybrid/Remote Tracker can be found here.

We identify job postings as open to remote work if the job title or description includes terms like “remote work,” “telecommute,” “work from home,” “hybrid,” or similar language, or if the location is explicitly listed as remote. These postings include both permanent and temporarily remote jobs, though employers often don’t specify.

We calculate the remote share of postings daily. When reporting data on specific months we present the monthly mean of the daily series.

Cross-country differences in the share of remote postings are driven to some extent by differences in the occupational mix of postings, specifically, the prevalence of postings in high-remote and low-remote occupations. To illustrate the impact of such differences, we recalculated the remote share using the occupational mix from US job postings, where 8.4% of postings mention remote or hybrid work as of 31 December 2023. Imposing this occupational structure on the six European labour markets we analyse, the remote shares are as follows: Italy 6.9%, the Netherlands 6.9%, France 9.1%, Germany 12.0%, Spain 12.0%, and the UK 14.1%. The shares and the country ranking change, demonstrating the impact of differences in the occupational mix, but overall cross-country differences remain.

The Indeed Job Postings Index is built from a 7-day moving average of job postings, with the index set to 100 on February 1, 2020. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. We adopted this methodology in January 2021. Data for several dates in 2021 and 2022 are missing and were interpolated. Non-seasonally adjusted data are calculated in a similar manner, except that the data are not adjusted to historical patterns.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.