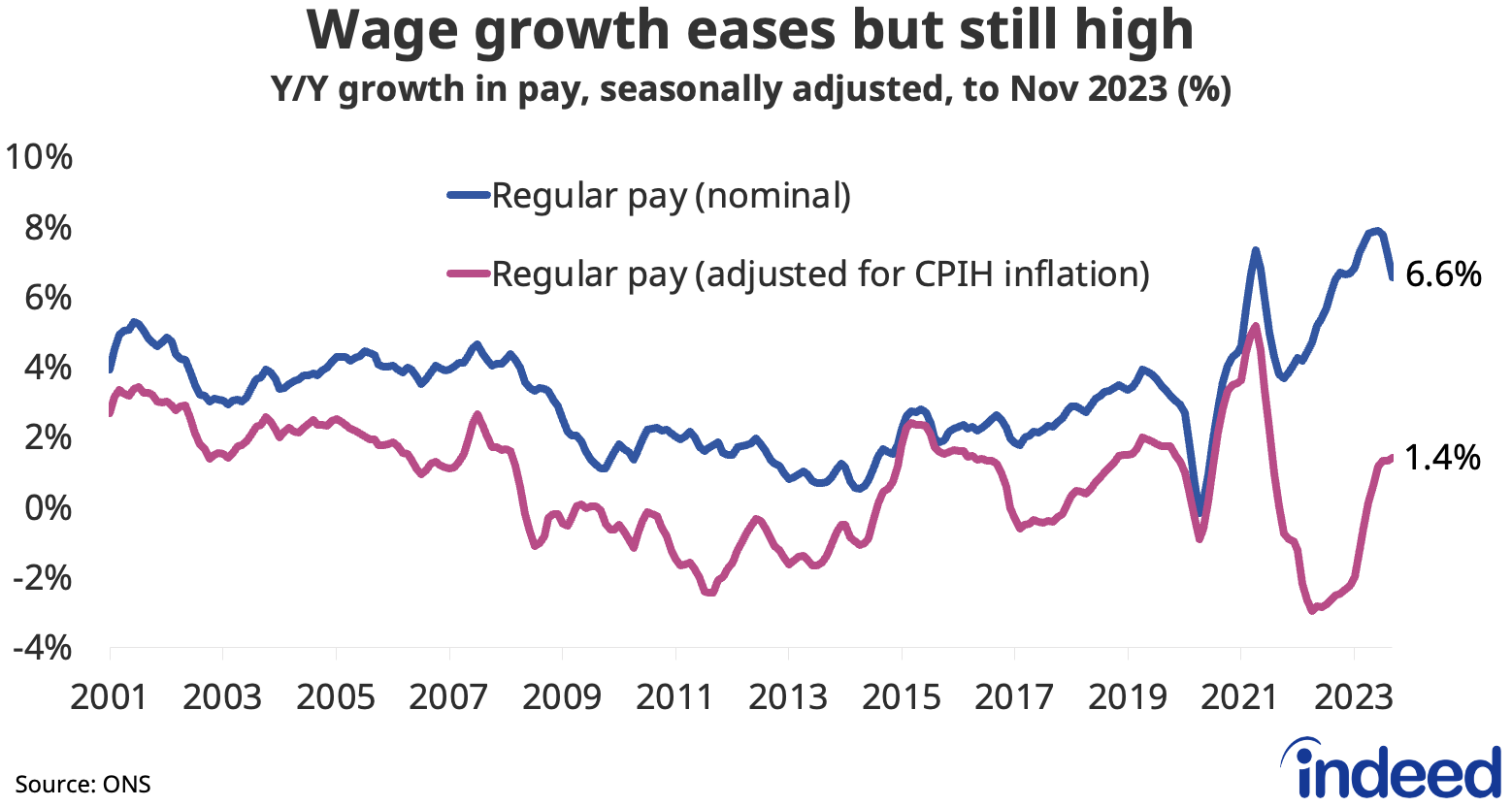

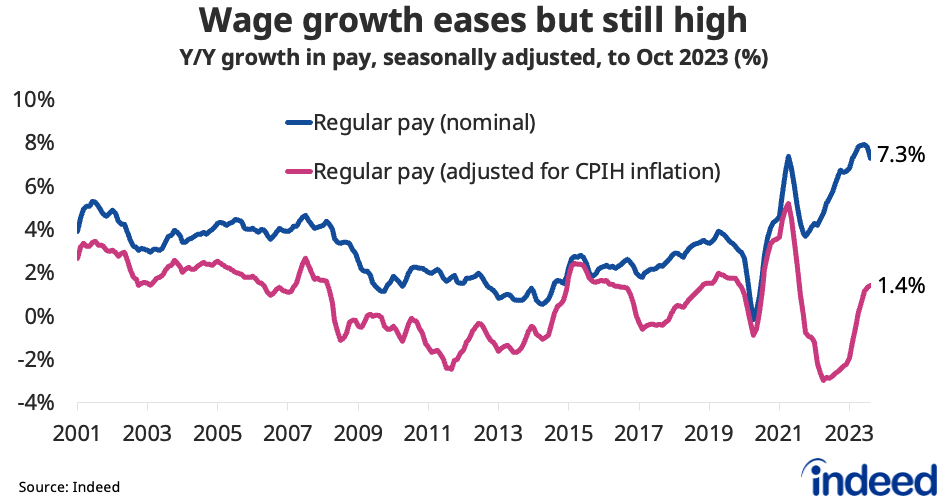

The continued gradual softening in the UK labour market supports expectations that the Bank of England will begin cutting interest rates in the coming months. But there is a way to go yet. Regular pay growth eased further from highs but, at 6.6% year-on-year in the three months to November, the pace remains well above the Bank’s comfort zone.

Policymakers remain vigilant for signs that large wage increases could lead companies to raise prices, locking in more persistent inflation pressures. But before considering a rate cut, they will want to see further evidence across a range of indicators that the loosening labour market will dissipate these pressures.

Their task is complicated by the continued uncertainty around data estimates from the Labour Force Survey, with the full suite of labour market data from the Office for National Statistics not due for several more months. That makes it more difficult to confidently assess the specific drivers of the labour market and the speed at which it is cooling.

The figures suggest that the labour market remains somewhat tight, despite recent softening. Vacancies have fallen continuously for 18 months but remain above pre-pandemic levels, while unemployment remains fairly low at 4.2%.