The labour market returned to a familiar trend in May. Employment rose, but more slowly than population growth, resulting in a further softening of conditions after being briefly interrupted by strong job numbers in April. The unemployment rate is no longer particularly low, ticking up to 6.2%, matching where it stood in 2017 but slightly higher than in 2018 and 2019.

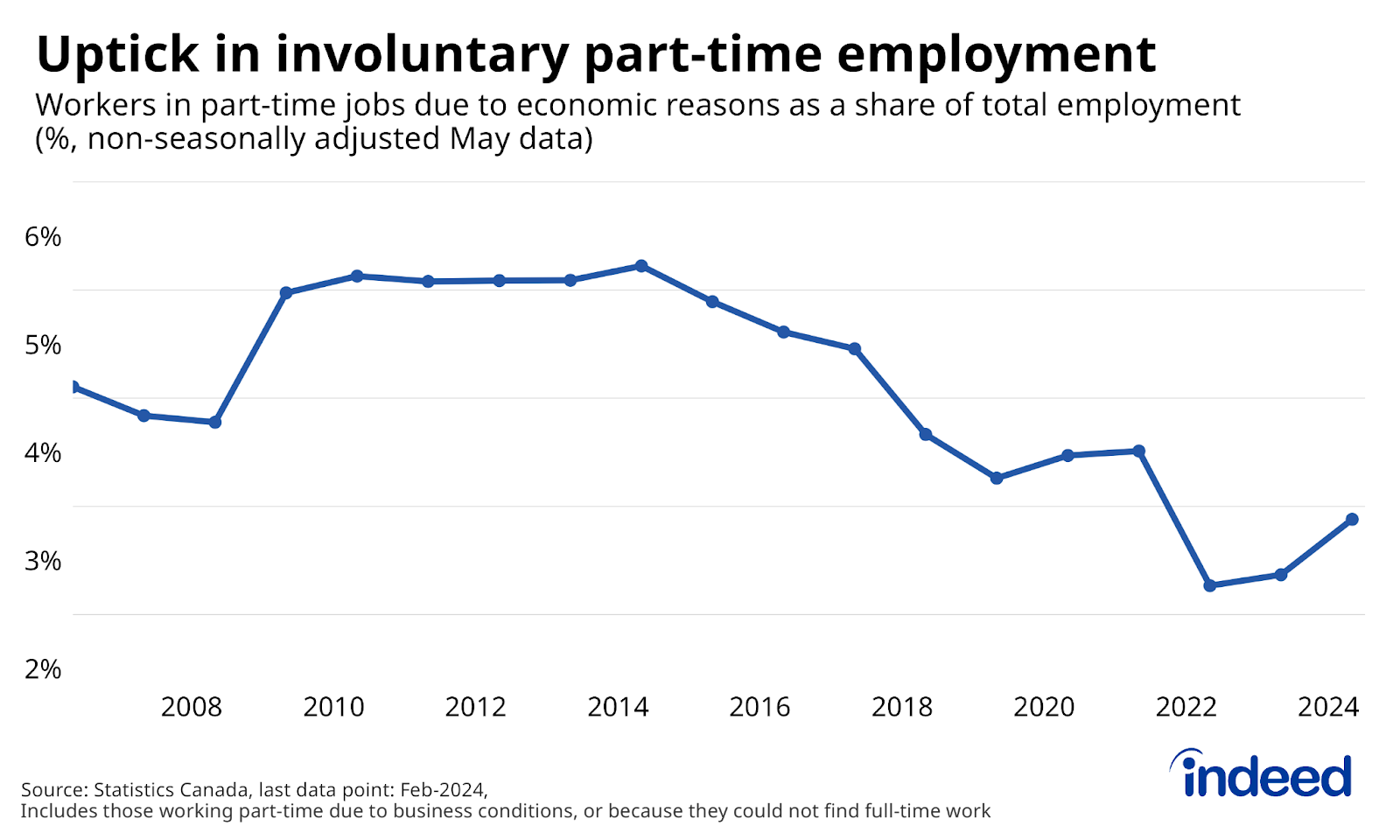

Rising part-time jobs also suggest the situation has deteriorated. After plunging in mid-2022, the share of workers in part-time jobs who would prefer full-time work has picked up, now standing at 3.4% of total employment in May, up from 2.9% a year earlier. That said, unlike the unemployment rate, the involuntary part-time rate remains quite low by historical standards.

Canada’s labour market cooldown continues to be driven by weak hiring. The number of new jobs started last month was well below typical May levels. At the same time, job security among the gainfully employed has held strong, as layoff rates have remained low. These diverging trends have made breaking into the labour market more difficult for youth, and the summer job market got off to a slow start this year.

The job numbers might be weakening, but wage growth showed a different trend in May, popping back up above 5% after slipping in April. While cost of living increases are likely helping pay catch up to the earlier jump in prices, it’s still surprising to see wages maintain their solid gains, even as other indicators of demand have cooled. The good news has been that, so far, elevated pay growth hasn’t prevented broader inflation from cooling. If this continues, the door is open for further Bank of Canada rate cuts in the months ahead.