Key points

- The labor market downshifted in April with employers adding 175,000 jobs; a notable slowdown from the pace in the first few months of the year.

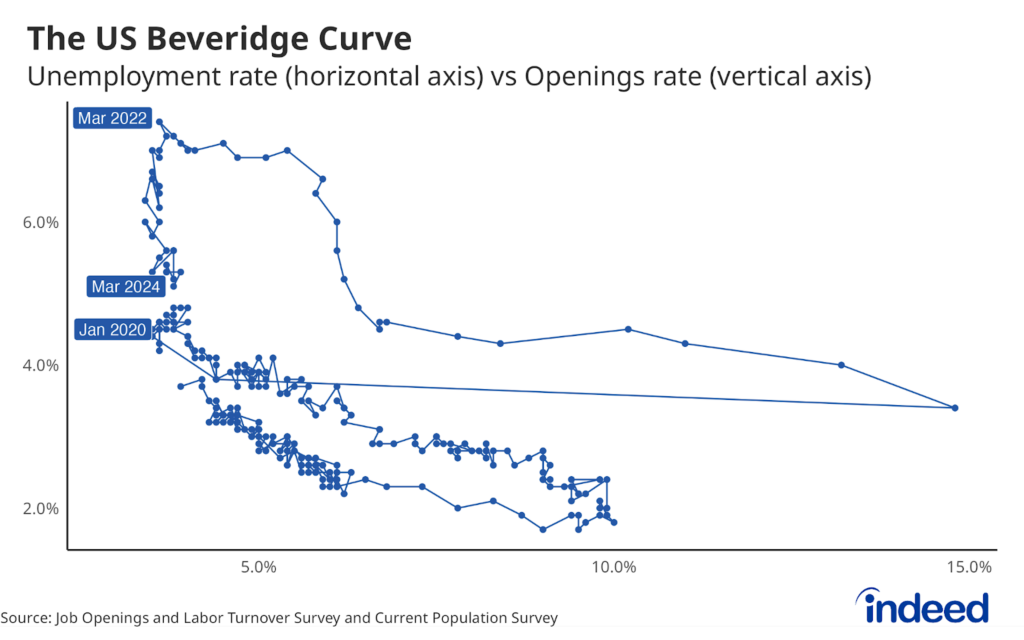

- The unemployment rate ticked up to 3.9% — a sign that perhaps job gains need to be faster to keep joblessness steady.

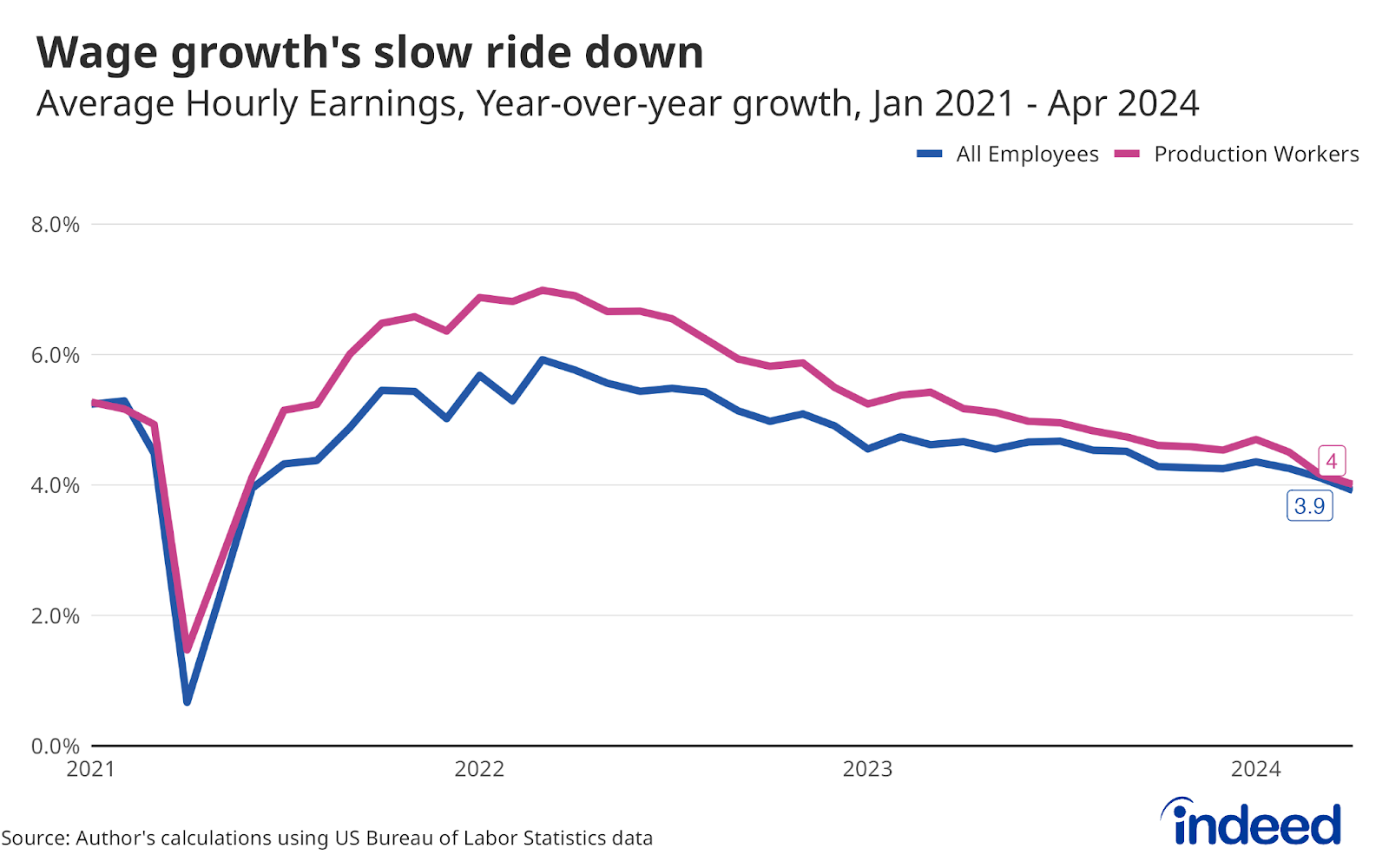

- The continued slowdown in wage growth is the clearest sign the labor market is not reheating, with April’s year-over-year gain the slowest since May 2021.

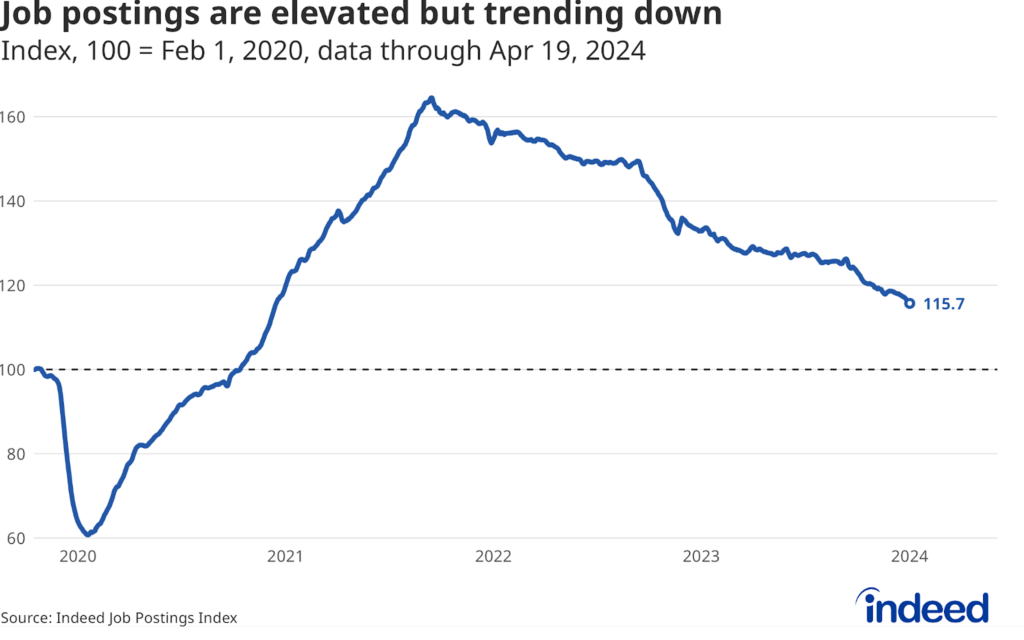

The labor market is not accelerating. The April jobs report represents a notable downshift from prior months, with merely good, not great, job gains. These data should definitively ease any lingering concerns of reacceleration in the face of stubborn inflation and strong overall economic growth. In most months prior to the pandemic, adding 175,000 jobs would be considered a strong report, expected to be enough to keep unemployment steady. But even with that growth last month, the unemployment rate still rose modestly. The slowdown in wage growth also shows that the labor market is not getting back on the boil. The signs of moderation, even with these solid gains, are another indication more workers entering the workforce through immigration and increased participation require even more robust gains to keep the labor market at its current temperature.

Job gains were relatively widespread in April, with more than 60% of all sectors reporting gains for the month. But the really big gains came in just a handful of sectors — half of all total payroll gains came from the health care and social assistance sector alone. Government jobs, which had been a major contributor in recent months, slowed considerably and added only 8,000 jobs in April. Leisure and Hospitality, another former source of large gains, slowed as well. Perhaps some of the sectors that had been making big catch-up gains are now approaching slower but steadier paces of growth, something to keep an eye on in the months ahead.

Wage growth is a key thermometer of the labor market and its reading this month clearly points toward a continued cooldown. If you’re concerned that the labor market might be a force to keep inflation high, don’t fret. Average hourly earnings grew at a 3.9% pace over the year, below expectations and their slowest pace since May 2021, which Federal Reserve Chairman Jerome Powell and his colleagues will find encouraging. On its own, this report, while not great, is not necessarily overly worrisome — when the market is cooling as it is, you should expect a few reports like this from time to time. But if reports going forward continue to come in weaker than expected, then that may be cause for more concern.