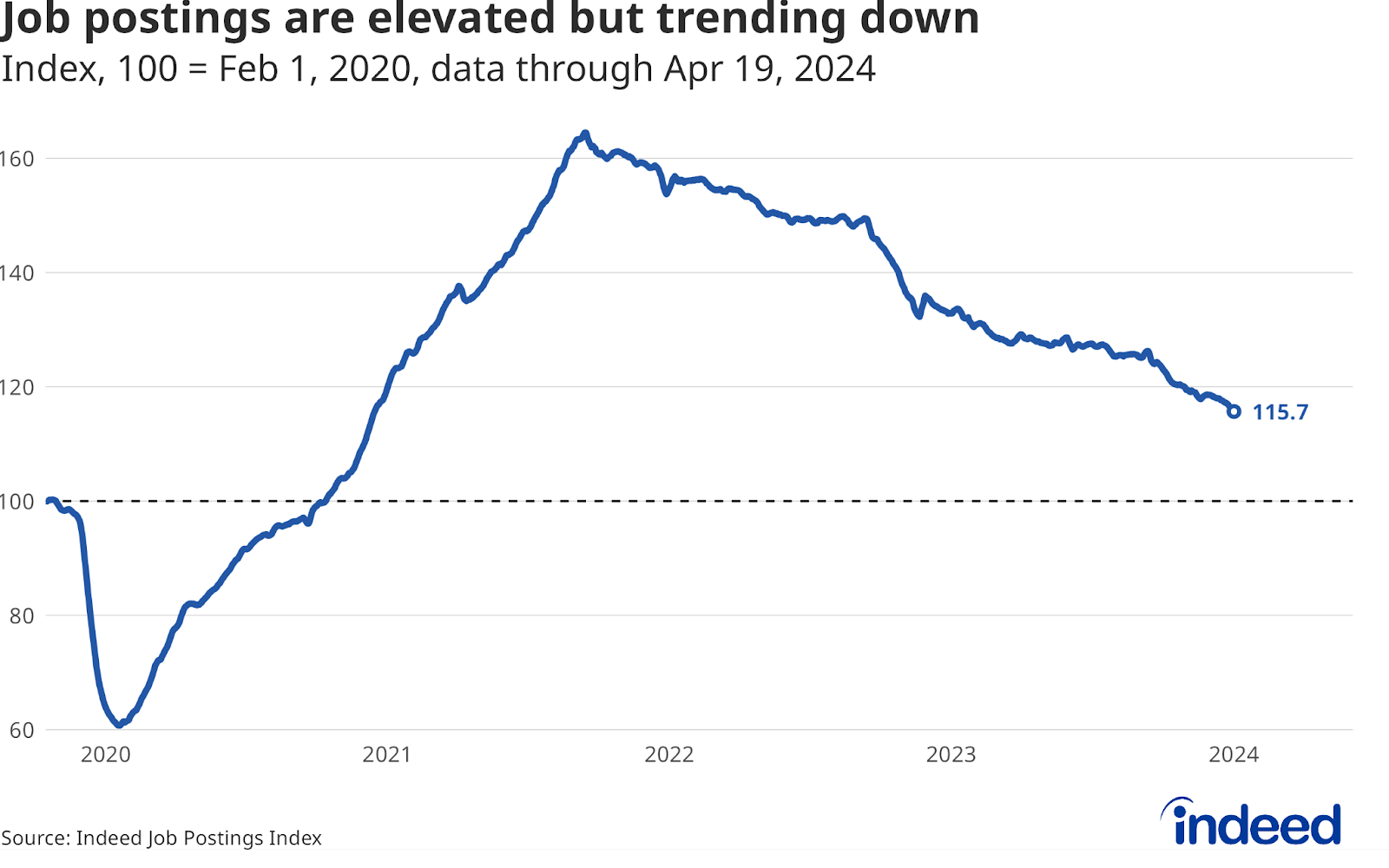

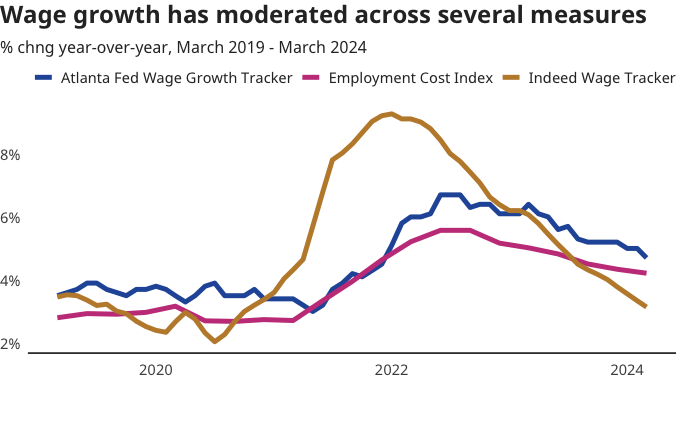

“A lack of further progress” in getting inflation back to its 2% target in recent months prompted the Federal Reserve to hold benchmark interest rates steady today, as expected. Recent economic data has hinted at the possibility that inflation, GDP growth, and the labor market are heating back up, even in the face of elevated interest rates meant to keep them cool. But in his press conference following the rates announcement, Federal Reserve Chairman Jerome Powell pointed to declining labor demand as a way of pushing back on the idea that higher rates aren’t slowing growth or inflation. His evidence included declining job openings from JOLTS and continued moderation in the Indeed Job Postings Index.

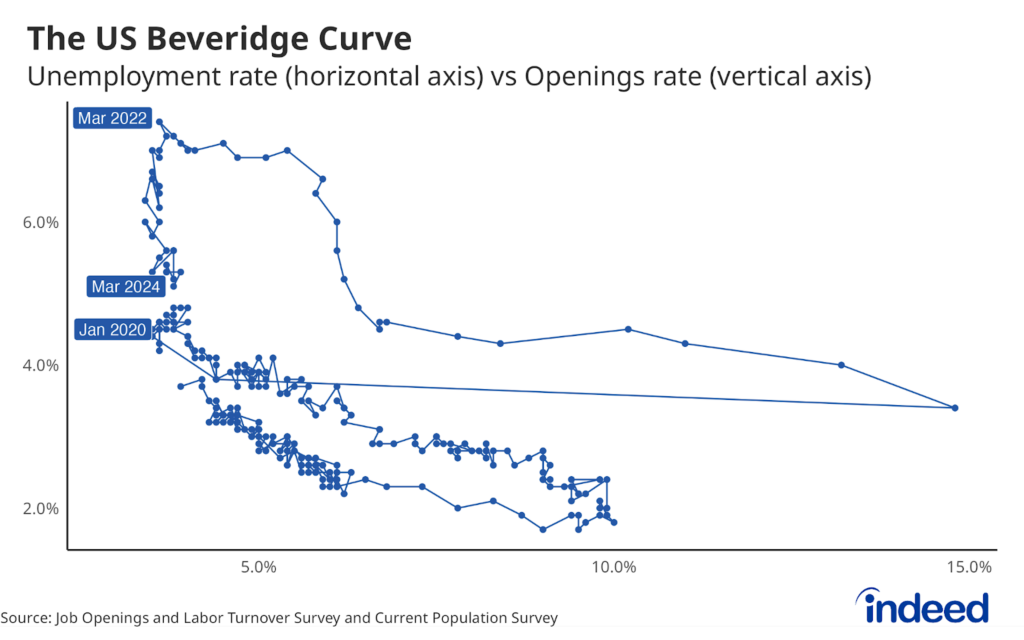

Both measures of demand have fallen dramatically since their peaks in early 2022, each down by at least 30 percent from recent highs. Remarkably, however, this rapid descent didn’t lead to a spike in unemployment. But the longer the Fed keeps monetary policy restrictive, the risk grows that further reductions in demand may not be as benign as they have been in recent years. The Indeed Job Postings Index shows job postings were 15.7% above their pre-pandemic levels as of April 19, so demand is still strong. But further reductions in demand could risk the strong US labor market.