Key Points:

- Tech-related job postings are 25% below pre-pandemic levels, declining 2.7% in the last three months.

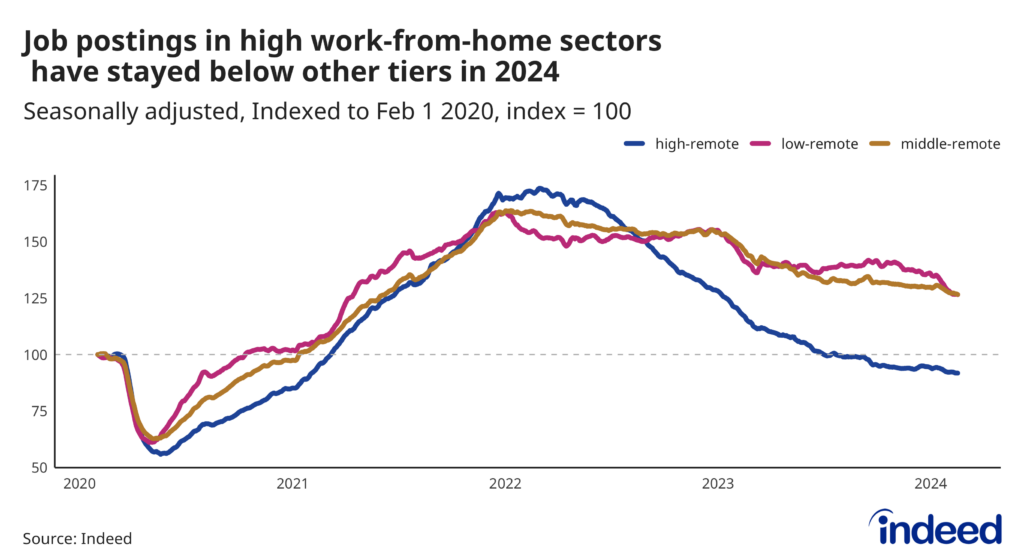

- Postings in sectors with a high share of remote-eligible roles have declined as well, falling to 8% below pre-pandemic baselines, while demand for in-person sectors remains above pre-pandemic norms.

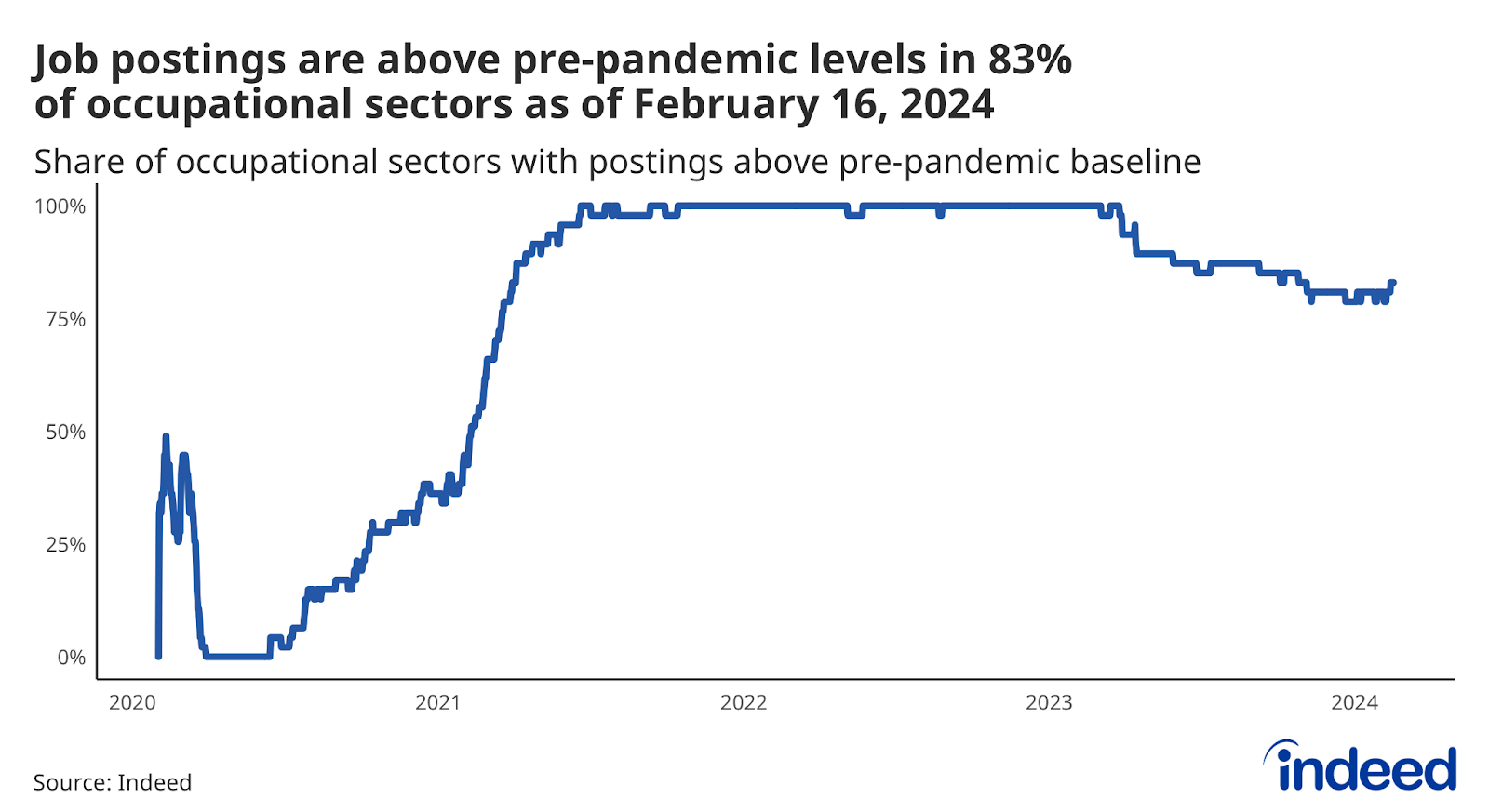

- Out of the 47 total sectors tracked by Indeed, job postings as of Feb. 16 were down compared to pre-pandemic levels in only 8 sectors — the level of opportunities in the remaining 39 sectors is still above pre-pandemic baselines.

Indeed’s monthly Labor Market Update looks at important labor market trends through the lens of Indeed data. A more comprehensive view of the US labor market can be found in our US Labor Market Overview chartbook. Data from our Job Postings Index — which stands 20% above its pre-pandemic baseline as of February 16th — and the Indeed Wage Tracker are regularly updated and can be downloaded on our data portal and GitHub.

How can the overall job market remain relatively healthy if a prominent segment of the market — in this case, tech and other professional, knowledge-worker roles — is laying off thousands of workers to start the year? The answer lies in the fact that the tech and professional sectors actually represent a smaller share of the market than their outsized cultural influence and media presence would suggest. Hiring demand in a majority of sectors remains strong compared to pre-pandemic norms, especially for in-person work.

Tech cuts get headlines, but tech is not the whole job market

The national job market has been sending conflicting messages recently. On one hand, official measures including the monthly jobs report continue to paint a fairly rosy picture of low layoffs, strong wage growth, and sustained employment growth. On the other hand, a slew of tech and media companies marked the start of 2024 by announcing thousands of high-profile layoffs (on the heels of the tens of thousands of layoffs already made in 2023). But rather than being in conflict, both these stories are true.

Layoffs are historically low, and the level of job postings on Indeed was higher at the start of February than it was immediately before the onset of the pandemic, both overall (the headline US Job Postings Index was 20% above pre-pandemic levels as of Feb. 16), and in a majority of sectors analyzed by Indeed. Of the 47 sectors tracked by Indeed, 83% had job postings above pre-pandemic levels as of Feb. 16, 2024. Put another way, 39 of the 47 sectors tracked by Indeed had more opportunities this February than in February 2020, and only 8 had fewer. The share of sectors with job postings above pre-pandemic levels fell throughout 2023 and continues to decline, but remains comfortably in positive territory after a long period — beginning in mid-2021 and stretching through 2022 — in which virtually every sector tracked had more opportunities than prior to the pandemic. The high share of sectors looking to hire more today than in early 2020 reflects a high demand for in-person services. From dental care to dining out, consumer spending is still strong in 2024, translating into more job postings in a majority of sectors.

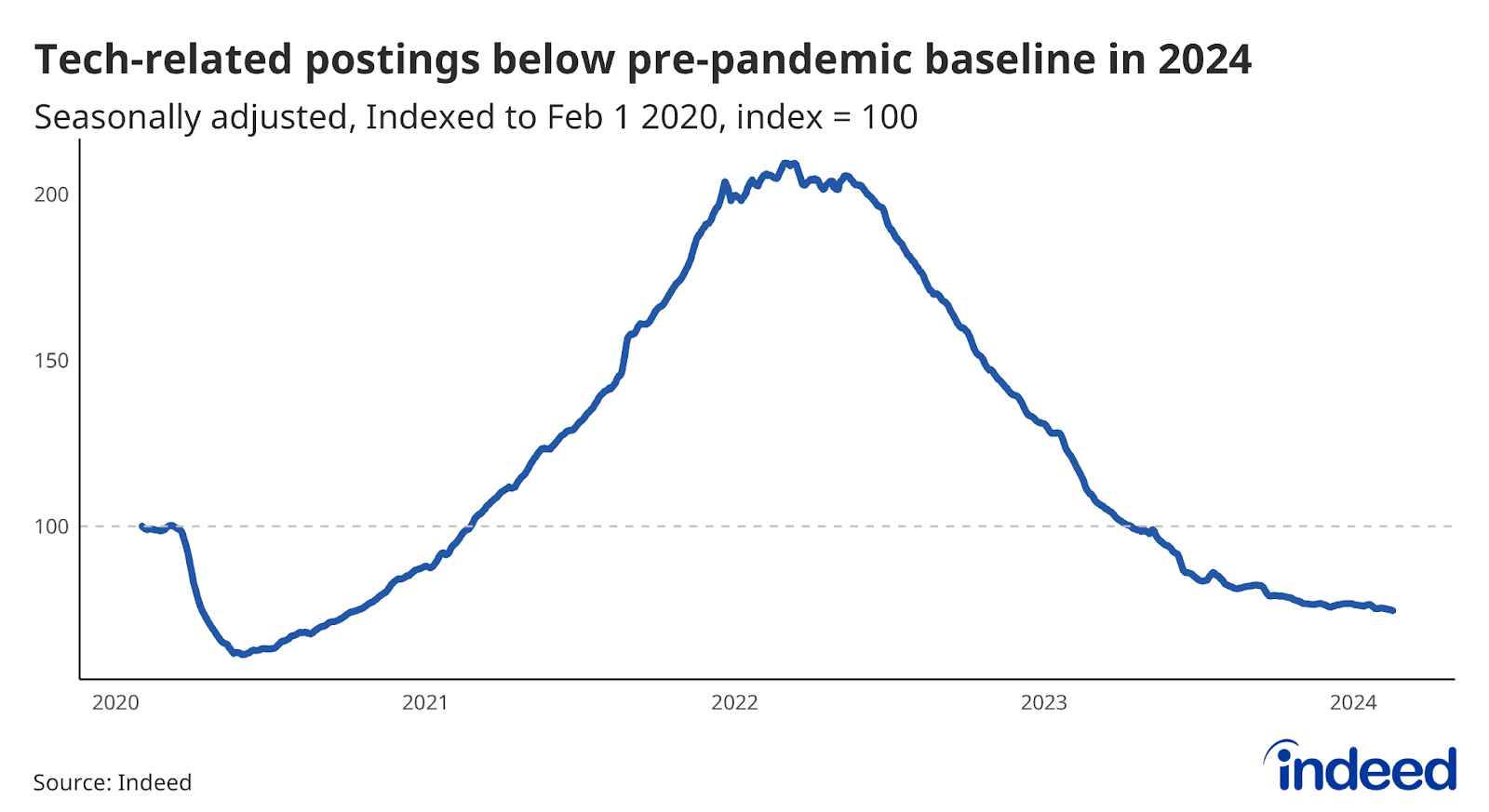

But it is also true that tech-related job postings, in sectors including Software Development, IT Operations & Helpdesk, and Information Design & Documentation, have fallen drastically from their peak over roughly the same period. In spring 2022, tech postings were 109% above their pre-pandemic baseline before declining rapidly, falling below pre-pandemic levels by May 2023, and standing 25% below their pre-pandemic level as of Feb. 16, 2024.

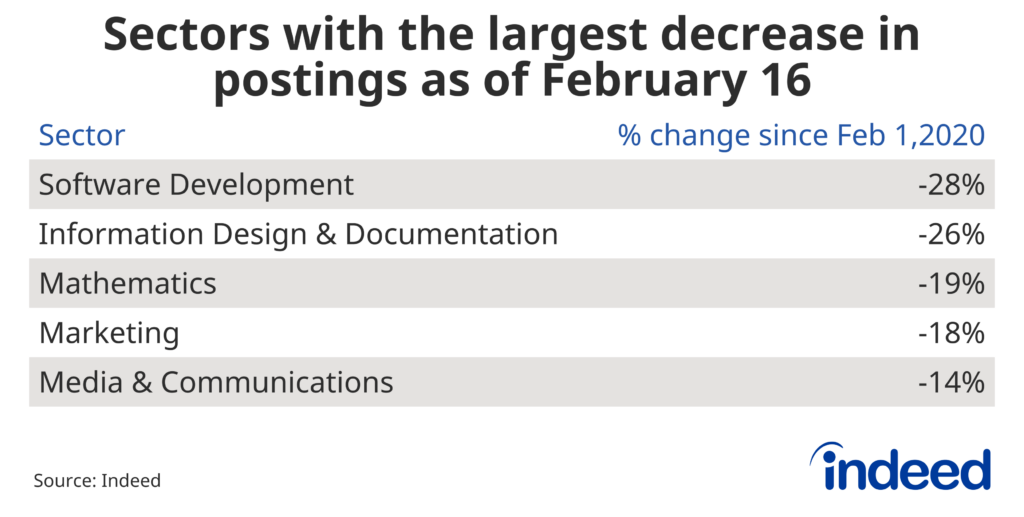

And job postings have declined notably from pre-pandemic levels across several professional sectors, not just tech. Among the five sectors with the largest decrease in postings as of Feb. 16 relative to pre-pandemic levels, three are directly tech-related (software development, information design & documentation, and mathematics). But the remaining two (marketing and media & communications) are otherwise more generally associated with knowledge workers and other professionals, and are not necessarily tech-specific. And job postings for Human Resources roles — a sector that often rises and falls with overall hiring demand, particularly for recruiting-intensive roles — recently fell below its pre-pandemic baseline, down by 17% as of Feb. 16.

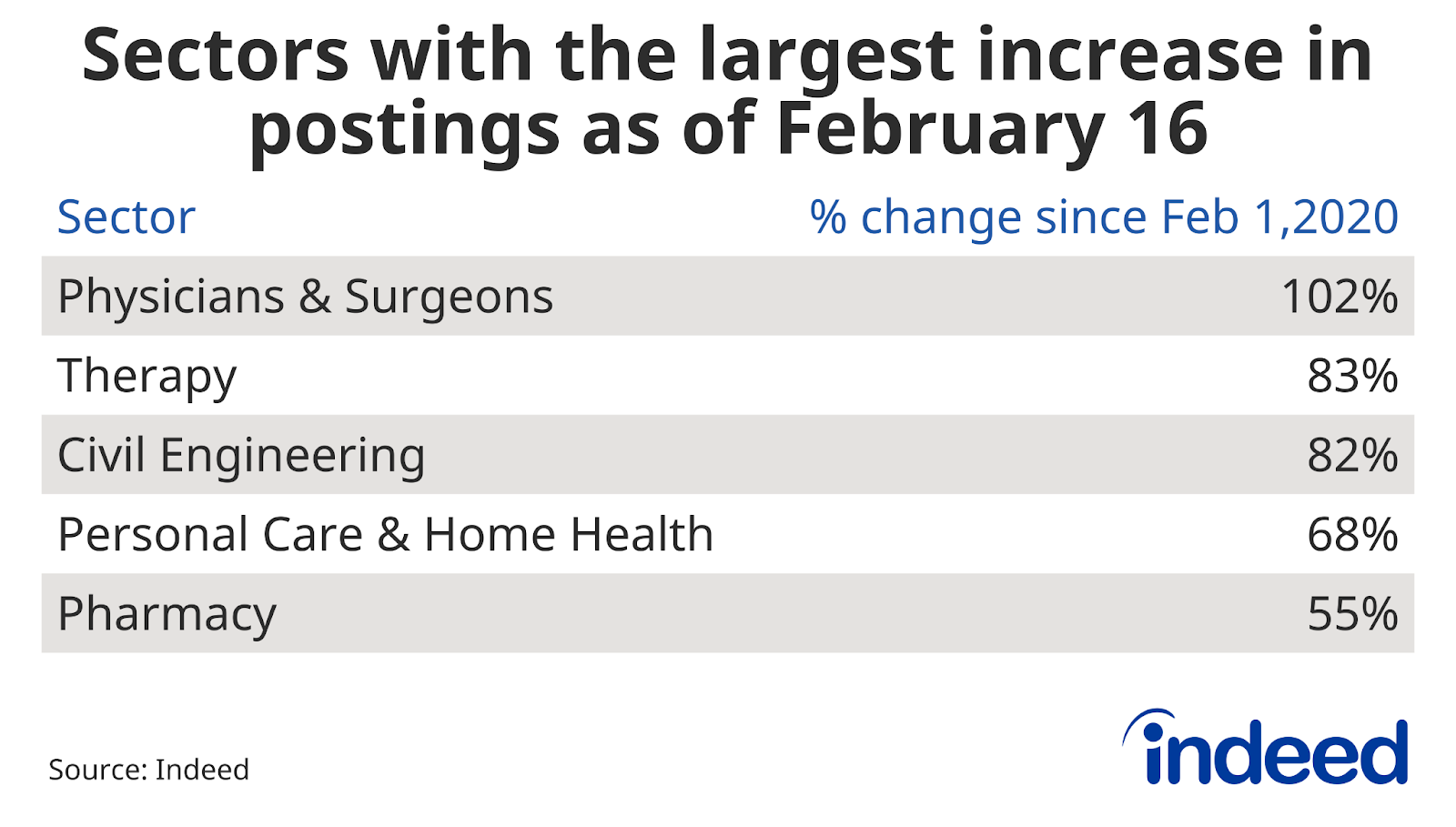

But while those declines are sizable, they ignore the often even larger gains experienced in many other sectors. Among sectors with the biggest increase in job postings over their pre-pandemic levels, postings for Physicians & Surgeons lead the way, more than double (+102%) their pre-pandemic baseline. Of those five sectors, the 55% increase in Pharmacy postings since February 2020 is the smallest, but still greater in magnitude than the largest decline among sectors over the same period (Software development, -28%).

In-person work is in demand

Another potential driver of the disconnect between positive official data and negative layoff headlines may be attributable to a decline in opportunities among the kinds of jobs that both grew (and gained so much attention) during the pandemic: Jobs that can be done from home. Job postings in sectors with the highest share of remote-eligible roles were down 8% from pre-pandemic levels as of Feb. 16. But in-person work remains in demand: As of Feb. 16, postings in sectors with low or medium shares of remote-eligible roles were each up 27% from their pre-pandemic baselines

Postings in low work-from-home sectors have dipped more recently, falling 8% in the past three months, but many of those sectors decline after the holidays as demand for seasonal jobs — like retail or delivery work — tapers off. Job postings in medium-remote sectors, including accounting and customer service, have also fallen recently (though more modestly), down just 2.8% over the past three months.

Conclusion

High-profile tech layoffs are making news, but the relatively large declines in tech and other professional sectors are not echoed across the job market as a whole. Employer demand in a majority of sectors remains above pre-pandemic levels, especially for in-person work. Job seekers in some professional sectors likely aren’t having as easy of a time finding opportunities as they did in 2022, but medium- and low-remote sectors like those in healthcare, beauty and wellness, and childcare are holding strong. Consumer demand for in-person services is bolstering hiring in some sectors, even as postings for other professional jobs pull back, and hiring managers re-evaluate their budgets and priorities after a surge in those roles during the pandemic.

Methodology

Data on seasonally adjusted Indeed job postings are an index of the number of seasonally adjusted job postings on a given day, using a seven-day trailing average. Feb. 1, 2020, is our pre-pandemic baseline, so the index is set to 100 on that day. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. We adopted this methodology in January 2021. Data for several dates in 2021 and 2022 are missing and were interpolated. Non-seasonally adjusted data are calculated in a similar manner, except that the data are not adjusted to historical patterns.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of the performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.