Key Points:

- Job seeker interest is recovering for in-person work, according to Indeed’s Relative Job Seeker Interest metric.

- The US labor market remains hot as demand for workers outstrips worker readiness to take jobs.

- This imbalance is the root cause of the current strong wage growth, though inflation has diluted those gains.

- With elevated levels of employer demand, employment is recovering, though by some measures it has not returned to pre-pandemic levels.

Spotlight: Job seeker interest in in-person work is recovering

Job seeker interest is recovering for in-person work, according to Indeed’s Relative Job Seeker Interest metric, which measures interest in an occupational sector relative to the average job posting. And that may be good news for employers — greater enthusiasm for working at job sites might help ease the difficulty many of them face finding workers.

The Relative Job Seeker Interest metric measures interest by tracking trends in job seeker clicks on positions posted on Indeed relative to the average job. Since the start of this year, an occupational sector’s likelihood of offering remote work no longer has had a statistically significant relationship with relative job seeker interest. Put more simply, job seekers appear to be more open to in-person opportunities, even as they continue to prioritize higher wages.

Last year, job seeker interest in an occupation relative to the average job shifted toward postings in sectors more likely to be remote and advertise higher wages. For some sectors, like food preparation & service, this created a substantial problem for employers. It’s simply not possible to do some jobs remotely, leaving employers in those fields with few options except to boost wages. That was good news for workers — those wage gains materialized, particularly at the bottom of the wage distribution.

Among the occupational sectors with high shares of in-person work registering greater relative interest are food preparation & service and hospitality & tourism. Relative interest in job postings in these fields is now at or above pre-pandemic levels. But interest in in-person sectors hasn’t recovered across the board. For example, interest in personal care & home health still lags in relative terms.

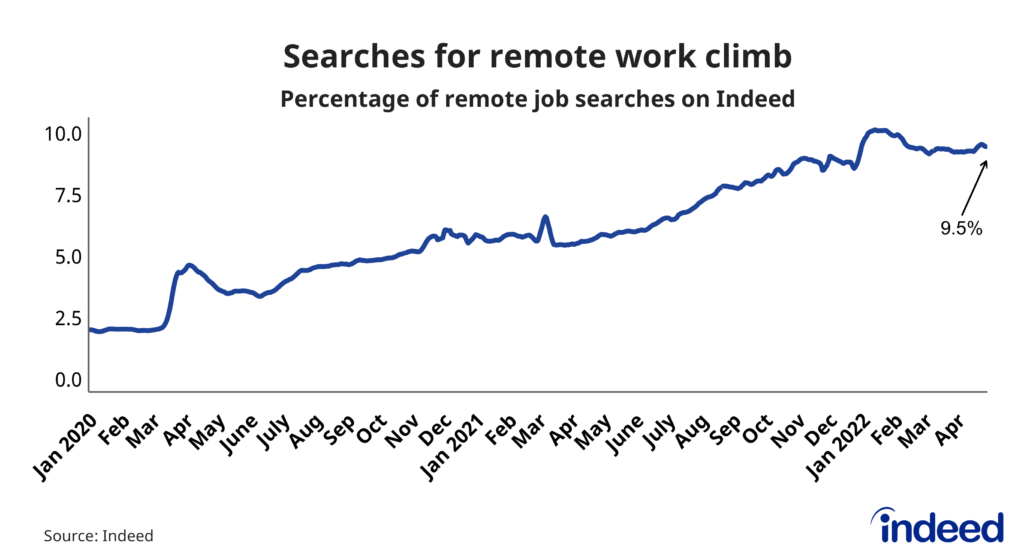

Rising interest in in-person jobs should make it easier for employers to find workers. At the same time though, remote work is still more popular than it was pre-pandemic. As of April 2022, 9.5% of US job searches on Indeed involved remote work compared with just 2.0% in January 2020. This means that even though remote work is still widely sought, it may now be less of a make-or-break factor than it was at earlier stages of the pandemic.

Labor Market Overview

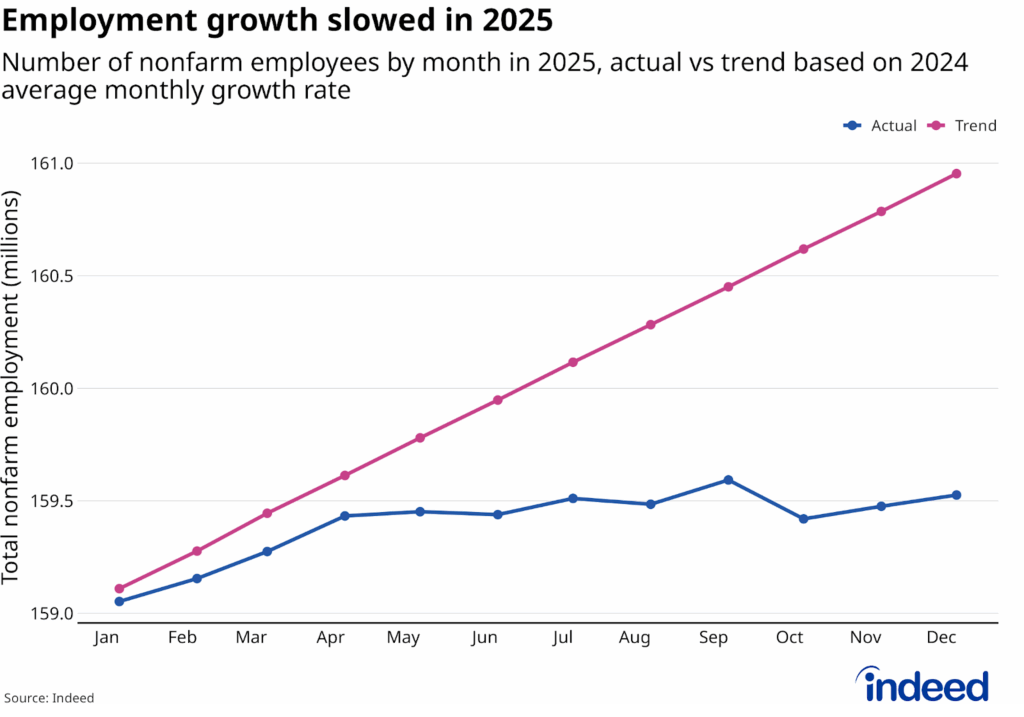

The US labor market remains hot. As the US economy has bounced back from the initial COVID-19 shock, demand for labor has grown much more quickly than supply. Employment has rebounded, wages are growing fast, and joblessness is approaching pre-pandemic levels. Nevertheless, this momentum faces potential roadblocks in the form of quickly tightening monetary policy, geopolitical instability, and new variants of COVID-19.

Employer demand for workers remains strong, with Indeed job postings as of May 20, 2022 55.8% above their pre-pandemic baseline. New job postings, defined as those on Indeed for seven days or less, are also well above their pre-pandemic baseline, up 73.9%.

While job postings growth has slowed in recent months, the leveling out is not a plunge by any means. For example, new job postings have fallen from their series high earlier this year of 90.3% above pre-pandemic baseline. But at 73.9%, new job postings growth is still above any point between February 2020 and December 2021. This moderation indicates employer demand is slowing from its extraordinary peak but remains strong.

Strong wage growth, but inflation is eating away gains

Strong demand for workers combined with acute hiring difficulties across multiple sectors have driven wages up roughly 6% on an annual basis, a higher growth rate than at any point in over the past 20 years. This is what economists call nominal wage growth — that is, pay gains before taking inflation into account. However, rising prices are eating away those gains and causing many employees to lose ground when it comes to actual purchasing power.

One of the biggest questions for the US economy is whether this high nominal wage growth can be sustained. There are signs this growth is starting to ebb or even fall as competition for new hires tempers. Should wages slow considerably, inflation would have to drop substantially to keep even more workers from seeing their inflation-adjusted wages decline.

People of prime working age are returning to work

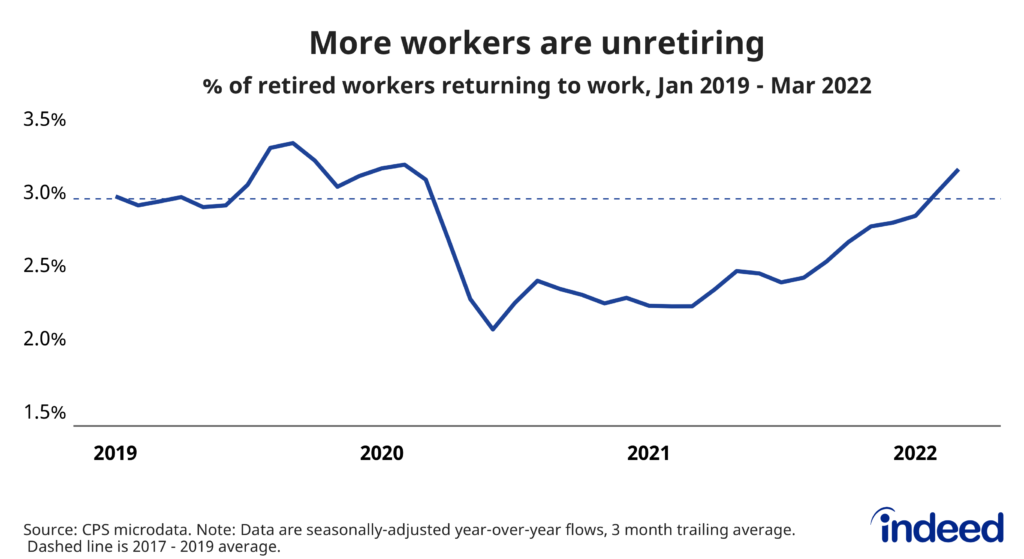

Labor supply has not grown as swiftly as demand, but, overall, people are returning to work. Some labor supply measures have been sluggish, including the rate of participation in the labor force and the percentage of the working age population that’s employed. In fact, if you take into account the aging of the population, which means a larger share of the public is no longer of prime working age, the rebound in labor supply has been solid. When we focus on people from 25 to 54, which economists consider the prime working years, we see much stronger growth in employment and labor force participation. Meanwhile, a continued pickup in so-called ‘unretirements’, or retirees returning to work, would strengthen employment recovery among older workers.

Urgent search among the jobless is muted

Many people are taking new jobs. But job seeker urgency to find work has been relatively muted, according to data from our most recent Indeed Hiring Lab Job Search Survey. Urgent job search among the jobless has slipped the past two months. However overall active job search among this group has been steady since the beginning of the year. The rise in employment is being driven by workers enticed by higher pay and active recruitment into jobs rather than by those who feel a compelling need to find new work.

Workers are quitting jobs at a high rate

Employed workers are also finding new work, pushing the rate of job quitting to levels not seen in the 21st century. A remarkable 3.3% of private sector workers voluntarily left their jobs in March 2022. This high volume of quitting reflects strong demand for workers and is concentrated in lower average-wage industry sectors such as manufacturing and leisure and hospitality.

The US labor market has been offering plenty of opportunities for workers while presenting some challenges to employers. However, the present situation undoubtedly will change. We will continue to monitor these trends and track others as the labor market evolves.

Methodology

The Relative Job Seeker Interest metric takes the average number of clicks per job posting for each job category relative to February 1, 2020, divided by national clicks per posting relative to the same time period. Both clicks and job postings are 28-day moving averages of seasonally adjusted data.

A positive change means the average job posting in a category is now more attractive to job seekers relative to the average posting than it was before the pandemic. A negative change indicates that the category has lost interest relative to the average posting since February 1, 2020. By construction, the national average across all sectors is zero.

The median hourly wage and remote share of job postings is calculated by category for calendar year 2019. The logs of median wage and remote share are then regressed on the change in relative job seeker interest with standardized coefficients and weighted by the raw sectoral job postings count for 2019.

Data on seasonally adjusted Indeed job postings are the percentage change in seasonally adjusted job postings since February 1, 2020, using a seven-day trailing average. February 1, 2020, is our pre-pandemic baseline. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. We adopted this methodology in January 2021. Data for June 24-30, 2021; November 1, 2021; January 1, 2022; January 27, 2022; and January 28, 2022, are missing and were interpolated. Non-seasonally adjusted data are calculated in a similar manner except that the data are not adjusted to historical patterns.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.

The data from the Job Search Survey is based on 11 online surveys of 5,000 US adults ages 18-64 starting in late May 2021 and continuing through March 2022. The first survey was conducted May 26-June 3, the second July 12-20, the third August 10-18, the fourth September 13-29, the fifth October 11-20, the sixth November 8-18, the seventh December 6-22, the eighth January 10-24, the ninth February 7-21, the tenth March 7-21, and the eleventh April 11-23 and the most recent May 9 – 23. Weights were applied to each survey to match respondent distributions across age, educational attainment, race/ethnicity, and sex with the 2020 Current Population Survey’s Annual Social and Economic Supplement.