So far 2022 looks a lot like 2021 in the federal Job Openings and Labor Turnover Survey (JOLTS) data. Demand for labor is historically high and workers are quitting their jobs at historic rates to take advantage of that demand. At the same time, employers continue to have a hard time filling open positions. This year could see some easing of pressure in the labor market with demand slowing and hiring becoming easier, but we aren’t seeing that yet in these data.

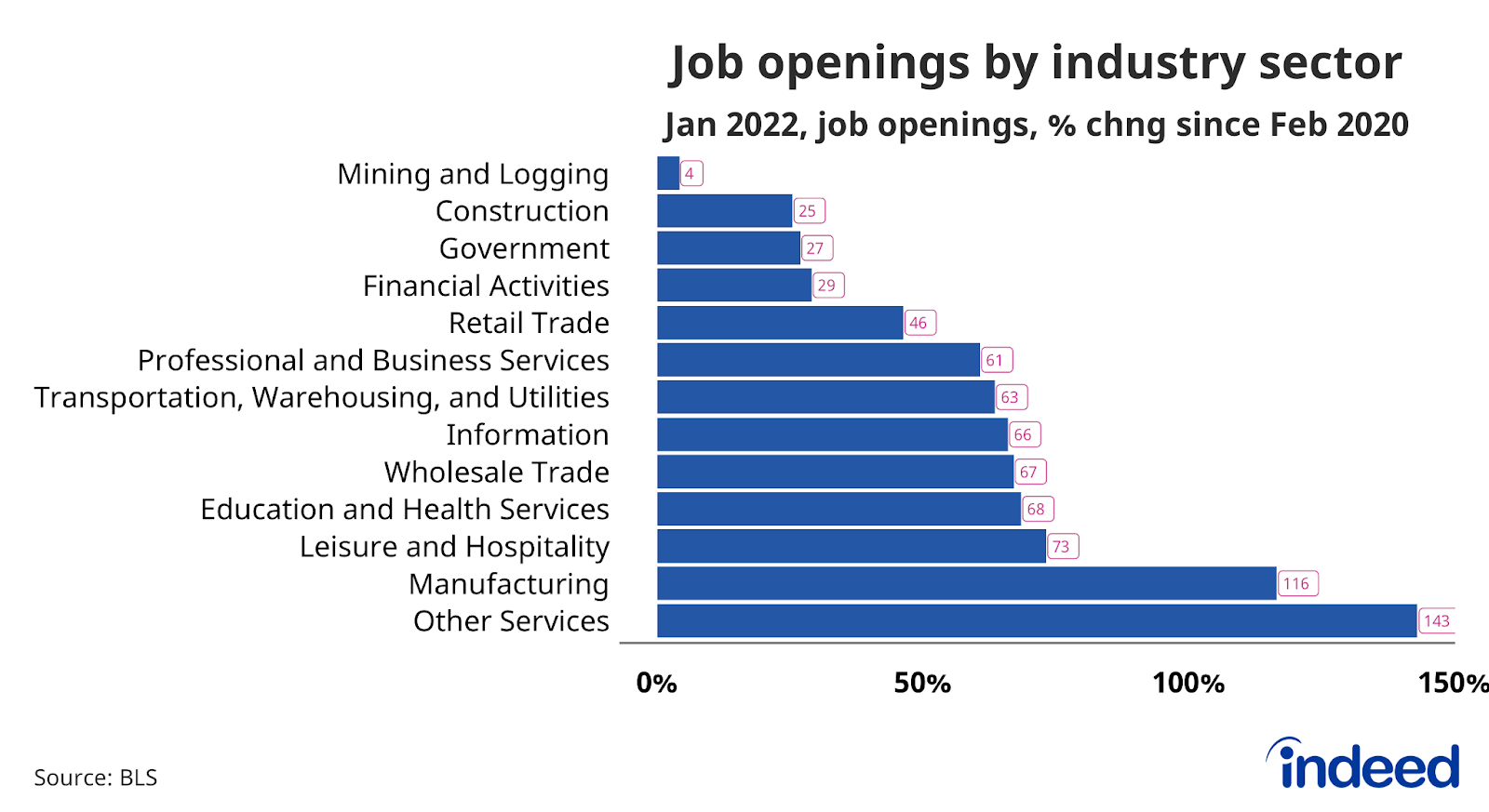

Job openings continue to be elevated, with 11.3 million open jobs at the end of January. That’s a roughly 61% increase from the number of openings back at the end of February 2020. Of course this increase in demand varies by sectors. Openings in construction are up 25% over that time period, which not only lags the overall labor market but is far beneath the astounding 116% increase for manufacturing.

One of the outgrowths of this strong demand is the elevated quits rate. While the headline number declined in January, factors such as the large number of job openings suggest quitting could remain elevated. Similarly, job openings still outnumber unemployed workers, and the ratio of the two metrics is still well below its pre-pandemic baseline. Job seekers are still set to reap benefits from this hot labor market.

The labor market still has the chance to gracefully slow down with demand cooling but not necessarily crashing. But so far the data on openings and turnover don’t show that trend beginning. The labor market continues to power ahead. When and why it slows down remain critical questions for the US economy.