Key points:

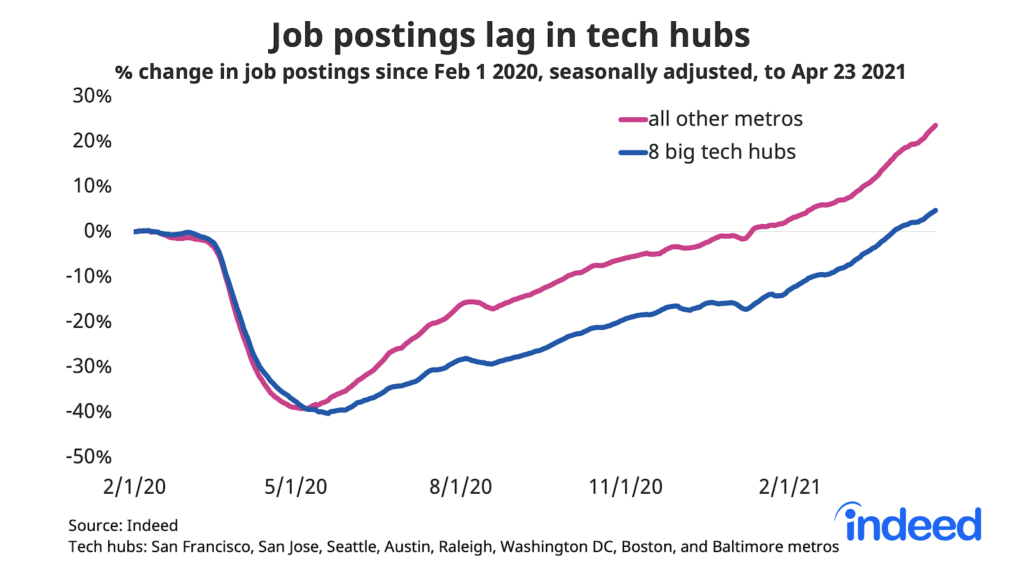

- During the pandemic, tech job postings remained concentrated in eight big tech hubs and did not shift toward smaller or more affordable metros.

- Tech hubs registered steeper declines and slower recoveries in overall job postings than other places.

- Tech job postings in big tech hubs were less likely to mention remote work than tech job postings in other places.

Tech hubs had steeper declines and slower recoveries in job postings on Indeed during the pandemic than other places. But that’s not because tech jobs dispersed. Rather, tech hubs lost other jobs — especially in local service businesses — because larger shares of their residents worked from home. Tech job postings declined nationally, but became slightly more concentrated in big tech hubs like San Francisco, Seattle, Austin, and Washington, DC. Even though people have left tech hubs, tech jobs have not.

At the same time, tech job postings in tech hubs were less likely to mention remote work than such postings elsewhere. During the pandemic, nonremote tech job postings became even more concentrated in big tech hubs than tech postings overall. Remote work might end up benefiting tech employers outside tech hubs most because there are fewer specialized tech workers in those local markets.

Tech hubs kept their share of tech jobs but lagged in other jobs

Throughout the pandemic, overall job postings have lagged in the eight big tech hubs. These hubs — Austin, Baltimore, Boston, Raleigh, San Francisco, San Jose, Seattle, and Washington, DC — had similar plunges in job postings in March and April 2020 as other places, but slower recoveries since then. On April 23, 2021, job postings on Indeed were only 5% above pre-pandemic baselines in the big tech hubs compared with 24% above baseline in all other metropolitan areas.

Sectors outside tech account for the slower recoveries in tech hubs. In fact, tech jobs themselves — software development, information technology operations, and information design — have held up slightly better in the big eight tech hubs than elsewhere.

Put another way, among job postings that mentioned a location, the share of tech job postings nationally in the eight big tech hubs increased by a hair, from 37.46% in the year before the pandemic to 37.53% in the first full year of the pandemic. This continues a pattern evident long before COVID-19. Our two previous close looks at tech jobs, in 2017 and 2019, both found that the eight big tech hubs maintained or increased their shares of US tech jobs.

The big declines in job postings in tech hubs were outside technology, mainly in local service jobs. Retail job postings were down 16% year-over-year in tech hubs, but were flat outside tech hubs. Childcare and food prep postings declined far more in tech hubs than elsewhere. These local service sectors got hit because tech hubs are full of people who can work remotely. Tech hubs have clusters of both tech jobs and related professional services jobs that can be done from home. With high shares of people working from home, local businesses like shops and restaurants have been getting less traffic. As a result, job postings and employment have suffered.

Tech jobs in tech hubs were less likely to be remote

Remote work increased during the pandemic. Indeed job postings in nearly all sectors became more likely to mention remote work. Tech postings mentioned remote work more than postings in all other sectors.

The rise of remote work has the potential to change what a tech hub is. A job based in Seattle but open to remote work is less tied to Seattle than a Seattle job with no remote option. What “remote work” even means is in flux — it can imply anything from working at home a couple of days a week to being truly anywhere always. To see how the geography of tech jobs is shifting, we can remove job postings that are open to remote work from our analysis in order to focus on jobs where location really matters.

Here’s the surprise: Tech jobs in tech hubs were less likely to mention remote work than tech jobs elsewhere. In the eight big tech hubs, 16% of tech jobs mentioned remote work versus 18% of tech jobs in the two dozen smaller tech centers across the country, 19% in other big metros, and 22% in other smaller metros. That has had two implications.

First, nonremote tech job postings have become slightly more concentrated in the eight big tech hubs than tech postings overall.

Second, the concentration of nonremote tech job postings in the big hubs increased more during the pandemic than the concentration of tech postings overall did. The differences are so small that you have to squint hard — and look at hundredths of a percent — to see them. But the key point is that tech jobs are at least as concentrated in tech hubs as before the pandemic, and more so when looking only at jobs where location matters enough that the posting doesn’t mention remote work. The increase of remote work makes location less important for many tech jobs. But jobs for which location still matters have become even more clustered in tech hubs.

These patterns hint that tech firms outside big tech hubs benefit even more from remote work than tech firms in the big hubs. For employers outside those big tech hubs, being open to remote work helps them recruit workers from elsewhere, including workers located in big tech hubs. Of course, employers in big tech hubs already have access to the concentrations of tech workers in those hubs. Even though employers in big tech hubs might embrace remote work to give their employees flexibility, and perhaps save money by paying them less if they move away, remote work more dramatically expands the recruiting pool for tech employers located outside the big hubs.

The geography of tech jobs remained surprisingly stable

Among the eight big tech hubs, tech job postings fell least in Baltimore and Austin and most in Raleigh and Boston. The three hubs with high concentrations of huge tech firms and cutting-edge tech jobs — Seattle, San Jose, and San Francisco — were in the middle of the pack.

The remote shares of tech job postings were lowest in Seattle and San Jose, where the biggest tech companies are headquartered. The drops in tech postings were steeper in Seattle and San Jose than in Baltimore, Austin, and Washington DC, but that gap is smaller when looking at nonremote tech postings only.

Despite these differences among big tech hubs, the tech geography pattern changed little during the pandemic. Tech job postings fell less in metros where tech jobs are more concentrated — especially nonremote tech job postings. That’s consistent with data showing smaller declines in the eight big tech hubs than elsewhere. Also, tech job postings grew faster in metros where job postings outside tech increased more. Other factors, like a metro’s population or cost of living, had no statistically significant relationship with the change in tech job postings.

The pandemic and rise of remote work had a profound effect on tech hubs, which lost jobs in local services at a much steeper rate than other places did. But they held on to their tech jobs better than the rest of the country. Even as remote work increases, tech jobs remain as concentrated in the big tech hubs as before the pandemic.

Methodology

This post compares US job postings on Indeed in the first full year of the pandemic (March 2020 to February 2021) to the year just before the pandemic (March 2019 to February 2020). Tech jobs refer to jobs categorized by Indeed as software development, unless otherwise noted.

The eight big tech hubs are the metropolitan areas with at least 1 million population with the highest shares of local job postings in software development in the year just before the pandemic. The smaller tech centers are the 24 metropolitan areas with populations between 250,000 and 1 million with the highest shares of local job postings in software development in the year just before the pandemic.

The last section is based on a metropolitan-level regression of the change in tech job postings on the pre-pandemic share of local job postings in tech, college attainment, cost of living, population size, racial and ethnic population shares, and seasonal housing unit share.