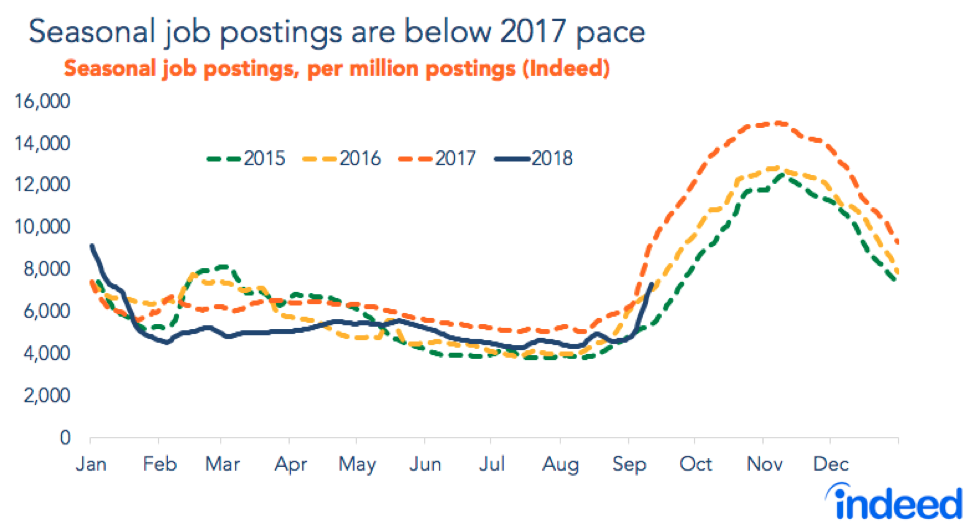

With Labor Day behind us and the school year underway, fall has arrived and summer is a memory. As the seasons change, US employers are beginning to ramp up for their traditional seasonal hiring. But seasonal job postings on Indeed are lagging behind last year’s level, though they’re exceeding the levels in 2015 and 2016.

Previous Indeed research has shown that employers begin posting seasonal jobs in September, right after Labor Day, with an acceleration in postings that peaks in October and November. But this year, as of Sept. 11, the share of seasonal job postings on Indeed is about 21% below the same date last year. At the same time though, this year’s level is 5% higher than the level seen in 2016 and 35% above the 2015 level. That means this year’s seasonal hiring spree will be strong, but probably not as strong as last year. (See our methodology section on how we identify seasonal jobs.)

This is happening when the overall labor market is very strong. So what gives? Two trends are emerging: (1) Seasonal sales job postings are only slightly below last year’s level, while seasonal nonsales jobs are down significantly. (2) It’s possible that more job openings are becoming permanent rather than seasonal.

Not all seasonal jobs are in sales

When we think of holiday seasonal jobs, store salespeople may be what comes to mind. Think of a seasonal beauty consultant at Macy’s or retail sales associate at Target. Retailers are looking for workers to help get through the heavy holiday shopping season. Now, with the US job market the strongest it has been in years, many retailers are finding it difficult to staff up. In recent months, there have been more retail job openings than hires, according to the US Bureau of Labor Statistics.

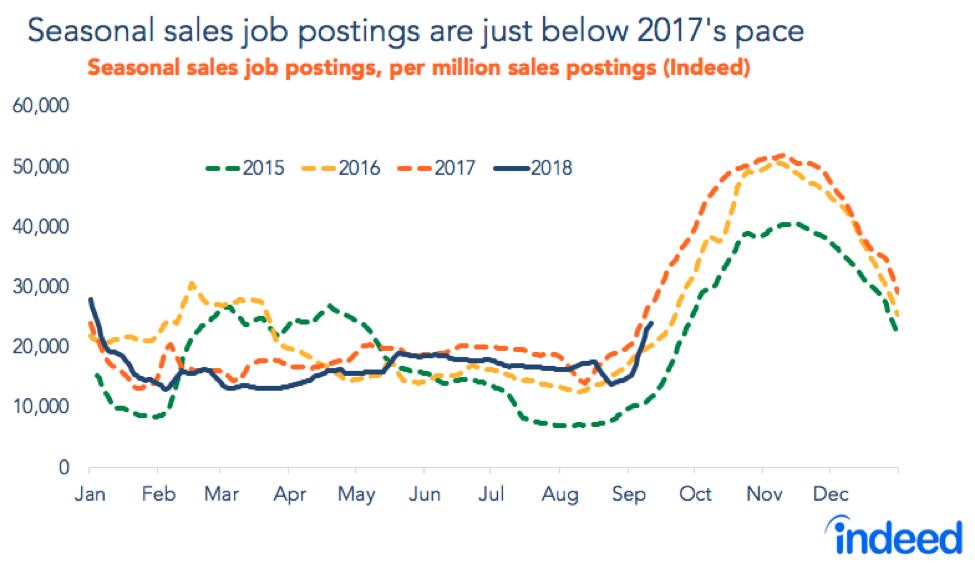

It’s important to stress that, even though sales jobs are by far the biggest seasonal category, seasonal hiring consists of more than just sales jobs. The share of all seasonal job postings that are in sales occupations peaks at around 40% to 45% during the midsummer vacation months and later in the year during the winter shopping holidays, according to Indeed’s job postings over the past two years. While sales jobs are the largest category of seasonal jobs, they’re never a majority.

Let’s start with those seasonal sales jobs. Seasonal sales job postings as a share of all sales postings are lagging behind last year’s levels, but not by much—12% below last year’s levels. However, that’s 18% above the share in 2016 and 105% above (or more than double) the share in 2015 at the same point in the year.

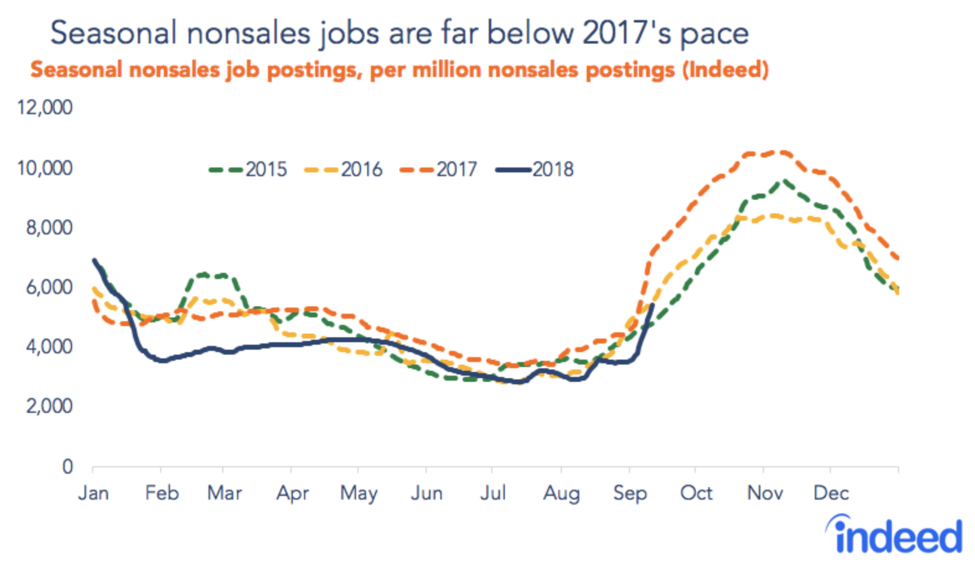

It’s seasonal demand for nonsales jobs that is really down compared with last year. These are for jobs in production, office and administrative support, and transportation occupations. Included are jobs like “seasonal associate”—which is widely used even by nonretail employers and by retailers for nonsales positions—as well as transportation or logistics jobs like truck driver and warehouse worker. The share of seasonal nonsales job postings is down over 25% from last year’s share on the same date. But, like other measures, it’s broadly in line with the previous two years—2% below the 2016 share and 13% above the 2015 share.

Shift from seasonal to permanent

Of course, it’s too early to tell whether this seasonal posting trend will continue and result in fewer seasonal hirings this year compared with 2017. It’s also possible that 2017 was a genuine outlier. But suppose the current trend continues. What could explain the lag in seasonal job postings concentrated in nonsales jobs?

Given the tight labor market overall—and strengthening demand in retail as job openings increase—a bigger phenomenon might be at work here. Employers may be trying to use their traditional seasonal hiring spree as an opportunity to snag full-time workers.

Forthcoming research from my Hiring Lab colleague Nick Bunker finds that retail employers especially are shifting away from part-time offerings toward full-time ones. For example, the part-time share of job postings for sales consultant—a common job in retail—fell by nearly 30 percentage points from 2016 to 2018.

As the job market strengthens, the structure of seasonal jobs may be changing, leading employers to shift from part-time or temporary openings toward more full-time jobs.

What about job seekers?

Meanwhile, job seekers are right on track in looking for seasonal work. The share of seasonal job searches on Indeed as of Sept. 11, 2018—about 1,150 searches per million total searches—is tracking very closely with 2017. This means that, while job seekers are competing with about as many other applicants as last year, they’ll be vying for fewer seasonal opportunities than last year unless there is a pickup in posting volume.

But, again, the fact that there have been more retail job openings than retail hires in recent months may indicate a shift away from seasonal openings to more permanent ones. It’s interesting that employers are shifting away from seasonal jobs even though the share of job seekers looking for seasonal jobs hasn’t fallen.

Where can job seekers find seasonal positions? No surprise—the companies posting the greatest number of seasonal jobs on Indeed are mostly retailers. Macy’s tops the list, with shopping stalwarts Target, Lowe’s, Kohl’s, and Bath & Body Works rounding out the top five. Outside of retail, Cherry Hill Programs, a company specializing in Santa photographs, is also gearing up for heavy holiday hiring (long white beards supplied).

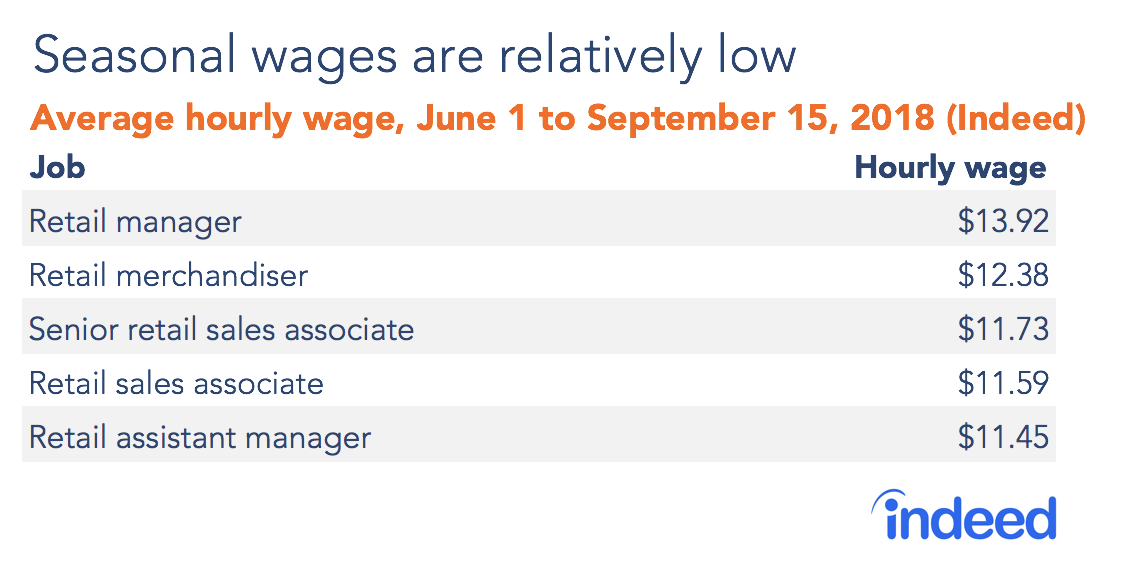

As the seasonal hiring surge gets underway, it bears repeating that many of these jobs pay relatively low wages. Among five common job titles for seasonal work—such as retail manager or retail sales associate—average hourly wages range from about $11.50 to $14.00 per hour.

Methodology

We define seasonal job postings as those with one or more holiday-related terms in the job title, including, but not limited to, “holiday,” “seasonal” and “Christmas.” Seasonal job searches are defined as those containing one or more of the same list of holiday-related terms.

We define sales job postings as those with a two-digit SOC code of 41, which encompasses the Sales and Related Occupations category according to the Bureau of Labor Statistics. Nonsales jobs are all occupations falling outside the Sales and Related Occupations category.

Salary data are gathered from Indeed job postings from June 1, 2018 to Sept. 15, 2018 that listed a salary in the job description. The average hourly wage is calculated as the log average of all salaries posted for that particular job title.

Companies are ranked by the number of seasonal job postings on Indeed from June 1, 2018 to Sept. 15, 2018.