The latest data from the US Bureau of Labor Statistics suggest there are more vacant jobs now in the US than unemployed people. This tight labor market makes it challenging for employers to find job seekers in the right numbers to fill their rosters. On top of that though, a big issue is whether today’s job seekers are well suited to the job opportunities in today’s economy. Economists use the term “mismatch” to describe when job seekers and available positions aren’t aligned. Lately, there’s been a lot of discussion in academic and policy circles about whether the US has a mismatch problem—particularly given the tightening labor market.

When there’s mismatch, some jobs have lots of job seekers but few openings, while others have lots of openings but few job seekers. So just how much mismatch is there in today’s economy? And how has mismatch changed over the past few years as the economy has improved? Using Indeed’s unique data set of job postings and resumes, we took a look at how fast the mix of job opportunities is changing and how well job seekers are keeping up.

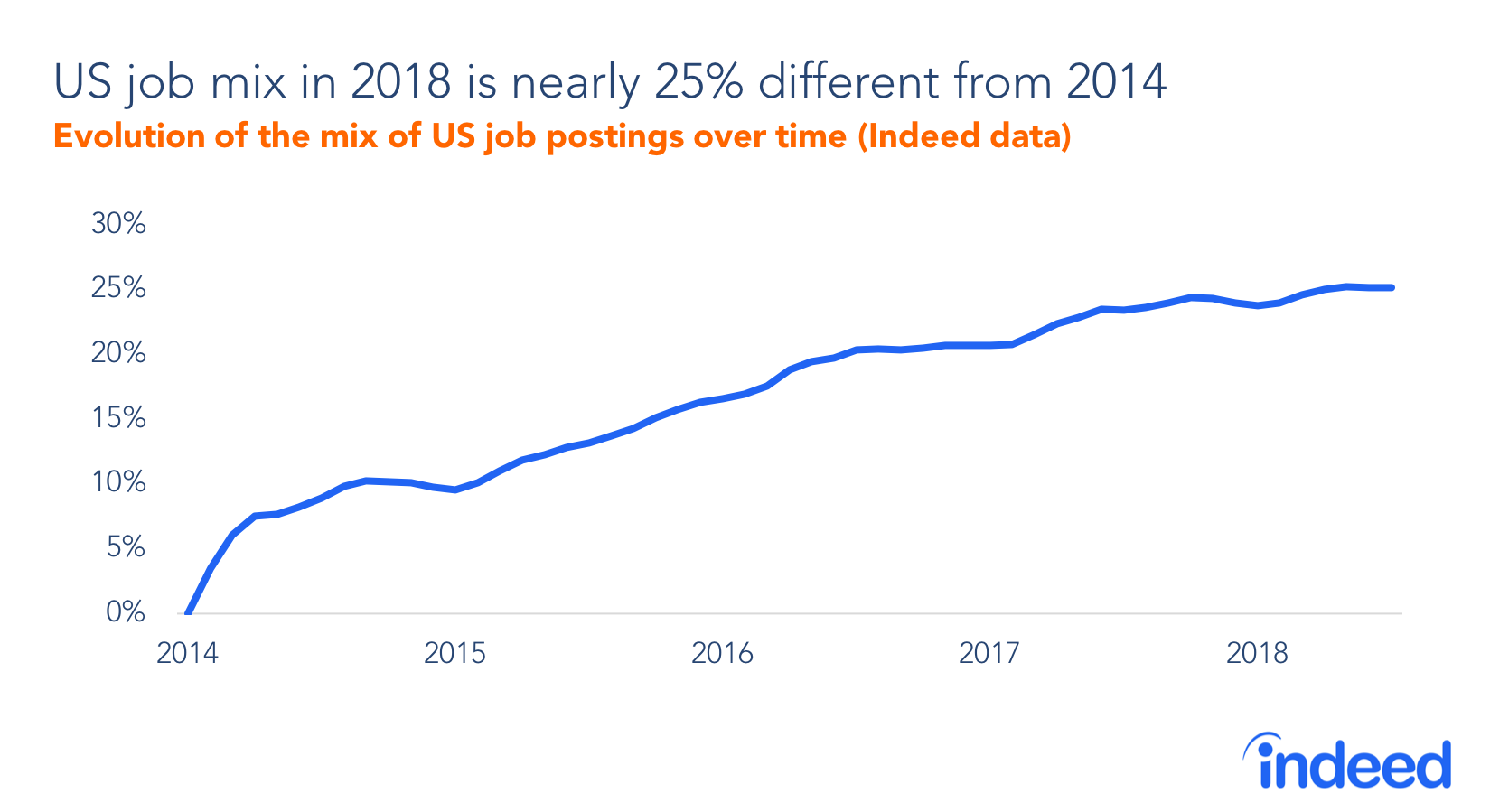

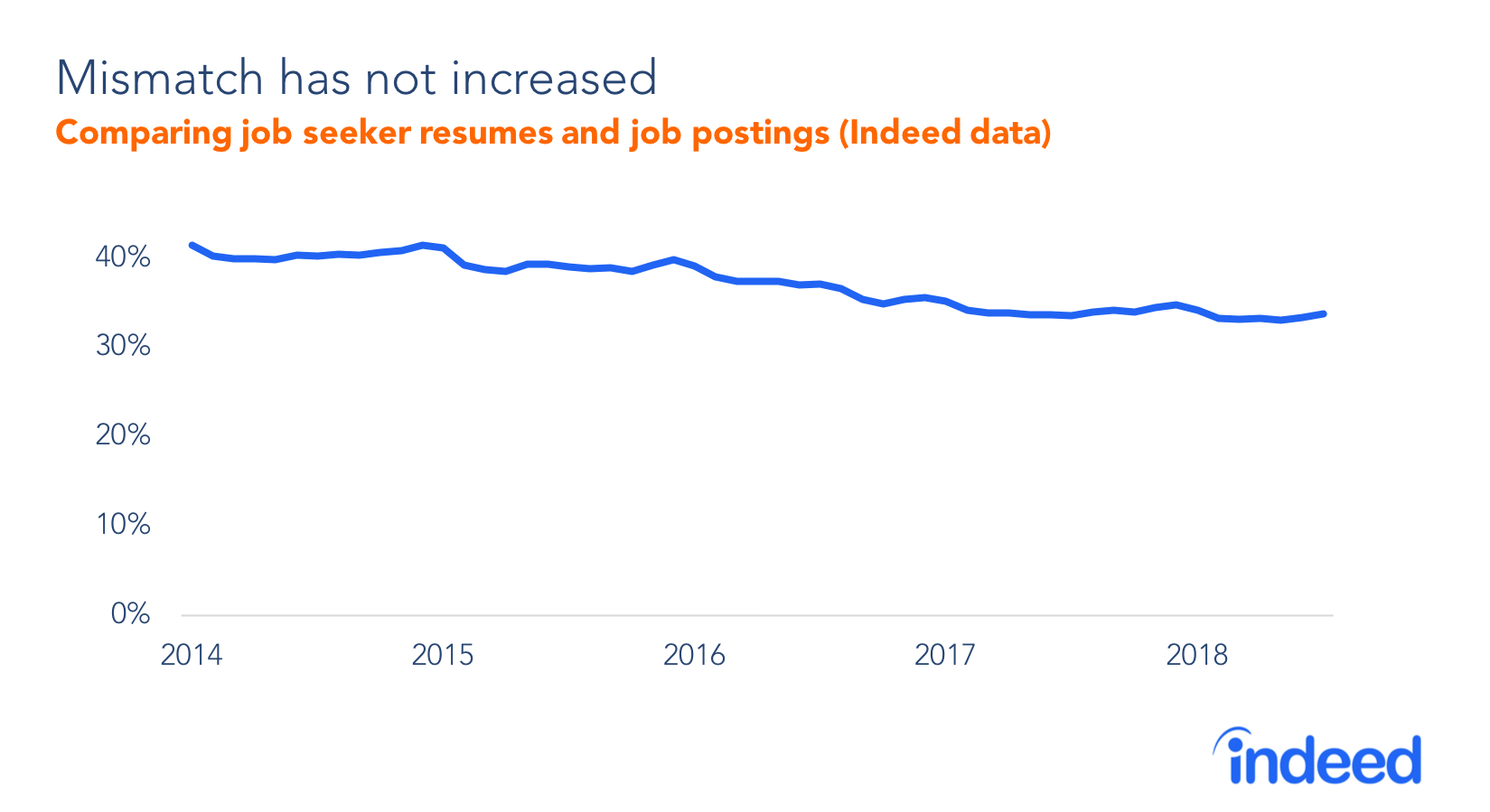

What we’ve found is that the jobs mix has been changing quickly. The distribution of jobs in 2018 is nearly 25% different than it was just four years ago. However, job seekers are doing a good job of keeping up. As the jobs mix has changed, we’re not seeing increased mismatch between job opportunities and job seekers. Instead, mismatch has stayed level since 2017 and perhaps even declined a bit since 2014.

To be sure, the level of mismatch is high enough that it might cause employers some angst. We would need to change about a third of today’s job seekers for them to match today’s job opportunities. So although mismatch hasn’t been getting worse, there are no signs that employers should expect the skills of job seekers to change anytime soon relative to the skills they’re looking for. Moreover, the current level of mismatch may not be as much a concern as first appears. Mismatch can reflect opportunities for employers to hire workers coming out of school, as well as those who are applying for a stretch promotion or have learned all they can in their current roles. A dynamic economy relies on job seekers moving to—and growing into—new roles.

How fast is the labor market changing?

A key part of the discussion around mismatch is exactly how much the opportunities in the job market have changed over the past few years. To quantify this, we compare the mix of job titles in postings monthly over time with the mix in January 2014. Employers use tens of thousands of job title variations to describe their roles. Our analysis is organized around a fixed set of over 6000 normalized job titles which group together slight variations in titles. For example, the normalized title “customer service representative” groups titles such as “customer service associate,” “customer service rep,” and “customer service specialist.” (See methodology notes below). We compare January 2018 with January 2014 to exclude seasonal differences.

Our key finding is that the distribution of jobs in January was 23.8% different than it was just four years before. In other words, nearly a quarter of today’s jobs would need to be changed for the mix of opportunities to be the same as in 2014.

Some jobs are much more prevalent today than they were in 2014, while others are less prevalent. The table shows in rank order which titles are the top contributors to the changing job mix.

Given the popular view that the tech sector has been driving recent major changes in our economy, we might expect technology to dominate the list of job titles that have grown most in the share of postings over the past four years. Surprisingly, we don’t find any tech roles on that list. This doesn’t mean tech roles aren’t growing. Tech is indeed growing quickly, but roles in the sector are specialized and still represent a relatively small share of the economy.

What drives changes in the overall distribution of employment opportunities are shifts in larger categories, such as the retail sector, represented by titles such as “retail sales associate.” In addition, the distribution reflects shifts in broad titles, such as “assistant manager” and “general manager,” the two categories that have registered the biggest growth in labor market share in our analysis.

Looking at titles with shrinking share, it’s important to remember that overall jobs have grown over the past few years, so a share decline does not necessarily mean an absolute drop in the number of job opportunities.

We also shouldn’t interpret these results as representative of a broader category since the normalized titles are narrow. For example, healthcare overall is growing in importance in the US economy. But, within healthcare, the job title mix is changing, with “occupational therapist,” “speech pathologist” and “physical therapist” becoming less common. In addition, such titles as “stylist” and “owner operator driver” are also becoming less common.

How well are job seekers keeping up with the changing job market?

To measure mismatch in the labor market, we compare the normalized job titles of active job seekers’ current or most recent jobs from their resumes with the titles of posted job opportunities.

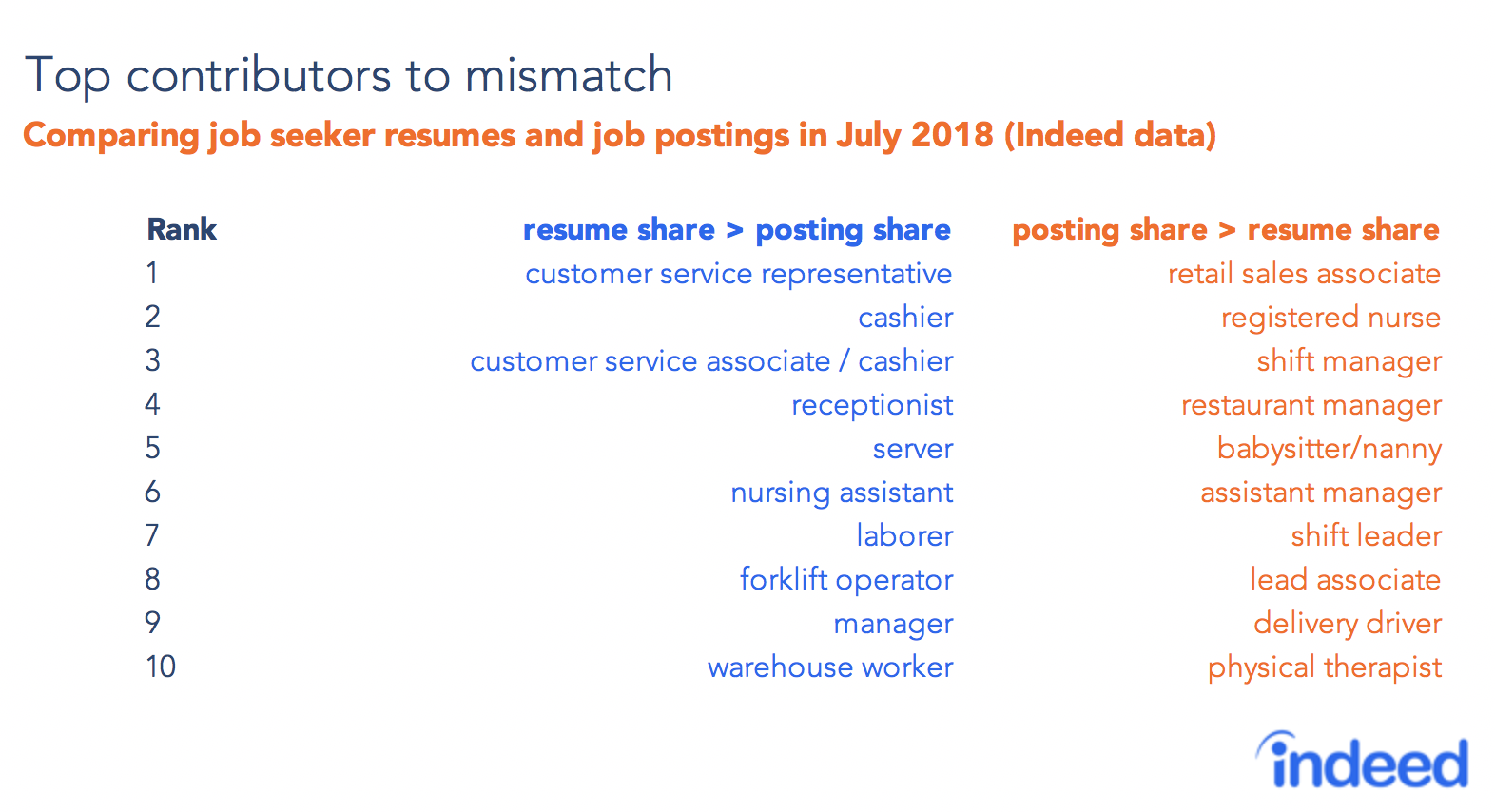

Two key results leap out. First, mismatch is substantial—over a third of job seekers would need to change job titles in order to have the same distribution as job postings. Currently, many job titles have lots of job seekers but few openings, while others have lots of vacancies but few applicants.

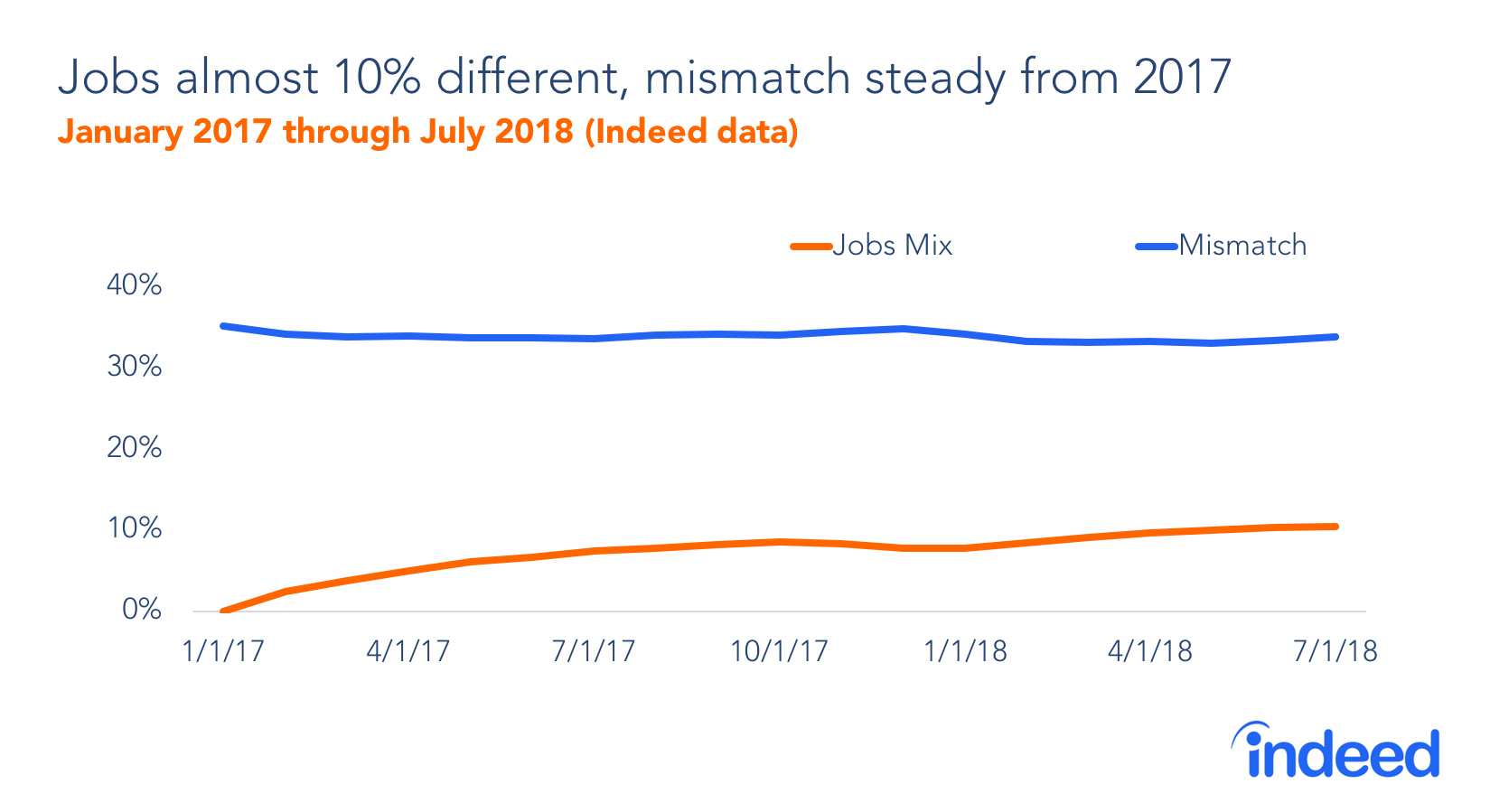

Second, the level of mismatch over the past several years has been trending flat to downward even as the labor market has grown tighter. In other words, job seekers and job opportunities have become, if anything, more similar to each other in recent years.

Given the constraints in Indeed’s data (see methodology), the best period to look at is 2017 to the present, during which mismatch has remained constant. While employers may have fewer applicants for jobs than they did when the economy was weaker, the applicants they are getting now are just as likely to fit the jobs as the applicants they were getting a year ago.

Of course, some jobs are harder—or easier—to hire for. For instance, we consistently hear that it is particularly challenging to fill registered nurse vacancies, and our data bears that out (see table below.) And even though “physical therapist” has declined in share of job opportunities over the past few years, the share of physical therapist job opportunities is still greater than the share of job seekers.

Even in today’s tight job market, mismatch isn’t rising

If we focus on the period starting in January 2017, mismatch in the US economy has been statistically flat. But underneath, both job opportunities and job seekers have been changing. These changes are not pulling opportunities and job searches apart. Rather, they are changing in ways that keep mismatch steady. Comparing July 2018 with January 2017, mismatch has stayed around 33-35% even as job postings have changed over 10%.

Over this period, the labor market has tightened markedly. The unemployment rate went from 4.8% in January 2017 to 3.9% in July 2018. This means employers are facing greater challenges to fill roles, but there is no worsening match between the candidate pool and existing job opportunities aggravating those difficulties.

Importantly, a one-third level of mismatch does not indicate that a third of positions in the US are impossible to fill. Employers facing mismatch are seeing applicants who do not have the exact titles of the jobs they are hiring for on their resumes. But that does not mean they do not have the skills or the know-how to do the job, or that they could not be developed into a good fit through training. In a dynamic economy, new workers are constantly entering the workforce from school. Others are applying for promotions. Both show up as mismatches, proving perfect alignment between job seekers and employers should not be expected or aimed for.

Jobs are changing, but mismatch is holding steady

This measure of mismatch is preliminary. We will continue to track it over the coming months to see how it evolves. Our analysis suggests that mismatch between job seekers and job opportunities has not increased, despite an almost 25% change in the mix of job opportunities over the past four years. In a tight labor market with fewer candidates overall, employers may struggle to find qualified candidates who precisely fit their requirements. To fill roles, employers may need to expand their on-the-job training or look at applicants they might not have considered in the past.