We regularly update this report to track the performance of the labour market.

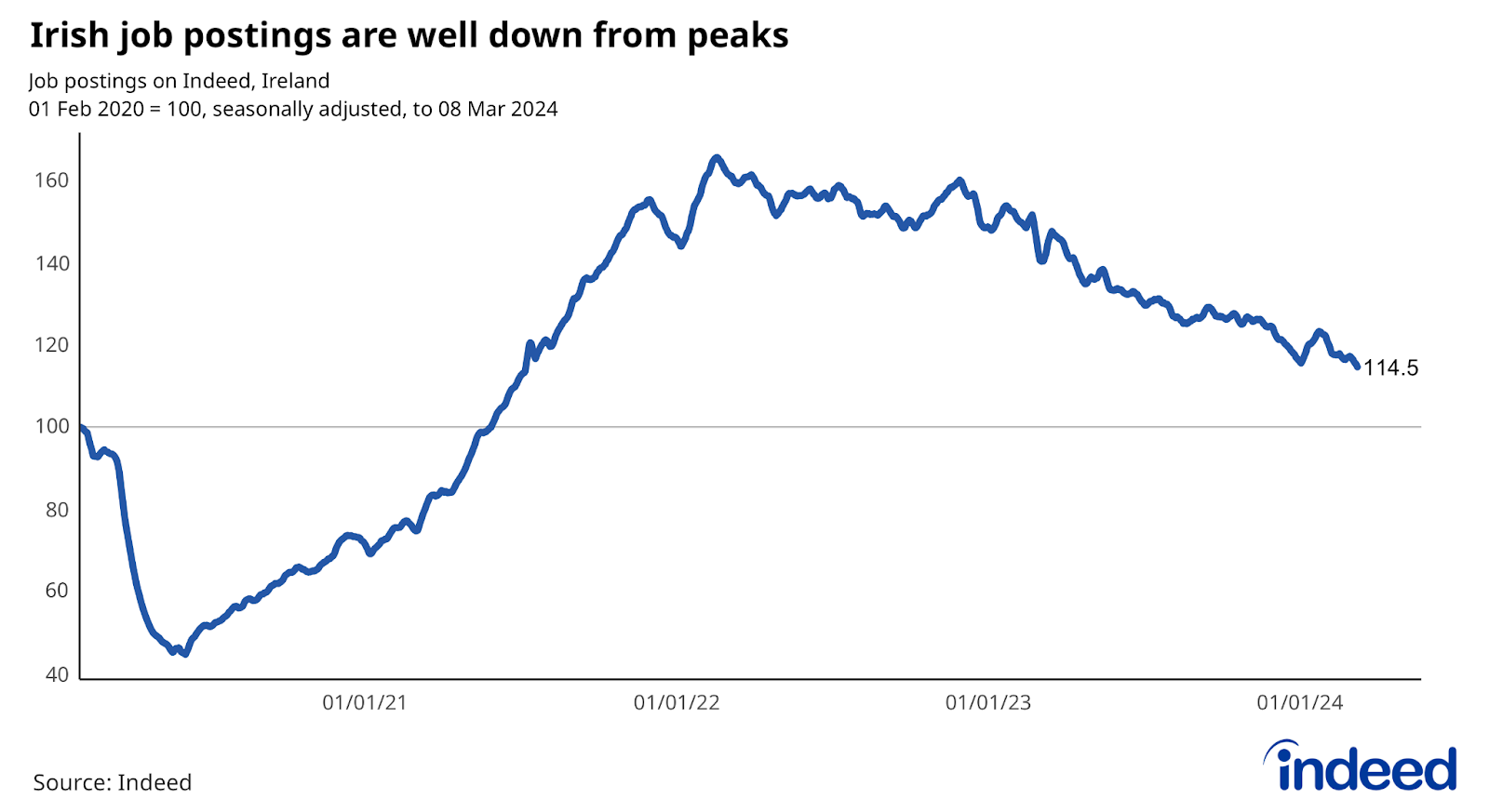

Irish job postings on Indeed have continued to soften in recent months, descending from post-pandemic highs. The level of job postings has been gradually falling and normalising after peaking in February 2022 at 65% above their pre-pandemic baseline. As of 8 March, the Indeed Job Postings Index for Ireland — a real-time measure of labour market activity — was 15% above its 1 February, 2020, pre-pandemic baseline (seasonally adjusted). Hiring demand remains reasonably healthy, with the Irish economy expected to grow at a moderate pace this year.

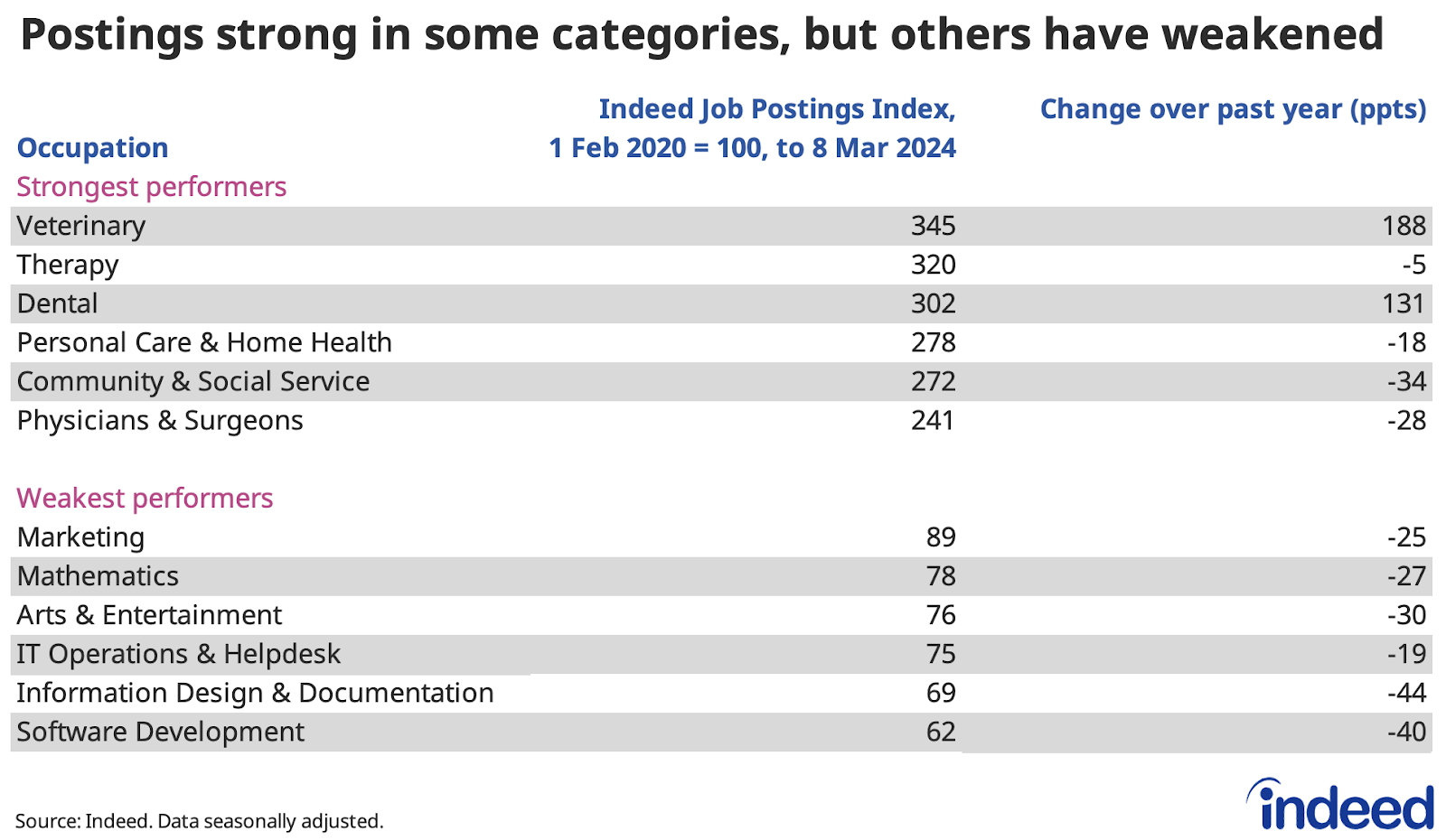

Some categories have boomed while others lag

We continue to see considerable variation in the strength of job postings across occupational categories. Healthcare-related occupations dominate the categories where job postings are farthest above pre-pandemic levels. Three tech categories take the bottom places in the table.

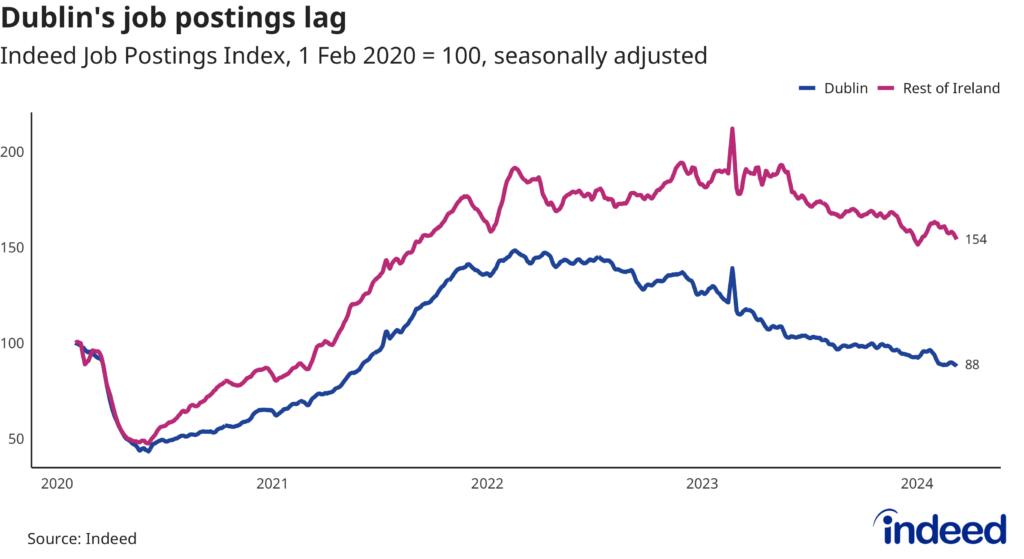

Dublin job postings weaker than rest of Ireland

Dublin continues to underperform the rest of Ireland, with job postings in the capital now sitting 12% below their pre-pandemic level. That partly reflects Dublin’s greater exposure to slowdowns in tech and certain professional services categories. Across the rest of Ireland, job postings stand 54% above their pre-pandemic level.

We will continue to provide regular updates on these trends as the situation evolves. We also host the data behind the postings trends plots on Github as downloadable CSV files. Typically, the site will be updated with the latest data one day after the respective Hiring Lab tracker is published.

Methodology

All figures in this blog post are the percentage change in seasonally-adjusted job postings since 1 February, 2020, using a seven-day trailing average. 1 February, 2020, is our pre-pandemic baseline. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. Each series, including the national trend, occupational sectors, and sub-national geographies, is seasonally adjusted separately. We adopted this new methodology in January 2021.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.