Today’s ONS figures paint a familiar picture of continued gradual softening and easing pay pressures in the UK labour market, but it remains an incremental process. Regular pay growth edged down to 6.1% year-on-year in the three months to January — from 6.2% in the previous period — but is still running well above levels where the Bank of England would be comfortable initiating interest rate cuts.

The data also point to ongoing constraints on labour supply, with unemployment remaining low and inactivity well above its pre-pandemic level. But the dubious veracity of the Labour Force Survey data makes it harder to accurately gauge underlying dynamics and the extent to which conditions for a sustained moderation of pay pressures are falling into place. Rate setters remain focused on a range of forward indicators of pay pressures as a guide, including various surveys and advertised pay for new hires.

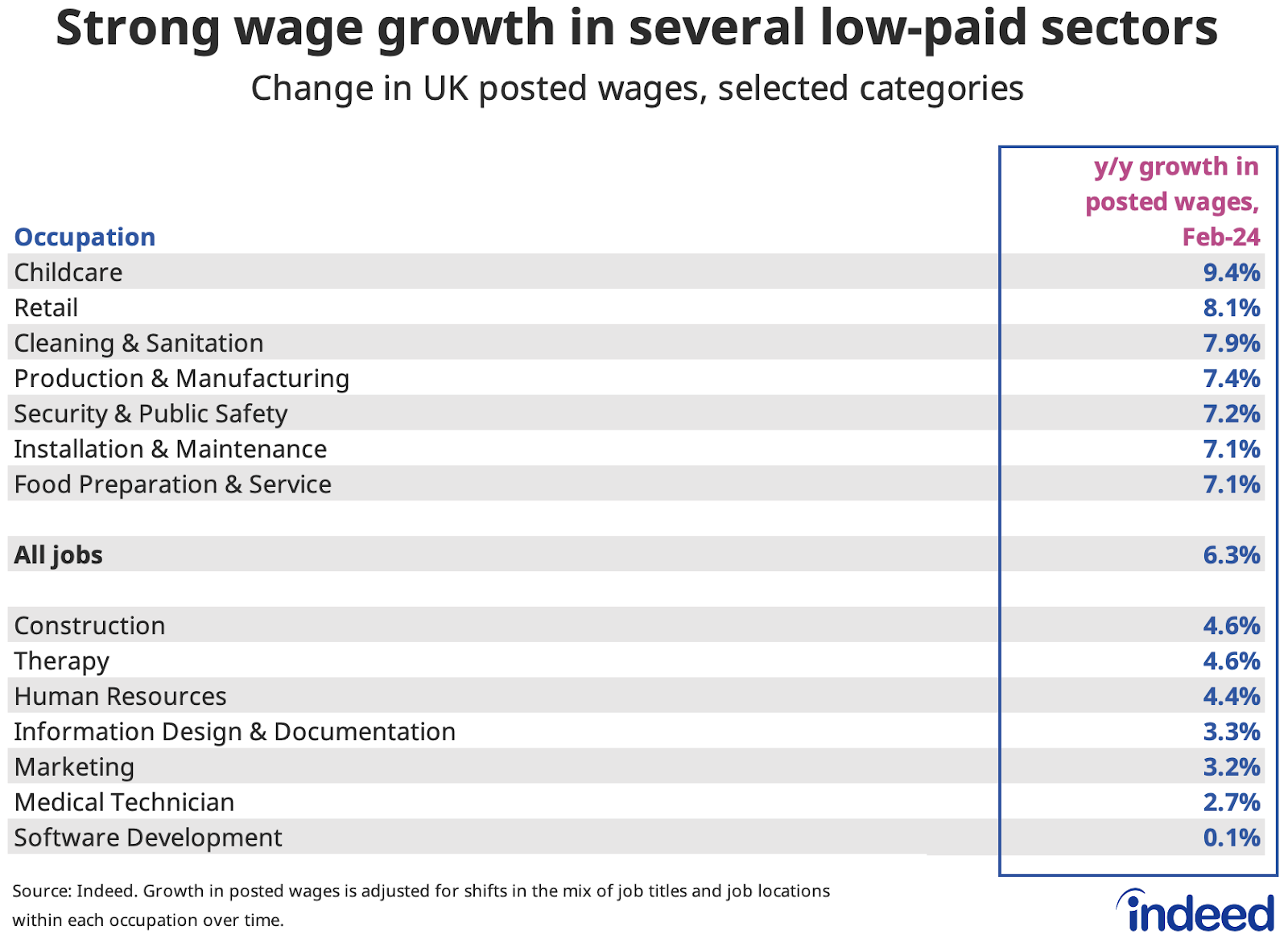

Indeed Wage Tracker (IWT) data on posted wages shows a similar picture of wage growth that remains high but is gradually easing. Annual wage growth as measured by the IWT slowed to 6.3% in February, down from 6.5% in January, and around one percentage point lower than last summer’s peak. The Bank of England has raised its key benchmark interest rate as part of its efforts to combat high inflation. Many observers are now waiting for cuts to those same rates in a bid to jumpstart economic growth, but the BoE will not do so until it is convinced that inflation is under control — and high wage growth can often be a contributor to elevated inflation. Annual wage growth closer to historic norms of 3% to 3.5% is what the BoE will be looking for before it feels fully confident that the time to cut rates has arrived.

Year-on-year posted wage growth remains particularly strong in lower-paid occupations including childcare, cleaning, retail, and hospitality all running in the 7-9% range. Hiring challenges persist in these areas, despite the broad cooling in the labour market, supporting relatively stronger pay increases for these workers. The latest round of supermarket wage rises is the most recent example of this, in advance of a 9.8% rise in the National Living Wage coming into effect in April.