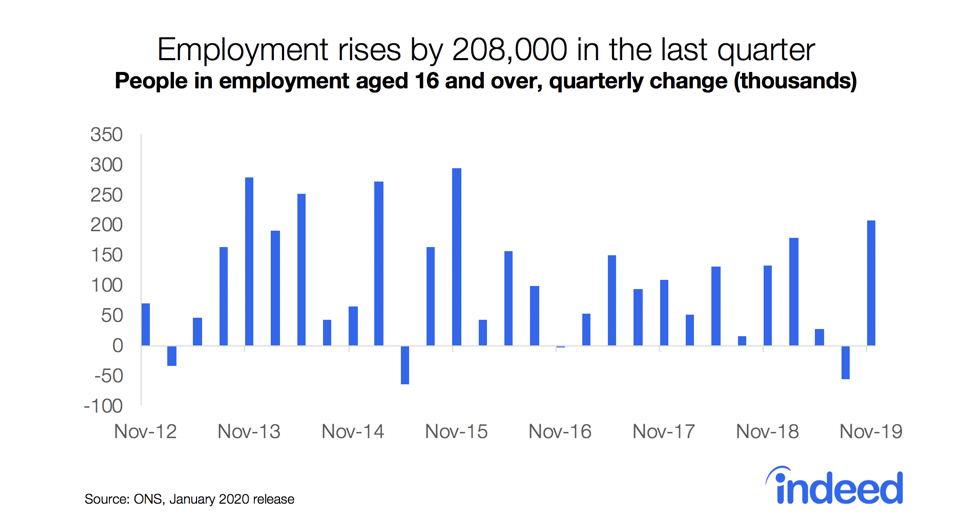

The ONS figures continue to highlight a very tight labour market. Unemployment remains low at 4.1%, while vacancies hit a new record at almost 1.3 million. Hiring has been occurring apace — with so many vacancies available, workers have been able to jump ship easily. Job-to-job moves hit record numbers in the final quarter of 2021.

Several aspects of the data are concerning though. Economic inactivity remains stubbornly high, with participation rates in older age groups having dropped dramatically during the pandemic and a worrying increase in the number of people leaving the labour force due to long-term sickness. Hours worked have been rising as the economy has rebounded. But amid persistently challenging hiring conditions, that’s increasingly been covered by more people reporting that they are working longer hours than they would like.

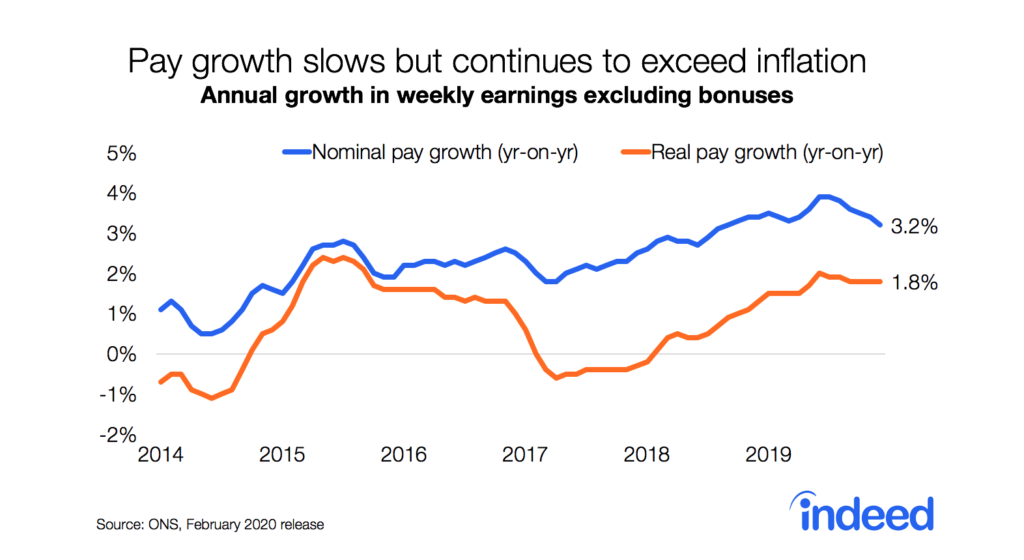

Headline wage growth figures show that pay is falling in real terms, with regular average weekly earnings rising 3.7% year over year (y/y) in December, below the rate of consumer price inflation. But a different ONS pay metric paints a conflicting picture, with early estimates for January signalling median monthly pay up by an above-inflation 6.3% y/y. Our own analysis of advertised wages in Indeed job postings is more in line with the (more subdued) average weekly earnings figures, though the picture varies considerably by occupation and job role.