Key Points

- Advertised pay in job postings rose 3.4% year-over-year in January, lagging behind consumer price inflation.

- Above-inflation pay growth is still limited to a handful of categories where hiring challenges have been most acute, such as distribution, construction, manufacturing, hospitality and healthcare.

- Delving deeper into individual professions, sales consultants, lorry drivers and chefs are the job titles with the strongest pay growth, while a range of skilled trades, software developers, healthcare professionals and warehouse packers have also seen double-digit wage increases.

Growth of advertised wages in UK job postings slowed in January. Looking at advertised pay in Indeed job postings offers several advantages — timeliness, ability to look at detailed job categories, and reflecting what employers advertise as hiring conditions change. Using a methodology that controls for shifts in the mix of job titles over time, annual pay growth dipped from 4.1% to 3.4%.

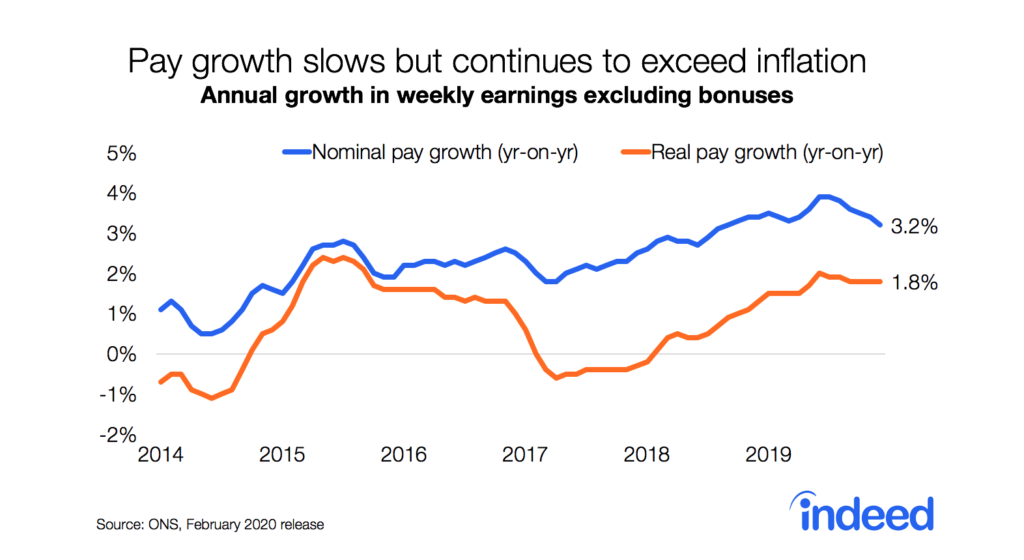

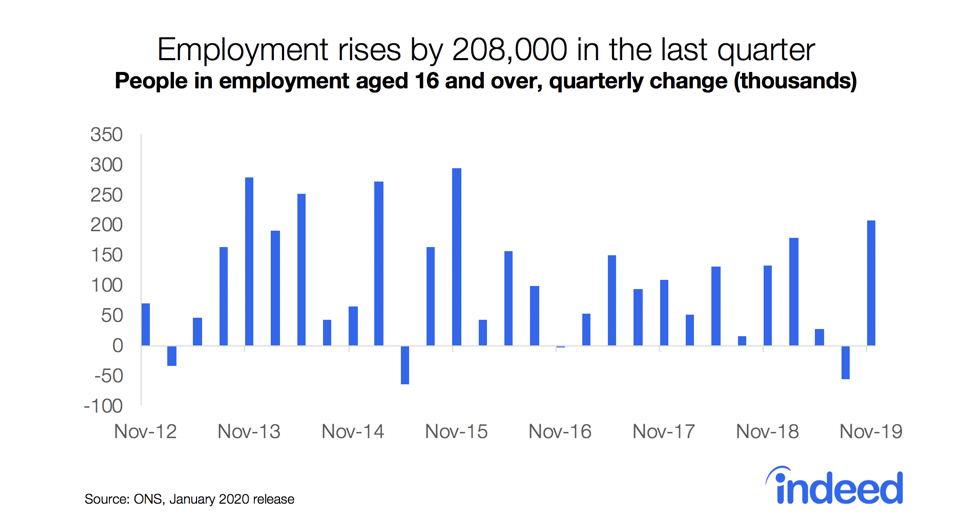

With consumer price inflation rising to 4.8% on the CPIH (Consumer Prices Index including owner occupiers’ housing costs) measure (and 5.5% on the CPI – Consumer Prices Index – measure) and expected to hit 7% over the coming months amid looming energy price rises and tax hikes, workers face a real-terms pay squeeze. Office for National Statistics (ONS) data signal 3.8% year over year (y/y) headline regular pay growth, with 3.5% y/y single-month growth in November.

Workers in some occupations are in a position to bargain for higher wages to cushion themselves from this cost of living squeeze, but the picture varies considerably across different job categories and job titles.

Inflation-busting pay rises limited to a few categories

A handful of occupations continue to see strong wage growth, typically those facing the biggest recruitment challenges. Advertised pay in the driving category (which includes all types of drivers) rose 8.3% y/y in January, closely followed by construction at 8.2% and production & manufacturing at 7.9%.

Personal care & home health, food preparation & service, loading & stocking and nursing also saw marked increases. Most of those categories have seen jobseeker interest fail to keep pace with rising demand for workers recently (albeit driving saw a rise in interest following extensive media coverage around shortages and rising pay for roles such as HGV drivers).

At the other end of the scale, advertised pay growth in some occupations has been minimal or even negative. Despite reports of soaring pay for newly qualified lawyers at elite ‘magic circle’ law firms in the City of London, that’s not replicated across the broader legal category, which saw a 3.4% y/y decline in advertised salaries.

Most of the categories at the bottom of the pay growth rankings have seen increases in relative candidate interest since the beginning of the pandemic. That’s a reflection of the fact that job posting growth generally hasn’t been as spectacular as in certain other occupations and that other job features such as remote work feasibility may have boosted their attractiveness to jobseekers.

Sales consultants see biggest annual rise in salaries

While occupational categories can be quite broad, we can drill down to the job title level to see which roles are seeing the fastest pay increases.

Though the overall sales occupation saw minimal wage growth, one job title within that category bucked the trend. Sales consultants saw a 20.1% y/y increase in advertised wages, the largest of all job titles. Part of that strength could reflect changing job mix even within that title, as it includes various types of job, including relatively low-paid in-store retail sales consultants as well as higher-paid business-to-business sales roles.

It’s not surprising to see lorry drivers featuring among the largest wage increases following well-publicised chronic shortages in the sector, with 7.5 tonne drivers and HGV drivers seeing eye-catching 16.2% and 14.5% rises respectively.

Hiring challenges in hospitality have seen the services of line cooks and sous chefs at a premium, with advertised wages up over 15%. A range of skilled trades, software developers, healthcare professionals and warehouse packers have also seen double-digit wage increases.

Methodology

Wage and salary data are extracted from job postings. Wage growth figures were calculated using regression analysis that accounted for shifts in the mix of job titles and job locations within each sectoral category over time. Further details here. Job title analysis includes roles with at least 10,000 observations of advertised pay in job postings since 2019.

Information is based on publicly available information on the Indeed UK website, is limited to the UK, is not a projection of future events, and includes both paid and unpaid job solicitations.