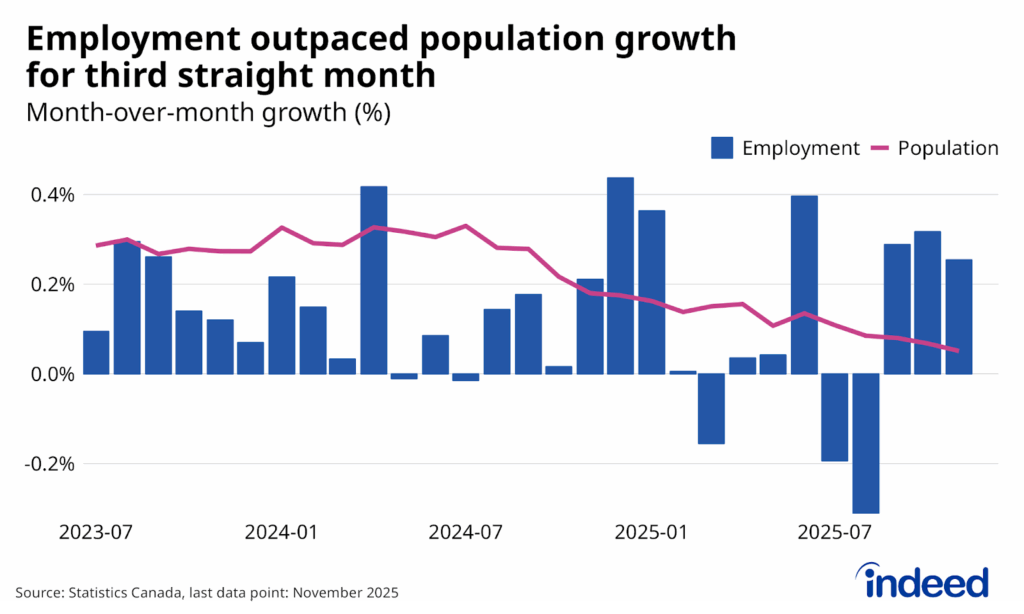

Hopefully, three months make a trend. Canadian employment jumped for a third straight month in November, led by part-time gains concentrated among youth. The result was an outsized 0.4 percentage point drop in the unemployment rate, which came from both rising employment and a downtick in the labour force participation rate. Nonetheless, with jobs growing faster than population, the employment rate rose.

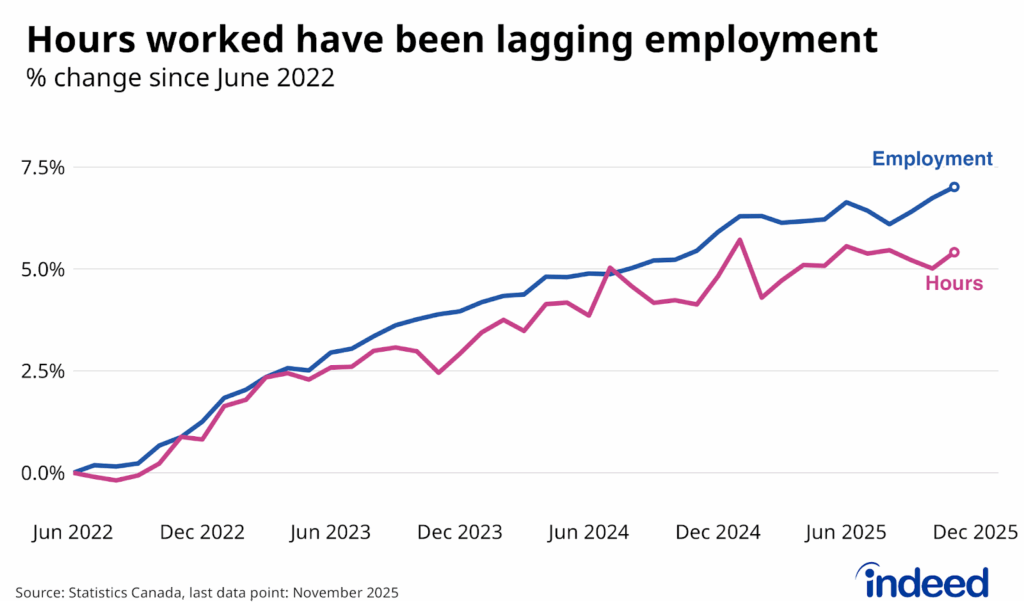

The details in the recent Labour Force Survey data don’t suggest a roaring economy. Hours worked ticked up in November, but had been soft in prior months. Meanwhile, the breadth of the November employment increase across industries was limited, with health care and social assistance accounting for 84% of the net increase, offsetting declines in wholesale and retail, and manufacturing. And while the ranks of private sector employees are up since the summer, self-employment has been reversing gains from a year earlier.

Even with three solid months in hand, caution is always required when interpreting the Labour Force Survey. One trend we’d like to see continue amid the monthly volatility was the notable drop in the youth unemployment rate from 14.1% to 12.8%. The jobless rate of Canadians under 25 is still elevated compared to other groups, but this is a positive development, even though most of the youth improvement was driven by part-time employment. If the progress continues, even amid an otherwise lukewarm economic situation, it could be a sign that the slowdown in population growth from abroad is contributing to an improvement in youth employment rates, but more data is needed to confirm the trend.