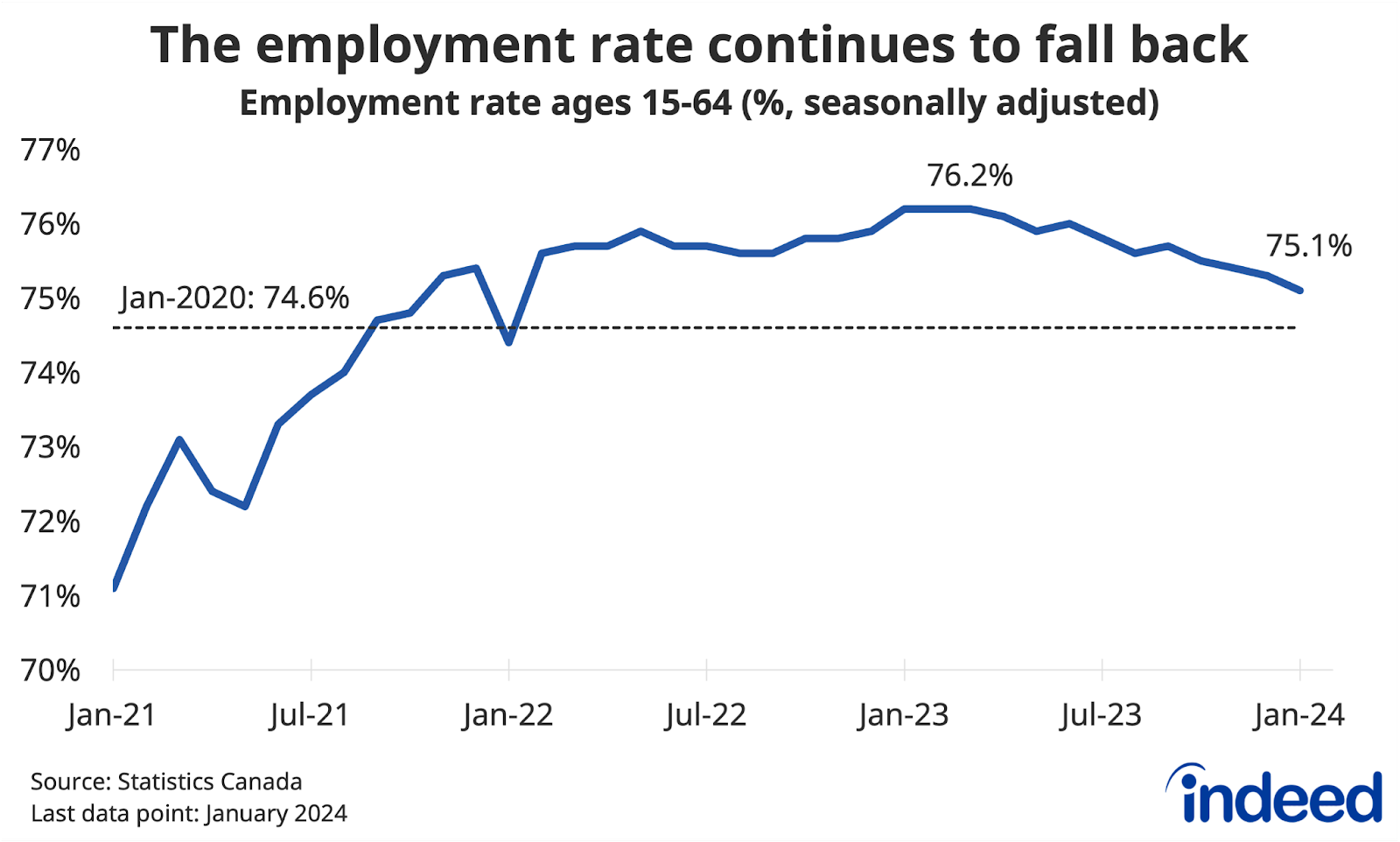

The Canadian labour market kicked off 2024 in familiar fashion, continuing its gradual, but not dramatic, cooling. Employment posted a seemingly respectable increase (37,000), but once again job growth failed to match population growth. The result was a fourth consecutive downtick in the overall employment rate. In contrast to the lagging job numbers, the unemployment rate also edged lower, but only because of a slip in labour force participation. The still-low jobless rate suggests the labour market is in decent shape for now, but trending in the wrong direction.

Details in the report were mixed. The composition of job growth didn’t show great labour market health: on-net, gains only came from part-time positions, as well as the public sector. However, the news was more positive for hours worked, which posted their strongest monthly gain in a year after flatlining over the second half of 2023.

Wage growth also maintained its recent trajectory, but unlike among employment figures, the trends for pay have been strong. Hourly earnings growth chugged ahead at a 5.3% year-over-year rate, once again out of step with the otherwise lackluster pace of the Canadian economy. It looks like the tug-of-war between wages and prices has continued to start the year. There was room for wages to somewhat catch up to prices after inflation popped in 2022, without much of a feedback loop. But if pay gains persist at this rate, inflation could linger higher than Canadians, and the Bank of Canada, hope.