Key points:

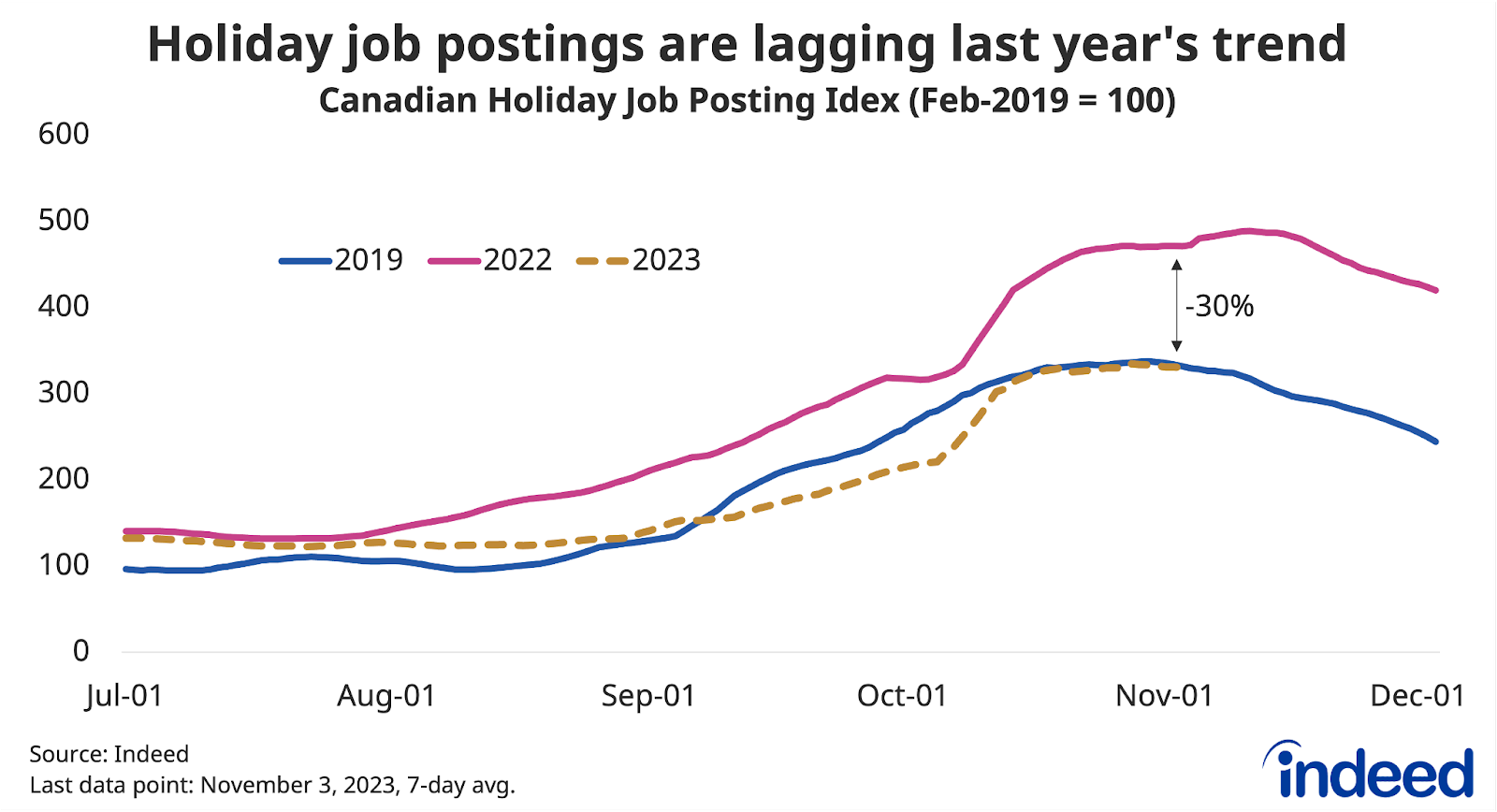

- As of November 3rd, Canadian holiday job postings were down 30% from a year earlier, as seasonal recruiting started slow in September, and failed to catch up in October.

- The drop-off over the past year has coincided with a broader decline in Canadian job postings, but holiday postings in early November were at their pre-pandemic level while overall postings remained above, suggesting factors beyond the macro-economy — such as the rise of e-commerce — are also weighing on seasonal demand.

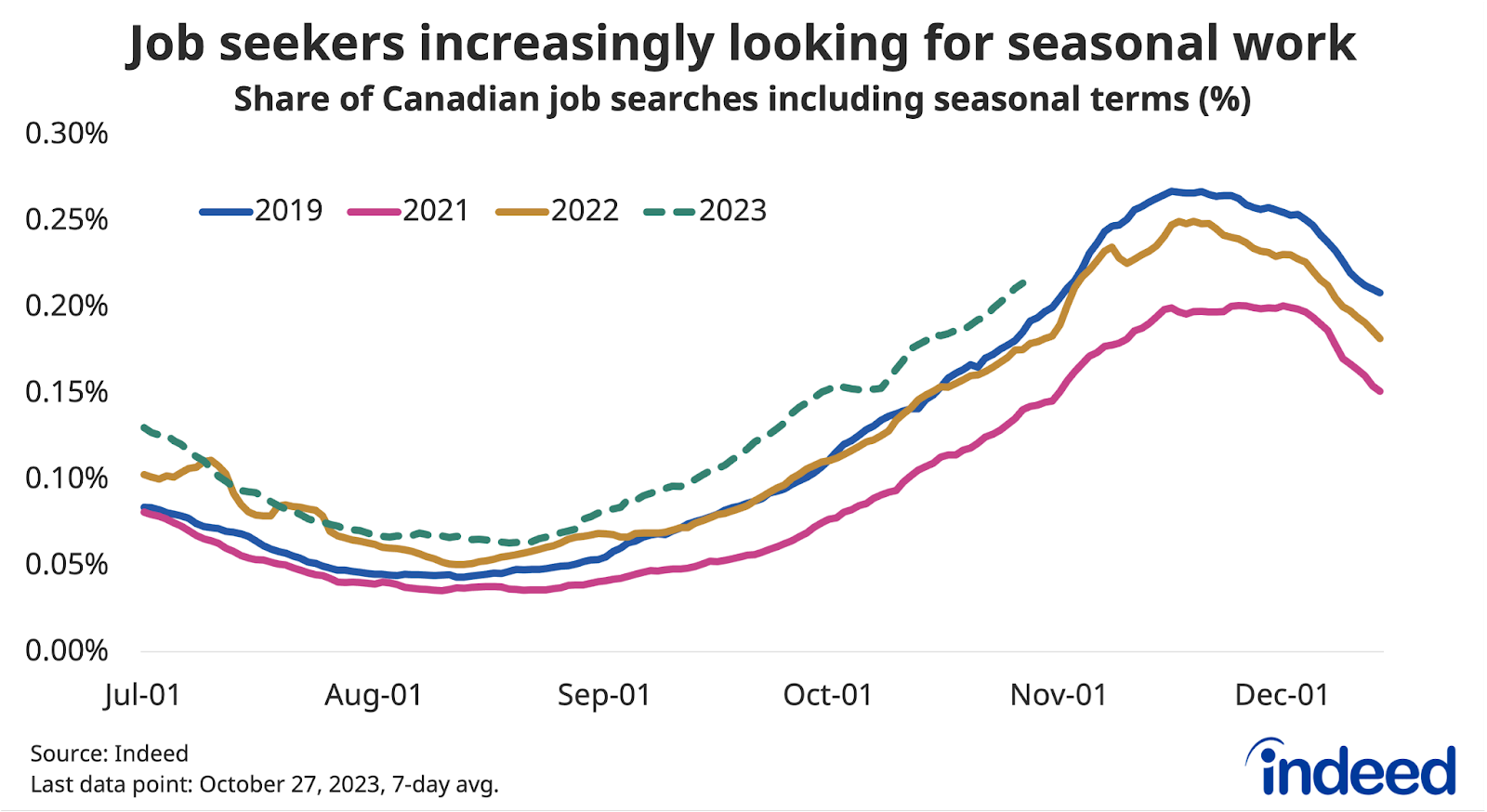

- The share of total job seeker searches mentioning holiday-related terms is higher than it’s been in recent years; consistent with weaker economic conditions facing those looking for work, while also suggesting an easier hiring environment for seasonal employers following some challenging years.

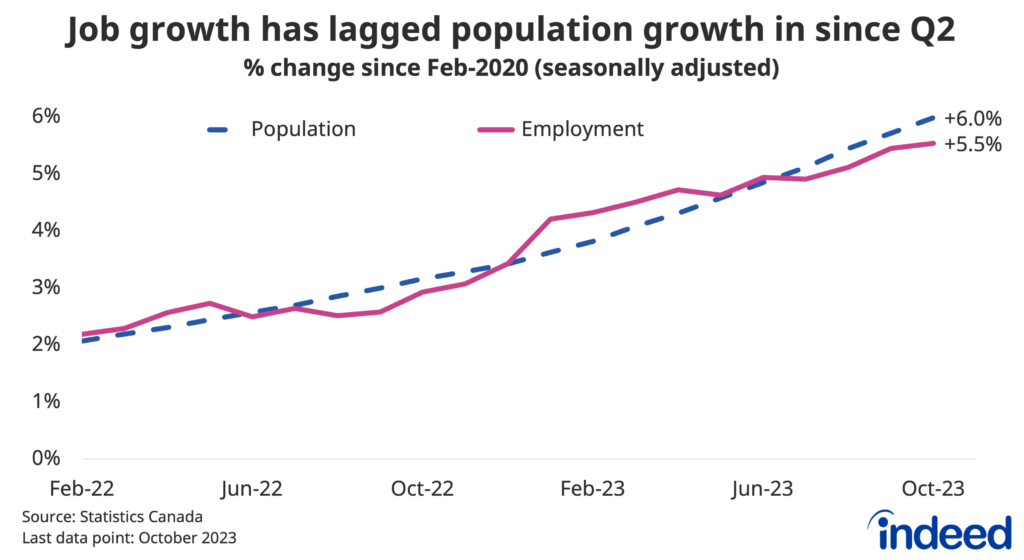

Every September, Canadian employers start recruiting workers for the holiday season, ramping up their efforts even further in October. However, in early November, Canadian holiday-related job postings on Indeed were down 30% compared to a year earlier. Seasonal recruitment started slow in September this year, and while it picked up in October, it wasn’t enough to close the gap. Instead, holiday-related job postings as of November 3rd were similar to where they stood at the same point in 2019 (-0.4%).

Both the macro and industry-specific trends appear to have impacted holiday postings. These job ads — which include terms like “holiday,” “seasonal,” and “Christmas” in their job titles — are predominantly for retail-related roles, as more than half of seasonal postings in October were for some form of sales associate or customer service representative.

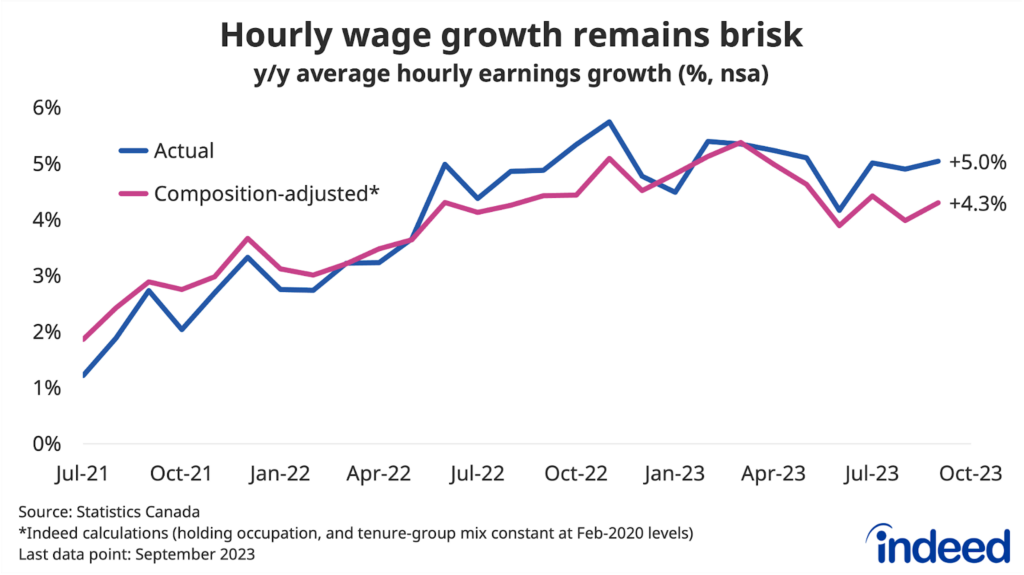

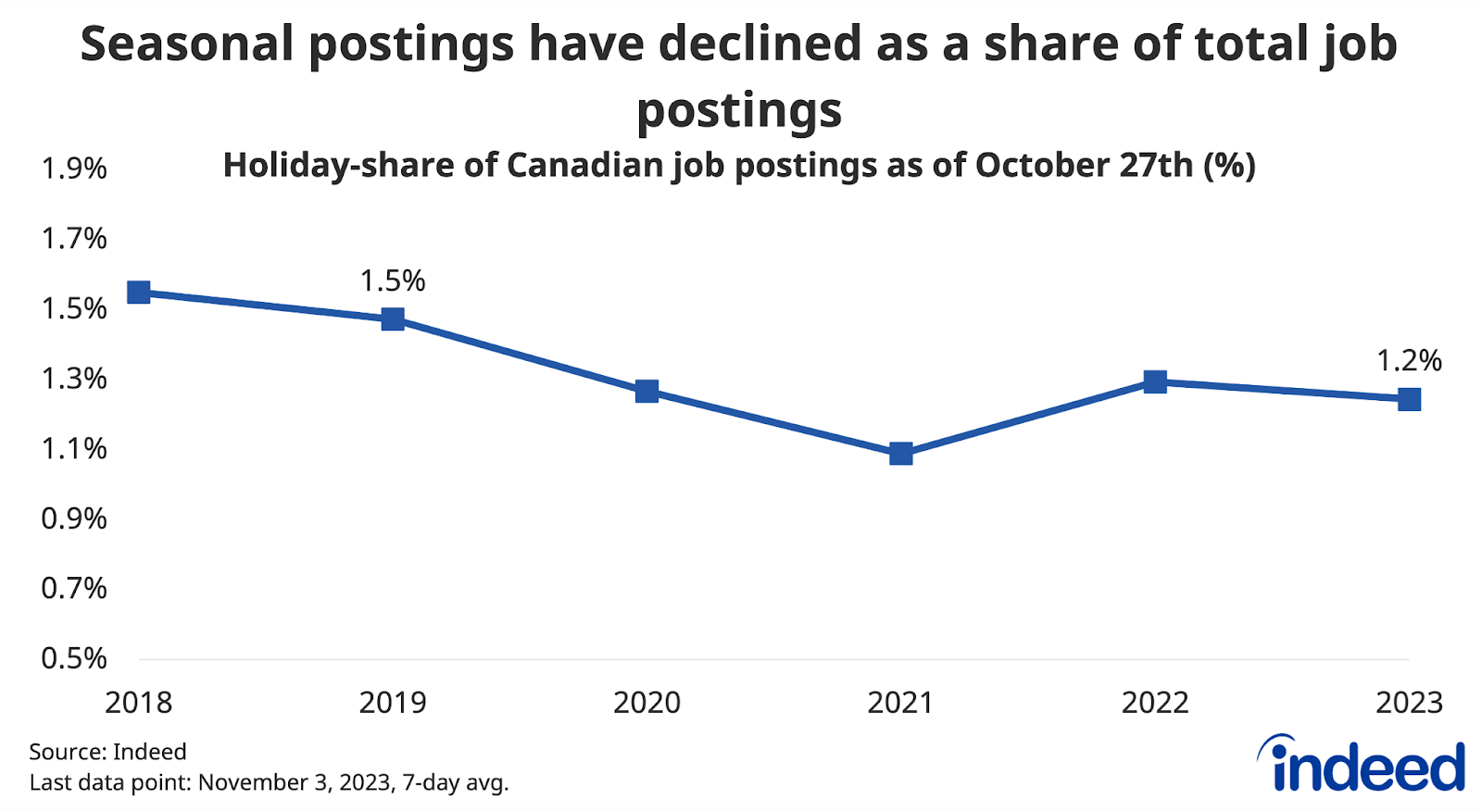

As of November 3rd, economy-wide job postings were down 27% year-over-year, similar to the decline in holiday-specific posts, pointing to the latter’s link to the recent broad-based decline in employer demand. But despite the annual decline, total Canadian job postings were still up 18% from four years earlier. As a result, holiday posts represented only 1.2% of all postings as of early November 2023, down from 1.5% at the same time in 2019.

This drop-off in holiday posting share from 2019 suggests other trends beyond the macro economy have also influenced demand for seasonal hiring. Holiday job postings in 2022 weren’t as elevated as postings overall, a potential reflection of several factors including a shift to e-commerce sales, changes in foot traffic at large urban malls, and different commuting patterns surrounding the rise of remote work.

Job seeker interest in seasonal work strongest in years

Filling seasonal openings in recent years likely hasn’t been easy for many employers, even though holiday hiring appetite hasn’t been as strong as the rest of the economy. However, this year could be different, and not just because employer demand has cooled: job seekers are also increasingly looking for seasonal work.

Job searches explicitly including seasonal terms are a small share of overall Canadian job seeker activity on Indeed, but provide a barometer for interest in job opportunities over the holidays. In both 2020 and 2021, the share of searches featuring these terms was well below pre-pandemic levels. But in 2022 it rebounded to its 2019 trend, and the share has been even higher in 2023. As of November 3rd, 2023, seasonal-related searches stood at 2.4 searches per thousand Canadian job seeker searches, compared to 2.1 per thousand a year earlier.

Solid levels of seasonal job seeker interest at least partly reflect the normalization of daily life as the pandemic has waned. But it also comes at a time when the Canadian labour market has weakened somewhat — including for younger workers — as the unemployment rate among those aged 15-to-24 in October stood at 11.4%, compared to 9.5% at the start of the year.

As a result, the elevated rate of seasonal searches could, at least in part, be a sign that job seekers aren’t as confident finding work elsewhere, at a time when the overall economic outlook is subdued. Given the time crunch employers face when filling positions over the holidays, seasonal retail offers at least a temporary bridge for job seekers looking for more permanent work. Meanwhile, the softer labour market could make filling these job openings easier than in recent years.

Methodology

We track holiday-related job postings by tallying job postings on Indeed Canada that use terms like ‘Christmas,’ ‘xmas,’ ‘santa,’ ‘holiday,’ ‘seasonal,’‘advent,’ as well as their French equivalents, while excluding terms like ‘technician,’ ‘labourer,’ ‘lifeguard’ that aren’t unique to the holiday season. We track job seeker interest in seasonal jobs by counting the number of searchers on Indeed Canada using these same terms. All numbers in the post represent seven-day moving averages.

The number of job postings on Indeed, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.