Key Points

- Canadian jobs approached the end of 2021 closer to their pre-pandemic levels than US employment did, led by stronger rebounds across a range of mid- and higher-paying industries.

- Canada’s faster recovery is apparent across a range of demographic groups, including parents and non-parents, and has been aided by workers of different education levels shifting to higher-paying occupations.

- Job postings are well above pre-pandemic levels in both Canada and the US, but so far the US is seeing more effects of a tightening labour market, such as job hopping and wage growth.

- There’s been a shift away from self-employment in Canada, but not the US.

As the Canadian labour market approached the end of 2021, through November, it was in much better shape than it had been at the beginning of the year. Second and third COVID-19 waves stalled the economic recovery, but those setbacks proved temporary and employment now stands close to its pre-pandemic level. Whether the gap has fully closed depends on which set of Canadian job numbers are used: the more-upbeat Labour Force Survey (LFS) or the slightly weaker Survey of Employment, Payrolls, and Hours (SEPH).

Notably, Canada’s employment rebound is also doing well compared with the US recovery. Employment is closer to pre-pandemic levels in Canada after plunging similarly to the US early in the crisis. This contrast holds even after accounting for Canada’s faster working-age population growth since early 2020. A deeper dive into the cross-country comparison highlights areas of similarity and difference that illustrate key developments in the Canadian labour market since the start of the crisis, and what to watch for in 2022.

Higher-paying industries drive Canada’s faster recovery

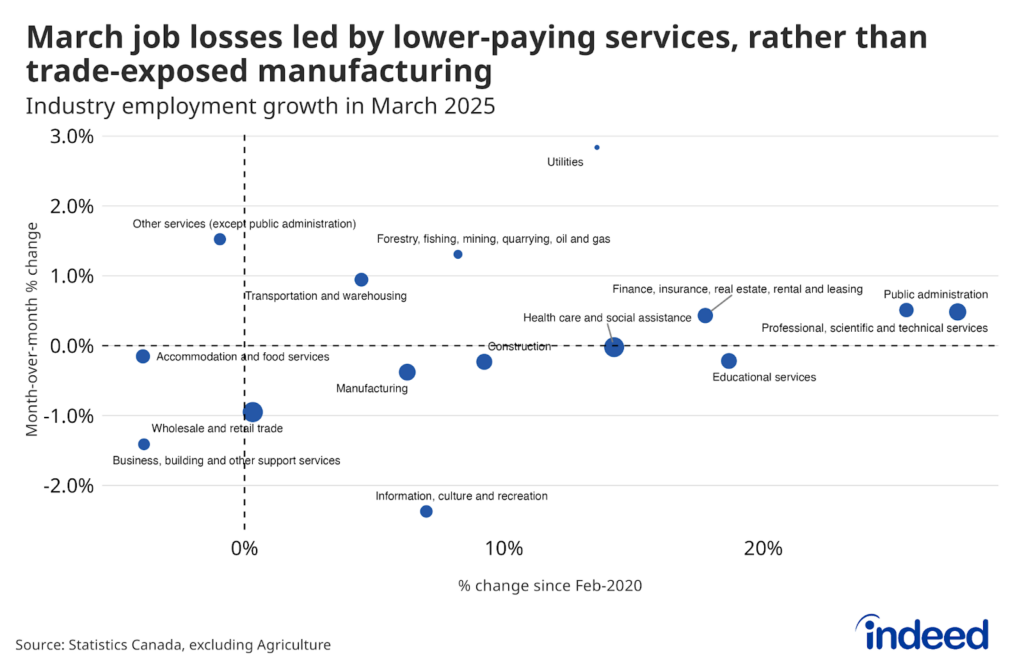

The pattern of a faster Canadian employment rebound than in the US isn’t universal across industries. Rather, Canada’s relative strength has mainly come from mid- and, especially, high-paying industries. As of October, Canadian payrolls in industries with average weekly earnings in the upper third of the 2019 pay distribution were up 3.3% from their pre-pandemic level. The same industries in the US were still down 1.7% as of November. This gap reflects stronger Canadian growth in areas like professional and technical services, finance, and construction, as well as ongoing weakness in US public administration, as well as mining and logging.

Mid-paying industries have also outperformed in Canada, albeit by a lesser degree. Rebounds in educational services, and especially health care and social assistance, have been stronger in Canada. In the US, employment in both sectors is still down more than 3% from pre-pandemic levels. Meanwhile, manufacturing payrolls are a tad closer to February 2020 levels in Canada.

By contrast, lower-paying industries still have further to recover in Canada than in the US. This primarily reflects greater weakness in the Canadian leisure and hospitality sector, which includes accommodation and food services, as well as arts, entertainment, and recreation. While Canadian leisure and hospitality payrolls were starting to catch up with those in the US this past summer, they were still off 14% from their February 2020 levels in October compared with an 8% decline in the US as of November. The probable explanation? Public health restrictions were relaxed earlier south of the border.

There isn’t a clear explanation why mid- and higher-paying sectors have rebounded more in Canada. On some dimensions, like real GDP growth, the economic recovery has actually been stronger in the US. And though the pandemic has generally been more severe in the US, many of the sectors most directly affected have fared better there.

Policy differences, like the Canada Emergency Wage Subsidy, could have played a role, although the subsidy was also used widely in industries where Canadian payrolls didn’t outperform those in the US, including several lower-paying sectors. That said, for industries with many public sector jobs, like government, health care, and education, differences in how services are funded, such as tighter budgets at the state and local government levels, might have contributed to Canada’s relative strength. In other sectors, like tech, different foreign migration trends could also be boosting Canadian growth.

Employment rates have rebounded faster in Canada across a range of groups

The stronger recovery of employment in Canada is evident across many demographic groups. One group differing substantially is mothers ages 25-54 with children under 13. This group’s employment rate in the US is further from pre-pandemic levels than those of men and women without children in the same age bracket, as well as fathers with younger kids. In Canada, the share of parents and non-parents ages 25-54 who are working is higher than it was two years ago. Mothers of young children are tied with fathers for the largest increase. Differences in securing childcare during the pandemic could be contributing to this contrast, though childcare has also been a particular challenge in many parts of Canada.

The Canadian employment rebound has also been relatively broad-based across education levels. This breadth partly reflects that people of varying education levels have shifted toward higher-paying job types. For instance, this November, 21% of those ages 25-54 with a high school diploma or less were working in occupations typically in the upper third of the pay scale, compared with 18.7% two years earlier. Similar, albeit less dramatic shifts have occurred among university and other post-secondary grads.

The ability of some in the Canadian workforce to shift occupations has probably helped speed the pace of the labour market recovery. It could also be a sign that some employers are hiring candidates they previously would have passed over, opening new opportunities for growth, but also raising potential challenges if new hires require greater on-the-job training

Other pandemic labour market shifts have been more pronounced in the US

Employer hiring appetite has surged to well beyond its pre-pandemic levels on both sides of the border. Job postings on Indeed in both Canada and the US plunged in spring 2020, but then gradually clawed back those losses over the second half of the year. Then, in early 2021, the recovery shifted into high gear. As of early December, Indeed job ads in both countries were up roughly 60% from pre-pandemic levels, reflecting broad-based strength across occupations.

While employer demand has rebounded similarly from early pandemic levels, the reverberations have been felt much more in the US. Canadian wage growth held up well in 2020, according to SEPH’s fixed-weight index of hourly earnings. Pay gains then cooled earlier this year, before perking up during the 2021 third quarter to 2.6% year-over-year. In the US, wage growth has shot up a lot more, especially recently. Hourly wages and salaries of private sector workers accelerated to 4.6% year-over-year growth in the third quarter, according to the Bureau of Labor Statistics Employment Cost Index. Wages in the US leisure and hospitality sector have taken off even more.

A related shift that’s more evident in the US is the rate at which workers are hopping between jobs. While the share of employed workers switching jobs in a given month has rebounded substantially in the US, Canada’s job changing rate was relatively subdued this year, only showing a bit of life toward the end of the year. The surge in American workers leaving jobs is visible across a range of sectors, but the quit rate has especially jumped in several lower-wage industries.

Faster wage growth and more job hopping in the US raises a chicken-or-egg question. Higher rates of job switching could be putting greater pressure on employers to raise wages to retain existing staff. On the flip side, one reason workers might be switching jobs is that they’re securing better wages elsewhere. American employers on Indeed are often more aggressive in offering perks like signing bonuses than their Canadian counterparts.

Self-employment evolving differently

Canada and the US also exhibit contrasting recent self-employment trends. In Canada, self-employment has slid as the overall job market has recovered. Some of this decline likely reflects workers leaving self-employment to secure abundant traditional employment opportunities instead. In contrast, despite the surge in employer job openings, self-employment in the US this year is above pre-pandemic levels.

What can the US comparison tell us about the year ahead in Canada?

Canada’s labour market recovery is ahead of that in the US on some dimensions and behind on others. Employment levels in several mid- and higher-paying industries are doing relatively well. The main questions here for the year ahead aren’t about whether there will be a recovery, but rather whether the factors that have driven solid job growth can push employment still higher.

At the lower end of the wage spectrum in Canada, sectors like leisure and hospitality have a way to go to catch up with the US, let alone achieve a full recovery. The latest surge in Canadian COVID-19 cases and resulting public-health restrictions suggests some recent progress will reverse in the near-term.

Looking further ahead, the extent of the rebound will also hinge on how much interest job seekers show in lower-paying roles. Urgent job search among unemployed Canadians has increased since the Canada Recovery Benefit wound down in late October, according to the Indeed Job Search Survey. However, there has been little reversal of the early pandemic decline in relative job seeker interest per posting in several lower-wage, non-remote job categories.

Among the key questions in the year ahead is whether Canada follows the US lead in wage growth and job hopping, especially in lower-paying parts of the labour market. The implications could be significant — for households at a time of elevated inflation and shrinking government support, and for the officials who set monetary and fiscal policy.