A downbeat report. The momentum in the job numbers at the turn of the year ended up short-lived. Conditions weakened in March, as employment slipped following a flat February, while hours worked barely rebounded following a sharp weather-induced drop. The employment decline was concentrated among full-time private sector employees, only partially offset by a rise in self-employment, which has perked up in recent months.

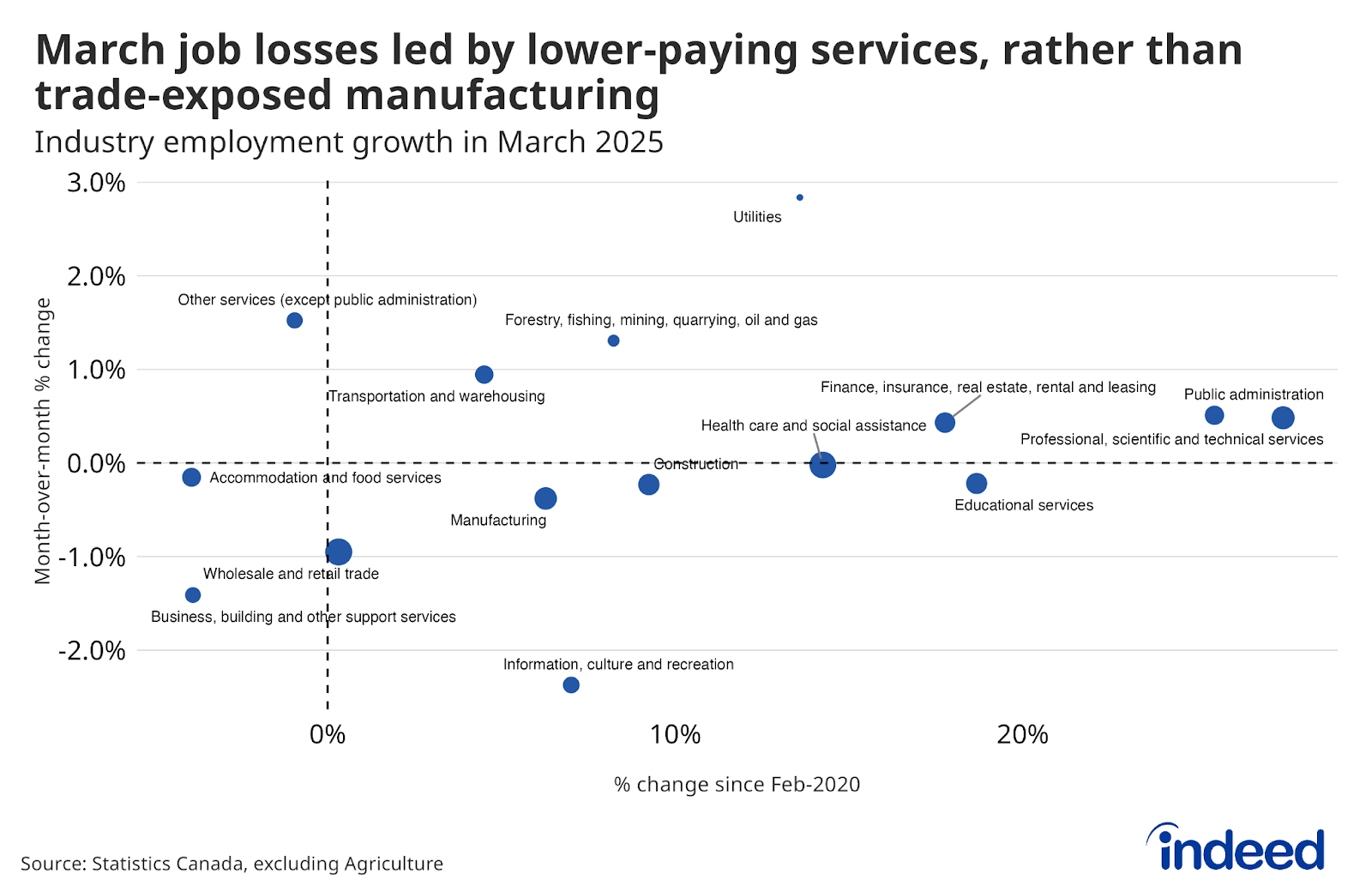

With tariff winds swirling, the natural question is how much they contributed to the soft March numbers. However, the breakdown in changes at the industry level didn’t show a smoking gun. Employment declines were particularly sharp in lower-paying services like information and culture, business and building services, and retail and wholesale trade. Meanwhile, the more trade-exposed manufacturing industry also slipped, but the decline was within the sector’s typical monthly volatility, while jobs in natural resources ticked up.

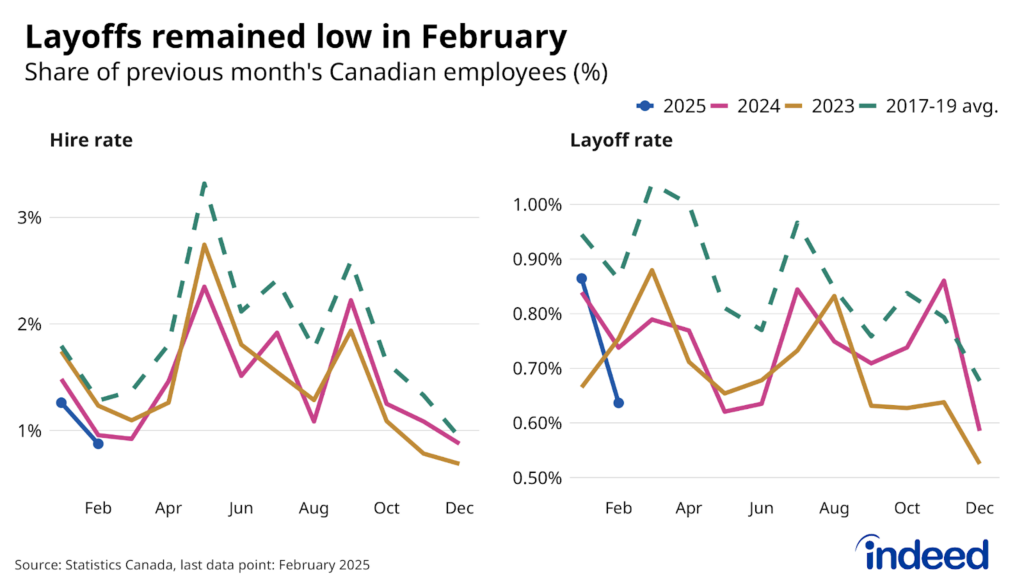

Instead, March’s weakness likely stemmed from trends that weighed on the job market in 2024, namely, slow hiring, which has made it more challenging for those out of work to land a job. Job postings on Indeed ticked down slightly in the month, but demand throughout the past year hasn’t been sufficient to help job seekers find work quickly. The result is that long-term unemployment is now trending up.

The unemployment rate ended the first quarter at 6.7%, matching where it stood in August. This rate isn’t bad by historic standards, but we’re still waiting for the real hit from the trade war. With global stock markets now falling, the storm clouds on the horizon are quickly approaching.