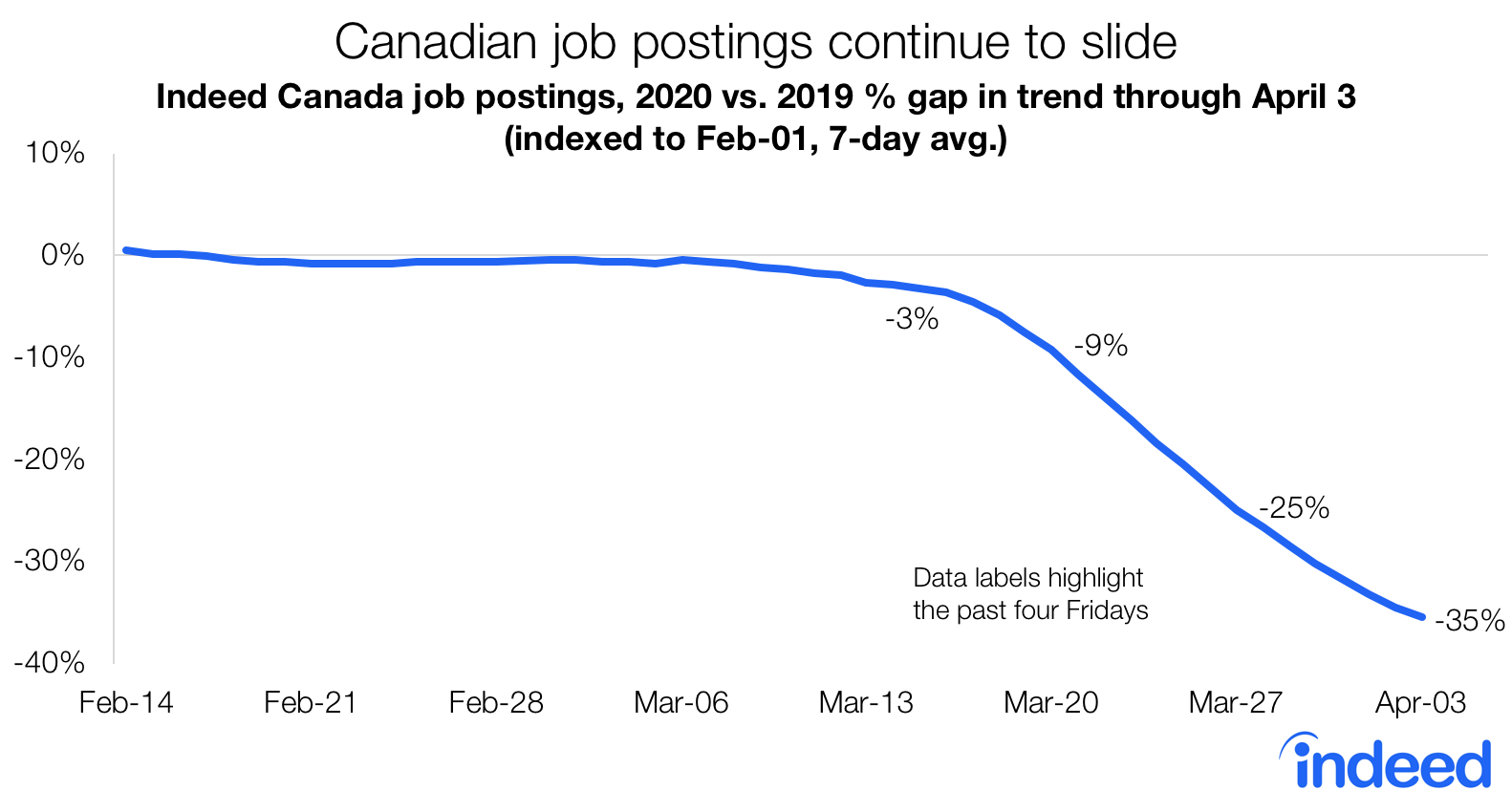

This post is updated as of April 7, reflecting data through April 3. We will be regularly updating these data as we track how coronavirus impacts the global labour market. This post uses updated methodology from previous posting updates, meaning results are not directly comparable to earlier versions.

The decline in Canadian job postings continued last week. On Friday April 3rd, the trend in total job postings on Indeed Canada stood 35% below 2019 levels, down from a 25% shortfall a week earlier. Similar to last week, the drop-off in Canadian activity has been greater than in the U.S. (which is currently off 24% from its 2019 trend), while tracking more similarly to the U.K. and Ireland.

The drop-off in total Canadian job postings has been driven by a particularly sharp decline in the trend of new job postings. Some employer hiring plans that pre-existed the acceleration of the COVID-19 crisis potentially continued as conditions deteriorated. Rather, the more immediate response by businesses was to stop posting new opportunities for work. As of April 3rd, the trend in Indeed Canada job postings that were a week or less old was 64% below 2019 levels, far more dramatic than the gap for total job postings.

Total job postings have taken a major hit across Canadian provinces, with the trend down at least 27% compared to 2019 in all regions. Atlantic Canada, as well as Saskatchewan and Manitoba, have declined slightly less than elsewhere, potentially reflecting their more rural populations. Meanwhile, the gap in trend is a bit wider in Alberta, where the economy is facing an additional shock from the recent plunge in oil prices.

Extent of decline varies across sectors

As the COVID-19 crisis has continued, job posting trends are now down across the vast majority of Canadian sectors. In this economy, sectors are doing “relatively well” if their trend in postings isn’t tracking 25% below their 2019 path. Some of these areas include parts of the healthcare sector, like personal care and home health, which employs support workers and healthcare aides, as well as the pharmacy sector. Job posting trends have also declined less than average in security and public safety (which includes security guards), as well as in software development.

Posting trends have declined similarly to the economy-wide 35% gap in a wide variety of sectors. In this range falls arts and entertainment (which includes artists and designers), production and manufacturing, community and social service (which includes social workers and counsellors), and electrical engineering.

Lastly, trends in certain sectors have dropped much further than the economy-wide average. With non-essential dental services halted, the posting trend in the dental field (which include dentists and dental hygienists) has declined sharply. Meanwhile, some of Canada’s largest declines in postings compared to 2019 trends have been in sectors directly impacted by the virus and social distancing, like food preparation and service, hospitality and tourism, and aviation, all down over 49% relative to last year’s trend.

The public health situation and its economic spillovers continue to change on a daily basis. We’ll be regularly updating these data as conditions evolve.

Methodology

To measure the trends in job postings, we calculated the 7-day moving average of the number of job postings on Indeed Canada. We index each day’s 7-day moving average to the start of February (Feb 1, 2020 = 100 for 2020 data, and so on).

We report how the trend in job postings this year differs from last year, in order to focus on the recent changes in labour market conditions due to COVID-19. For example: if job postings for a country increased 30% from February 1, 2019, to April 3, 2019, but only 20% from February 1, 2020, to April 3, 2020, then the index would have risen from 100 to 130 in 2019 and 100 to 120 in 2020. The year-to-date trend in job postings would therefore be down 8.3% on April 3 (120 is 8.3% below 130) in 2020 relative to 2019.

For new postings, we calculate a similar metric but the underlying measure is the number of postings that have been on Indeed for seven days or less.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.