As 2026 begins, labor markets worldwide are entering a cautious period of stabilization. Economic growth is expected to be modest, unemployment pressures linger, and regional differences will shape professional opportunities as much as national trends.

Flexibility and transparency are emerging as key differentiators among employers eager to attract and retain workers. Hybrid work remains widely valued, though some countries are seeing stricter in-office requirements. Salary transparency is set to rise in many areas as policies shift and job seekers search for any and all data that will help them make the best decisions. Across regions, where you live and what you do will continue to heavily influence professional prospects.

Technology, particularly AI, is reshaping the landscape. Job postings referencing AI are climbing across the board, affecting high-skilled and creative roles alike, even as the full impact on employment and skill requirements remains unclear. Overall, 2026 is shaping up as a year of measured recovery and strategic adaptation — where modest growth, ongoing labor shortages, and rapid technological change create both challenges and opportunities for workers and employers alike.

Indeed Hiring Lab economists, armed with the most comprehensive and timely labor market data from Indeed, have the pulse of what’s happening in labor markets worldwide. We’ve compiled some of their top insights and expectations for a host of critical countries below, and encourage you to dive deeper into each country’s unique trends by clicking through to the full outlook posts. We will add to this post as outlook reports for more countries are published in the coming weeks.

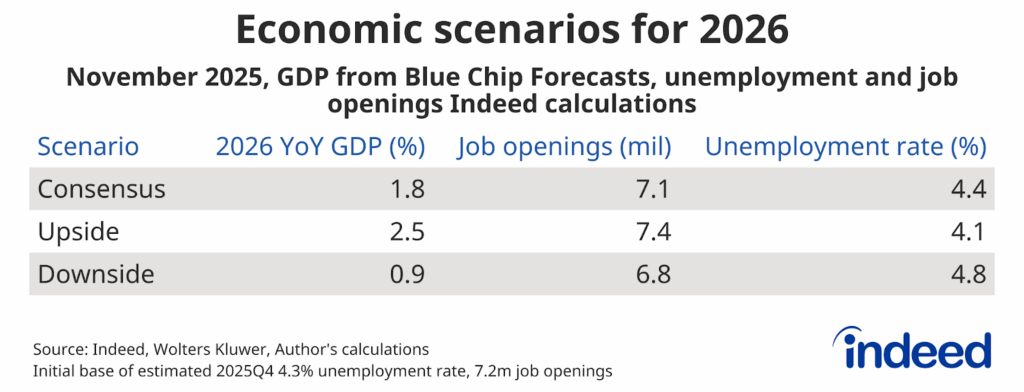

United States

- Job openings are poised to stabilize, but may not grow much; unemployment is likely to rise, but not alarmingly so; and GDP growth looks to remain positive, but somewhat anemic.

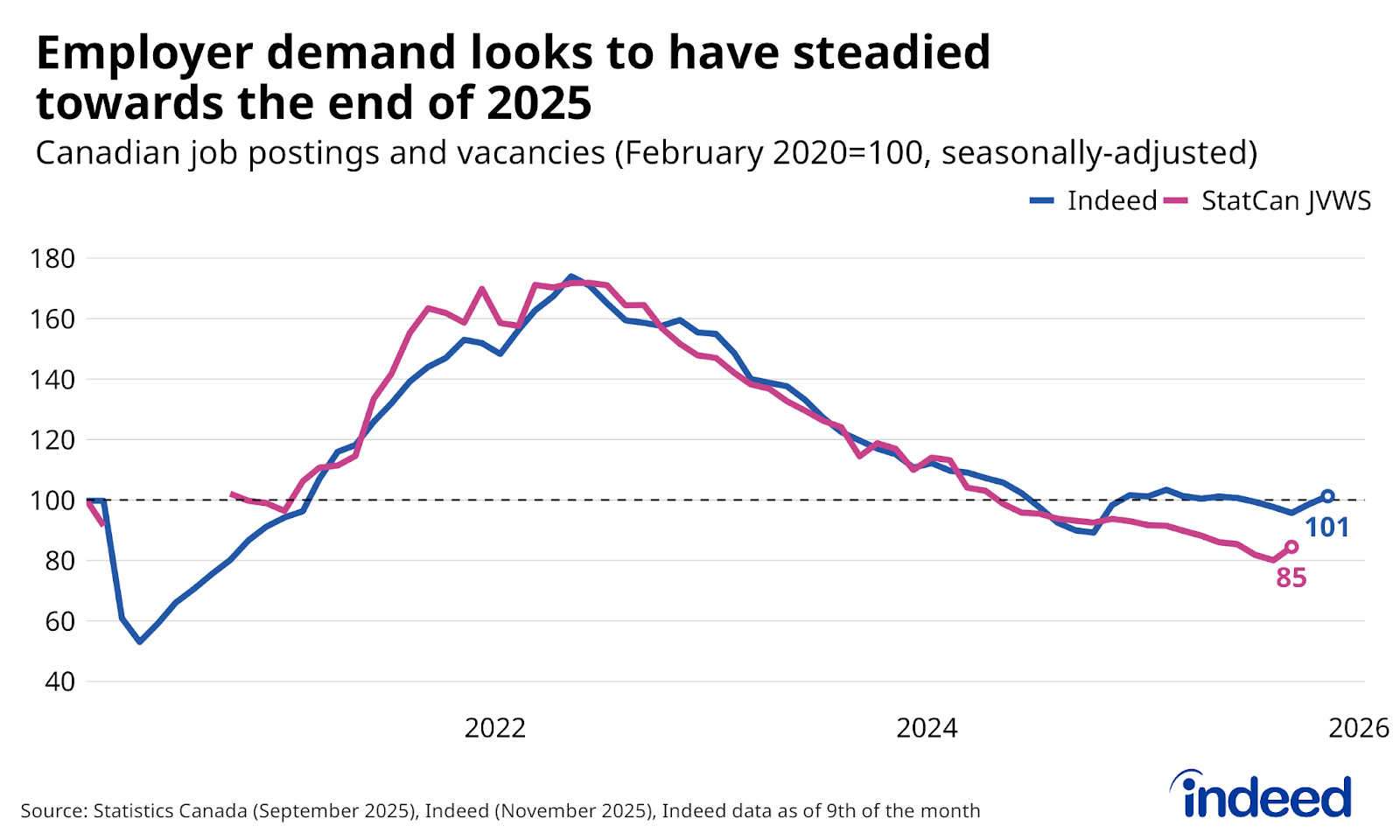

Canada

- A surprisingly stable 2025 could yield to modest progress in 2026, but policy questions at home and abroad loom.

United Kingdom

- The UK labour market has weakened, but signs of a significant downturn remain limited. Employers are cautious rather than pessimistic, and growth persists in some areas of the job market.

France

- The climate of uncertainty on the political, geopolitical, and economic fronts continues to weigh on the job market, which is slowing down but not stopping.

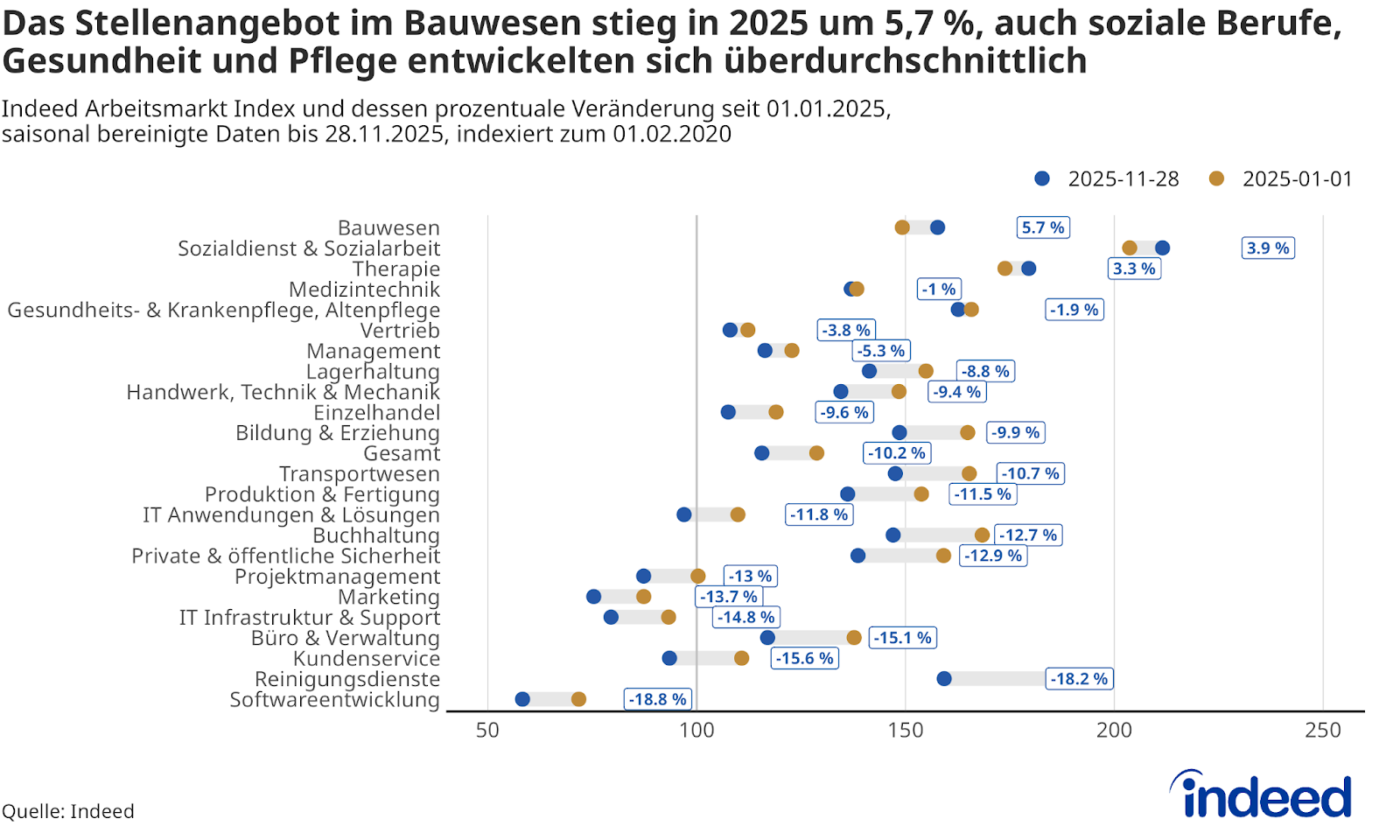

Germany

- The job market is stabilizing moderately, but a strong upswing is not yet in sight. Government investment and demographics are creating demand, while the AI transformation and structural changes require adaptability.