Key Points:

- Employers added an estimated 130,000 jobs in January and the unemployment rate declined to 4.3%, according to the US Bureau of Labor Statistics.

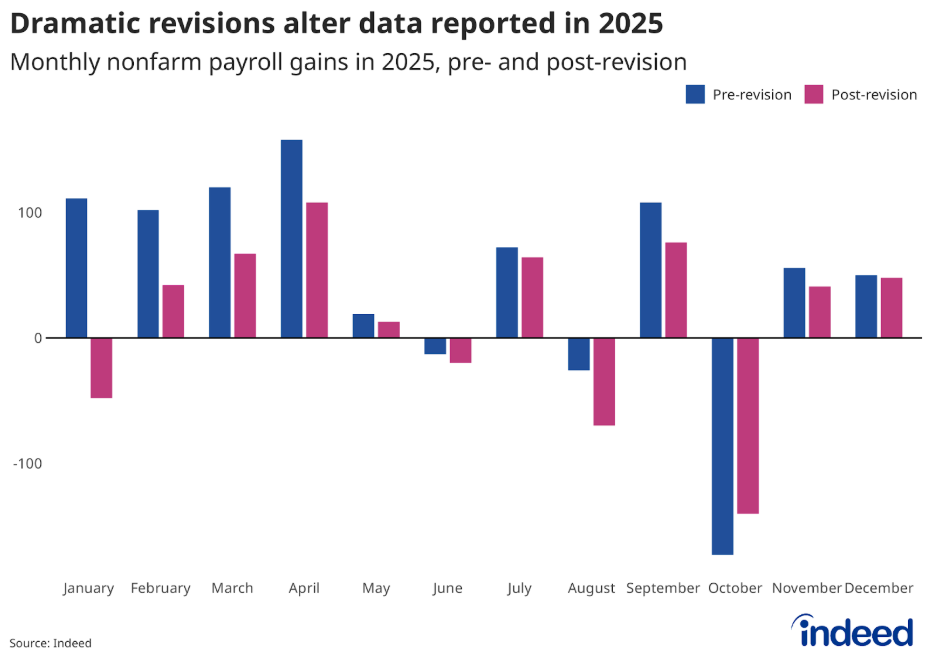

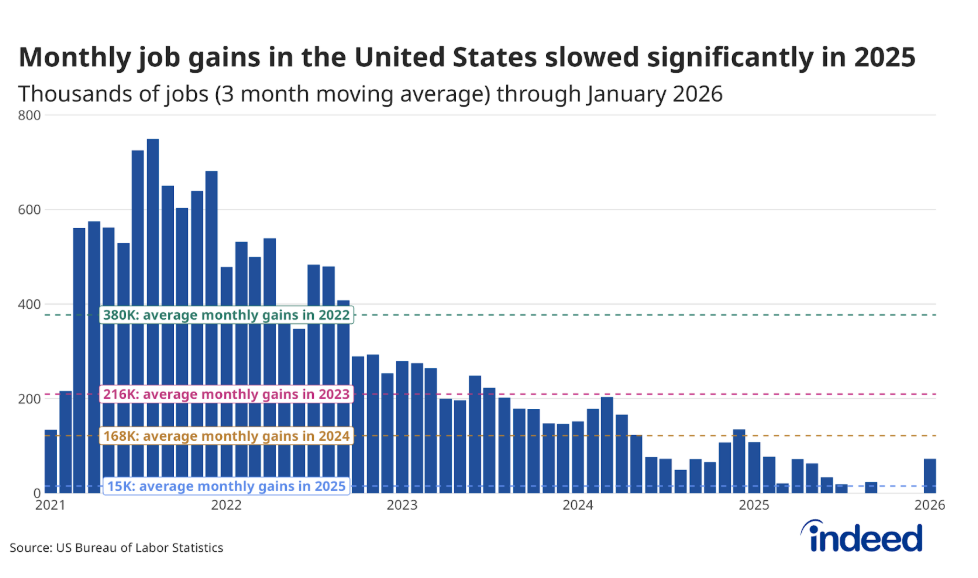

- Significant revisions to 2025 data pushed last year’s payroll employment down by 403,000 jobs, resulting in the addition of just 181,000 jobs last year.

- Data show continued strength in health care and social assistance, a pattern that has become a monthly expectation.

The labor market got off to a solid start in January, adding 130,000 jobs and bringing the unemployment rate down to 4.3%. That unexpected strength is particularly welcome given benchmark revisions to full-year 2025 data revealed that a labor market already viewed as soft actually performed worse than initially thought. Revisions brought the total number of jobs added last year down by more than 400,000, to only 181,000 for the year – an exceptionally weak year by almost any standard. There are now real doubts about how long the broader economy can continue to power forward with the job market at an almost complete standstill outside of the essential healthcare sector.

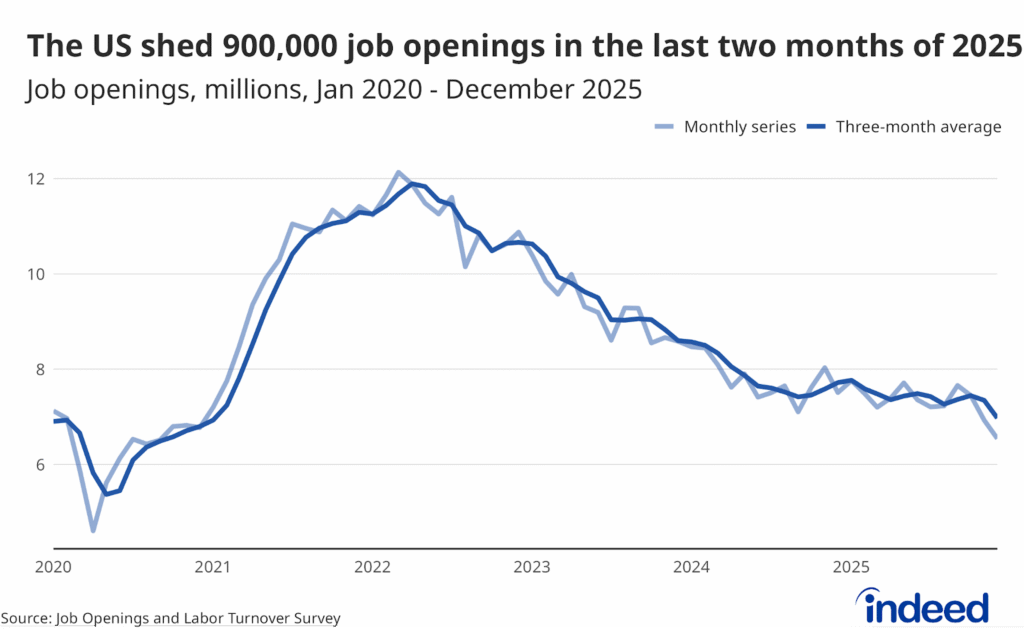

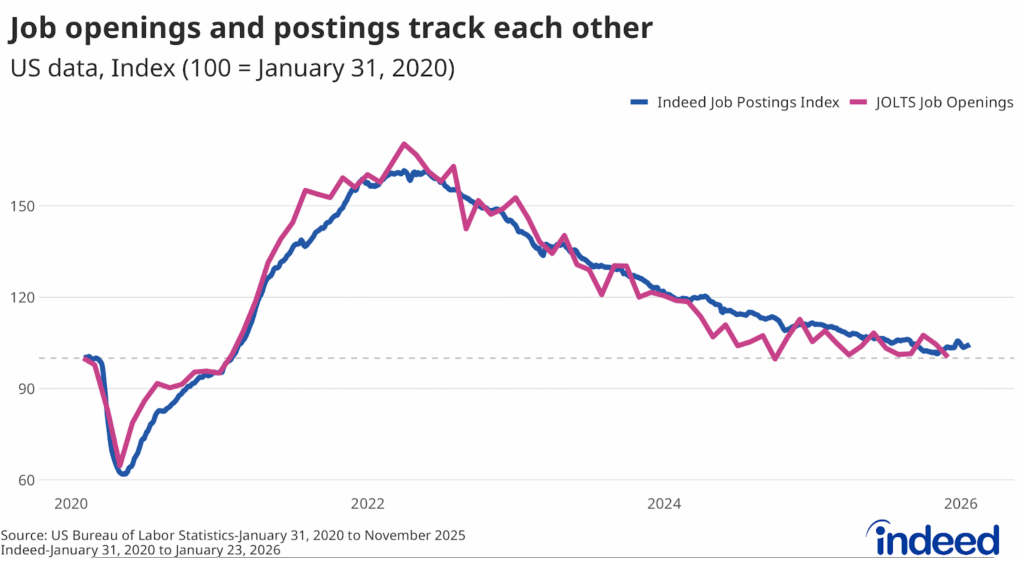

The BLS has now updated its key birth-death model that tracks business openings and closures, which likely contributed to some of the 2025 revisions. The hope is that payroll estimates will be more accurate going forward. The latest data show that the health care and social assistance sub-sector continued to dominate job growth in January, adding 81,900 jobs in health care and 41,600 in social assistance. Construction and business and professional services had a strong month as well, adding 33,000 and 34,000 jobs respectively. Retail trade and leisure and hospitality, on the other hand, added just around 1,000 jobs each, fitting with the stagnant retail numbers reported for December. Federal government and financial activities employment both notched large declines in employment last month. Today’s report aligns with more real-time indicators from Indeed data, which shows job postings have increased slightly over the past few months after steady declines for most of 2025. Postings remain especially high in health care, social assistance, and engineering sectors.

The US economy in early 2026 is probably confusing to most Americans – the labor market looks increasingly weak, but stock markets are hitting all-time highs. The low-hire/low-fire environment continues for now, and the declining unemployment rate is always a welcome sign. But this balance is precarious. The Federal Reserve has been waiting for a while now for some kind of clarity in the market to help inform the future path of key interest rates, and this data won’t help one way or the other. At some point either the hiring rate will increase, and payroll employment reports will improve, or the flame will be turned up on the low-fire dynamic and unemployment rates will begin to increase. In the face of ongoing uncertainty, workers are likely to continue hugging the jobs they do have and unemployed workers will continue to face limited choices and long job hunts.